-

Greece set new tourism record in 2025

Greece set new tourism record in 2025

-

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Snoop Dogg 'can't wait' for first Swansea visit

-

Stocks fluctuate as traders assess AI fallout, tariffs

Stocks fluctuate as traders assess AI fallout, tariffs

-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

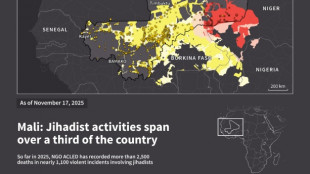

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

ARIA Cybersecurity Announces Major Oil Refiner Deploys AZT PROTECT(TM)

ARIA Cybersecurity Announces Major Oil Refiner Deploys AZT PROTECT(TM)

-

Greene Concepts Announces Major Be Water Expansion in Walmart Stores Across the Southeast

-

Fuse Battery Announces Amended Subscription Receipt Financing Details

Fuse Battery Announces Amended Subscription Receipt Financing Details

-

Lightwave Logic, Inc. Provides Update on Commercial Pipeline and Announces Timing of Fourth Quarter and Full Year 2025 Earnings Call

-

Unlearn Advances Huntington's Disease AI Modeling Through Access to CHDI Foundation Data

Unlearn Advances Huntington's Disease AI Modeling Through Access to CHDI Foundation Data

-

Protagonist Therapeutics to Participate in Multiple Investment Bank Conferences in March 2026

-

Specificity (OTCID:SPTY) to Present on the Emerging Growth Conference on February 26th, 2026.

Specificity (OTCID:SPTY) to Present on the Emerging Growth Conference on February 26th, 2026.

-

Havertys Reports Operating Results for Fourth Quarter 2025

-

Viemed Healthcare Announces Year End 2025 Earnings Conference Call Details

Viemed Healthcare Announces Year End 2025 Earnings Conference Call Details

-

Galway Metals Drilling Intersects 9.0 g/t Gold Over 6.0m Beginning 15.0m from Surface at Southwest Deposit

-

PeanutButterJelly Expands Affiliate Marketplace From 15 to 40 Affiliate Merchants; Website Sessions Rise 70%; Launches Conversion and Growth Optimization Plan

PeanutButterJelly Expands Affiliate Marketplace From 15 to 40 Affiliate Merchants; Website Sessions Rise 70%; Launches Conversion and Growth Optimization Plan

-

Digipower X Announces Uplisting to Cboe Canada

-

Jaguar Mining Provides Update on Geologic Interpretation at the Chamé Gold Exploration Target, Brazil

Jaguar Mining Provides Update on Geologic Interpretation at the Chamé Gold Exploration Target, Brazil

-

Electrovaya Receives $10.5 Million P.O from Fortune 500 Customer

Volcon ePowersports Reports Operational Highlights and First Quarter 2025 Financial Results

AUSTIN, TX / ACCESS Newswire / May 9, 2025 / Volcon Inc. (NASDAQ:VLCN) ("Volcon'', the "Company" or "we"), the first all-electric, off-road powersports company, today reported its operational highlights and financial results for the quarter ended March 31, 2025.

Company Highlights:

Sold all remaining Grunt EVO motorcycles in Q1

Signed amended and restated golf cart supply agreement with Venom-EV

Evaluating impact of tariffs on products

In the first quarter of 2025, Volcon successfully sold all remaining Grunt EVO motorcycles. The company has since received prototypes of a dual-sport motorcycle, which is currently in development. The primary goal is to make it available for sale in the second half of 2025. As of now, reaching this goal is dependent on testing, meeting on-road regulations, manufacturing costs, and the impact of tariffs.

As previously announced in February 2025, Volcon signed a golf cart supply agreement with Venom-EV LLC ("Venom") to supply Venom with golf carts. In April 2025, the agreement was amended and restated to adjust payment terms and the percentage Volcon will be paid for each golf cart ordered under said agreement.

On April 2, 2025, the U.S. imposed tariffs on goods imported from certain countries including China and Vietnam, where Volcon's vehicles are manufactured. On April 9, 2025, tariffs for China were increased while tariffs for Vietnam were deferred for 90 days. Further adjustments to these tariffs could occur. If the tariffs are put into place as proposed, they will significantly increase Volcon's vehicle and part costs. The company is currently evaluating the option of importing parts and assembling vehicles in the U.S. The second option would be to continue to import vehicles and pay the higher tariffs, increasing the selling price of vehicles.

