-

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

-

US to end shipping loophole for Chinese goods Friday

-

Forest's Champions League dreams hit by Brentford defeat

Forest's Champions League dreams hit by Brentford defeat

-

Norris and Piastri taking championship battle in their stride

-

Chelsea close in on UEFA Conference League final with win at Djurgarden

Chelsea close in on UEFA Conference League final with win at Djurgarden

-

Spurs take control in Europa semi against Bodo/Glimt

-

Man Utd seize control of Europa League semi against 10-man Bilbao

Man Utd seize control of Europa League semi against 10-man Bilbao

-

With minerals deal, Ukraine finds way to secure Trump support

-

Amazon revenue climbs 9%, but outlook sends shares lower

Amazon revenue climbs 9%, but outlook sends shares lower

-

Trump axes NSA Waltz after chat group scandal

-

Forest Champions League dreams hit after Brentford defeat

Forest Champions League dreams hit after Brentford defeat

-

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

-

US expects Iran talks but Trump presses sanctions

US expects Iran talks but Trump presses sanctions

-

Baffert returns to Kentucky Derby, Journalism clear favorite

-

Top Trump security official replaced after chat group scandal

Top Trump security official replaced after chat group scandal

-

Masked protesters attack Socialists at France May Day rally

-

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

Mumbai eliminate Rajasthan from IPL playoff race with bruising win

-

McDonald's profits hit by weakness in US market

-

Rio goes Gaga for US singer ahead of free concert

Rio goes Gaga for US singer ahead of free concert

-

New research reveals where N. American bird populations are crashing

-

Verstappen late to Miami GP as awaits birth of child

Verstappen late to Miami GP as awaits birth of child

-

Zelensky says minerals deal with US 'truly equal'

