-

NFL Cardinals hire Rams' assistant LaFleur as head coach

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

Fiji top sevens standings after comeback win in Singapore

-

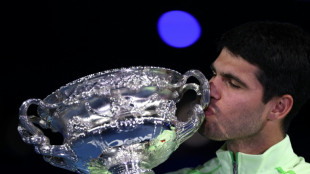

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

-

Djokovic says 'been a great ride' after Melbourne final loss

Djokovic says 'been a great ride' after Melbourne final loss

-

Von Allmen storms to downhill win in final Olympic tune-up

-

Carlos Alcaraz: tennis history-maker with shades of Federer

Carlos Alcaraz: tennis history-maker with shades of Federer

-

Alcaraz sweeps past Djokovic to win maiden Australian Open title

-

French IT giant Capgemini to sell US subsidiary after row over ICE links

French IT giant Capgemini to sell US subsidiary after row over ICE links

-

Iran's Khamenei likens protests to 'coup', warns of regional war

-

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

New Epstein accuser claims sexual encounter with ex-prince Andrew: report

-

Italy's extrovert Olympic icon Alberto Tomba insists he is 'shy guy'

-

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

Chloe Kim goes for unprecedented snowboard halfpipe Olympic treble

-

Pakistan combing for perpetrators after deadly separatist attacks

-

Israel partially reopens Gaza's Rafah crossing

Israel partially reopens Gaza's Rafah crossing

-

Iran declares European armies 'terrorist groups' after IRGC designation

-

Snowstorm disrupts travel in southern US as blast of icy weather widens

Snowstorm disrupts travel in southern US as blast of icy weather widens

-

Denmark's Andresen swoops to win Cadel Evans Road Race

S&P Global (S&P) Assigns 'A/A-1' Ratings with a Positive Outlook to Africa Finance Corporation Reflecting its Robust Credit Profile

The agency pointed in particular to AFC's capacity to structure and execute complex transactions, and to deploy capital across priority sectors where private financing alone is often insufficient

LONDON, UK / ACCESS Newswire / January 29, 2026 / Africa Finance Corporation (AFC) (www.AfricaFC.org), the continent's leading infrastructure solutions provider, today welcomed the assignment of 'A' long-term and 'A-1' short-term issuer credit ratings, with a Positive Outlook, by S&P Global (S&P) Ratings, following the rating agency's official announcement.

According to S&P, the ratings reflect AFC's strong institutional and financial risk profile, underpinned by robust liquidity buffers, disciplined risk management, and the institution's ability to mobilise private capital for complex, cross‑border infrastructure and industrial projects across Africa. The 'A' category assessment represents the highest rating assigned to AFC by a major global ratings agency, reinforcing its position as one of the highest-rated investment-grade African financial institutions, strengthening its standing in global capital markets and supporting continued access to diversified, long-term funding sources.

In its published analysis, S&P emphasised AFC's expanded scale, broadened mandate and established operating model, underscoring the institution's leadership in delivering infrastructure and industrial assets that are central to Africa's long‑term growth. The agency pointed in particular to AFC's capacity to structure and execute complex transactions, and to deploy capital across priority sectors where private financing alone is often insufficient.

S&P also referenced AFC's growing continental footprint, with the institution having disbursed US$18.5 billion across 36 African countries since inception. Investments span energy, transport and logistics, natural resources, heavy industry, telecommunications and technology, with flagship projects including the Lobito Corridor, linking Angola, Zambia and the Democratic Republic of Congo - a strategically important trade and logistics corridor supporting regional integration and supply‑chain resilience. S&P commented, "Given its mandate and emphasis on financing critical infrastructure, AFC plays a strategically important role that is not easily replicated by other development finance institutions (DFIs) or commercial lenders, in our view."

Further AFC investments include ARISE Integrated Industrial Platforms, supporting the development of industrial zones that anchor local value addition in sectors such as agro-processing, manufacturing and logistics, and the Kamoa-Kakula copper complex in the Democratic Republic of Congo, one of the world's highest-grade and fastest-growing copper projects. The Corporation has a history of successful asset exits, including partial exits from ARISE and from Ghana's Takoradi Port, demonstrating AFC's ability to originate, scale and responsibly reinvest capital. Together, these investments underline AFC's capacity to combine long-term development impact with disciplined execution and capital stewardship.

The Positive Outlook reflects S&P's expectation that AFC will continue to broaden its shareholder base - which currently comprises 60 shareholders, including sovereigns, financial institutions, pension funds and multilaterals - strengthen its capital position, and sustain strong liquidity and asset‑quality metrics as it delivers on its medium‑term strategy.

"This S&P Global rating is a strong validation of AFC's financial strength, governance, and strategic role in financing Africa's infrastructure and industrial transformation," said Samaila Zubairu, President & CEO of Africa Finance Corporation. "It reflects the institution we have built: a solutions-oriented, execution-driven platform with disciplined balance-sheet management and a track record of delivering complex, high-impact projects. Just as importantly, it reinforces AFC's commitment to work in lockstep with sovereign priorities, supporting long-term national development plans with bankable structures, catalytic capital, and measurable outcomes that accelerate growth, competitiveness, and jobs across the continent."

S&P highlighted AFC's experienced management team, its successful capital-raising programme and track record of maintaining very strong liquidity coverage ratios, even under stressed market conditions. S&P commented, "Based on end-2024 data, our 12-month liquidity ratio was 3.1x (including scheduled loans disbursements), while the six-month ratio was 5.5x. These ratios compare favorably with peers. Under stressed market conditions, we consider AFC's liquid assets sufficient to service its borrowing and maintain operations through the next year without slowing the pace of planned disbursements."

The S&P ratings are expected to further reinforce AFC's role as a catalyst for private investments, as it continues to finance infrastructure, industrialisation and trade-enabling assets critical to Africa's long-term economic transformation.

Structured Credit International Corp. (www.4SCIC.com) acted as a ratings adviser to AFC.

Distributed by APO Group on behalf of Africa Finance Corporation (AFC).

Download Image: https://apo-opa.co/3Zr9WXH (Africa Finance Corporation receives 'A' long-term and 'A-1' short-term issuer credit ratings, with a Positive Outlook, by S&P Global (S&P) Ratings)

Media Enquiries:

Yewande Thorpe

Communications

Africa Finance Corporation

Mobile: +234 1 279 9654

Email: [email protected]

About AFC:

AFC was established in 2007 to be the catalyst for pragmatic infrastructure and industrial investments across Africa. AFC's approach combines specialist industry expertise with a focus on financial and technical advisory, project structuring, project development, and risk capital to address Africa's infrastructure development needs and drive sustainable economic growth.

Eighteen years on, AFC has developed a track record as the partner of choice in Africa for investing and delivering on instrumental, high-quality infrastructure assets that provide essential services in the core infrastructure sectors of energy, natural resources, heavy industry, transport, and telecommunications. AFC has 48 member countries and has invested over US$18.5 billion in 36 African countries since its inception.

AFC is also rated A3 (Stable Outlook) by Moody's Ratings, A+ (Stable Outlook) by Japan Credit Rating Agency, and AAAspc (Stable Outlook) by S&P Ratings (China) Co., Ltd. and AAA (Stable Outlook) by China Chengxin International Credit Rating Co. Ltd. (CCXI).

SOURCE: Africa Finance Corporation (AFC)

View the original press release on ACCESS Newswire

P.Mathewson--AMWN