-

Israel says Hamas 'will be disarmed' after group proposes weapons freeze

Israel says Hamas 'will be disarmed' after group proposes weapons freeze

-

ECB proposes simplifying rules for banks

-

Toll in deadly Indonesia floods near 1,000, frustrations grow

Toll in deadly Indonesia floods near 1,000, frustrations grow

-

Myanmar junta air strike on hospital kills 31, aid workers say

-

General strike hits planes, trains and services in Portugal

General strike hits planes, trains and services in Portugal

-

Vietnam's capital chokes through week of toxic smog

-

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

Stocks mixed as US rate cut offset by Fed outlook, Oracle earnings

-

Mexico approves punishing vape sales with jail time

-

Desert dunes beckon for Afghanistan's 4x4 fans

Desert dunes beckon for Afghanistan's 4x4 fans

-

Myanmar junta air strike on hospital kills 31: aid worker

-

British porn star faces Bali deportation after studio raid

British porn star faces Bali deportation after studio raid

-

US, Japan hold joint air exercise after China-Russia patrols

-

Skydiver survives plane-tail dangling incident in Australia

Skydiver survives plane-tail dangling incident in Australia

-

Filipino typhoon survivors sue Shell over climate change

-

Eurogroup elects new head as Russian frozen assets debate rages

Eurogroup elects new head as Russian frozen assets debate rages

-

Thunder demolish Suns, Spurs shock Lakers to reach NBA Cup semis

-

Fighting rages along Cambodia-Thailand border ahead of expected Trump call

Fighting rages along Cambodia-Thailand border ahead of expected Trump call

-

Hay fifty on debut helps put New Zealand on top in West Indies Test

-

Taiwan to keep production of 'most advanced' chips at home: deputy FM

Taiwan to keep production of 'most advanced' chips at home: deputy FM

-

Warmer seas, heavier rains drove Asia floods: scientists

-

Ex-Man Utd star Lingard scores on tearful farewell to South Korea

Ex-Man Utd star Lingard scores on tearful farewell to South Korea

-

Hay fifty on debut helps New Zealand to 73-run lead against West Indies

-

South Korea minister resigns over alleged bribes from church

South Korea minister resigns over alleged bribes from church

-

Yemeni city buckles under surge of migrants seeking safety, work

-

Breakout star: teenage B-girl on mission to show China is cool

Breakout star: teenage B-girl on mission to show China is cool

-

Chocolate prices high before Christmas despite cocoa fall

-

Debut fifty for Hay takes New Zealand to 200-5 in West Indies Test

Debut fifty for Hay takes New Zealand to 200-5 in West Indies Test

-

Sweet 16 as Thunder demolish Suns to reach NBA Cup semis

-

Austria set to vote on headscarf ban in schools

Austria set to vote on headscarf ban in schools

-

Asian traders cheer US rate cut but gains tempered by outlook

-

Racing towards great white sharks in Australia

Racing towards great white sharks in Australia

-

Fighting rages at Cambodia-Thailand border ahead of expected Trump call

-

Venezuelan opposition leader emerges from hiding after winning Nobel

Venezuelan opposition leader emerges from hiding after winning Nobel

-

Eddie Jones given Japan vote of confidence for 2027 World Cup

-

Kennedy's health movement turns on Trump administration over pesticides

Kennedy's health movement turns on Trump administration over pesticides

-

On Venezuela, how far will Trump go?

-

AI's $400 bn problem: Are chips getting old too fast?

AI's $400 bn problem: Are chips getting old too fast?

-

Conway fifty takes New Zealand to 112-2 in West Indies Test

-

Winners Announced at the Energy Storage Awards 2025

Winners Announced at the Energy Storage Awards 2025

-

Formation Metals Further Validates Open Pit Potential at N2 Gold Project: Intersects Over 100 Metres of Near Surface Target Mineralization in Three New Drillholes

-

Genflow to Attend Healthcare Conference

Genflow to Attend Healthcare Conference

-

HyProMag USA Finalizes Long-Term Lease For Dallas-Fort Worth Rare Earth Magnet Recycling and Manufacturing Hub

-

Ur-Energy Announces Pricing of $100 Million Offering of 4.75% Convertible Senior Notes Due 2031

Ur-Energy Announces Pricing of $100 Million Offering of 4.75% Convertible Senior Notes Due 2031