John Kim, CEO, notes "the international trade landscape is in a state of flux and the ultimate tariff structure is uncertain. We are working to navigate this uncertainty by evaluating how we can limit the impact of the tariffs and still sell our products profitably. Our cash position is strong and we still believe we are on track to operate into 2026, but we are continuing to evaluate where we can reduce costs further while we assess our options."

Financial highlights:

3 Months Ended | ||||||||||

GAAP | March 31, | December 31, | September 30, | |||||||

Revenue | $ | 736,049 | $ | 986,916 | $ | 1,075,864 | ||||

Cost of goods sold | (781,383 | ) | (3,138,559 | ) | (10,294,720 | ) | ||||

Gross Margin | (45,334 | ) | (2,151,643 | ) | (9,218,856 | ) | ||||

Sales & Marketing | 510,957 | 774,026 | 470,692 | |||||||

Product Development | 388,523 | 519,483 | 528,352 | |||||||

General & Administrative | 1,561,657 | 1,660,627 | 1,916,712 | |||||||

Total Operating Expenses | 2,461,137 | 2,954,136 | 2,915,756 | |||||||

Loss from Operations | (2,506,471 | ) | (5,105,779 | ) | (12,134,612 | ) | ||||

Other Income (Expense) | 46,041 | (111,590 | ) | (1,503,866 | ) | |||||

Net loss | $ | (2,460,430 | ) | $ | (5,217,369 | ) | $ | (13,638,478 | ) | |

The financial results presented herein are subject to change pending completion of the audit of the annual financial statements.

Revenue: The Company's revenue for the first quarter of 2025 was $0.7 million compared to $1.0 million for the fourth quarter of 2024, and $1.1 million for the third quarter of 2024. Revenue for the first quarter of 2025 includes Grunt EVO revenue of $0.3 million, Brat revenue of $0.1 million, HF1 revenue of $0.1 million and MN1 revenue of $0.1 million. Revenue for the fourth quarter of 2024 includes Grunt EVO revenue of $0.3 million, Brat revenue of $0.4 million and $0.2 million for the adjustment of expired dealer rebates. Revenue for the third quarter of 2024 includes Grunt EVO revenue of $0.3 million, Brat revenue of $0.3 million, Stag revenue of $0.1 million and $0.1 million for the adjustment of expired dealer rebates.

Cost of Goods Sold: Included in cost of goods sold for the fourth quarter of 2024 is a charge of $2.5 million for the termination of the Stag and EVO supply agreements, offset by a reduction in the settlement for Torrot of $0.7 million and a charge for the write down of Grunt EVO finished goods of $0.3 million. Included in cost of goods sold for the third quarter of 2024 is a charge of $8.7 million for the write down of Stag parts inventory and prepaid deposits and $0.5 million for the write down of Grunt EVO finished goods inventory Absent the adjustments noted above, the Company's gross margin is trending close to break even. There were no significant expenses similar to the above in the first quarter of 2025.

Operating Expenses: Operating costs for the first quarter of 2025 have decreased across all categories as we continue to focus on reducing operating costs while continuing to make investments in product sourcing and our sales team to continue to build our dealer network to generate sales of our new products. Our product development costs have declined in the first quarter of 2025 compared to the last two quarters of 2024 since we no longer develop our vehicles which reduced prototype costs and payroll costs due to lower headcount requirements. Our general and administrative costs have declined in the first quarter of 2025 due to lower legal fees due to the completion of settlements, lower product liability costs compared to the fourth quarter of 2024 and an adjustment for estimated franchise tax expense in the fourth quarter of 2024.

Net loss: Net loss for the first quarter of 2025 includes an insignificant amount of other income.

Net loss for the fourth quarter of 2024 includes the recognition of a loss of $0.1 million for warrants issued in our November 2023 public offering as these warrants were deemed to be liabilities and are recorded at fair value with changes being recorded in income.

Net loss for the third quarter of 2024 includes the recognition of a gain of $0.1 million for warrants issued in our November 2023 public offering and a loss on repayment of debt of $1.5 million for the repayment of notes issued in May 2024 that were repaid with proceeds from our July 2024 equity offering and interest expense of $0.1 million primarily for these notes.

