-

Ecuador votes on reforms as Noboa eyes anti-crime ramp-up

Ecuador votes on reforms as Noboa eyes anti-crime ramp-up

-

Chileans vote in elections dominated by crime, immigration

-

Turkey seeks to host next COP as co-presidency plans falter

Turkey seeks to host next COP as co-presidency plans falter

-

Bezzecchi claims Valencia MotoGP victory in season-ender

-

Wasim leads as Pakistan dismiss Sri Lanka for 211 in third ODI

Wasim leads as Pakistan dismiss Sri Lanka for 211 in third ODI

-

Serbia avoiding 'confiscation' of Russian shares in oil firm NIS

-

Coach Gambhir questions 'technique and temperament' of Indian batters

Coach Gambhir questions 'technique and temperament' of Indian batters

-

Braathen wins Levi slalom for first Brazilian World Cup victory

-

Rory McIlroy wins seventh Race to Dubai title

Rory McIlroy wins seventh Race to Dubai title

-

Samsung plans $310 bn investment to power AI expansion

-

Harmer stars as South Africa stun India in low-scoring Test

Harmer stars as South Africa stun India in low-scoring Test

-

Mitchell ton steers New Zealand to seven-run win in first Windies ODI

-

Harmer stars as South Africa bowl out India for 93 to win Test

Harmer stars as South Africa bowl out India for 93 to win Test

-

China authorities approve arrest of ex-abbot of Shaolin Temple

-

Clashes erupt in Mexico City anti-crime protests, injuring 120

Clashes erupt in Mexico City anti-crime protests, injuring 120

-

India, without Gill, 10-2 at lunch chasing 124 to beat S.Africa

-

Bavuma fifty makes India chase 124 in first Test

Bavuma fifty makes India chase 124 in first Test

-

Mitchell ton lifts New Zealand to 269-7 in first Windies ODI

-

Ex-abbot of China's Shaolin Temple arrested for embezzlement

Ex-abbot of China's Shaolin Temple arrested for embezzlement

-

Doncic scores 41 to propel Lakers to NBA win over Bucks

-

Colombia beats New Zealand 2-1 in friendly clash

Colombia beats New Zealand 2-1 in friendly clash

-

France's Aymoz wins Skate America men's gold as Tomono falters

-

Gambling ads target Indonesian Meta users despite ban

Gambling ads target Indonesian Meta users despite ban

-

Joe Root: England great chases elusive century in Australia

-

England's Archer in 'happy place', Wood 'full of energy' ahead of Ashes

England's Archer in 'happy place', Wood 'full of energy' ahead of Ashes

-

Luxury houses eye India, but barriers remain

-

Budget coffee start-up leaves bitter taste in Berlin

Budget coffee start-up leaves bitter taste in Berlin

-

Reyna, Balogun on target for USA in 2-1 win over Paraguay

-

C&F Launches Next Best Action Offering to Transform Sales Effectiveness in Life Sciences

C&F Launches Next Best Action Offering to Transform Sales Effectiveness in Life Sciences

-

Doha Tattoo Festival Announced as Ticket Sales Officially Open

-

Japa's Miura and Kihara capture Skate America pairs gold

Japa's Miura and Kihara capture Skate America pairs gold

-

Who can qualify for 2026 World Cup in final round of European qualifiers

-

UK to cut protections for refugees under asylum 'overhaul'

UK to cut protections for refugees under asylum 'overhaul'

-

England's Tuchel plays down records before final World Cup qualifier

-

Depoortere double helps France hold off spirited Fiji

Depoortere double helps France hold off spirited Fiji

-

Scotland face World Cup shootout against Denmark after Greece defeat

-

Hansen hat-trick inspires Irish to record win over Australia

Hansen hat-trick inspires Irish to record win over Australia

-

Alcaraz secures ATP Finals showdown with 'favourite' Sinner

-

UK to cut protections for refugees under asylum 'overhaul': govt

UK to cut protections for refugees under asylum 'overhaul': govt

-

Spain, Switzerland on World Cup brink as Belgium also made to wait

-

Sweden's Grant leads by one at LPGA Annika tournament

Sweden's Grant leads by one at LPGA Annika tournament

-

Scotland cling to hopes of automatic World Cup qualification despite Greece defeat

