-

Thunder hold off Blazers to avenge lone defeat of NBA season

Thunder hold off Blazers to avenge lone defeat of NBA season

-

Zelensky meets Macron to shore up support for Ukraine as Trump optimistic

-

Trump-backed candidate leads Honduras poll

Trump-backed candidate leads Honduras poll

-

Australia ban offers test on social media harm

-

Williamson bolsters New Zealand for West Indies Test series

Williamson bolsters New Zealand for West Indies Test series

-

South Korean religious leader on trial on graft charges

-

Please don't rush: slow changes in Laos 50 years after communist victory

Please don't rush: slow changes in Laos 50 years after communist victory

-

Williamson bolsters New Zealand batting for West Indies Test series

-

How Australia plans to ban under-16s from social media

How Australia plans to ban under-16s from social media

-

Militaries come to aid of Asia flood victims as toll nears 1,000

-

'For him': Australia mum channels grief into social media limits

'For him': Australia mum channels grief into social media limits

-

Thunder down Blazers to avenge lone defeat of season

-

Asian markets mixed as traders eye US data ahead of Fed decision

Asian markets mixed as traders eye US data ahead of Fed decision

-

Migrant domestic workers seek support, solace after Hong Kong fire

-

Experts work on UN climate report amid US pushback

Experts work on UN climate report amid US pushback

-

Spain aim to turn 'suffering' to success in Nations League final second leg

-

Pope to urge unity, bring hope to Lebanese youth on day two of visit

Pope to urge unity, bring hope to Lebanese youth on day two of visit

-

Thousands march in Zagreb against far right

-

Trump confirms call with Maduro, Caracas slams US maneuvers

Trump confirms call with Maduro, Caracas slams US maneuvers

-

Young dazzles as Panthers upset Rams, Bills down Steelers

-

Linear Minerals Corp. Announces Completion of the Plan of Arrangement and Marketing Agreement

Linear Minerals Corp. Announces Completion of the Plan of Arrangement and Marketing Agreement

-

Arms makers see record revenues as tensions fuel demand: report

-

Trump optimistic after Ukraine talks as Rubio says 'more work' needed

Trump optimistic after Ukraine talks as Rubio says 'more work' needed

-

Real Madrid title hopes dented at Girona in third straight draw

-

Pau beat La Rochelle as Hastoy sent off after 34 seconds

Pau beat La Rochelle as Hastoy sent off after 34 seconds

-

Real Madrid drop points at Girona in third straight Liga draw

-

Napoli beat rivals Roma to join Milan at Serie A summit

Napoli beat rivals Roma to join Milan at Serie A summit

-

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

-

Disney's 'Zootopia 2' rules Thanksgiving at N. American box office

Disney's 'Zootopia 2' rules Thanksgiving at N. American box office

-

Arteta takes heart from Arsenal escape in Chelsea battle

-

Duplantis and McLaughlin-Levrone crowned 'Athletes of the Year'

Duplantis and McLaughlin-Levrone crowned 'Athletes of the Year'

-

Rubio says 'more work' required after US-Ukraine talks in Florida

-

McLaren boss admits team made strategy blunder

McLaren boss admits team made strategy blunder

-

West Ham's red-carded Paqueta slams FA for lack of support

-

Ramaphosa labels US attacks on S.Africa 'misinformation'

Ramaphosa labels US attacks on S.Africa 'misinformation'

-

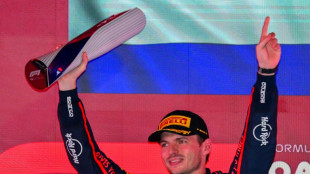

Relaxed Verstappen set for another title showdown

-

Van Graan compares Bath match-winner Arundell to Springbok great Habana

Van Graan compares Bath match-winner Arundell to Springbok great Habana

-

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

-

Slot hails 'important' Isak goal as Liverpool beat West Ham

Slot hails 'important' Isak goal as Liverpool beat West Ham

-

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

-

Thauvin double sends Lens top of Ligue 1 for 1st time in 21 years

Thauvin double sends Lens top of Ligue 1 for 1st time in 21 years

-

Pope urges Lebanese to embrace reconciliation, stay in crisis-hit country

-

Arundell stars as Bath top Prem table with comeback win over Saracens

Arundell stars as Bath top Prem table with comeback win over Saracens

-

Villarreal edge Real Sociedad, Betis win fiery derby

-

Israel's Netanyahu seeks pardon in corruption cases

Israel's Netanyahu seeks pardon in corruption cases

-

Verstappen wins Qatar GP to set up final race title showdown

-

Afghan suspect in Washington shooting likely radicalized in US: security official

Afghan suspect in Washington shooting likely radicalized in US: security official

-

Pastor, bride among 26 kidnapped as Nigeria reels from raids

-

Trump officials host crucial Ukraine talks in Florida

Trump officials host crucial Ukraine talks in Florida

-

OPEC+ reaffirms planned pause on oil output hikes until March

SCIB Delivers RM46.19 Million Revenue in Q5 FPE2025

KUALA LUMPUR, MY / ACCESS Newswire / November 27, 2025 / Industrialised building systems specialist, Sarawak Consolidated Industries Berhad ("SCIB" or the "Company") today announced its unaudited consolidated results for the fifth quarter ended 30 September 2025 ("Q5 FPE2025"), reporting continued progress and stable momentum, with revenue of RM46.19 million as the Company continues to streamline its operations and transition toward a Construction and Engineering, Procurement, Construction and Commissioning ("EPCC") business.

