-

How Myanmar's junta-run vote works, and why it might not

How Myanmar's junta-run vote works, and why it might not

-

Watkins wants to sicken Arsenal-supporting family

-

Arsenal hold off surging Man City, Villa as Wirtz ends drought

Arsenal hold off surging Man City, Villa as Wirtz ends drought

-

Late penalty miss denies Uganda AFCON win against Tanzania

-

Watkins stretches Villa's winning streak at Chelsea

Watkins stretches Villa's winning streak at Chelsea

-

Zelensky stops in Canada en route to US as Russia pummels Ukraine

-

Arteta salutes injury-hit Arsenal's survival spirit

Arteta salutes injury-hit Arsenal's survival spirit

-

Wirtz scores first Liverpool goal as Anfield remembers Jota

-

Mane rescues AFCON draw for Senegal against DR Congo

Mane rescues AFCON draw for Senegal against DR Congo

-

Arsenal hold off surging Man City, Wirtz breaks Liverpool duck

-

Arsenal ignore injury woes to retain top spot with win over Brighton

Arsenal ignore injury woes to retain top spot with win over Brighton

-

Sealed with a kiss: Guardiola revels in Cherki starring role

-

UK launches paid military gap-year scheme amid recruitment struggles

UK launches paid military gap-year scheme amid recruitment struggles

-

Jota's children join tributes as Liverpool, Wolves pay respects

-

'Tired' Inoue beats Picasso by unanimous decision to end gruelling year

'Tired' Inoue beats Picasso by unanimous decision to end gruelling year

-

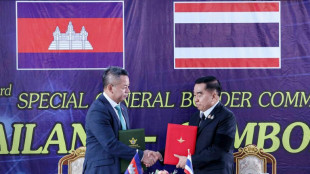

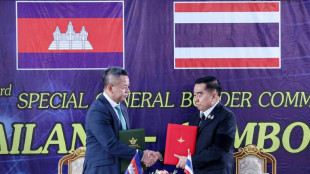

Thailand and Cambodia declare truce after weeks of clashes

-

Netanyahu to meet Trump in US on Monday

Netanyahu to meet Trump in US on Monday

-

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

-

Cherki stars in Man City win at Forest

Cherki stars in Man City win at Forest

-

Schwarz records maiden super-G success, Odermatt fourth

-

Russia pummels Kyiv ahead of Zelensky's US visit

Russia pummels Kyiv ahead of Zelensky's US visit

-

Smith laments lack of runs after first Ashes home Test loss for 15 years

-

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

-

Stokes, Smith agree two-day Tests not a good look after MCG carnage

-

Stokes hails under-fire England's courage in 'really special' Test win

Stokes hails under-fire England's courage in 'really special' Test win

-

What they said as England win 4th Ashes Test - reaction

-

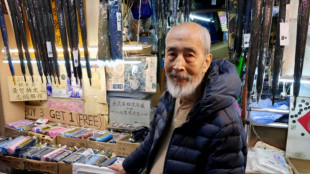

Hong Kongers bid farewell to 'king of umbrellas'

Hong Kongers bid farewell to 'king of umbrellas'