-

Weinstein lawyer says accuser sought payday from complaint

Weinstein lawyer says accuser sought payday from complaint

-

Police arrest more than 400 in Istanbul May Day showdown

-

Herbert named head coach of Canada men's basketball team

Herbert named head coach of Canada men's basketball team

-

'Boss Baby' Suryavanshi falls to second-ball duck in IPL

-

Shibutani siblings return to ice dance after seven years

Shibutani siblings return to ice dance after seven years

-

300,000 rally across France for May 1, union says

-

US-Ukraine minerals deal: what we know

US-Ukraine minerals deal: what we know

-

Top Trump official ousted after chat group scandal: reports

-

Schueller hat-trick sends Bayern women to first double

Schueller hat-trick sends Bayern women to first double

-

Baudin in yellow on Tour de Romandie as Fortunato takes 2nd stage

-

UK records hottest ever May Day

UK records hottest ever May Day

-

GM cuts 2025 outlook, projects up to $5 bn hit from tariffs

-

Thousands of UK children write to WWII veterans ahead of VE Day

Thousands of UK children write to WWII veterans ahead of VE Day

-

Top Trump official exiting after chat group scandal: reports

-

Madrid Open holder Swiatek thrashed by Gauff in semis

Madrid Open holder Swiatek thrashed by Gauff in semis

-

Sheinbaum says agreed with Trump to 'improve' US-Mexico trade balance

-

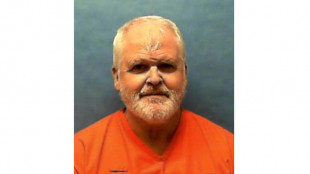

US veteran convicted of quadruple murder to be executed in Florida

US veteran convicted of quadruple murder to be executed in Florida

-

UK counter terrorism police probe Irish rappers Kneecap

-

S. Korea crisis deepens with election frontrunner retrial, resignations

S. Korea crisis deepens with election frontrunner retrial, resignations

-

Trump administration releases report critical of youth gender care

-

IKEA opens new London city centre store

IKEA opens new London city centre store

-

Police deploy in force for May Day in Istanbul, arrest hundreds

-

Syria Druze leader condemns 'genocidal campaign' against community

Syria Druze leader condemns 'genocidal campaign' against community

-

Prince Harry to hear outcome of UK security appeal on Friday

-

Microsoft raises Xbox prices globally, following Sony

Microsoft raises Xbox prices globally, following Sony

-

US stocks rise on Meta, Microsoft ahead of key labor data

-

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

Toulouse injuries mount as Ramos doubtful for Champions Cup semi

-

Guardiola glad of Rodri return but uncertain if he'll play in FA Cup final

Stocks rise as traders eye rate hikes, Ukraine

Stock markets in the United States and Europe mostly rose Monday as investors track corporate earnings, expected interest rate hikes and the standoff over Ukraine.

Wall Street was mixed in early trading, with the Dow slightly lower while the NASDAQ and S&P 500 were up.

In Europe, the London FTSE 100, Frankfurt DAX and Paris CAC 40 were up at least half a point in afternoon trading.

A forecast-busting US jobs report Friday reinforced optimism that the world's top economy was well on the recovery track, but also ramped up expectations of an interest rate hike by the US Federal Reserve in March.

It comes as surging global inflation resulted in the Bank of England last week hiking its main interest rate for a second meeting in a row, while the European Central Bank signalled for the first time that it may raise borrowing costs this year.

"Volatility is likely to continue as the global markets adjust to the prospect of tighter monetary policies, as well as geopolitical tensions between Russia and Ukraine, and a mixed Q4 (fourth quarter) earnings season, which will continue to roll on this week," investment bank Charles Schwab said in a note.

With US inflation data this week tipped to show prices rising at a pace not seen in 40 years, traders are becoming increasingly anguished that Federal Reserve rate hike plans could jeopardise the recovery.

There is mounting talk that the US central bank will have to hike borrowing costs at least four times this year -- with some predicting as many as seven rises could occur.

- 'Worst appears behind us' -

Craig Erlam at trading platform OANDA said investors have already prepared for potential rate increases.

"And with so much now priced in -- of course, there's always room for more -- we could see investors taking some comfort from the fact that the worst appears to be behind us," he said.

On the geopolitical front, investors are nervous over Western fears that Russia plans to invade Ukraine.

Investors are also watching for more corporate earnings statements this week after a disappointing report from Facebook parent Meta last week caused the company's shares to sink, dragging markets along.

Elsewhere Monday, oil prices continued their retreat after European benchmark contract, Brent North Sea crude, hit $94 -- the highest level for more than seven years.

"Oil prices are a little flat at the start of the week with the rally losing a little momentum after nuclear talks between the US and Iran appeared to make positive progress," Erlam said.

But the continued reopening of the world economy as well as a cold snap in the United States and uncertainty over the Russia-Ukraine stand-off are expected to keep crude futures well supported, according to analysts.

- Key figures around 1430 GMT -

London - FTSE 100: UP 0.7 percent at 7566.06 points

Frankfurt - DAX: UP 0.6 percent at 15191.47

Paris - CAC 40: UP 0.5 percent at 6985.99

EURO STOXX 50: UP 0.7 percent at 4,113.14

Tokyo - Nikkei 225: DOWN 0.7 percent at 27,248.87 (close)

Hong Kong - Hang Seng Index: FLAT at 24,579.55 (close)

Shanghai - Composite: UP 2.0 percent at 3,429.58 (close)

New York - Dow: DOWN 0.1 percent at 35062.41 percent

Euro/dollar: DOWN at $1.1431 from $1.1453 Friday

Pound/dollar: DOWN at $1.3514 from $1.3527

Euro/pound: DOWN at 84.58 pence from 84.65 pence

Dollar/yen: DOWN at 115.08 from 115.21 yen

Brent North Sea crude: DOWN 0.54 percent at $92.77 per barrel

West Texas Intermediate: DOWN 1.16 percent at $91.24 per barrel

P.Costa--AMWN