-

Injured Courtois set to miss Belgium World Cup qualifiers

Injured Courtois set to miss Belgium World Cup qualifiers

-

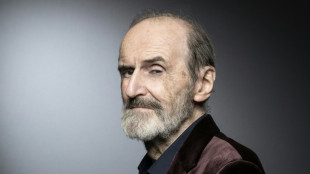

Bulatov, pillar of Russian contemporary art scene, dies at 92

-

Fritz sees off Musetti in ATP Finals

Fritz sees off Musetti in ATP Finals

-

US strikes on alleged drug boats kill six more people

-

Sarkozy released from jail 'nightmare' pending appeal trial

Sarkozy released from jail 'nightmare' pending appeal trial

-

COP30 has a mascot: the fiery-haired guardian of Brazil's forest

-

The Sudanese who told the world what happened in El-Fasher

The Sudanese who told the world what happened in El-Fasher

-

Three things we learned from the Sao Paulo Grand Prix

-

ASC acquire majority share in Atletico Madrid

ASC acquire majority share in Atletico Madrid

-

Ferrari boss tells Hamilton, Leclerc to drive, not talk

-

Bank of England seeks to 'build trust' in stablecoins

Bank of England seeks to 'build trust' in stablecoins

-

China suspends 'special port fees' on US vessels for one year

-

French court frees ex-president Sarkozy from jail pending appeal

French court frees ex-president Sarkozy from jail pending appeal

-

No link between paracetamol and autism, major review finds

-

Typhoon Fung-wong floods Philippine towns, leaves 5 dead in its wake

Typhoon Fung-wong floods Philippine towns, leaves 5 dead in its wake

-

France's Sarkozy says prison a 'nightmare' as prosecutors seek his release

-

Guinness maker Diageo picks new CEO after US tariffs cloud

Guinness maker Diageo picks new CEO after US tariffs cloud

-

China suspends 'special port fees' on US vessels

-

US senators take major step toward ending record shutdown

US senators take major step toward ending record shutdown

-

Typhoon Fung-wong leaves flooded Philippine towns in its wake

-

From Club Med to Beverly Hills: Assinie, the Ivorian Riviera

From Club Med to Beverly Hills: Assinie, the Ivorian Riviera

-

The 'ordinary' Arnie? Glen Powell reboots 'The Running Man'

-

Typhoon exposes centuries-old shipwreck off Vietnam port

Typhoon exposes centuries-old shipwreck off Vietnam port

-

French court to decide if ex-president Sarkozy can leave jail

-

China lifts sanctions on US units of South Korea ship giant Hanwha

China lifts sanctions on US units of South Korea ship giant Hanwha

-

Japan death row inmate's sister still fighting, even after release

-

Taylor sparks Colts to Berlin win as Pats streak hits seven

Taylor sparks Colts to Berlin win as Pats streak hits seven

-

Dreyer, Pellegrino lift San Diego to 4-0 MLS Cup playoff win over Portland

-

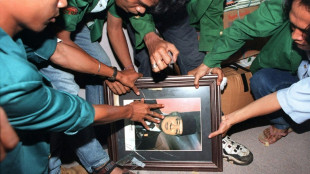

Indonesia names late dictator Suharto a national hero

Indonesia names late dictator Suharto a national hero

-

Fourth New Zealand-West Indies T20 washed out

-

Tanzania Maasai fear VW 'greenwashing' carbon credit scheme

Tanzania Maasai fear VW 'greenwashing' carbon credit scheme

-

Chinese businesswoman faces jail after huge UK crypto seizure

-

Markets boosted by hopes for deal to end US shutdown

Markets boosted by hopes for deal to end US shutdown

-

Amazon poised to host toughest climate talks in years

-

Ex-jihadist Syrian president due at White House for landmark talks

Ex-jihadist Syrian president due at White House for landmark talks

-

Saudi belly dancers break taboos behind closed doors

-

The AI revolution has a power problem

The AI revolution has a power problem

-

Big lips and botox: In Trump's world, fashion and makeup get political

-

NBA champion Thunder rally to down Grizzlies

NBA champion Thunder rally to down Grizzlies

-

US senators reach deal that could end record shutdown

-

Weakening Typhoon Fung-wong exits Philippines after displacing 1.4 million

Weakening Typhoon Fung-wong exits Philippines after displacing 1.4 million

-

Lenny Wilkens, Basketball Hall of Famer as player and coach, dies

-

Montlick Partners with 11Alive for Veterans Day Telethon Benefiting Top Dogg K9 Foundation