-

England snap 15-year losing streak to win chaotic 4th Ashes Test

-

Thailand and Cambodia agree to 'immediate' ceasefire

Thailand and Cambodia agree to 'immediate' ceasefire

-

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

-

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

-

Somalia, African nations denounce Israeli recognition of Somaliland

-

England need 175 to win chaotic 4th Ashes Test

England need 175 to win chaotic 4th Ashes Test

-

Cricket Australia boss says short Tests 'bad for business' after MCG carnage

-

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

Russia lashes out at Zelensky ahead of new Trump talks on Ukraine plan

-

Six Australia wickets fall as England fight back in 4th Ashes Test

-

Dental Implant Financing and Insurance Options in Georgetown, TX

Dental Implant Financing and Insurance Options in Georgetown, TX

-

Man Utd made to 'suffer' for Newcastle win, says Amorim

-

Morocco made to wait for Cup of Nations knockout place after Egypt advance

Morocco made to wait for Cup of Nations knockout place after Egypt advance

-

Key NFL week has playoff spots, byes and seeds at stake

-

Morocco forced to wait for AFCON knockout place after Mali draw

Morocco forced to wait for AFCON knockout place after Mali draw

-

Dorgu delivers winner for depleted Man Utd against Newcastle

-

US stocks edge lower from records as precious metals surge

US stocks edge lower from records as precious metals surge

-

Somalia denounces Israeli recognition of Somaliland

-

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

The Cure guitarist and keyboard player Perry Bamonte dies aged 65

-

Draper to miss Australian Open

-

Police arrest suspect after man stabs 3 women in Paris metro

Police arrest suspect after man stabs 3 women in Paris metro

-

Former Montpellier coach Gasset dies at 72

-

Trump's Christmas gospel: bombs, blessings and blame

Trump's Christmas gospel: bombs, blessings and blame

-

Russia lashes out at Zelensky ahead of new Trump meeting on Ukraine plan

China's economic growth jumps 4.5% in Q1 after zero-Covid scrapped

China's economy grew a forecast-busting 4.5 percent in the first quarter as the country reopened after the end of zero-Covid measures late last year, official data showed Tuesday.

The figures were the first snapshot since 2019 of the world's second-largest economy unencumbered by the strict health measures that helped keep the coronavirus in check but battered businesses and supply chains.

A key driver of the standout reading was a bounce in retail sales, the main indicator of household consumption, which surged 10.6 percent on-year in March, the biggest increase since June 2021.

However, industrial production climbed 3.9 percent last month, an improvement from January-February but below analysts' expectations of 4.4 percent, according to data published by the National Bureau of Statistics (NBS).

Tuesday's NBS report said in the first three months of the year China had faced a "grave and complex international environment as well as arduous tasks to advance reform, development and ensure stability at home".

Beijing's virus-containment policy -- an unstinting regime of strict quarantines, mass testing and travel curbs -- strongly constrained normal economic activity before it was abruptly ditched in December.

The Chinese economy is also beset by a series of other crises, from a debt-laden property sector to flagging consumer confidence, global inflation, the threat of recession elsewhere, and geopolitical tensions with the United States.

Since the rapid dismantling of the suffocating zero-Covid policy, Chinese people have in recent months returned to restaurants and started to travel again, giving much-needed stimulus to services.

- Modest growth target -

"Consumption saw a recovery during the first quarter partly because of pent-up demand but is not yet back on pre-pandemic levels," Teeuwe Mevissen, an analyst at RaboBank, said.

"Loss in household wealth due to the real estate crisis and loss of household income during the pandemic are factors why consumers have not spent more."

And Iris Pang, the chief economist for Greater China at ING, said the primary reason for the faster-than-expected growth was the much stronger growth in retail sales, which were "mainly boosted by catering".

The official January-to-March growth figure was significantly higher than the 3.8 percent predicted by analysts in an AFP poll.

China's economy grew just three percent in the whole of last year, one of its weakest performances in decades.

It posted a 4.8 percent expansion in the first quarter of 2022, though that slowed to just 2.9 percent in the final three months of the year.

The government has set a comparatively modest growth target of around five percent this year, a goal the country's Premier Li Qiang has warned could be hard to achieve.

An AFP poll of analysts predicted that the Chinese economy would grow by an average of 5.3 percent this year, roughly in line with the International Monetary Fund's 5.2 percent forecast.

Still, experts have warned that wider global trends could yet weigh on China's recovery.

Ken Cheung at Mizuho Bank said domestic consumption "proved to be the pillar" behind the economic improvement, but "industrial production was disappointing given the strong rebound in exports growth".

He added it will "take time for business confidence recovery, which requires translating the credit expansion into money flow to support real economic activities".

M.Fischer--AMWN