-

In show stretched over 50 years, Slovenian director shoots for space

In show stretched over 50 years, Slovenian director shoots for space

-

Hard right wins local UK election in blow to PM Starmer

-

Australian triple-murder suspect never asked after poisoned guests: husband

Australian triple-murder suspect never asked after poisoned guests: husband

-

Brunson brilliance as Knicks clinch series, Clippers sink Nuggets

-

UK court to rule on Prince Harry security appeal

UK court to rule on Prince Harry security appeal

-

'Alarming deterioration' of US press freedom under Trump, says RSF

-

Hard right makes early gains as local polls test UK's main parties

Hard right makes early gains as local polls test UK's main parties

-

China says open to US trade talks offer but wants tariffs scrapped

-

Climate change takes spice from Indonesia clove farms

Climate change takes spice from Indonesia clove farms

-

Bruised Real Madrid must stay in title fight against Celta

-

Top-five race heats up as Saints try to avoid unwanted history

Top-five race heats up as Saints try to avoid unwanted history

-

Asian stocks gain after China teases US tariff talks

-

South Korea former PM launches presidential bid

South Korea former PM launches presidential bid

-

Mueller eyes one final title as Bayern exit draws near

-

Canelo aims to land knockout blow against Scull in Saudi debut

Canelo aims to land knockout blow against Scull in Saudi debut

-

Lions hopefuls get one last chance to shine with Champions Cup semis

-

Trump vs Toyota? Why US cars are a rare sight in Japan

Trump vs Toyota? Why US cars are a rare sight in Japan

-

Ryu, Ariya shake off major letdowns to start strong in Utah

-

Sean 'Diddy' Combs: the rap mogul facing life in prison

Sean 'Diddy' Combs: the rap mogul facing life in prison

-

Sean 'Diddy' Combs sex crimes trial to begin Monday

-

Backyard barnyard: rising egg prices prompt hen hires in US

Backyard barnyard: rising egg prices prompt hen hires in US

-

Trinidad leader sworn in, vows fresh start for violence-weary state

-

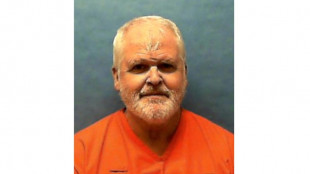

US veteran convicted of quadruple murder executed in Florida

US veteran convicted of quadruple murder executed in Florida

-

UK comedian Russell Brand due in court on rape charges

-

Tokyo's tariff envoy says US talks 'constructive'

Tokyo's tariff envoy says US talks 'constructive'

-

Ledecky out-duels McIntosh in sizzing 400m free

-

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

Scheffler grabs PGA lead with sizzling 61 at CJ Cup Byron Nelson

-

'Divine dreams' and 38 virgins at Trump prayer event

-

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

Apple expects $900 mn tariff hit, US iPhone supply shifts to India

-

Lakers prepare for offseason rebuild after playoff exit

-

Dr. Moirar Leveille to Speak at Yale’s Women’s Mental Health Conference on Integrative, Cross-Cultural Healing

Dr. Moirar Leveille to Speak at Yale’s Women’s Mental Health Conference on Integrative, Cross-Cultural Healing

-

RYDE Files Annual Report on Form 20-F for Fiscal Year 2024

-

Mindfulness Architect Holly McNeill to Speak at Yale's Women’s Mental Health Conference on Quarter-Life Crisis and Mental Clarity

Mindfulness Architect Holly McNeill to Speak at Yale's Women’s Mental Health Conference on Quarter-Life Crisis and Mental Clarity

-

Dr. Mariel Buqué and Madam Nselaa Ward, JD to Headline Yale’s Women’s Mental Health Conference with Groundbreaking Talks on Shame, Trauma, and Equity in Healthcare

-

Empire Metals Limited Announces Conference Presentations in Australia & N America

Empire Metals Limited Announces Conference Presentations in Australia & N America

-

Madam Nselaa Ward, JD Named Yale Speaker on Shame, Mental Health & Equity in Healthcare

