-

From blockades to ballots: Serbian students confront government

From blockades to ballots: Serbian students confront government

-

Kyiv's EU allies endorse tribunal to try Russian leaders

-

Two men found guilty of chopping down iconic UK tree

Two men found guilty of chopping down iconic UK tree

-

Tennis, Twitter and marinated fish: Things to know about Pope Leo

-

Liverpool's Salah voted Football Writers' Player of the Year

Liverpool's Salah voted Football Writers' Player of the Year

-

Pakistan says India has brought neighbours 'closer to major conflict'

-

Stocks lifted by hopes for US-China talks after UK deal

Stocks lifted by hopes for US-China talks after UK deal

-

Putin hails troops fighting in Ukraine as foreign leaders attend parade

-

Howe urges Newcastle to fulfil Champions League expectation

Howe urges Newcastle to fulfil Champions League expectation

-

Weary border residents in Indian Kashmir struggle to survive

-

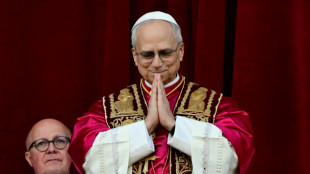

Leo XIV says Church must fight 'lack of faith' in first mass as pope

Leo XIV says Church must fight 'lack of faith' in first mass as pope

-

Liverpool boss Slot fears replacing Alexander-Arnold will be a tough task

-

British Airways owner unveils big Boeing, Airbus order

British Airways owner unveils big Boeing, Airbus order

-

IPL suspended for one week over India-Pakistan conflict

-

Slot says all at Liverpool sad to see Alexander-Arnold go

Slot says all at Liverpool sad to see Alexander-Arnold go

-

Leo XIV celebrates first mass as pope in Sistine Chapel

-

India says repulsed fresh Pakistan attacks as death toll climbs

India says repulsed fresh Pakistan attacks as death toll climbs

-

Japan's Panasonic targets 10,000 job cuts worldwide

-

Putin evokes WWII victory to rally Russia behind Ukraine offensive

Putin evokes WWII victory to rally Russia behind Ukraine offensive

-

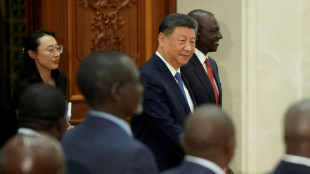

China exports beat forecasts ahead of US tariff talks

-

Leo XIV, the 'Latin Yankee', to celebrate first mass as pope

Leo XIV, the 'Latin Yankee', to celebrate first mass as pope

-

Most stocks lifted by hopes for US-China talks after UK deal

-

IPL suspended indefinitely over India-Pakistan conflict: reports

IPL suspended indefinitely over India-Pakistan conflict: reports

-

German lender Commerzbank's profits jump as it fends off UniCredit

-

Rare bone-eroding disease ruining lives in Kenya's poorest county

Rare bone-eroding disease ruining lives in Kenya's poorest county

-

India says repulsed fresh Pakistan attacks as de-escalation efforts grow

-

Zhao's historic snooker title sparks talk of China world domination

Zhao's historic snooker title sparks talk of China world domination

-

'High expectations': EU looks to Merz for boost in tough times

-

Poisoned guests rarely invited before deadly mushroom lunch, Australia trial hears

Poisoned guests rarely invited before deadly mushroom lunch, Australia trial hears

-

China sales to US slump even as exports beat forecasts

-

Indian cricket to make 'final decision' on IPL over Pakistan conflict

Indian cricket to make 'final decision' on IPL over Pakistan conflict

-

Dethroned Bundesliga champions Leverkusen face uncertain future

-

China can play hardball at looming trade talks with US: analysts

China can play hardball at looming trade talks with US: analysts

-

French monuments in trouble while PSG prepare for Champions League final

-

Newcastle face Chelsea in top five showdown, Alexander-Arnold in spotlight

Newcastle face Chelsea in top five showdown, Alexander-Arnold in spotlight

-

Flick's Barca must show 'hunger' in crunch Liga Clasico

-

Clasico the last chance saloon for Ancelotti's Real Madrid

Clasico the last chance saloon for Ancelotti's Real Madrid

-

Timberwolves overpower Warriors to level series

-

Chinese fabric exporters anxious for US trade patch-up

Chinese fabric exporters anxious for US trade patch-up

-

Putin gears up to host world leaders at lavish army parade

-

Nearing 100, Malaysian ex-PM Mahathir blasts 'old world' Trump

Nearing 100, Malaysian ex-PM Mahathir blasts 'old world' Trump

-

Leo XIV, first US pope, to celebrate first mass as pontiff

-

Asian stocks lifted by hopes for US-China talks after UK deal

Asian stocks lifted by hopes for US-China talks after UK deal

-

Former head of crypto platform Celsius sentenced 12 years

-

Ex-model testifies in NY court that Weinstein assaulted her at 16

Ex-model testifies in NY court that Weinstein assaulted her at 16

-

Newsmax Signs with Hulu+ Live TV for Carriage

-

DealFlow Discovery Day on Nuclear Energy to Spotlight Industry Innovation and Investment Opportunities

