-

Betts honored with MLB Roberto Clemente Award

Betts honored with MLB Roberto Clemente Award

-

Brendan Rodgers resigns as Celtic manager

-

Venezuela claims CIA 'false flag' attack foiled, as US deploys bombers

Venezuela claims CIA 'false flag' attack foiled, as US deploys bombers

-

Brazil ex-leader Bolsonaro appeals 27-year prison sentence

-

'Not our first hurricane': Jamaicans prepare to ride out deadly Melissa

'Not our first hurricane': Jamaicans prepare to ride out deadly Melissa

-

AI-generated fakes proliferate as Hurricane Melissa nears Jamaica

-

Atletico win at Betis to bounce back from Arsenal drubbing

Atletico win at Betis to bounce back from Arsenal drubbing

-

Sudan army admits loss of key city as reports of atrocities emerge

-

MLB Orioles name Guardians' Albernaz as new manager

MLB Orioles name Guardians' Albernaz as new manager

-

MLS Rapids and Red Bulls dump coaches after missing playoffs

-

Injured NBA T-Wolves guard Edwards to miss at least a week

Injured NBA T-Wolves guard Edwards to miss at least a week

-

NBA reviewing policies to fight 'dire risks' of gambling: report

-

Trump to meet Japan PM as hopes grow for China deal

Trump to meet Japan PM as hopes grow for China deal

-

Fear of mass destruction in Jamaica as Hurricane Melissa churns in

-

Slow but savage: Why hurricanes like Melissa are becoming more common

Slow but savage: Why hurricanes like Melissa are becoming more common

-

US authorities to release Sean 'Diddy' Combs in May 2028

-

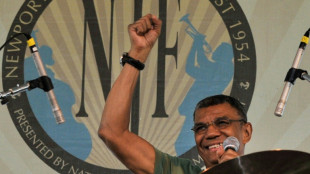

American jazz drummer Jack DeJohnette dies

American jazz drummer Jack DeJohnette dies

-

Dimitrov wins on comeback as Paris Masters enters new era

-

US B-1B bombers fly off coast of Venezuela: flight tracking data

US B-1B bombers fly off coast of Venezuela: flight tracking data

-

UK, Turkey sign $11-bn Eurofighter deal as Starmer visits

-

Freeman backed to cope as England's centre of attention against Australia

Freeman backed to cope as England's centre of attention against Australia

-

Rallies in Cameroon after rival rejects 92-year-old Biya's win

-

Russia's Lukoil to sell overseas assets after US sanctions

Russia's Lukoil to sell overseas assets after US sanctions

-

Frank confident Van de Ven has 'big future' at Spurs

-

'A kind of freedom': Amsterdam celebrates 750 years

'A kind of freedom': Amsterdam celebrates 750 years

-

Amazon's Prime releases trailer for 'unprecedented' Paul McCartney documentary

-

Ouattara wins landslide fourth term as Ivory Coast president

Ouattara wins landslide fourth term as Ivory Coast president

-

Turkey, UK sign $11 bn Eurofighter deal as Starmer visits

-

UK activists who tried to paint Taylor Swift jet spared jail

UK activists who tried to paint Taylor Swift jet spared jail

-

Rival rejects Cameroon's 92-year-old Biya's eighth term

-

Napoli's De Bruyne unlikely to play again this year

Napoli's De Bruyne unlikely to play again this year

-

Struggling Juventus sack coach Tudor

-

Cameroon's veteran leader Paul Biya wins controversial eighth term

Cameroon's veteran leader Paul Biya wins controversial eighth term

-

Juventus sack coach Igor Tudor

-

Timber warns Premier League leaders Arsenal against complacency

Timber warns Premier League leaders Arsenal against complacency

-

Putin terminates plutonium disposal agreement with US

-

Asian stocks rally on US-China trade progress; Europe flat

Asian stocks rally on US-China trade progress; Europe flat

-

Wales call up uncapped Cracknell into Autumn Nations squad in place of injured Faletau

