-

Greece set new tourism record in 2025

Greece set new tourism record in 2025

-

Zelensky says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

Zelenksy says Ukraine unbroken after 4 years, but Russia vows to fight on

-

Snoop Dogg 'can't wait' for first Swansea visit

-

Stocks fluctuate as traders assess AI fallout, tariffs

Stocks fluctuate as traders assess AI fallout, tariffs

-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

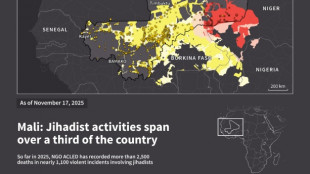

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

ARIA Cybersecurity Announces Major Oil Refiner Deploys AZT PROTECT(TM)

ARIA Cybersecurity Announces Major Oil Refiner Deploys AZT PROTECT(TM)

-

Greene Concepts Announces Major Be Water Expansion in Walmart Stores Across the Southeast

-

Fuse Battery Announces Amended Subscription Receipt Financing Details

Fuse Battery Announces Amended Subscription Receipt Financing Details

-

Lightwave Logic, Inc. Provides Update on Commercial Pipeline and Announces Timing of Fourth Quarter and Full Year 2025 Earnings Call

-

Unlearn Advances Huntington's Disease AI Modeling Through Access to CHDI Foundation Data

Unlearn Advances Huntington's Disease AI Modeling Through Access to CHDI Foundation Data

-

Protagonist Therapeutics to Participate in Multiple Investment Bank Conferences in March 2026

-

Specificity (OTCID:SPTY) to Present on the Emerging Growth Conference on February 26th, 2026.

Specificity (OTCID:SPTY) to Present on the Emerging Growth Conference on February 26th, 2026.

-

Havertys Reports Operating Results for Fourth Quarter 2025

-

Viemed Healthcare Announces Year End 2025 Earnings Conference Call Details

Viemed Healthcare Announces Year End 2025 Earnings Conference Call Details

-

Galway Metals Drilling Intersects 9.0 g/t Gold Over 6.0m Beginning 15.0m from Surface at Southwest Deposit

-

PeanutButterJelly Expands Affiliate Marketplace From 15 to 40 Affiliate Merchants; Website Sessions Rise 70%; Launches Conversion and Growth Optimization Plan

PeanutButterJelly Expands Affiliate Marketplace From 15 to 40 Affiliate Merchants; Website Sessions Rise 70%; Launches Conversion and Growth Optimization Plan

-

Digipower X Announces Uplisting to Cboe Canada

-

Jaguar Mining Provides Update on Geologic Interpretation at the Chamé Gold Exploration Target, Brazil

Jaguar Mining Provides Update on Geologic Interpretation at the Chamé Gold Exploration Target, Brazil

-

Electrovaya Receives $10.5 Million P.O from Fortune 500 Customer

Classover Completes Initial SOL Purchase and Enters into New Purchase Agreement to Sell up to $500 Million of Notes to Accelerate SOL Treasury Strategy

NEW YORK, NY / ACCESS Newswire / June 2, 2025 / Classover Holdings, Inc. (Nasdaq:KIDZ, KIDZW) ("Classover" or the "Company"), a leading provider of live, interactive online learning, today announced it has entered into a securities purchase agreement with Solana Growth Ventures LLC for the issuance of up to $500 million in senior secured convertible notes, advancing its strategic initiative to build a Solana (SOL)-based treasury reserve

Key Highlights:

- The securities purchase agreement provides for the issuance of up to $500 million in senior secured convertible notes. An initial closing and funding of $11 million is expected to occur promptly after customary closing conditions have been satisfied.

- The notes may be converted by the holder into the Company's Class B common stock at an initial conversion price equal to 200% of the closing price of the Company's Class B common stock on the trading day immediately prior to the closing date, subject to adjustment as provided for in the notes.

- Under the agreement, Classover is required to allocate up to 80% of the net proceeds toward purchases of SOL (Solana), subject to certain terms and limitations.

- This new agreement complements Classover's previously announced $400 million equity purchase agreement, increasing the Company's total potential financing capacity to $900 million, dedicated to supporting its SOL acquisition strategy.

- Prior to this agreement, Classover had already initiated its SOL reserve strategy, having purchased 6,472 SOL for approximately $1.05 million - marking the first step in its long-term strategy to acquire, hold, and stake Solana ("SOL") tokens.

The Company is also exploring opportunities for acquiring discounted blocks of locked tokens, as part of its broader accumulation and treasury strategy.

Ms. Luo, Chief Executive Officer of Classover Holdings, stated "This agreement marks a significant milestone in the Company's strategic initiative to build a SOL-based treasury reserve. By entering into this agreement, Classover reaffirms its strong commitment to becoming a leader in blockchain-aligned financial strategy and positioning itself among the first publicly traded companies to directly integrate SOL into its treasury operations."

Chardan is acting as the financial advisor and sole placement agent in connection with the offering.

For additional information on the purchase agreement and terms of the notes and related transactions, see Classover's Current Report on Form 8-K, which will be filed promptly, and which can be obtained, without charge, at the Securities and Exchange Commission's internet site (http://www.sec.gov).

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any securities of Classover, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

About Classover

Founded in 2020 and headquartered in New York, Classover has rapidly emerged as a leader in educational technology, specializing in live online courses for K-12 students worldwide. Offering a diverse curriculum tailored to different learning levels and interests, Classover empowers students through personalized instruction, innovative course design, and cutting-edge AI technology. From creativity-driven programs to competitive test preparation, Classover is dedicated to redefining education through accessible, high-quality learning experiences.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on Classover's current beliefs, expectations and assumptions regarding the future of Classover's business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Classover's control including, but not limited to: Classover's ability to execute its business model, including obtaining market acceptance of its products and services; Classover's financial and business performance, including financial projections and business metrics and any underlying assumptions thereunder; Classover's ability to maintain the listing of its securities on Nasdaq; changes in Classover's strategy, future operations, financial position, estimated revenue and losses, projected costs, prospects and plans; Classover's ability to attract and retain a large number of customers; Classover's future capital requirements and sources and uses of cash; Classover's ability to attract and retain key personnel; Classover's expectations regarding its ability to obtain and maintain intellectual property protection and not infringe on the rights of others; changes in applicable laws or regulations; and the possibility that Classover may be adversely affected by other economic, business, and/or competitive factors. These risks and uncertainties also include those risks and uncertainties indicated in the definitive proxy statement/prospectus included in the Registration Statement on Form S-4 filed by Classover in connection with its previously consummated business combination with Battery Future Acquisition Corp. Classover's actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

Any forward-looking statement made by Classover in this press release is based only on information currently available to Classover and speaks only as of the date on which it is made. Classover undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Contacts:

Classover Holdings Inc.

[email protected]

800-345-9588

SOURCE: Classover Holdings, Inc.

View the original press release on ACCESS Newswire

S.F.Warren--AMWN