-

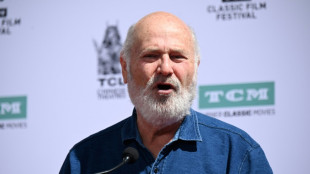

Rob Reiner: Hollywood giant and political activist

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

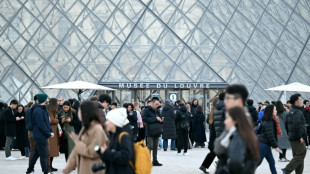

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

Turkey nearly doubles interest rate in Erdogan policy U-turn

Turkey's central bank on Thursday reversed years of unconventional economics promoted by President Recep Tayyip Erdogan and nearly doubled its key interest rate to fight inflation and steady the troubled lira.

The bank hiked the rate to 15 percent from 8.5 percent in its first meeting since Erdogan filled his government with investor-friendly faces after winning tight May polls.

It added that this was only the start of a process aimed at bringing Turkey's annual inflation rate of nearly 40 percent to single figures "as soon as possible".

"Monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved," the central bank said.

Fitch Ratings said it expected the benchmark rate to reach 25 percent by the end of the year.

But the lira still lost four percent of its value against the dollar due to investor disappointment that the bank had decided to pursue a more gradual rate-hiking course.

"Not enough. They needed to front load hike," BlueBay Asset Management economist Timothy Ash remarked.

"Further hikes are needed at the coming meetings to tackle Turkey's inflation problem," Capital Economics analyst Liam Peach added.

- Economic overhaul -

Other analysts said new central bank chief Hafize Gaye Erkan wanted to avoid suffering the fate of past governors whom Erdogan had fired for quickly raising rates.

Erdogan still defends his markets-defying idea that high interest rates contribute to -- rather than cure -- rising consumer prices that have been Turkey's bane for the past five years.

The Turkish leader pushed the central bank to start slashing interest rates two years ago as part of a "new economic model" that focuses on job creation and economic growth.

The policy badly backfired.

The annual inflation rate reached 85 percent late last year and the central bank burned through most of its reserves trying to prop up the lira -- down 90 percent against the dollar over 10 years -- from even bigger falls.

Erdogan was forced into his first election runoff and then orchestrated one of his trademark policy reversals after extending his two-decade rule until 2028.

He appointed respected economist Mehmet Simsek as finance minister and former Goldman Sachs director Erkan as the head of the nominally independent central bank.

Turkish media said Simsek agreed to join the government only after winning assurances that he would be free to steady the ship as he saw fit.

- 'Clash with Erdogan' -

Simsek's presence has already made an impact.

The lira has lost an additional 18 percent against the dollar since the May 28 election runoff -- a sign that the central bank is slowly unwinding its costly currency defence.

Simsek said on Thursday that a return to a "free exchange regime... will provide a very serious flow capital to Turkey".

"This will make financing investments and production much easier, and will ensure that the Turkish lira regains stability and becomes a reliable currency," Simsek said in a tweet.

But investors who initially cheered Erdogan's new appointments now worry about how long the Turkish leader's patience with his new team will last.

Many point to the grim experience of Naci Agbal -- a market-friendly central banker whom Erdogan fired four months into his attempts to raise rates in late 2020 and early 2021.

"The scale of the rate hike was lower than the average market expectation of an increase to between 17-20 percent," Verisk Maplecroft risk consultancy analyst Hamish Kinnear said.

"This is a sign that the new governor is looking to tread carefully to avoid a clash with President Erdogan."

One of Turkey's most costly programmes involves a bank deposit protection scheme that Erdogan rolled out in late 2021.

It commits the government to cover any losses lira deposits incur from the currency's depreciation against the dollar.

That means that a quick return to a free-floating exchange rate could put an even bigger burden on the strained budget.

Many expect Simsek to gradually phase out the scheme.

M.Thompson--AMWN