-

Balkan nations offer lessons on handling cow virus sowing turmoil

Balkan nations offer lessons on handling cow virus sowing turmoil

-

French readers lap up Sarkozy's prison diaries

-

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

UK PM warns Abramovich 'clock is ticking' over Chelsea sale fund

-

Warner Bros. Discovery rejects Paramount bid

-

Winners of 2026 World Cup to pocket $50 million in prize money

Winners of 2026 World Cup to pocket $50 million in prize money

-

World no. 1 Alcaraz ends 'incredible ride' with coach Ferrero

-

World number one Alcaraz announces 'difficult' split with coach Ferrero

World number one Alcaraz announces 'difficult' split with coach Ferrero

-

Iran boxer sentenced to death at 'imminent' risk of execution: rights groups

-

Snicko operator admits error that led to Carey's Ashes reprieve

Snicko operator admits error that led to Carey's Ashes reprieve

-

Finland PM apologises to Asian countries over MPs' mocking posts

-

Doctors in England go on strike for 14th time

Doctors in England go on strike for 14th time

-

Romania journalists back media outlet that sparked graft protests

-

Rob Reiner's son awaiting court appearance on murder charges

Rob Reiner's son awaiting court appearance on murder charges

-

Ghana's Highlife finds its rhythm on UNESCO world stage

-

Stocks gain as traders bet on interest rate moves

Stocks gain as traders bet on interest rate moves

-

France probes 'foreign interference' after malware found on ferry

-

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

Europe's Ariane 6 rocket puts EU navigation satellites in orbit

-

Bleak end to the year as German business morale drops

-

Hundreds queue at Louvre museum as strike vote delays opening

Hundreds queue at Louvre museum as strike vote delays opening

-

Bondi shooting shocks, angers Australia's Jewish community

-

Markets rise even as US jobs data fail to boost rate cut bets

Markets rise even as US jobs data fail to boost rate cut bets

-

Senegal talisman Mane overcame grief to become an African icon

-

Carey pays tribute to late father after home Ashes century

Carey pays tribute to late father after home Ashes century

-

'Many lessons to be learned' from Winter Games preparations, says ski chief

-

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

Emotional Carey slams ton to give Australia upper hand in 3rd Ashes Test

-

Asian markets mixed as US jobs data fails to boost rate cut hopes

-

Carey slams ton as Australia seize upper hand in third Ashes Test

Carey slams ton as Australia seize upper hand in third Ashes Test

-

Bondi shooting shocks, angers Australia Jewish community

-

Myanmar junta seeks to prosecute hundreds for election 'disruption'

Myanmar junta seeks to prosecute hundreds for election 'disruption'

-

West Indies hope Christmas comes early in must-win New Zealand Test

-

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

Knicks beat Spurs in NBA Cup final to end 52-year trophy drought

-

Khawaja revels in late lifeline as Australia 194-5 in 3rd Ashes Test

-

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

Grief and fear as Sydney's Jewish community mourns 'Bondi rabbi'

-

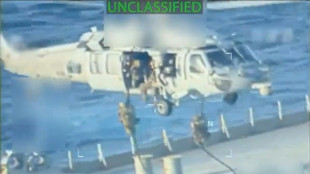

Trump orders blockade of 'sanctioned' Venezuela oil tankers

-

Brazil Senate to debate bill to slash Bolsonaro jail term

Brazil Senate to debate bill to slash Bolsonaro jail term

-

New Zealand ex-top cop avoids jail time for child abuse, bestiality offences

-

Eurovision facing fractious 2026 as unity unravels

Eurovision facing fractious 2026 as unity unravels

-

'Extremely exciting': the ice cores that could help save glaciers

-

Asian markets drift as US jobs data fails to boost rate cut hopes

Asian markets drift as US jobs data fails to boost rate cut hopes

-

What we know about Trump's $10 billion BBC lawsuit

-

Ukraine's lost generation caught in 'eternal lockdown'

Ukraine's lost generation caught in 'eternal lockdown'

-

'Catastrophic mismatch': Safety fears as Jake Paul faces Anthony Joshua

-

Australia's Steve Smith ruled out of third Ashes Test

Australia's Steve Smith ruled out of third Ashes Test

-

Khawaja grabs lifeline as Australia reach 94-2 in 3rd Ashes Test

-

Undefeated boxing great Crawford announces retirement

Undefeated boxing great Crawford announces retirement

-

Trump says orders blockade of 'sanctioned' Venezuela oil tankers

-

UK experiences sunniest year on record

UK experiences sunniest year on record

-

Australia holds first funeral for Bondi Beach attack victims

-

FIFA announces $60 World Cup tickets after pricing backlash

FIFA announces $60 World Cup tickets after pricing backlash

-

Maresca relishes support of Chelsea fans after difficult week

Tax Extensions Don't Stop Interest - Clear Start Tax Breaks Down the Hidden Cost of Filing Late

Many taxpayers mistakenly believe an extension pauses IRS penalties and interest. Experts say that misunderstanding can quietly inflate tax bills by thousands.

IRVINE, CA / ACCESS Newswire / December 17, 2025 / As the annual tax deadline passes, millions of Americans who filed for an extension may be unaware that extra time to file does not mean extra time to pay. According to tax resolution specialists at Clear Start Tax, interest on unpaid balances continues to accrue from the original filing deadline - often catching taxpayers off guard months later when their balance is significantly higher than expected.

An IRS filing extension allows taxpayers to submit their return later in the year, typically by October, but it does not stop interest from accumulating on any unpaid taxes. In many cases, penalties may also apply, depending on how much was paid by the original deadline.

"Extensions are commonly misunderstood as a pause button," said a spokesperson for Clear Start Tax. "In reality, the IRS starts charging interest immediately on unpaid taxes, even if you've done everything 'right' by requesting an extension."

Clear Start Tax reports that taxpayers who underestimate their balance or delay payment often face compounding costs that can escalate quickly. Interest accrues daily, and even relatively modest balances can grow substantially over time.

"We regularly speak with people who are shocked when their tax bill increases by hundreds or even thousands of dollars," the spokesperson said. "They assumed filing later meant paying later, and that's simply not how the system works."

The firm advises taxpayers who need more time to file to still submit an estimated payment by the April deadline whenever possible. Even partial payments can significantly reduce interest and penalties.

"The IRS doesn't require perfection, but it does reward proactive effort," the Clear Start Tax spokesperson added. "Paying something is almost always better than paying nothing."

Tax professionals note that with enforcement efforts increasing, misunderstandings around extensions could lead to avoidable financial stress later in the year, especially for self-employed individuals, gig workers, and households with variable income.

By answering a few simple questions, taxpayers can find out if they're eligible for the IRS Fresh Start Program and take the first step toward resolving their tax debt.

About Clear Start Tax

Clear Start Tax is a national tax resolution firm that helps individuals and businesses navigate complex IRS matters, including back taxes, penalties, and collection actions. The company focuses on education-driven guidance and personalized strategies designed to help taxpayers regain financial stability and compliance.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

J.Oliveira--AMWN