-

Post-it maker 3M faces Belgian trial over 'forever' chemicals

Post-it maker 3M faces Belgian trial over 'forever' chemicals

-

UK comedian Russell Brand pleads not guilty to new rape, assault charges

-

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

Duterte drew up 'death lists', boasted about murders: ICC prosecutor

-

UK govt urged to release documents linked to ex-prince Andrew

-

Rights group slams treatment of viral Japanese monkey

Rights group slams treatment of viral Japanese monkey

-

Inside the bunker where Zelensky led response to Russian invasion

-

France demands explanation from US envoy over 'surprise' no-show

France demands explanation from US envoy over 'surprise' no-show

-

Putin failed to achieve goals in Ukraine, Zelensky says on war anniversary

-

China tightens Japanese trade restrictions as spat worsens

China tightens Japanese trade restrictions as spat worsens

-

Ukraine war exhibition opens at Berlin Nazi bunker museum

-

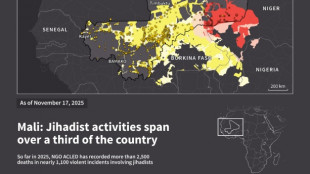

Jihadist threat puts eastern Senegal on edge

Jihadist threat puts eastern Senegal on edge

-

Kim Yo Jong: the powerful sister behind North Korea's supreme leader

-

North Korea ruling party promotes Kim Jong Un's younger sister

North Korea ruling party promotes Kim Jong Un's younger sister

-

Mexico's Jalisco cautiously tries returning to normal after cartel violence

-

Mexico's violence-hit Guadalajara to host World Cup games

Mexico's violence-hit Guadalajara to host World Cup games

-

Mourinho's Bernabeu homecoming upended by suspension, racism row

-

China targets Japanese companies over military ties

China targets Japanese companies over military ties

-

Griezmann in talks to join MLS side Orlando City: source

-

France to revoke US envoy's govt access after summons no-show

France to revoke US envoy's govt access after summons no-show

-

Spurs overpower Pistons in clash of NBA's form teams

-

Inoue to fight Nakatani in Tokyo in May: reports

Inoue to fight Nakatani in Tokyo in May: reports

-

Canada PM to push trade, rebuild fractured ties in India trip

-

Asian markets mixed as traders weigh AI and tariffs outlook

Asian markets mixed as traders weigh AI and tariffs outlook

-

Votes may 'melt like snow': Reform, Greens eye Labour UK bastion

-

Venezuela says exiles welcome to return following mass amnesty

Venezuela says exiles welcome to return following mass amnesty

-

Australia buys parts for future AUKUS sub reactor

-

Ukraine marks four years since Russian invasion

Ukraine marks four years since Russian invasion

-

Brazil court to try politicians over hit on black councilwoman

-

Interim president says Venezuelans welcome to return after amnesty law

Interim president says Venezuelans welcome to return after amnesty law

-

Man kills police officer in Moscow train station blast

-

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

Despite drop in 2025, Russian oil exports exceed pre-war volumes: report

-

Simulab Launches TraumaMan(R) System Ultrasound Module for Realistic Trauma Training

-

Bytek Joins the Google Cloud Ready - BigQuery Program

Bytek Joins the Google Cloud Ready - BigQuery Program

-

Formation Metals Intersects 0.95 g/t Au over 61.1 Metres, including 1.68 g/t Au over 26.5 Metres at the Advanced N2 Gold Project; Bulk-Tonnage Gold Target Identified with 8 Kilometres of Strike to Explore

