-

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

-

US to end shipping loophole for Chinese goods Friday

-

Forest's Champions League dreams hit by Brentford defeat

Forest's Champions League dreams hit by Brentford defeat

-

Norris and Piastri taking championship battle in their stride

-

Chelsea close in on UEFA Conference League final with win at Djurgarden

Chelsea close in on UEFA Conference League final with win at Djurgarden

-

Spurs take control in Europa semi against Bodo/Glimt

-

Man Utd seize control of Europa League semi against 10-man Bilbao

Man Utd seize control of Europa League semi against 10-man Bilbao

-

With minerals deal, Ukraine finds way to secure Trump support

-

Amazon revenue climbs 9%, but outlook sends shares lower

Amazon revenue climbs 9%, but outlook sends shares lower

-

Trump axes NSA Waltz after chat group scandal

-

Forest Champions League dreams hit after Brentford defeat

Forest Champions League dreams hit after Brentford defeat

-

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

-

US expects Iran talks but Trump presses sanctions

US expects Iran talks but Trump presses sanctions

-

Baffert returns to Kentucky Derby, Journalism clear favorite

-

Top Trump security official replaced after chat group scandal

Top Trump security official replaced after chat group scandal

-

Masked protesters attack Socialists at France May Day rally

-

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

-

McDonald's profits hit by weakness in US market

-

Rio goes Gaga for US singer ahead of free concert

Rio goes Gaga for US singer ahead of free concert

-

New research reveals where N. American bird populations are crashing

-

Verstappen late to Miami GP as awaits birth of child

Verstappen late to Miami GP as awaits birth of child

-

Zelensky says minerals deal with US 'truly equal'

-

Weinstein lawyer says accuser sought payday from complaint

Weinstein lawyer says accuser sought payday from complaint

-

Police arrest more than 400 in Istanbul May Day showdown

-

Herbert named head coach of Canada men's basketball team

Herbert named head coach of Canada men's basketball team

-

'Boss Baby' Suryavanshi falls to second-ball duck in IPL

-

Shibutani siblings return to ice dance after seven years

Shibutani siblings return to ice dance after seven years

-

300,000 rally across France for May 1, union says

-

US-Ukraine minerals deal: what we know

US-Ukraine minerals deal: what we know

-

Top Trump official ousted after chat group scandal: reports

-

Schueller hat-trick sends Bayern women to first double

Schueller hat-trick sends Bayern women to first double

-

Baudin in yellow on Tour de Romandie as Fortunato takes 2nd stage

-

UK records hottest ever May Day

UK records hottest ever May Day

-

GM cuts 2025 outlook, projects up to $5 bn hit from tariffs

-

Thousands of UK children write to WWII veterans ahead of VE Day

Thousands of UK children write to WWII veterans ahead of VE Day

-

Top Trump official exiting after chat group scandal: reports

-

Madrid Open holder Swiatek thrashed by Gauff in semis

Madrid Open holder Swiatek thrashed by Gauff in semis

-

Sheinbaum says agreed with Trump to 'improve' US-Mexico trade balance

-

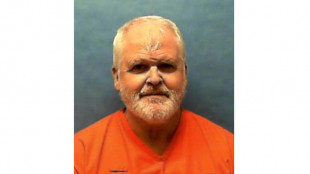

US veteran convicted of quadruple murder to be executed in Florida

US veteran convicted of quadruple murder to be executed in Florida

-

UK counter terrorism police probe Irish rappers Kneecap

-

S. Korea crisis deepens with election frontrunner retrial, resignations

S. Korea crisis deepens with election frontrunner retrial, resignations

-

Trump administration releases report critical of youth gender care

-

IKEA opens new London city centre store

IKEA opens new London city centre store

-

Police deploy in force for May Day in Istanbul, arrest hundreds

-

Syria Druze leader condemns 'genocidal campaign' against community

Syria Druze leader condemns 'genocidal campaign' against community

-

Prince Harry to hear outcome of UK security appeal on Friday

-

Microsoft raises Xbox prices globally, following Sony

Microsoft raises Xbox prices globally, following Sony

-

US stocks rise on Meta, Microsoft ahead of key labor data

-

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

-

Guardiola glad of Rodri return but uncertain if he'll play in FA Cup final

Oil prices, US jobs data weigh on stocks

A surge in oil prices to close to $93 per barrel as well as robust US jobs data weighed on stock prices Friday as they fuelled expectations central banks will move forcefully to raise interest rates.

Oil prices struck seven-year highs as traders bet on continued improvement in demand thanks to the economic reopening, and with the United States hit by a cold snap.

Lingering worries over Ukraine-Russia tensions were also playing a key role in the spike, with analysts predicting $100 could be breached soon.

But high oil prices would push inflation even higher, with central banks already under pressure to raise interest rates.

US data released Friday showed the US economy added 467,000 jobs in January, far more than had been expected given the renewed onslaught of Covid-19 infections caused by the Omicron variant.

"The key takeaway from the report is that it will inflame concerns about the Fed being behind the curve in fighting inflation," said Briefing.com analyst Patrick J. O'Hare.

The US Federal Reserve is expected to begin raising interest rates next month, but more analysts are expecting it may do so more agressively, by moving with half percentage point hikes rather than quarter point increases.

On Wall Street, both the Dow and S&P 500 were roughly flat in early trading. But the tech-heavy Nasdaq was higher thanks to better-than-expected earnings reports from Amazon, Snap and Pinterest.

Shares in Amazon jumped more than 10 percent as the company reported revenues jumped 9 percent to $137.4 billion in the fourth quarter.

Meanwhile, stocks were lower in Europe, where the European Central Bank's apparent shift in its outlook towards lifting rates this year itself stunned investors Thursday.

ECB chief Christine Lagarde had for months said inflationary pressures would be temporary and dissipate as the world economy reopens and supply chains resume -- allowing the bank to keep rates ultra-low this year.

But a record jump in eurozone prices last month and no sign of them easing has forced her to re-evaluate, saying the "situation had indeed changed".

The news boosted the euro -- the single currency recording a weekly gain of nearly three percent against the dollar.

But an ECB board member, French central bank chief Francois Villeroy de Galhau, warned against making predictions.

"If the direction of our trajectory is clear, no one should jump to conclusions about its time," he said.

- Key figures around 1430 GMT -

London - FTSE 100: DOWN 0.1 percent at 7,220.96 points

Frankfurt - DAX: DOWN 1.6 percent at 15,116.21

Paris - CAC 40: DOWN 0.7 percent at 6,954.47

EURO STOXX 50: DOWN 1.2 percent at 4,091.03

New York - Dow: UP less than 0.1 percent at 35,125.39

Tokyo - Nikkei 225: UP 0.7 percent at 27,439.99 (close)

Hong Kong - Hang Seng Index: UP 3.2 percent at 24,573.29 (close)

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.1426 from $1.1438 late Thursday

Pound/dollar: DOWN at $1.3524 from $1.3601

Euro/pound: UP at 84.43 pence from 84.06 pence

Dollar/yen: DOWN at 115.34 yen from 114.95 yen

Brent North Sea crude: UP 2.6 percent at $93.46 per barrel

West Texas Intermediate: UP 2.9 percent at $92.86 per barrel

Th.Berger--AMWN