Adjusted EBITDA: Adjusted EBITDA for each quarter represents net loss adjusted to add back stock-based compensation, depreciation and amortization expense, interest expense, and the loss/gain on warrant liabilities. The Company's adjusted EBITDA for the first quarter of 2025 was a loss of $2.4 million, fourth quarter 2024 was a loss of $5.0 million compared to the third quarter 2024 loss of $12.1 million. See "Non-GAAP Reconciliation" below.

For the latest Company updates, follow Volcon on YouTube, Facebook, Instagram, and LinkedIn. Investor information about the Company, including press releases, company SEC filings, and more can be found at http://ir.volcon.com.

About Volcon

Based in the Austin, Texas area, Volcon was founded as the first all-electric powersports company producing high-quality and sustainable electric vehicles for the outdoor community. Volcon electric vehicles are the future of off-roading, not only because of their environmental benefits but also because of their near-silent operation, which allows for a more immersive outdoor experience.

Volcon's vehicle roadmap includes both motorcycles and utility terrain vehicles ("UTVs"). Its first product, the innovative Grunt, began shipping to customers in late 2021 and combines a fat-tired physique with high-torque electric power and a near-silent drive train. The Volcon Grunt EVO, an evolution of the original Grunt with a belt drive, an improved suspension, and seat, began shipping to customers in October 2023 and sold out in March 2025. The Brat is Volcon's first foray into the wildly popular eBike market for both on-road and off-road riding and is currently being delivered to dealers across North America. In 2024, Volcon entered the rapidly expanding low speed utility vehicles ("LUV") and UTV market and shipped its first production MN1 unit in October 2024. The new MN1 and HF1 products empower the driver to explore the outdoors in a new and unique way that gas-powered units cannot. They offer the same thrilling performance of a standard LUV / UTV without the noise (or pollution), allowing the driver to explore the outdoors with all their senses.

Volcon Contacts

For Media: [email protected]

For Dealers: [email protected]

For Investors: [email protected]

For Marketing: [email protected]

For more information on Volcon or our vehicle line-up, visit: www.volcon.com

NON-GAAP RECONCILIATION

We believe presenting adjusted EBITDA provides management and investors consistency and facilitates period to period comparisons of operations, as it eliminates the effects of certain variations to overall performance.

The following table reconciles net loss to adjusted EBITDA:

Adjusted EBITDA | 3 Months Ended | |||||||||

March 31, | December 31, | September 30, | ||||||||

Net loss | $ | (2,460,430 | ) | $ | (5,217,369 | ) | $ | (13,638,478 | ) | |

Share-based compensation (benefit) expense | 10,052 | 15,079 | 10,053 | |||||||

Depreciation and amortization expense | 40,754 | 92,568 | 72,332 | |||||||

Net interest expense | 36,412 | 33,417 | 83,334 | |||||||

Loss on repayment of May 2024 Notes | - | - | 1,470,554 | |||||||

(Gain) loss on change in fair value of derivative liabilities | (28,068 | ) | 94,413 | (53,724 | ) | |||||

Adjusted EBITDA | $ | (2,401,280 | ) | $ | (4,981,892 | ) | $ | (12,055,929 | ) | |

Forward-Looking Statements:

Some of the statements in this release are forward-looking statements, which involve risks and uncertainties. Whether tariffs will change for products manufactured for us in foreign countries, whether we can continue to reduce costs and whether we have sufficient cash to operate into 2026. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking statements. The Company has attempted to identify forward-looking statements by terminology including ''believes,'' ''estimates,'' ''anticipates,'' ''expects,'' ''plans,'' ''projects,'' ''intends,'' ''potential,'' ''may,'' ''could,'' ''might,'' ''will,'' ''should,'' ''approximately'' or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors. Any forward-looking statements contained in this release speak only as of its date. The Company undertakes no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events. More detailed information about the risks and uncertainties affecting the Company is contained under the heading "Risk Factors" in the Company's Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC, which are available on the SEC's website, www.sec.gov.

SOURCE: Volcon ePowersports, Inc.

View the original press release on ACCESS Newswire

F.Schneider--AMWN