-

Rapid floods shock Sri Lanka's survivors

Rapid floods shock Sri Lanka's survivors

-

Equity markets mixed as traders eye US data ahead of Fed decision

-

Pope to offer hope on Lebanon visit

Pope to offer hope on Lebanon visit

-

Seoul mayor indicted over alleged illegal polling payments

-

Asia floods toll tops 1,000 as military aid survivors

Asia floods toll tops 1,000 as military aid survivors

-

Hong Kong student urging probe into deadly fire leaves police station

-

Thunder hold off Blazers to avenge lone defeat of NBA season

Thunder hold off Blazers to avenge lone defeat of NBA season

-

Zelensky meets Macron to shore up support for Ukraine as Trump optimistic

-

Trump-backed candidate leads Honduras poll

Trump-backed candidate leads Honduras poll

-

Australia ban offers test on social media harm

-

Williamson bolsters New Zealand for West Indies Test series

Williamson bolsters New Zealand for West Indies Test series

-

South Korean religious leader on trial on graft charges

-

Please don't rush: slow changes in Laos 50 years after communist victory

Please don't rush: slow changes in Laos 50 years after communist victory

-

Williamson bolsters New Zealand batting for West Indies Test series

-

How Australia plans to ban under-16s from social media

How Australia plans to ban under-16s from social media

-

Militaries come to aid of Asia flood victims as toll nears 1,000

-

'For him': Australia mum channels grief into social media limits

'For him': Australia mum channels grief into social media limits

-

Thunder down Blazers to avenge lone defeat of season

-

Asian markets mixed as traders eye US data ahead of Fed decision

Asian markets mixed as traders eye US data ahead of Fed decision

-

Migrant domestic workers seek support, solace after Hong Kong fire

-

Experts work on UN climate report amid US pushback

Experts work on UN climate report amid US pushback

-

Spain aim to turn 'suffering' to success in Nations League final second leg

-

Pope to urge unity, bring hope to Lebanese youth on day two of visit

Pope to urge unity, bring hope to Lebanese youth on day two of visit

-

Thousands march in Zagreb against far right

-

Trump confirms call with Maduro, Caracas slams US maneuvers

Trump confirms call with Maduro, Caracas slams US maneuvers

-

Young dazzles as Panthers upset Rams, Bills down Steelers

-

BioNxt Signs Letter Agreement to Acquire 100% Interest in IP and to Codevelop a Sublingual Drug Formulation for Chemotherapy and Immunosuppressant Treatments

BioNxt Signs Letter Agreement to Acquire 100% Interest in IP and to Codevelop a Sublingual Drug Formulation for Chemotherapy and Immunosuppressant Treatments

-

Grande Portage Resources Announces Additional Offtake Study Validating the Flexibility of Offsite-Processing Configuration for the New Amalga Gold Project

-

Powertechnic Records RM10.50 Million Revenue in Q3 FY2025

Powertechnic Records RM10.50 Million Revenue in Q3 FY2025

-

Linear Minerals Corp. Announces Completion of the Plan of Arrangement and Marketing Agreement

-

Arms makers see record revenues as tensions fuel demand: report

Arms makers see record revenues as tensions fuel demand: report

-

Trump optimistic after Ukraine talks as Rubio says 'more work' needed

-

Real Madrid title hopes dented at Girona in third straight draw

Real Madrid title hopes dented at Girona in third straight draw

-

Pau beat La Rochelle as Hastoy sent off after 34 seconds

-

Real Madrid drop points at Girona in third straight Liga draw

Real Madrid drop points at Girona in third straight Liga draw

-

Napoli beat rivals Roma to join Milan at Serie A summit

-

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

-

Disney's 'Zootopia 2' rules Thanksgiving at N. American box office

-

Arteta takes heart from Arsenal escape in Chelsea battle

Arteta takes heart from Arsenal escape in Chelsea battle

-

Duplantis and McLaughlin-Levrone crowned 'Athletes of the Year'

-

Rubio says 'more work' required after US-Ukraine talks in Florida

Rubio says 'more work' required after US-Ukraine talks in Florida

-

McLaren boss admits team made strategy blunder

-

West Ham's red-carded Paqueta slams FA for lack of support

West Ham's red-carded Paqueta slams FA for lack of support

-

Ramaphosa labels US attacks on S.Africa 'misinformation'