DealFlow Discovery Day on Nuclear Energy to Spotlight Industry Innovation and Investment Opportunities

-

Tax Relief Is More Accessible Than You Think - Clear Start Tax Explains Who Qualifies and How to Apply

-

Tempo TES Project Update: Brenmiller Energy Set to Begin Installation of its Storage Modules - bCubes(TM) - in May 2025 and Start Commissioning in October 2025

Tempo TES Project Update: Brenmiller Energy Set to Begin Installation of its Storage Modules - bCubes(TM) - in May 2025 and Start Commissioning in October 2025

-

Dominari Securities Leads $40 Million Public Offering Providing Continued Capital Markets Support to Established Client, Unusual Machines

Stocks recover, oil drops on Russia sanctions impact

Stock markets mostly rose and oil prices fell Wednesday as economic sanctions imposed on Moscow over the Russia-Ukraine crisis were deemed less harsh than expected.

Brent crude stood at $93.50 per barrel, having soared to a seven-year high of $99.50 Tuesday on fears of disruptions to key Russian oil supplies.

Other commodities have also hit multi-year peaks on fears of all-out war.

"Market mood is not cheerful but the softer-than-feared sanctions somewhat help," SwissQuote analyst Ipek Ozkardeskaya noted Wednesday.

Trading floors remain on edge, with Ukraine mobilising its military reserve and urging its citizens to leave Russian territory as Moscow sharpened its demands, increasing fears of all-out war.

Russian President Vladimir Putin has defied an avalanche of international sanctions to put his forces on stand-by to occupy two rebel-held areas of eastern Ukraine.

Sanctions include moves against Russian banks, cutting the country off from Western financing by targeting Moscow's sovereign debt, and penalising oligarchs and their families who are part of Putin's inner circle.

US and allies including Britain have warned of further sanctions should Putin extended his country's military grip beyond the two territories in the eastern Donbas region.

So far the sanctions were not as bad as markets had feared -- crucially with none aimed at Russia's crude exports -- providing some much-needed breathing room for investors and halting the surge in oil prices that has seen both main contracts pile on more than 20 percent so far this year.

Germany has though halted certification of the Nord Stream 2 gas pipeline from Russia.

- 'Considerable risk' -

"There's still considerable risk that oil prices may surge above $100 a barrel" if the situation escalates, said Vivek Dhar at Commonwealth Bank of Australia.

"Oil markets are particularly vulnerable at the moment given that global oil stockpiles are at seven‑year lows."

Dhar added that spare oil capacity among the Organization of the Petroleum Exporting Countries and its allies, including Russia, was "being questioned due to disappointing OPEC+ supply growth".

The crisis comes with investors preparing for a series of interest rate hikes by the US Federal Reserve as it tries to rein in 40-year-high inflation.

Commentators said that while a March hike is baked in, forecasts for further increases this year are being affected by events in Europe as officials try to assess the impact on the economy.

"Markets will likely bubble along sideways now until we see Mr Putin's next move," forecast Jeffrey Halley, analyst at OANDA trading group.

- Key figures around 1200 GMT -

London - FTSE 100: UP 0.3 percent at 7,519.10 points

Frankfurt - DAX: UP 0.6 percent at 14,784.88

Paris - CAC 40: UP 1.0 percent at 6,852.37

EURO STOXX 50: UP 0.9 percent at 4,020.66

Hong Kong - Hang Seng Index: UP 0.6 percent at 23,660.28 (close)

Shanghai - Composite: UP 0.9 percent at 3,489.15 (close)

New York - Dow: DOWN 1.4 percent at 33,596.61 (close)

Tokyo - Nikkei 225: Closed for a holiday

Brent North Sea crude: DOWN 0.2 percent at $93.66 per barrel

West Texas Intermediate: DOWN 0.5 percent at $91.44 per barrel

Euro/dollar: UP at $1.1345 from $1.1330 late Tuesday

Pound/dollar: UP at $1.3595 from $1.3588

Euro/pound: UP at 83.44 pence from 83.35 pence

Dollar/yen: UP at 115.09 yen from 115.08 yen

D.Cunningha--AMWN