-

World champion Liu wins Skate America women's crown

World champion Liu wins Skate America women's crown

-

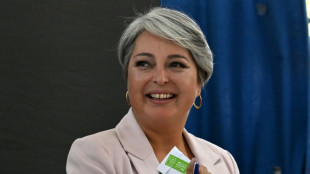

Leftist leads Chile presidential poll, faces run-off against far right

-

Haaland's Norway thump sorry Italy to reach first World Cup since 1998

Haaland's Norway thump sorry Italy to reach first World Cup since 1998

-

Portugal, Norway book spots at 2026 World Cup

-

Sinner hails 'amazing' ATP Finals triumph over Alcaraz

Sinner hails 'amazing' ATP Finals triumph over Alcaraz

-

UK govt defends plan to limit refugee status

-

Haaland's Norway thump Italy to qualify for first World Cup since 1998

Haaland's Norway thump Italy to qualify for first World Cup since 1998

-

Sweden's Grant captures LPGA Annika title

-

Tuchel lays down law to Bellingham after England star's frustration

Tuchel lays down law to Bellingham after England star's frustration

-

Sinner caps eventful year with ATP Finals triumph over great rival Alcaraz

-

Portugal book spot at 2026 World Cup as England stay perfect

Portugal book spot at 2026 World Cup as England stay perfect

-

Hakimi, Osimhen, Salah shortlisted for top African award

-

Sinner beats great rival Alcaraz to retain ATP Finals title

Sinner beats great rival Alcaraz to retain ATP Finals title

-

Schenk wins windy Bermuda Championship for first PGA title

-

Crime, immigration dominate as Chile votes for president

Crime, immigration dominate as Chile votes for president

-

Kane double gives England record-setting finish on road to World Cup

-

World champions South Africa add Mbonambi, Mchunu to squad

World champions South Africa add Mbonambi, Mchunu to squad

-

Greenpeace says French uranium being sent to Russia

-

'Now You See Me' sequel steals N. American box office win

'Now You See Me' sequel steals N. American box office win

-

Argentina beat Scotland after frenzied fightback

-

Argentina beat Scotland after stunning fightback

Argentina beat Scotland after stunning fightback

-

Pope urges leaders not to leave poor behind

-

Pressure will boost Germany in 'knockout' Slovakia clash, says Nagelsmann

Pressure will boost Germany in 'knockout' Slovakia clash, says Nagelsmann

-

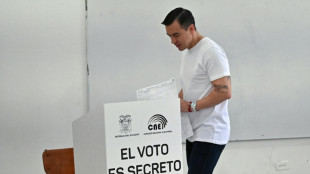

Ecuador votes on hosting foreign bases as Noboa eyes more powers

-

Portugal qualify for 2026 World Cup by thrashing Armenia

Portugal qualify for 2026 World Cup by thrashing Armenia

-

Greece to supply winter gas to war battered Ukraine

-

India and Pakistan blind women show spirit of cricket with handshakes

India and Pakistan blind women show spirit of cricket with handshakes

-

Ukraine signs deal with Greece for winter deliveries of US gas

-

George glad England backed-up haka response with New Zealand win

George glad England backed-up haka response with New Zealand win

-

McIlroy loses playoff but clinches seventh Race to Dubai title

-

Ecuador votes on reforms as Noboa eyes anti-crime ramp-up

Ecuador votes on reforms as Noboa eyes anti-crime ramp-up

-

Chileans vote in elections dominated by crime, immigration

-

Turkey seeks to host next COP as co-presidency plans falter

Turkey seeks to host next COP as co-presidency plans falter

-

Bezzecchi claims Valencia MotoGP victory in season-ender

-

Wasim leads as Pakistan dismiss Sri Lanka for 211 in third ODI

Wasim leads as Pakistan dismiss Sri Lanka for 211 in third ODI

-

Serbia avoiding 'confiscation' of Russian shares in oil firm NIS

-

Coach Gambhir questions 'technique and temperament' of Indian batters

Coach Gambhir questions 'technique and temperament' of Indian batters

-

Braathen wins Levi slalom for first Brazilian World Cup victory

-

Rory McIlroy wins seventh Race to Dubai title

Rory McIlroy wins seventh Race to Dubai title

-

Samsung plans $310 bn investment to power AI expansion

-

Harmer stars as South Africa stun India in low-scoring Test

Harmer stars as South Africa stun India in low-scoring Test

-

Mitchell ton steers New Zealand to seven-run win in first Windies ODI

-

Harmer stars as South Africa bowl out India for 93 to win Test

Harmer stars as South Africa bowl out India for 93 to win Test

-

China authorities approve arrest of ex-abbot of Shaolin Temple

-

Clashes erupt in Mexico City anti-crime protests, injuring 120

Clashes erupt in Mexico City anti-crime protests, injuring 120

-

India, without Gill, 10-2 at lunch chasing 124 to beat S.Africa

-

