-

Guardiola hails Man City's 'massive' win over Newcastle

Guardiola hails Man City's 'massive' win over Newcastle

-

PSG win to reclaim Ligue 1 lead after Lens lose to Monaco

-

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

-

Man City close gap on Arsenal after O'Reilly sinks Newcastle

-

Finland down Slovakia to claim bronze in men's ice hockey

Finland down Slovakia to claim bronze in men's ice hockey

-

More than 1,500 request amnesty under new Venezuela law

-

US salsa legend Willie Colon dead at 75

US salsa legend Willie Colon dead at 75

-

Canada beat Britain to win fourth Olympic men's curling gold

-

Fly-half Jalibert ruled out of France side to face Italy

Fly-half Jalibert ruled out of France side to face Italy

-

Russell restart try 'big moment' in Scotland win, says Townsend

-

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

-

Liga leaders Real Madrid stung by late Osasuna winner

-

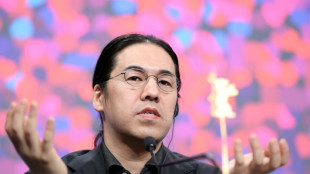

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

-

England's Genge says thumping Six Nations loss to Ireland exposes 'scar tissue'

-

Thousands march in France for slain far-right activist

Thousands march in France for slain far-right activist

-

Imperious Alcaraz storms to Qatar Open title

-

Klaebo makes Olympic history as Gu forced to wait

Klaebo makes Olympic history as Gu forced to wait

-

Late Scotland try breaks Welsh hearts in Six Nations

-

Lens lose, giving PSG chance to reclaim Ligue 1 lead

Lens lose, giving PSG chance to reclaim Ligue 1 lead

-

FIFA's Gaza support 'in keeping' with international federation - IOC

-

First all-Pakistani production makes history at Berlin film fest

First all-Pakistani production makes history at Berlin film fest

-

Gu forced to wait as heavy snow postpones Olympic halfpipe final

-

NASA chief rules out March launch of Moon mission over technical issues

NASA chief rules out March launch of Moon mission over technical issues

-

Dutch double as Bergsma and Groenewoud win Olympic speed skating gold

-

At least three dead as migrant boat capsizes off Greek island

At least three dead as migrant boat capsizes off Greek island

-

Struggling Juventus' woes deepen with home loss to Como

-

Chelsea, Aston Villa held in blow to Champions League hopes

Chelsea, Aston Villa held in blow to Champions League hopes

-

Thousands march in France for slain far-right activist under heavy security

-

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

-

Canada beat USA to take bronze in Olympic women's curling

-

Hunger and belief key to Ireland's win, says Sheehan

Hunger and belief key to Ireland's win, says Sheehan

-

Pegula sees off Svitolina to win Dubai WTA 1000 title

-

Trump hikes US global tariff rate to 15%

Trump hikes US global tariff rate to 15%

-

AI revolution looms over Berlin film fest

-

Gibson-Park guides Ireland to record-breaking win in England

Gibson-Park guides Ireland to record-breaking win in England

-

Defence the priority for France against Italy, says Dupont

-

Juventus end bad week with 2-0 loss against Como

Juventus end bad week with 2-0 loss against Como

-

Libya's Ramadan celebrations tempered by economic woes

-

Norway's cross-country king Klaebo wins sixth gold of Milan-Cortina Winter Olympics

Norway's cross-country king Klaebo wins sixth gold of Milan-Cortina Winter Olympics

-

Iranian students chant anti-government slogans, as US threats loom

-

Hezbollah vows resistance after deadly Israeli strike

Hezbollah vows resistance after deadly Israeli strike

-

'Stormy seas' of Gaza row overshadow Berlin film fest finale

-

Pakistan-New Zealand Super Eights clash delayed by rain

Pakistan-New Zealand Super Eights clash delayed by rain

-

Werder Bremen cancel US tour citing 'political reasons'

-

South Africa's De Kock says handling pressure key in India clash

South Africa's De Kock says handling pressure key in India clash

-

French volunteer bakes for Ukraine amid frosts and power outages

-

Mexico's Del Toro wins stage to take overall UAE Tour lead

Mexico's Del Toro wins stage to take overall UAE Tour lead

-

Brook says a 'shame' if Pakistan players snubbed for Hundred

-

Gu shoots for elusive gold as Klaebo makes Olympic history

Gu shoots for elusive gold as Klaebo makes Olympic history

-

France win Olympic ski mountaineering mixed relay

Swiss mining giant Glencore drops plan to exit coal

Swiss commodities giant Glencore announced Wednesday that it had decided against spinning off its coal business for now after consulting shareholders who view the polluting fossil fuel as a cash-generating activity.

Glencore completed its takeover of the steelmaking coal unit of Teck Resources in July following a protracted battle over the business with the Canadian company.

The Swiss mining and commodities trading group had considered merging the newly acquired business, Elk Valley Resources, with its own coal activities and spinning it off.

But Glencore said that after consulting its shareholders, most expressed a preference for retaining the coal and carbon steel materials business.

"Following extensive consultation with our shareholders, whose views were very clear, and our own analysis, the Board believes retention offers the lowest risk pathway to create value for Glencore shareholders today," chairman Kalidas Madhavpeddi said.

"The expected cash generative capacity of the coal and carbon steel materials business significantly enhances the quality of our portfolio," Madhavpeddi added in a statement.

The company said shareholders preferred to keep the coal business "primarily on the basis that retention should enhance Glencore's cash generating capacity to fund opportunities in our transition metals portfolio" such as copper.

They also concluded that it would "accelerate and optimise the return of excess cash flows to shareholders".

Oil, gas and coal companies are under pressure to transition away from fossil fuels, the biggest contributor to climate change.

While Glencore's Australian rival Rio Tinto and British group Anglo American are exiting coal, the Swiss company has a "managed decline" strategy to ensure a "responsible" phase out its coal operations.

Glencore said Wednesday that while it has decided to keep coal, its board "preserves the option to consider a demerger of all or part of this business in the future if circumstances change".

Separately, Glencore posted a $233-million loss for the first half of the year, after earning $4.6 billion over the same period last year, as commodity prices fell, "particularly thermal coal".

P.M.Smith--AMWN