-

Fears for trapped civilians in Sudan's El-Fasher after RSF claims control

Fears for trapped civilians in Sudan's El-Fasher after RSF claims control

-

Category 5 Hurricane Melissa strengthens as it heads for Jamaica

-

Fears for trapped civilians in Sudan's El-Fasher as fighting flares

Fears for trapped civilians in Sudan's El-Fasher as fighting flares

-

Asia stocks surge on US-China trade deal breakthrough

-

Trump in Japan as hopes grow for China trade deal

Trump in Japan as hopes grow for China trade deal

-

Australian Murray cod wallops swim record

-

'Definitive solution' on Brazil-US trade within days: Lula

'Definitive solution' on Brazil-US trade within days: Lula

-

ECB to hold interest rates steady with inflation subdued

-

Murder, kidnap, censorship: the 'new normal' of Tanzania politics

Murder, kidnap, censorship: the 'new normal' of Tanzania politics

-

Apprentice tames master as Love leads Packers past Rodgers, Steelers

-

Top seeds Philadelphia, San Diego win in MLS playoff openers

Top seeds Philadelphia, San Diego win in MLS playoff openers

-

Argentina's Milei vows more reforms after stunning election win

Wall Street stocks hit fresh records on easing US-China worries

Wall Street stocks ended at fresh records again on Monday over optimism that the US-China trade war was about to ease, with a possible deal in view when presidents Donald Trump and Xi Jinping meet later this week.

Major indices in New York charged higher, with the Dow, S&P 500 and Nasdaq all finishing at records on the improved sentiment on trade talks. Monday's buoyant session also featured heady gains by Microsoft, Facebook parent Meta and other tech giants ahead of earnings later this week.

Argentina's stocks soared more than 20 percent on the back of President Javier Milei's midterm victory, which saw his party win the biggest amount of votes in weekend legislative elections. The peso also jumped.

European stock markets were muted, reined in by anticipation of interest-rate decisions this week from the Federal Reserve and European Central Bank, although Spain's index reached a record high from strong growth and corporate earnings.

Overall the positive sentiment was "buoyed by weekend chatter suggesting that Washington and Beijing may finally be finding some common ground" and pulling back from painful tit-for-tat trade measures, said Fawad Razaqzada, market analyst at Forex.com.

"All eyes now turn to Thursday's meeting between US President Donald Trump and Chinese President Xi Jinping, which could see these tentative understandings formalized," he said.

Gold prices retreated on easing risk sentiment.

Trump arrived in Japan on Monday as part of a tour of Asia that could see the US president and Xi end their bruising trade war.

Speaking on Air Force One, Trump said he was hopeful of a deal when he sees Xi Thursday, while also indicating he was willing to extend his trip to meet North Korean leader Kim Jong Un.

China's vice commerce minister, Li Chenggang, said a "preliminary consensus" had been reached.

The progress paves the way for Trump and Xi to meet Thursday in South Korea on the sidelines of the Asia-Pacific Economic Cooperation summit, their first face-to-face meeting since the US leader returned to office.

Chinese stock indices closed up more than one percent Monday.

The advances followed a strong finish Friday on Wall Street, after benign US inflation data set the stage for a Federal Reserve interest-rate cut on Wednesday, despite a lack of clarity over the health of the US economy as a government shutdown churns on.

On Thursday, the European Central Bank is expected to hold borrowing costs steady for its third straight meeting, with eurozone inflation largely under control.

In corporate news, shares in US chipmaker Qualcomm soared 11.2 percent after the company unveiled two new AI processors designed for data centers, pushing into a market dominated by rivals Nvidia and AMD.

Keurig Dr. Pepper jumped 7.6 percent after lifting its full-year sales forecast and as it announced it had received $7 billion in investment agreements from affiliates of Apollo and KKR.

- Key figures at around 1630 GMT -

New York - Dow: UP 0.5 percent at 47,435.81 points

New York - S&P: UP 1.0 percent at 6,857.90

New York - Nasdaq: UP 1.6 percent at 23,580.33

London - FTSE 100: UP 0.1 percent at 9,653.82 (close)

Paris - CAC 40: UP 0.2 percent at 8,239.18 (close)

Frankfurt - DAX: UP 0.3 percent at 24,308.78 (close)

Tokyo - Nikkei 225: UP 2.5 percent at 50,512.32 (close)

Shanghai - Composite: UP 1.2 percent at 3,996.94 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 26,433.70 (close)

Euro/dollar: UP at $1.1646 from $1.1627 on Friday

Pound/dollar: UP at $1.3333 from $1.3311

Dollar/yen: UP at 152.90 yen from 152.86 yen

Euro/pound: FLAT at 87.35 pence

Brent North Sea Crude: DOWN 0.5 percent at $65.62 per barrel

West Texas Intermediate: DOWN 0.3 percent at $61.31 per barrel

L.Durand--AMWN