-

Indigenous protesters occupy Cargill port terminal in Brazil

Indigenous protesters occupy Cargill port terminal in Brazil

-

Four lives changed by four years of Russia-Ukraine war

-

AI agent invasion has people trying to pick winners

AI agent invasion has people trying to pick winners

-

'Hamnet' eyes BAFTAs glory over 'One Battle', 'Sinners'

-

Cron laments errors after Force crash to Blues in Super Rugby

Cron laments errors after Force crash to Blues in Super Rugby

-

The Japanese snowball fight game vying to be an Olympic sport

-

'Solar sheep' help rural Australia go green, one panel at a time

'Solar sheep' help rural Australia go green, one panel at a time

-

Cuban Americans keep sending help to the island, but some cry foul

-

As US pressures Nigeria over Christians, what does Washington want?

As US pressures Nigeria over Christians, what does Washington want?

-

Dark times under Syria's Assad hit Arab screens for Ramadan

-

Bridgeman powers to six-shot lead over McIlroy at Riviera

Bridgeman powers to six-shot lead over McIlroy at Riviera

-

Artist creates 'Latin American Mona Lisa' with plastic bottle caps

-

Malinin highlights mental health as Shaidorov wears panda suit at Olympic skating gala

Malinin highlights mental health as Shaidorov wears panda suit at Olympic skating gala

-

Timberwolves center Gobert suspended after another flagrant foul

-

Guardiola hails Man City's 'massive' win over Newcastle

Guardiola hails Man City's 'massive' win over Newcastle

-

PSG win to reclaim Ligue 1 lead after Lens lose to Monaco

-

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

-

Man City close gap on Arsenal after O'Reilly sinks Newcastle

-

Finland down Slovakia to claim bronze in men's ice hockey

Finland down Slovakia to claim bronze in men's ice hockey

-

More than 1,500 request amnesty under new Venezuela law

-

US salsa legend Willie Colon dead at 75

US salsa legend Willie Colon dead at 75

-

Canada beat Britain to win fourth Olympic men's curling gold

-

Fly-half Jalibert ruled out of France side to face Italy

Fly-half Jalibert ruled out of France side to face Italy

-

Russell restart try 'big moment' in Scotland win, says Townsend

-

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

-

Liga leaders Real Madrid stung by late Osasuna winner

-

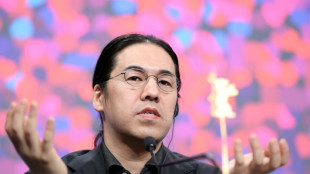

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

-

England's Genge says thumping Six Nations loss to Ireland exposes 'scar tissue'

-

Thousands march in France for slain far-right activist

Thousands march in France for slain far-right activist

-

Imperious Alcaraz storms to Qatar Open title

-

Klaebo makes Olympic history as Gu forced to wait

Klaebo makes Olympic history as Gu forced to wait

-

Late Scotland try breaks Welsh hearts in Six Nations

-

Lens lose, giving PSG chance to reclaim Ligue 1 lead

Lens lose, giving PSG chance to reclaim Ligue 1 lead

-

FIFA's Gaza support 'in keeping' with international federation - IOC

-

First all-Pakistani production makes history at Berlin film fest

First all-Pakistani production makes history at Berlin film fest

-

Gu forced to wait as heavy snow postpones Olympic halfpipe final

-

NASA chief rules out March launch of Moon mission over technical issues

NASA chief rules out March launch of Moon mission over technical issues

-

Dutch double as Bergsma and Groenewoud win Olympic speed skating gold

-

At least three dead as migrant boat capsizes off Greek island

At least three dead as migrant boat capsizes off Greek island

-

Struggling Juventus' woes deepen with home loss to Como

-

Chelsea, Aston Villa held in blow to Champions League hopes

Chelsea, Aston Villa held in blow to Champions League hopes

-

Thousands march in France for slain far-right activist under heavy security

-

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

-

Canada beat USA to take bronze in Olympic women's curling

-

Hunger and belief key to Ireland's win, says Sheehan

Hunger and belief key to Ireland's win, says Sheehan

-

Pegula sees off Svitolina to win Dubai WTA 1000 title

-

Trump hikes US global tariff rate to 15%

Trump hikes US global tariff rate to 15%

-

AI revolution looms over Berlin film fest

-

Gibson-Park guides Ireland to record-breaking win in England

Gibson-Park guides Ireland to record-breaking win in England

-

Defence the priority for France against Italy, says Dupont

UK inflation slows to central bank's 2% target

British inflation slowed in May to the central bank's two-percent target, official data showed Wednesday, boosting Prime Minister Rishi Sunak's struggling election campaign.

The Consumer Prices Index fell as expected from 2.3 percent in April, the Office for National Statistics said in a statement citing easing growth in food prices.

That follows almost three years Britain's above-target inflation, which last stood at two percent in July 2021 before surging higher in a cost-of-living crisis.

The news sets the scene for the July 4 general election which Sunak's Conservatives are tipped to lose badly to Keir Starmer's main opposition Labour Party, according to opinion polls.

Sunak hailed the inflation slowdown, but Labour slammed the Conservatives' stewardship of the economy after 14 years in power.

"It's very good news, because the last few years have been really tough for everybody," Sunak told LBC radio.

"Inflation is back to target, and that means people will start to feel the benefits and ease some of the burdens on the cost of living, and it's because of that economic stability that we've restored."

The Bank of England will meet Thursday but it is expected to sit tight on interest rates, as is customary ahead of UK elections.

- 'Worse off' -

After peaking at 11.1 percent in October 2022, consumer price growth has cooled following a series of interest-rate hikes by the UK central bank.

Britain's economy, however, stagnated in April after emerging from recession in the first quarter of the year, official data showed last week.

Prices are still rising on top of the sharp increases seen in recent years but at a slower rate, as businesses and households weather the easing cost-of-living crunch.

"After 14 years of economic chaos under the Conservatives, working people are worse off," said Labour finance spokesperson Rachel Reeves.

"Prices have risen in the shops, mortgage bills are higher and taxes are at a 70-year high," Reeves said.

"Labour has a plan to make people better off bringing stability back to our economy."

- No surprises -

The BoE began a series of rate hikes in late 2021 to combat inflation, which rose after countries emerged from Covid lockdowns and accelerated after Moscow invaded Ukraine.

The institution last month held its main interest rate at a 16-year high of 5.25 percent but hinted at a summer reduction as UK inflation cools further.

Added to the mix, elevated interest rates have worsened the cost-of-living squeeze because they increase the cost of borrowing, thereby cutting disposable incomes.

"The BoE will be encouraged by the slowdown in headline inflation, and while concerns will remain over elevated underlying price pressures, further falls in services inflation are anticipated over the coming months," said KPMG UK chief economist Yael Selfin.

"Today's data are unlikely to spur a surprise rate cut tomorrow, however, the (bank) could have sufficient evidence to begin its easing cycle in August."

Influential business lobby the Confederation of British Industry added that the stage was now set for the BoE to trim rates in August.

"Another fall in inflation in May will come as welcome news to households as we move towards a more benign inflationary environment," said CBI economist Martin Sartorius.

"However, many will still be feeling the pinch due to the level of prices being far higher than in previous years, particularly for food and energy bills."

F.Schneider--AMWN