-

Final chaos against Senegal leaves huge stain on Morocco's AFCON

Final chaos against Senegal leaves huge stain on Morocco's AFCON

-

Germany brings back electric car subsidies to boost market

-

Europe wants to 'avoid escalation' on Trump tariff threat: Merz

Europe wants to 'avoid escalation' on Trump tariff threat: Merz

-

Syrian army deploys in former Kurdish-held areas under ceasefire deal

-

Louvre closes for the day due to strike

Louvre closes for the day due to strike

-

Trump to charge $1bn for permanent 'peace board' membership

-

Centurion Djokovic romps to Melbourne win as Swiatek, Gauff move on

Centurion Djokovic romps to Melbourne win as Swiatek, Gauff move on

-

Brignone unsure about Olympics participation ahead of World Cup comeback

-

Roger Allers, co-director of "The Lion King", dead at 76

Roger Allers, co-director of "The Lion King", dead at 76

-

Senegal awaits return of 'heroic' AFCON champions

-

Trump to charge $1bn for permanent 'peace board' membership: reports

Trump to charge $1bn for permanent 'peace board' membership: reports

-

Trump says world 'not secure' until US has Greenland

-

Champions League crunch time as pressure piles on Europe's elite

Champions League crunch time as pressure piles on Europe's elite

-

Harry arrives at London court for latest battle against UK newspaper

-

Swiatek survives scare to make Australian Open second round

Swiatek survives scare to make Australian Open second round

-

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

-

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

-

What is the EU's anti-coercion 'bazooka' it could use against US?

-

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

-

Gold, silver hit peaks and stocks sink on new US-EU trade fears

-

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

-

Warhorse Wawrinka stays alive at farewell Australian Open

-

Bangladesh face deadline over refusal to play World Cup matches in India

Bangladesh face deadline over refusal to play World Cup matches in India

-

High-speed train collision in Spain kills 39, injures dozens

-

Auger-Aliassime retires in Melbourne heat with cramp

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

-

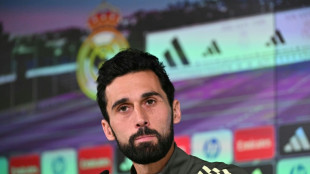

Stroking egos key for Arbeloa as Real Madrid host Monaco

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

-

Gauff 'erases' serving wobbles in winning Melbourne start

Gauff 'erases' serving wobbles in winning Melbourne start

-

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

-

Three-time finalist Medvedev grinds into Australian Open round two

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

Gold hits peak, stocks sink on new Trump tariff threat

Gold and silver prices hit record highs and stock markets slid Monday as investors sought safety after US President Donald Trump threatened fresh tariffs over opposition to his Greenland ambitions.

European countries including Denmark, of which Greenland is an autonomous territory, said they "stand united" against Trump's vow on Saturday to hit them with tariffs of up to 25 percent unless Greenland is ceded to the United States.

"Gold surged to a record high and stocks wobbled as fresh worries about Greenland surfaced," noted Neil Wilson, investor strategist at Saxo UK.

Gold has broken record after record in recent months as the precious commodity, along with sister metal silver, benefits from safe-haven status.

The latest market unrest followed Trump's threats against Iran last week and the recent US ouster of Venezuelan president Nicolas Maduro which triggered volatility in the oil market.

Gold hit a peak of $4,690.59 an ounce on Monday, while silver struck an all-time high of $94.12 an ounce.

The Frankfurt and Paris stock markets retreated around 1.5 percent in late morning deals, as London shed around 0.6 percent.

The dollar fell against main rivals, including the yen.

Wall Street was shut for Martin Luther King Day.

Japanese Prime Minister Sanae Takaichi said she would dissolve parliament this week ahead of a snap election on February 8, hoping for a stronger mandate to push through her ambitious policy agenda.

Reacting to Trump's latest move over tariffs, UK Prime Minister Keir Starmer said a "trade war is in no one's interest".

"The use of tariffs against allies is completely wrong," Starmer told a hastily-arranged press conference Monday.

In stocks trading, the luxury and auto sectors were hit hard by Trump's threats, with the share prices of LVMH and BMW each down 4.0 percent.

However, defence stocks climbed, with Germany's Rheinmetall up 2.8 percent and Britain's BAE Systems gaining 1.8 percent.

The IMF on Monday upgraded its 2026 global growth forecast, citing a boost from tech investments but warning that a reevaluation of AI productivity gains or renewed trade tensions could bring disruptions.

World economic growth is projected to hold steady at 3.3 percent this year, the International Monetary Fund said, raising its forecast by 0.2 percentage points from October.

This would match the pace of growth in 2025.

China's economy grew at one of the slowest rates in decades last year, official data revealed Monday, as authorities struggled to overcome low consumer spending and a debt crisis in the property sector.

Chinese stocks closed mixed at the start of the new trading week.

- Key figures at around 1045 GMT -

London - FTSE 100: DOWN 0.6 percent at 10,174.60 points

Frankfurt - DAX: DOWN 1.4 percent at 24,942.07

Paris - CAC 40: DOWN 1.6 percent at 8,130.12

Tokyo - Nikkei 225: DOWN 0.7 percent at 53,583.57 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 26,563.90 (close)

New York - Dow: DOWN 0.2 percent at 49,359.33 (close)

Shanghai - Composite: UP 0.3 percent at 4,114.00 (close)

Euro/dollar: UP at $1.1624 from $1.1604 on Friday

Pound/dollar: UP at $1.3410 from $1.3382

Dollar/yen: DOWN at 157.85 yen from 158.07 yen

Euro/pound: UP at 86.72 pence from 86.69 pence

Brent North Sea Crude: DOWN 0.6 percent at $63.76 per barrel

West Texas Intermediate: DOWN 0.5 percent at $59.02 per barrel

burs-bcp/ajb/rl

P.M.Smith--AMWN