-

Alcaraz secures ATP Finals showdown with great rival Sinner

Alcaraz secures ATP Finals showdown with great rival Sinner

-

England captain Itoje savours 'special' New Zealand win

-

Wales's Evans denies Japan historic win with last-gasp penalty

Wales's Evans denies Japan historic win with last-gasp penalty

-

Zelensky renews calls for more air defence after deadly strike on Kyiv

-

NBA's struggling Pelicans sack coach Willie Green

NBA's struggling Pelicans sack coach Willie Green

-

Petain tribute comments raise 'revisionist' storm in France

-

Spain on World Cup brink as Belgium also made to wait

Spain on World Cup brink as Belgium also made to wait

-

Spain virtually seal World Cup qualification in Georgia romp

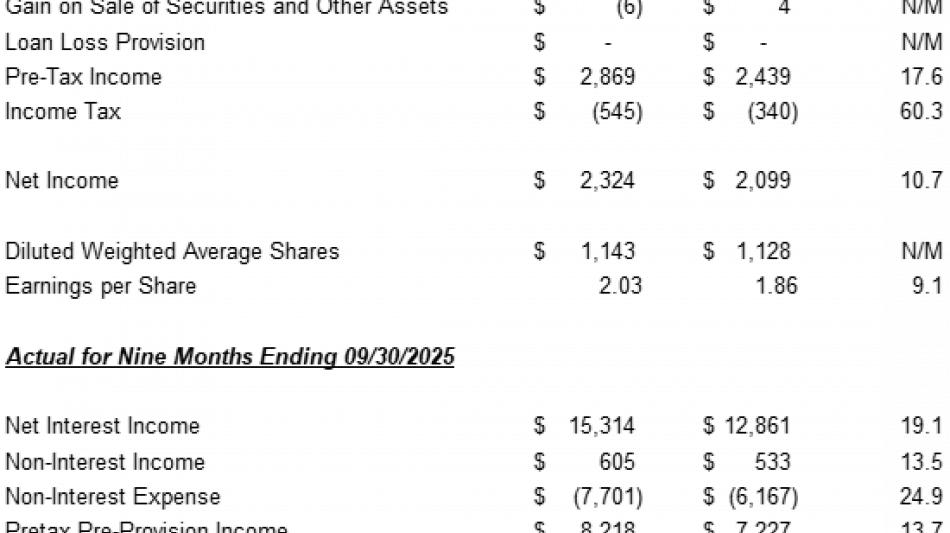

Trinity Bank Reports 2025 3rd Quarter Net Income Of $2,324,000

3RD QUARTER RETURN ON ASSETS 1.70%

3RD QUARTER RETURN ON EQUITY 14.35%

FORT WORTH, TX / ACCESS Newswire / November 7, 2025 / Trinity Bank, N.A. (OTC PINK:TYBT) today announced operating results for the third quarter and the nine months ending September 30, 2025.

Results of Operation

For the third quarter 2025, Trinity Bank, N.A. reported Net Income after Taxes of $2,324,000, an increase of 10.7% over third quarter 2024 earnings of $2,099,000. Earnings per diluted common share for the third quarter 2025 amounted to $2.03, an increase of 9.1% over third quarter 2024 results of $1.86 per diluted common share.

For the first nine months of 2025, Net Income after Taxes was $6,908,000, an increase of 10.0% over the first nine months of 2024 results of $6,281,000. Earnings per diluted common share for the first nine months of 2025 were $6.05, an increase of 8.6% over the first nine months of 2024 results of $5.57 per diluted common share.

Co-Chairman and CEO Matt R. Opitz stated, "I am pleased with the results Trinity Bank has produced in the third quarter and over the first nine months of the year. We continue to produce consistent earnings and growth despite the challenges we have faced at home and around the globe this year. Our exceptional staff and their dedication to constantly go above and beyond, providing our customers with exceptional experiences, are the primary drivers that make results like these achievable."

"Trinity Bank is also proud to announce that we recently paid our 28th semi-annual dividend of $1.00 on October 31, 2025. These results have made this 28th consecutive increase to our dividend possible."

Trinity Bank Third Quarter 2025 Earnings

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement, visit Trinity Bank's website: www.trinitybk.com Regulatory reporting format is also available at www.fdic.gov

###

For information contact:

Richard Burt

Executive Vice President

Trinity Bank

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB‑1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward‑looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

SOURCE: Trinity Bank N.A.

View the original press release on ACCESS Newswire

M.Fischer--AMWN