-

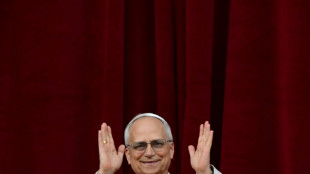

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

Cardinals elect first American pope as Robert Francis Prevost becomes Leo XIV

-

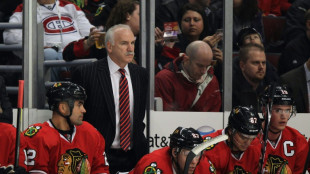

NHL Ducks name Quenneville as coach after probe into sex assault scandal

-

'Great honor': Leaders welcome Leo, first US pope

'Great honor': Leaders welcome Leo, first US pope

-

What is in the new US-UK trade deal?

-

MLB Pirates fire Shelton as manager after 12-16 start

MLB Pirates fire Shelton as manager after 12-16 start

-

Alcaraz '100 percent ready' for return to action in Rome

-

Prevost becomes first US pope as Leo XIV

Prevost becomes first US pope as Leo XIV

-

Andy Farrell holds out hope for son Owen after Lions omission

-

Roglic leads deep field of contenders at tricky Giro d'Italia

Roglic leads deep field of contenders at tricky Giro d'Italia

-

White smoke signals Catholic Church has new pope

-

Bill Gates speeds up giving away fortune, blasts Musk

Bill Gates speeds up giving away fortune, blasts Musk

-

LA Coliseum, SoFi Stadium to share 2028 Olympic opening ceremony

-

Trump unveils 'breakthrough' US-UK trade deal

Trump unveils 'breakthrough' US-UK trade deal

-

Andy Farrell holds out hope for Owen Farrell after Lions omission

-

Trump calls US Fed chair 'fool' after pause in rate cuts

Trump calls US Fed chair 'fool' after pause in rate cuts

-

Stocks rise as US-UK unveil trade deal

-

UN says Israel school closures in east Jerusalem 'assault on children'

UN says Israel school closures in east Jerusalem 'assault on children'

-

Itoje grateful for 'tremendous honour' of leading Lions in Australia

-

Cardinals to vote anew for pope after second black smoke

Cardinals to vote anew for pope after second black smoke

-

Arsenal fall short again as striker woes haunt Arteta

-

Inter turn attentions to fading Serie A title defence after Barca triumph

Inter turn attentions to fading Serie A title defence after Barca triumph

-

Elk could return to UK after 3,000 years as plan wins funding

-

Trump announces 'full and comprehensive' trade deal with UK

Trump announces 'full and comprehensive' trade deal with UK

-

Putin and Xi rail against West as Ukraine reports truce violations

-

England's Itoje to captain British and Irish Lions rugby team in Australia

England's Itoje to captain British and Irish Lions rugby team in Australia

-

Gates Foundation to spend $200 bn through 2045 when it will shut down

-

Swiatek makes fast start at Italian Open

Swiatek makes fast start at Italian Open

-

Israel's aid blockade to Gaza 'unacceptable': Red Cross

-

EU threatens to target US cars, planes if Trump tariff talks fail

EU threatens to target US cars, planes if Trump tariff talks fail

-

Amnesty says UAE supplying Sudan paramilitaries with Chinese weapons

-

Bank of England cuts interest rate as US tariffs hit economy

Bank of England cuts interest rate as US tariffs hit economy

-

Germany slams Russian 'lies' on Ukraine in WWII commemoration

-

Pakistan and India accuse each other of waves of drone attacks

Pakistan and India accuse each other of waves of drone attacks

-

Thrilling PSG home in on elusive Champions League trophy

-

Wolf protection downgrade gets green light in EU

Wolf protection downgrade gets green light in EU

-

Fijian Olympic medallist Raisuqe killed after car hit by train

-

EU parliament backs emissions reprieve for carmakers

EU parliament backs emissions reprieve for carmakers

-

Trump announces trade agreement with UK

-

Global temperatures stuck at near-record highs in April: EU monitor

Global temperatures stuck at near-record highs in April: EU monitor

-

Stocks rise as Trump signals US-UK 'trade deal'

