-

Rahm says golfers should be 'free' to play where they want after LIV defections

Rahm says golfers should be 'free' to play where they want after LIV defections

-

More baby milk recalls in France after new toxin rules

-

Rosenior will not rush Estevao return from Brazil

Rosenior will not rush Estevao return from Brazil

-

Mercedes ready to win F1 world title, says Russell

-

Germany hit by nationwide public transport strike

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

European stocks rise as gold, oil prices tumble

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

-

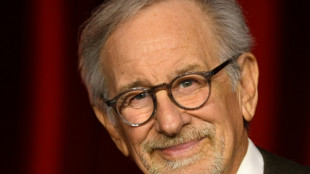

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

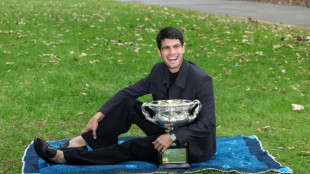

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

TaxBandits Offers E-Filing Support as Feb. 2 Deadline Arrives for 1099, W-2 and 94x Forms

TaxBandits Offers E-Filing Support as Feb. 2 Deadline Arrives for 1099, W-2 and 94x Forms

-

Bank of San Francisco Reports Fourth Quarter and Year Ended December 31, 2025 Financial Results

-

Jericho Energy Ventures Strategically Terminates SmartKem LOI to Advance Independent Data Center Energy Infrastructure Platform

Jericho Energy Ventures Strategically Terminates SmartKem LOI to Advance Independent Data Center Energy Infrastructure Platform

-

American Antimony Advances ALS-Led Flotation Testing on MTA Samples to Develop U.S.-Sourced High-Grade Concentrates as Initial Head Grades Exceed 30% Sb, Placing Bernice Canyon Among the Highest Antimony Head Grades Evaluated Globally

-

30% Healthcare Surge vs. The Remote Work Ceiling: Defining the 2026 U.S. Employment Shift

30% Healthcare Surge vs. The Remote Work Ceiling: Defining the 2026 U.S. Employment Shift

-

Formerra and Evonik Expand Distribution Partnership for Healthcare Grades

-

Ondas to Acquire Rotron Aero, Expanding Long‑Range Attack Capabilities and Unmanned Vehicle Technologies for Advanced Defense Missions

Ondas to Acquire Rotron Aero, Expanding Long‑Range Attack Capabilities and Unmanned Vehicle Technologies for Advanced Defense Missions

-

Auri Inc ("AURI") Releases Corporate Update Regarding subsidiary Companies

-

Global Interactive Technologies, Inc. Expands Music IP Portfolio with Key Artist Agreements

Global Interactive Technologies, Inc. Expands Music IP Portfolio with Key Artist Agreements

-

Unusual Machines Promotes Drew Camden to President

2026 Tax Brackets May Push More Taxpayers Into Higher Rates, Clear Start Tax Warns

Income Increases and Outdated Withholding May Leave Filers Owing More to the IRS This Tax Season

IRVINE, CALIFORNIA / ACCESS Newswire / January 28, 2026 / As taxpayers file returns this season, Clear Start Tax warns that changes tied to 2026 tax brackets could result in higher tax bills for individuals whose income increased modestly over the past year.

Tax brackets are adjusted periodically to account for inflation, but Clear Start Tax notes that wage growth, bonuses, overtime, and secondary income can still push taxpayers into higher brackets without a corresponding increase in withholding. As a result, many filers may owe more than expected despite earning only slightly more than the prior year.

"Taxpayers often assume raises automatically translate into higher take-home pay," said a Clear Start Tax spokesperson. "But moving into a higher bracket can create unexpected tax exposure if withholding isn't adjusted."

Clear Start Tax adds that taxpayers with multiple income sources - including freelance work, investment income or retirement distributions - are particularly vulnerable to bracket-related underpayment issues. These shortfalls can lead to balances due, penalties, and interest if not addressed promptly.

To reduce risk, Clear Start Tax recommends reviewing withholding annually, especially after income changes, and evaluating whether estimated payments are required. Taxpayers who discover they owe more than expected or receive IRS notices may benefit from professional assistance to explore resolution options.

About Clear Start Tax

Clear Start Tax is a national tax resolution firm that helps individuals and businesses address IRS and state tax issues, including back taxes, penalties, and collection actions. The firm focuses on educating taxpayers about compliance requirements and guiding them through available relief options to achieve lasting financial stability.

Need Help With Back Taxes?

Click the link below:

https://clearstarttax.com/qualifytoday/

(888) 710-3533

Contact Information

Clear Start Tax

Corporate Communications Department

[email protected]

(949) 800-4011

SOURCE: Clear Start Tax

View the original press release on ACCESS Newswire

Y.Aukaiv--AMWN