Montlick Partners with 11Alive for Veterans Day Telethon Benefiting Top Dogg K9 Foundation

-

Envirotech Secures 80-Drone Deposits, Rapidly Expanding Drone Business

-

Nexscient(R) and Tekcapital Form Strategic Alliance to Accelerate AI-Driven Technology Acquisitions

Nexscient(R) and Tekcapital Form Strategic Alliance to Accelerate AI-Driven Technology Acquisitions

-

BeenVerified People Search Tool Reunites a Family in Crisis

-

Medical Care Technologies Inc. (OTC PINK:MDCE) Marches Forward with Breakthrough Patent-Pending AI Healthcare Solutions using Smart Devices

Medical Care Technologies Inc. (OTC PINK:MDCE) Marches Forward with Breakthrough Patent-Pending AI Healthcare Solutions using Smart Devices

-

Telecom Argentina S.A. Announces Consolidated Results for The Nine-Month Period ("9M25") and Third Quarter of Fiscal Year 2025 ("3Q25")

-

HWAL Inc., to Collaborate with International Music Industry Veterans on K-Pop Music Venture

HWAL Inc., to Collaborate with International Music Industry Veterans on K-Pop Music Venture

-

Lir Life Sciences Corp. Formerly Blackbird Critical Metals Corp. Announces Closing of Acquisition of Lir Life Sciences Inc.

Capstone Reaffirms $100 Million 2026 Run-Rate Target with Acquisition Closing by December 15th

Acquisition of $15M stone distributor on track to close before December 15; the multi-location business will add revenue, EBITDA, and scale in a fast-growing category.

NEW YORK CITY, NEW YORK / ACCESS Newswire / November 10, 2025 / Capstone Holding Corp. (NASDAQ:CAPS), a national building products distribution platform, today announced that it expects to close its acquisition of a multi-location stone distributor with $15 million in annual revenue by December 15, significantly expanding Capstone's footprint.

The deal, first announced in October, is expected to be immediately accretive to both revenue and EBITDA, accelerating Capstone's growth trajectory. It further advances the company's progress toward its $100 million run-rate revenue target for 2026.

Key Highlights:

Transaction on Target: The acquisition is on track to close by early December, after a brief extension of exclusivity from the seller.

Strategic Fit: Adds a multilocation distributor to expand Capstone's footprint and premium brand portfolio, reinforcing scale and market leadership.

Market Tailwinds: Recent industry research projects a 4.1% CAGR in stone product demand over the next five years, driven by increased adoption among developers and homeowners.

Accelerated Growth Trajectory: Positions the company on track to reach its $100 million run-rate revenue goal by early 2026.

"We're very excited about this deal as it nears the finish line. It's another example of our ability to add revenue and EBITDA to the platform with discipline and strong strategic fit," said Matt Lipman, CEO of Capstone Holding Corp. "We expect to deliver record revenue and gross margins in 2025, carrying momentum into an even stronger 2026."

This acquisition comes amid strong growth in demand for stone products and complements Capstone's earlier acquisitions of HHT's Stone Business, Heller's Stone, and Carolina Stone. With a scaled presence in one of the building industry's fastest-growing categories, Capstone is well positioned to capture further growth in the quarters ahead.

Capstone reaffirms its $100 million run-rate revenue target for 2026. The company also reported record gross-margin expansion in Q2 2025, rising to 24.4% from 21.4% in the prior-year period.

About Capstone Holding Corp.

Capstone Holding Corp. (NASDAQ:CAPS) is a diversified platform of building products businesses focused on distribution, brand ownership, and acquisition. Through its Instone subsidiary, Capstone serves 31 U.S. states, offering proprietary stone veneer, hardscape materials, and modular masonry systems. The company's strategy combines disciplined M&A, operational efficiency, and a growing portfolio of owned brands to build a scalable and durable platform.

Investor Contact

Investor Relations

Capstone Holding Corp.

[email protected]

www.capstoneholdingcorp.com

Forward-Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. These statements relate to future events and performance, including guidance regarding revenue and EBITDA targets, M&A strategy, use of capital, and operating outlook. Actual results may differ materially from those projected due to a range of factors, including but not limited to acquisition timing, macroeconomic conditions, and execution risks. Please review the Company's filings with the SEC for a full discussion of risk factors. Capstone undertakes no obligation to revise forward-looking statements except as required by law.

SOURCE: Capstone Holding Corp.

View the original press release on ACCESS Newswire

F.Schneider--AMWN