-

Bolt Metals Announces Closing of Fully Subscribed Private Placement

Bolt Metals Announces Closing of Fully Subscribed Private Placement

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 24

-

Nikon Expands Popular Monarch and Prostaff Binocular Lines

Nikon Expands Popular Monarch and Prostaff Binocular Lines

-

Australian PM seeks removal of UK's Andrew from line of succession

-

Carrick hails 'ruthless' Man Utd match-winner Sesko

Carrick hails 'ruthless' Man Utd match-winner Sesko

-

N.Korea leader's sister promoted at party congress

-

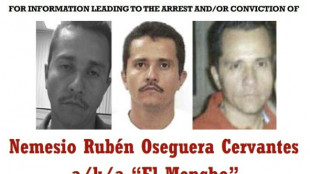

The key to taking down Mexico's most-wanted narco? His girlfriend

The key to taking down Mexico's most-wanted narco? His girlfriend

-

Winter storm blankets US northeast as travel bans imposed

-

Super-sub Sesko fires Man Utd to win at Everton

Super-sub Sesko fires Man Utd to win at Everton

-

YouTube exec says goal was viewer value not addiction

-

Panama wrests control of canal ports from Hong Kong group

Panama wrests control of canal ports from Hong Kong group

-

Trump denies top US officer warned of Iran strike risks

-

Mayweather to fight Pacquiao in Las Vegas in September

Mayweather to fight Pacquiao in Las Vegas in September

-

US stocks tumble on tariff fog, worries over AI

-

US says China 'massively expanded' nuclear arsenal

US says China 'massively expanded' nuclear arsenal

-

US forces to complete withdrawal from Syria within a month

Tianci International, Inc. Reports Financial Results for Fiscal Quarter Ended October 31, 2025

HONG KONG, HK / ACCESS Newswire / December 12, 2025 / Tianci International, Inc. (the "Company" or "Tianci"), a global logistics service provider specializing in ocean freight forwarding, today announced its financial results for the fiscal quarter ended October 31, 2025.

First Fiscal Quarter 2026 Highlights:

Revenue increased, quarter-to-quarter, by 28%, as global logistics revenue increased by 16.5% and was complemented by revenue of $505,465 resulting from our initial entry into the market for mineral ores.

General and administrative expenses increased from $260,393 in the quarter ended October 31, 2024 to $608,648 in the quarter ended October 31, 2025. As a result, the Company incurred a net loss of $268,874 in the quarter ended October 31, 2025, an increased loss compared to the quarter ended October 31, 2024.

Financial Results

Revenue from logistics operations for the quarter ended October 31, 2025, which represented 84% of the Company's overall revenue in that period, increased by 16.5% from the revenue generated by logistics operations during the quarter ended October 31, 2024. However, the cost of that revenue increased by 18.9% from the first quarter of fiscal year 2024 to the first quarter of fiscal year 2025, as demand for logistics services waned due to concerns about the implementation of tariffs, while shipping companies in the Southeast Asia market increased their pricing in an effort to offset the decline in demand for their services. As a result of the increase in cost of revenue, the Company's gross profit margin attributable to logistics operations decreased from 6.12% in the quarter ended October 31, 2024 to 4.17% in the quarter ended October 31, 2025.

To reduce the effect of declining demand in the Southeast Asia market, the Company intends to reorient its focus towards long-distance shipping lines, which generally produce higher profit margins. As one particular effort toward that reorientation, the Company has been accumulating an inventory of bulk chrome and manganese ore for the purpose of entering into the global commodity trade arena, and completed its initial mineral sales during the quarter ended October 31, 2025. Those sales yielded $505,465 in revenue and a gross profit margin of 32.51%. By applying its core resource control capabilities and supply chain integration strengths with an in-house demand for shipping services, the Company looks to release itself from dependence on local demand for shipping services.

We recorded a net loss of $268,874 for the quarter ended October 31, 2025, primarily due to a 134% increase in general and administrative expenses arising from most aspects of our operations. Our bottom line net loss of $268,874, therefore, represented an increase of 192% in our quarterly net loss.

Our operations during the quarter ended October 31, 2025 reduced our cash balance by $727,403 to $1,677,949. The greater portion of that cash drain was attributable to the $582,912 that we devoted to expanding our inventory of mineral ores, a commitment that we consider essential to the implementation of our business plan. At October 31, 2025 our working capital was $2,636,809.

About Tianci International, Inc.

Tianci International Inc., through its subsidiary Roshing, provides global logistics services specializing in ocean freight forwarding, including container and bulk goods shipping. Operating under an asset-light model, Roshing's logistics solutions are tailored to meet the diverse needs of its customers across the Asia-Pacific, including Hong Kong, Japan, South Korea, and Vietnam.

Starting in the current fiscal year, Roshing has expanded into global trade of bulk chrome and manganese ore by sourcing high-grade minerals directly from resource-rich regions for resale. Roshing intends to utilize optimized bulk vessel and container shipping, and provide end-to-end supply chain solutions for metallurgical and steelmaking customers.

Beyond logistics and mineral sales, Roshing generates revenue from the sale of electronic parts and business consulting services.

For more information, please visit the Company's website: tianci-ciit.com

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements that involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results. The Company encourages investors to review other factors that may affect its future results that are discussed in the Company's filings with the U.S. Securities and Exchange Commission.

For investor and media inquiries, please contact:

Tianci International, Inc.

Investor Relations

Email: [email protected]

SOURCE: Tianci International Inc.

View the original press release on ACCESS Newswire

M.Fischer--AMWN