-

Relaxed Verstappen set for another title showdown

Relaxed Verstappen set for another title showdown

-

Van Graan compares Bath match-winner Arundell to Springbok great Habana

-

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

-

Slot hails 'important' Isak goal as Liverpool beat West Ham

-

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

-

Thauvin double sends Lens top of Ligue 1 for 1st time in 21 years

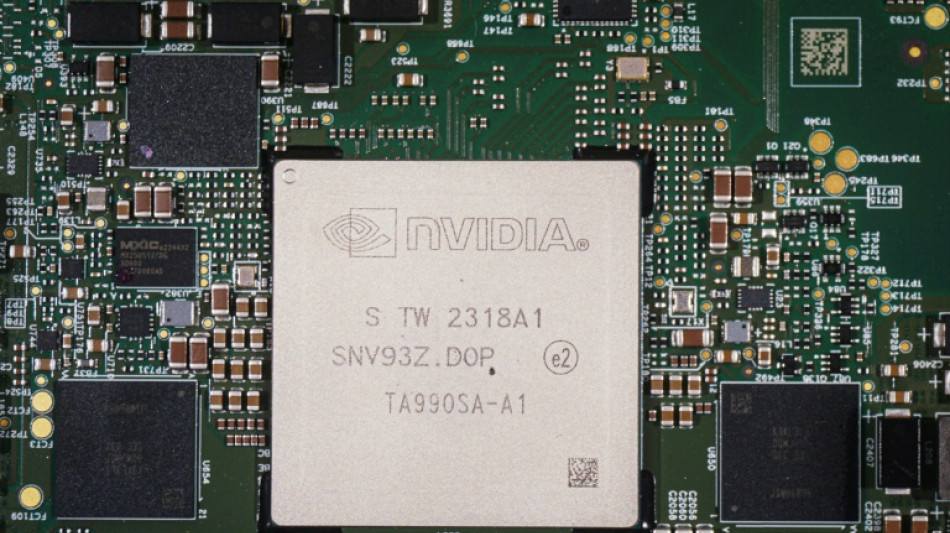

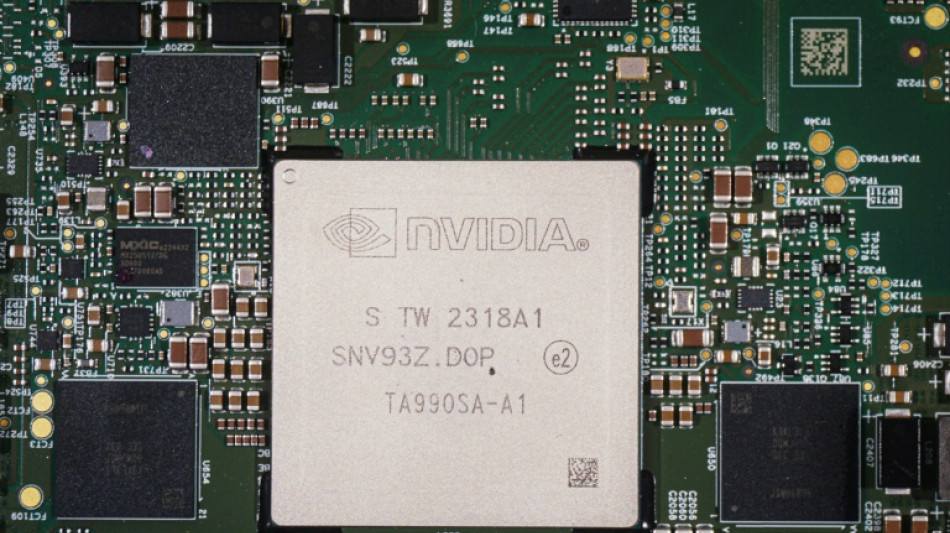

ECB warns on stretched AI valuations and sovereign debt risks

Heightened market exuberance around artificial intelligence and eye-popping levels of government debt could pose risks to eurozone financial stability, the European Central Bank warned Wednesday.

"Financial markets, notably equity markets, remain vulnerable to sharp adjustments due to persistently high valuations," the ECB said in its regular review of the single currency area's financial stability.

"Market sentiment could shift abruptly, not only if growth prospects deteriorate but also if technology sector earnings -- especially those of companies associated with artificial intelligence -- fail to deliver on expectations."

US equity markets have surged to successive record highs, recovering from a sharp sell-off in April after US President Donald Trump unveiled harsh new tariffs that were then partially rowed back.

But the gains have been mostly concentrated among technology companies such as AI-chip designer Nvidia, prompting fears of a hype-fuelled bubble that could pop.

Speaking on a call with reporters, ECB Vice President Luis de Guindos said there was a risk of an "accident" even though healthier company fundamentals meant the current situation was not directly comparable with the dotcom bubble of the 1990s.

"Valuations are very high according to historical standards," he said. "The possibility of an accident is going to be there."

High levels of government debt could further undermine financial stability, the ECB said, warning that this could result in swings in the value of the euro and the cost of eurozone government debt.

Market concerns around "stretched public finances could... create strains in global bond markets," the ECB said.

"At the same time, fiscal fundamentals in some euro area countries have been persistently weak. Fiscal slippage could test investor confidence."

P.M.Smith--AMWN