Bavuma fifty makes India chase 124 in first Test

Bavuma fifty makes India chase 124 in first Test

-

Mitchell ton lifts New Zealand to 269-7 in first Windies ODI

-

Ex-abbot of China's Shaolin Temple arrested for embezzlement

Ex-abbot of China's Shaolin Temple arrested for embezzlement

-

Doncic scores 41 to propel Lakers to NBA win over Bucks

D. Boral Capital acted as Joint Bookrunner to Miluna Acquisition Corp (NASDAQ: MMTXU) in connection with its $69,000,000 Initial Public Offering

NEW YORK, NY / ACCESS Newswire / November 5, 2025 / On Oct. 24, 2025, Miluna Acquisition Corp (Nasdaq:MMTXU) (the "Company"), a Cayman Islands exempted company, announced the closing of its Initial Public Offering of 6,000,000 units at $10.00 per unit. The units are listed on the Nasdaq Global Market ("Nasdaq") and began trading under the ticker symbol "MMTXU" on October 23, 2025. Each unit consists of one (1) ordinary share and one (1) redeemable warrant. Once the securities comprising the units begin separate trading, the ordinary shares and warrants are expected to be listed on Nasdaq under the symbols "MMTX" and "MMTXW", respectively.

D. Boral Capital LLC and ARC Group Securities LLC acted as joint book-running managers in the offering. The underwriters have been granted a 45-day option to purchase up to an additional 900,000 units offered by the Company to cover over-allotments, if any. The Company was represented by Hunter Taubman Fischer & Li LLC as its legal counsel, and D. Boral Capital LLC and ARC Group Securities LLC were represented by Baker & Hostetler LLP as legal counsel.

On October 28th, 2025, the Company announced that D. Boral Capital LLC and ARC Group Securities LLC have fully exercised the over-allotment option to purchase an additional 900,000 units at the public offering price of $10.00 per unit, resulting in additional gross proceeds of $9,000,000. After giving effect to this full exercise of the over-allotment option, the total number of units sold in the public offering increased to 6,900,000, resulting in an aggregate gross proceeds of $69,000,000 for the Company's Initial Public Offering.

A registration statement relating to these securities was declared effective by the Securities and Exchange Commission on September 30, 2025. The offering is being made only by means of a prospectus. Copies of the prospectus may be obtained, when available, from D. Boral Capital LLC, 590 Madison Ave., 39th Floor, New York, New York 10022, by telephone at (212) 970-5150 or by email at [email protected] or from ARC Group Securities LLC, 398 S Mill Ave, Suite 201B, Tempe, AZ 85281, by email at [email protected]. Copies of the registration statement can be accessed through the SEC's website at www.sec.gov.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About D. Boral Capital

D. Boral Capital LLC is a premier, relationship-driven global investment bank headquartered in New York. The firm is dedicated to delivering exceptional strategic advisory and tailored financial solutions to middle-market and emerging growth companies. With a proven track record, D. Boral Capital provides expert guidance to clients across diverse sectors worldwide, leveraging access to capital from key markets, including the United States, Asia, Europe, the Middle East, and Latin America.

A recognized leader on Wall Street, D. Boral Capital has successfully aggregated approximately $35 billion in capital since its inception in 2020, executing ~350 transactions across a broad range of investment banking products.

Forward Looking Statement

This press release contains statements that constitute "forward-looking statements," including with respect to the initial public offering and the anticipated use of the net proceeds. No assurance can be given that the offering discussed above will be completed on the terms described, or at all, or that the net proceeds of the offering will be used as indicated. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company's registration statement and preliminary prospectus for the Company's offering filed with the SEC. Copies are available on the SEC's website, www.sec.gov. The Company expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based, except as required by law.

For more information, please contact:

D. Boral Capital LLC

Email: [email protected]

Telephone: +1 (212) 970-5150

SOURCE: D. Boral Capital LLC

View the original press release on ACCESS Newswire

F.Schneider--AMWN