-

'Natural' for stars like Maguire to deliver now: Man Utd's Amorim

'Natural' for stars like Maguire to deliver now: Man Utd's Amorim

-

EU preparing new sanctions on Russia, French minister tells AFP

-

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

Apple expects $900 mn tariff hit as shifts US iPhone supply to India

-

US to end shipping loophole for Chinese goods Friday

-

Forest's Champions League dreams hit by Brentford defeat

Forest's Champions League dreams hit by Brentford defeat

-

Norris and Piastri taking championship battle in their stride

-

Chelsea close in on UEFA Conference League final with win at Djurgarden

Chelsea close in on UEFA Conference League final with win at Djurgarden

-

Spurs take control in Europa semi against Bodo/Glimt

-

Man Utd seize control of Europa League semi against 10-man Bilbao

Man Utd seize control of Europa League semi against 10-man Bilbao

-

With minerals deal, Ukraine finds way to secure Trump support

-

Amazon revenue climbs 9%, but outlook sends shares lower

Amazon revenue climbs 9%, but outlook sends shares lower

-

Trump axes NSA Waltz after chat group scandal

-

Forest Champions League dreams hit after Brentford defeat

Forest Champions League dreams hit after Brentford defeat

-

'Resilient' Warriors aim to close out Rockets in bruising NBA playoff series

| JRI | 0.77% | 13.01 | $ | |

| CMSD | -0.18% | 22.26 | $ | |

| SCS | -0.51% | 9.87 | $ | |

| BCC | -0.61% | 92.71 | $ | |

| NGG | -1.88% | 71.65 | $ | |

| CMSC | 0.09% | 22.03 | $ | |

| RYCEF | -0.99% | 10.12 | $ | |

| RIO | -1.45% | 58.55 | $ | |

| RBGPF | 100% | 67.21 | $ | |

| VOD | -0.31% | 9.73 | $ | |

| RELX | -1.02% | 54.08 | $ | |

| BCE | -3.78% | 21.44 | $ | |

| AZN | -1.82% | 70.51 | $ | |

| GSK | -2.84% | 38.75 | $ | |

| BTI | -0.58% | 43.3 | $ | |

| BP | 1.51% | 27.88 | $ |

Asian markets rise again as traders brace for US inflation data

Asian markets rose Wednesday following a positive performance on Wall Street as traders prepared for the release of highly anticipated US inflation data, while sentiment was also buoyed by signs of easing Russia-Ukraine tensions.

Oil prices also enjoyed a small bounce on demand optimism after two days of losses fuelled by the positive vibes from Eastern Europe and as talks on an Iran nuclear deal appear to be progressing.

With speculation swirling over the Federal Reserve's plans to battle soaring prices, global equities have fluctuated wildly at the start of the year as traders try to position themselves for a series of interest rate hikes that are likely to begin in March.

The prospect of the removal of cheap cash -- which has pushed markets to record or multi-year highs -- has particularly hit tech firms as they are more susceptible to higher rates.

However, the sector helped New York's three main indexes to healthy gains on Tuesday, and Asia followed suit in early trade Wednesday.

Hong Kong led the way, jumping 1.9 percent thanks to a six percent surge in market heavyweight Alibaba after Japan's SoftBank allayed fears it was planning to offload some of its huge holdings in the e-commerce giant.

Alibaba had taken a hit earlier on speculation about the share sale, which compounded the Chinese firm's woes after suffering hefty losses owing to Beijing's crackdown on the tech sector.

Tokyo, Sydney, Taipei and Bangkok were all up more than one percent, while Shanghai, Seoul, Singapore, Wellington, Mumbai, Manila and Jakarta also rallied.

Still, investors remain nervous and Thursday's US January inflation print is front and centre this week.

Forecasts are for another pop up from the four-decade-high seven percent seen in December, while a big miss in either direction could have big consequences for markets.

A higher reading will pile pressure on the Fed to embark on a more aggressive tightening campaign but a weaker figure would temper worries.

"The inflation data has continued to rise faster than many anticipated and we're now in a situation where central banks are racing to catch up and get to grips with price pressures," said OANDA's Craig Erlam.

"Many still expect we'll see an orderly return to inflation targets over the forecast horizon with moderate rate increases but the risk of inaction becomes far greater than the alternative."

He added: "The next 48 hours will be interesting, with the Fed minutes (from its most recent meeting) and US inflation data being released. So much has been priced in at this point -- five hikes from the Fed by December -- but there's potential for more.

"We may not yet have hit the peak as far as rate expectations are concerned and Thursday's (consumer prices) reading is expected to be another shocker."

Signs of a possible easing of tensions on the Russia-Ukraine border also provided a little pep to investors.

After speaking to Russia's Vladimir Putin, French President Emmanuel Macron said he saw the "possibility" for talks between Moscow and Kyiv over the festering conflict in eastern Ukraine to move forward, and "concrete, practical solutions" to lower tensions.

But hopes for a breakthrough have weighed on the oil market in recent days, as have indications that an agreement with Iran on its nuclear programme was close.

A deal with Tehran would pave the way for it to begin selling crude on the international market again, pushing much-needed supplies into a tight market.

Still, with demand expected to continue rising as the global economy reopens, commentators predict the black gold will break past $100 a barrel soon.

After falling more than two percent Tuesday, both main contracts extended losses in Asia.

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: UP 1.1 percent at 27,579.87 (close)

Hong Kong - Hang Seng Index: UP 1.9 percent at 24,792.10

Shanghai - Composite: UP 0.8 percent at 3,479.95 (close)

Euro/dollar: DOWN at $1.1418 from $1.1426 late Tuesday

Pound/dollar: UP at $1.3553 from $1.3545

Euro/pound: DOWN at 84.24 pence from 84.27 pence

Dollar/yen: DOWN at 115.50 from 115.53 yen

West Texas Intermediate: DOWN 0.3 percent at $89.12 per barrel

Brent North Sea crude: DOWN 0.3 percent at $90.53 per barrel

New York - Dow: UP 1.1 percent at 35,462.78 (close)

London - FTSE 100: DOWN 0.1 percent at 7,567.07 (close)

Y.Nakamura--AMWN