-

Second black smoke, cardinals to vote again for new pope

Second black smoke, cardinals to vote again for new pope

-

Screams and shattered glass under Pakistan bombardment

-

Drone strikes spark civilian exodus from army-controlled Sudan aid hub

Drone strikes spark civilian exodus from army-controlled Sudan aid hub

-

First responders in Gaza run out of supplies

-

Pakistan shoots down 25 Indian drones near military installations

Pakistan shoots down 25 Indian drones near military installations

-

Xi meets Putin in Moscow as Ukraine reports truce violations

-

Israel forces close UN schools in annexed east Jerusalem

Israel forces close UN schools in annexed east Jerusalem

-

Trump to announce 'trade deal' with UK

-

'Jumbo': the animated Indonesian film smashing records

'Jumbo': the animated Indonesian film smashing records

-

Stocks rise on trade hopes, London boosted by reports of deal

| RBGPF | 4.34% | 65.86 | $ | |

| RYCEF | 5.13% | 10.72 | $ | |

| CMSC | 0.04% | 22.168 | $ | |

| BCC | 2.93% | 89.73 | $ | |

| VOD | -1.46% | 9.265 | $ | |

| SCS | 5.17% | 10.45 | $ | |

| RELX | -0.97% | 54.345 | $ | |

| BCE | 4.39% | 22.225 | $ | |

| RIO | -1.66% | 59.04 | $ | |

| JRI | -0.35% | 12.98 | $ | |

| CMSD | -0.16% | 22.375 | $ | |

| GSK | -0.72% | 36.905 | $ | |

| BTI | -2.24% | 43.475 | $ | |

| BP | 1.3% | 28.5 | $ | |

| AZN | -3.95% | 67.41 | $ | |

| NGG | -3.45% | 70.15 | $ |

Most Asian markets up as traders eye Ukraine, Fed eases rate fears

Asian markets mostly rose Thursday as investors assess the situation in Ukraine after the West said Russia had not started withdrawing troops from its border, while minutes from the Federal Reserve's January meeting eased concerns it was set to hike rates sharply.

Meanwhile, oil prices tumbled more than two percent on further signs of a breakthrough in Iran nuclear talks.

Global equities were sent plunging and crude surged after a top US official said Russia could invade imminently, but Moscow appeared to soothe those fears Tuesday by saying it had started withdrawing some soldiers.

The announcement and an apparently more conciliatory tone from the Kremlin provided a much-needed lift to markets.

However, while the general mood on trading floors was upbeat that tensions had eased, Washington dismissed the Russian claims and accused it of sending more soldiers, adding that there were "indications they could launch a false pretext at any moment to justify an invasion".

That came after NATO joined Ukraine in saying there was no sign of any retreat, while chief Jens Stoltenberg said tensions in the east with Russia were "the new normal in Europe".

The geopolitical uncertainty jolted US markets Wednesday, though they enjoyed a late rally from intraday lows after the Fed minutes provided no surprises.

The release had been keenly awaited as the bank tries to walk a fine line of reining in four-decade-high inflation while not knocking the healthy economic recovery off track.

Expectations are for officials to hike interest rates in March and then several times again before the end of the year, but there has been much debate about how much its initial move will be and how many more there will be.

It has also said it will start to offload the bonds it has on its balance sheet, which are also helping to keep borrowing costs down.

Some have warned of a 50-basis-point hike at first -- twice what it usually announced -- and as many as six or seven more before January.

"The Fed's Minutes showed interest rate hikes are coming and that they are readying for a significant reduction in the size of the balance sheet," said OANDA's Edward Moya.

"Investors that were worried that the Fed would be pressured to begin the balance sheet runoff fairly soon could breathe a sigh of relief.

"The Fed sees inflation pressures broadening deep into the year but they would not be rushed into making any decisions at a faster tightening pace."

National Australia Bank's Ray Attrill added that the minutes did not "appear to give an obvious succour to the idea of the Fed kicking off the tightening cycle with a 50-point move".

And Minneapolis Fed boss Neel Kashkari said aggressive rate hikes would risk a recession, adding the bank should "not overdo it".

In early trade, Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Manila all rose, though Tokyo and Jakarta dipped.

On oil markets both main contracts tanked on growing hopes that talks on the Iran nuclear deal could soon bear fruit.

Tehran's top negotiator Ali Bagheri Kani said an agreement was "closer than ever" and while US and French officials were a little more circumspect, the comments raised the possibility that Iranian crude could return to the market soon.

"Positive developments in the US-Iran nuclear negotiations are helping to calm oil prices," Claudio Galimberti of Rystad Energy said.

"Although not a done deal yet, prices are sliding on news of progress and broad consensus in the talks as it could ultimately see up to 900,000 barrels a day of crude added to the market by December this year."

The developments offset uncertainty over the Russia-Ukraine crisis, which had helped propel prices towards $100 for the first time in more than seven years, and comes as demand continues to improve as the world economy reopens.

Data showed US stockpiles at their lowest since 2018.

- Key figures around 0240 GMT -

Tokyo - Nikkei 225: DOWN 0.2 percent at 27,395.85 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 24,783.36

Shanghai - Composite: UP 0.1 percent at 3,470.23

West Texas Intermediate: DOWN 2.3 percent at $91.50 per barrel

Brent North Sea crude: DOWN 2.1 percent at $92.78 per barrel

Euro/dollar: UP at $1.1381 from $1.1377 late Wednesday

Pound/dollar: UP at $1.3589 from $1.3584

Euro/pound: UP at 83.75 pence from 83.72 pence

Dollar/yen: UP at 115.49 yen from 115.46 yen

New York - Dow: DOWN 0.2 percent at 34,934.27 (close)

London - FTSE 100: DOWN less than 0.1 percent at 7,603.78 (close)

A.Rodriguezv--AMWN