Datuk Chong Loong Men, Executive Chairman of SCIB

The Manufacturing segment delivered RM33.86 million in revenue and generated RM3.70 million profit before tax ("PBT") during the current quarter. Cumulatively, the segment contributed RM146.71 million in revenue and RM13.40 million PBT over the 15-month period. Meanwhile, the Construction and EPCC segment recorded RM12.33 million revenue and a loss before tax ("LBT") of RM3.80 million in Q5 FPE2025, mainly attributable to lower progress recognition and higher costs associated with a specific Peninsular-based project. For the 15-month period, the segment generated RM75.47 million revenue and a LBT of RM2.64 million, partly mitigated by the recovery of impairment losses on receivables earlier in the period.

Compared to the immediate preceding quarter, the Company's revenue increased by 9.10% from RM42.33 million, driven by stronger manufacturing sales. However, the Company's profitability weakened as Construction and EPCC margins softened due to project-specific cost pressures. The Construction and EPCC segment registered lower revenue of RM12.33 million compared to RM17.62 million in the preceding quarter.

Over the extended 15-month financial period from 1 July 2024 to 30 September 2025, the Company posted cumulative revenue of RM222.18 million.

On 18 November 2025, SCIB announced a major corporate development involving the proposed disposal of 100% equity interest in SCIB Concrete Manufacturing Sdn. Bhd. ("SCM") to YTL Cement (Sarawak) Sdn. Bhd. for RM113.0 million, subject to adjustments in accordance to the Share Sale Purchase Agreement entered between the parties. This transaction is complemented by irrevocable Options to Purchase and Options to Sell seven (7) parcels of land under previously executed tenancy and right-to-build agreements, carrying total pre-agreed prices of RM38.19 million. Together, these components represent a potential realisation value of approximately RM151.19 million, which will significantly strengthen SCIB's balance sheet and enhance liquidity to support its core Construction and EPCC business.

The Company is also progressing with a renounceable rights issue involving up to 763.6 million new shares with free warrants, as well as a RM110.0 million share capital reduction. These capital exercises are designed to optimise the Company's capital structure and better align resources with SCIB's revised operating focus following the proposed divestment of the Manufacturing arm.

Additionally, the Company clarified that the EGM for the Proposals, scheduled for 15 January 2026 at St Giles Boulevard, Mid Valley City, will proceed as scheduled and will not be delayed while waiting for the outcome of the Proposed Disposal of its manufacturing business. SCIB explained that if the Proposed Disposal goes ahead, the Group's overall direction and funding needs may change, meaning that some parts of the current utilisation plan for the Proposed Rights Issue with Warrants, especially those related to manufacturing may no longer be suitable. Therefore, the Company will decide at the right time whether to continue with the Proposed Rights Issue with Warrants or move forward with the Proposed Disposal. If the Proposed Disposal is not approved by shareholders or does not proceed, SCIB plans to implement the rights issue under its existing structure. However, if the Proposed Disposal is approved at the expected EGM in March 2026, the Company will not proceed with the current version of the rights issue and may instead introduce a revised proposal after reassessing its funding needs and obtaining the necessary regulatory approvals.

Datuk Chong Loong Men, Executive Chairman of SCIB, commented, "Our Q5 FPE2025 results reflect our continued effort to streamline operations and refine our focus on Construction and EPCC activities. With improved quarter-on-quarter revenue and a stable performance across our business segments, we remain committed to strengthening project execution, optimising resources, and enhancing overall operational efficiency. These ongoing efforts place SCIB in a favourable position to pursue upcoming opportunities as we advance into the next phase of our transformation."

The macroeconomic outlook remains supportive as Malaysia maintains GDP growth of 4.0% to 4.8% in 2025, with continued domestic investment momentum and strong development allocations under Budget 2026 and RMK13. Sarawak continues to benefit from significant infrastructure investments, including Sarawak-Sabah Link Road, Autonomous Rapid Transit in Kuching, and wider SCORE-linked industrial expansion. These developments are expected to generate sustained demand for construction services, precast products, community development projects and industrial upgrading.

SCIB's established presence, proven capabilities in IBS and precast solutions, and its ongoing operational realignment position the Company to capture upcoming public and private sector opportunities across Sarawak and Peninsular Malaysia.

CONTACT: [email protected]

SOURCE: Sarawak Consolidated Industries Berhad

View the original press release on ACCESS Newswire

O.Norris--AMWN