-

US drops bid to preserve FIFA bribery convictions

-

Oracle shares dive as revenue misses forecasts

Oracle shares dive as revenue misses forecasts

-

'Grateful' Alonso feels Real Madrid stars' support amid slump

-

Arsenal crush Club Brugge to keep 100% Champions League record

Arsenal crush Club Brugge to keep 100% Champions League record

-

Venezuelans divided on Machado peace prize, return home

-

Ukraine sends US new plan to end the war as Trump blasts Europe

Ukraine sends US new plan to end the war as Trump blasts Europe

-

Haaland stuns Real as Arsenal remain perfect in Brugge

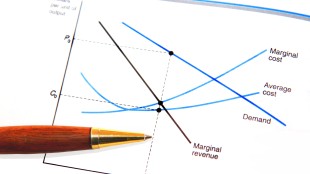

US stocks rise, dollar retreats as Fed tone less hawkish than feared

Wall Street stocks rose and the dollar retreated Wednesday after the Federal Reserve cut interest rates again as it seeks to shore up a vulnerable US labor market.

The rate cut was expected, but stocks had been under pressure in recent days in part due to speculation that the Fed would combine Wednesday's interest rate cut with commentary suggesting a pause to further easing in light of still-elevated inflation.

But market watchers read Fed Chair Jerome Powell's emphasis on the job market during a press conference as a signal that the Fed could cut interest rates again in 2026.

Powell's "press conference today was less hawkish than a lot of investors had anticipated," said CFRA Research's Sam Stovall. "And I think that that will go a long way to propelling stocks through the end of the year and allowing us to end on a positive note."

"Powell did sound very supportive of cutting rates more if need be," Stovall said.

Stocks rose throughout the news conference, with the broad-based S&P 500 finishing up 0.7 percent. The dollar retreated against the euro and other major currencies.

Powell described the current countervailing pressures on the central bank as an unusual challenge, with the Fed's dual mandates on inflation and the job market pointing towards opposite policies.

The US central bank's third straight interest rate cut comes as inflation remains well above the Fed two-percent target. Recent US labor data has also shown some weakening, although the central bank has been forced to do without key economic reports due to the government shutdown.

"We're going to need to have some years where real compensation is higher" than inflation "for people to start feeling good about affordability," Powell said.

Wednesday's cut by a quarter percentage point brings rates to a range between 3.50 percent and 3.75 percent, the lowest in around three years, a move aligned with market expectations.

Three Fed officials dissented.

Chicago Fed president Austan Goolsbee and Kansas City Fed president Jeffrey Schmid instead sought to keep rates unchanged. Fed Governor Stephen Miran backed a bigger, half-percentage-point cut.

Earlier, London closed 0.1 percent in the green but Frankfurt and Paris were just off, while Asia saw a lackluster session.

After November's tech-led swoon, stock markets have enjoyed a healthy run in recent weeks as weak jobs figures reinforced expectations for another step lower in borrowing costs.

But that has cooled heading into the Fed gathering after the release of US inflation data that was slightly higher than expected.

The price of silver hit a record high at $61.9507 an ounce owing to high demand for the metal used by industry as well as for making jewelry.

It topped $60 for the first time Tuesday, also thanks to supply constraints.

- Key figures at around 2115 GMT -

New York - Dow: UP 1.1 percent at 48,057.75 (close)

New York - S&P 500: UP 0.7 percent at 6,886.68 (close)

New York - Nasdaq Composite: UP 0.2 percent at 23,654.16 (close)

London - FTSE 100: UP 0.1 percent at 9,655.02 (close)

Paris - CAC 40: DOWN 0.4 percent at 8,022.69 (close)

Frankfurt - DAX: DOWN 0.1 percent at 24,130.14 (close)

Tokyo - Nikkei 225: DOWN 0.1 percent at 50,602.80 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 25,540.78 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,900.50 (close)

Dollar/yen: DOWN at 155.92 yen from 156.88 yen on Tuesday

Euro/dollar: UP at $1.1693 from $1.1627

Pound/dollar: UP at $1.3384 from $1.3297

Euro/pound: DOWN at 87.36 pence from 87.43 pence

Brent North Sea Crude: UP 0.4 percent at $62.21 per barrel

West Texas Intermediate: UP 0.4 percent at $58.46 per barrel

P.Stevenson--AMWN