-

Sinner moves through gears to reach Italian Open quarters

Sinner moves through gears to reach Italian Open quarters

-

Massages, chefs and trainers: Airbnb adds in-home services

-

Republicans eye key votes on Trump tax cuts mega-bill

Republicans eye key votes on Trump tax cuts mega-bill

-

Brazil legend Marta returns for Japan friendlies

-

McIlroy, Scheffler and Schauffele together to start PGA

McIlroy, Scheffler and Schauffele together to start PGA

-

Jose Mujica: Uruguay's tractor-driving leftist icon

-

Uruguay's ex-president Mujica dead at 89

Uruguay's ex-president Mujica dead at 89

-

It's showtime at Eurovision as semis begin

-

DeChambeau says '24 PGA near miss a major confidence boost

DeChambeau says '24 PGA near miss a major confidence boost

-

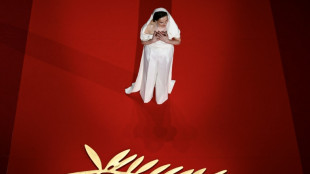

Gaza, Trump dominate politically charged Cannes Festival opening

-

Carney says new govt will 'relentlessly' protect Canada sovereignty

Carney says new govt will 'relentlessly' protect Canada sovereignty

-

Gaza rescuers says Israeli strikes kill 28 near hospital

-

Schauffele still has something to prove after two major wins

Schauffele still has something to prove after two major wins

-

US inflation cooled in April as Trump began tariff rollout

-

US reverses Biden-era export controls on advanced AI chips

US reverses Biden-era export controls on advanced AI chips

-

Trump, casting himself as peacemaker, to lift Syria sanctions

-

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

US Ryder Cup captain Bradley eyes LIV's Koepka, DeChambeau

-

Musetti battles Medvedev and match-point rain delay to reach Rome quarters

-

Rights groups urge court to halt UK fighter jet supplies to Israel

Rights groups urge court to halt UK fighter jet supplies to Israel

-

Steamy excitement at Eurovision contest

-

Forest hit back over criticism of owner Marinakis over Nuno clash

Forest hit back over criticism of owner Marinakis over Nuno clash

-

Sean Combs's ex Cassie says he 'controlled' her life with violence

-

Mali dissolves political parties in blow to junta critics

Mali dissolves political parties in blow to junta critics

-

Blackmore's history-making exploits inspiring to all: de Bromhead

-

Southern Hills named host of 2032 PGA Championship

Southern Hills named host of 2032 PGA Championship

-

Injury may delay outdoor season start for Norway's Ingebrigtsen

-

Tour de France to go through Paris' historic Montmartre district

Tour de France to go through Paris' historic Montmartre district

-

'We can't go back': India's border residents fear returning home

-

Finland returns sacred stool looted by France to Benin

Finland returns sacred stool looted by France to Benin

-

Israel PM says army entering Gaza 'with full force' in coming days

-

Sean Combs's ex Cassie says he 'controlled' her life

Sean Combs's ex Cassie says he 'controlled' her life

-

Carney forms new Canada govt to reshape US ties

-

Everton to preserve Goodison Park for women's team

Everton to preserve Goodison Park for women's team

-

Stocks mixed after cool US inflation and as rally tapers

-

Thomas confident at PGA having won a major at Quail Hollow

Thomas confident at PGA having won a major at Quail Hollow

-

Trump slashed US cancer research by 31 percent: Senate report

-

US inflation cooled in April as Trump rolled out tariffs

US inflation cooled in April as Trump rolled out tariffs

-

Dutch climate group launches new case against Shell

-

Dutch rider van Uden springs surprise to win Giro sprint

Dutch rider van Uden springs surprise to win Giro sprint

-

Tour de France to pass through historic Montmartre

-

'Apprentice' star Jeremy Strong says 'truth under assault'

'Apprentice' star Jeremy Strong says 'truth under assault'

-

India kills 3 suspected militants in Kashmir as Pakistan ceasefire holds

-

Cannes Festival opens under pressure to take stance on Gaza war

Cannes Festival opens under pressure to take stance on Gaza war

-

Rahm says no need to play perfect to win majors, just have faith

-

US consumer inflation cooled in April as Trump rolled out tariffs

US consumer inflation cooled in April as Trump rolled out tariffs

-

Kurds see ball in Ankara's court after PKK says disbanding

-

Zelensky urges Trump to make Putin meeting happen

Zelensky urges Trump to make Putin meeting happen

-

UN agency finds Russia responsible for 2014 downing of airliner over Ukraine

-

Halle Berry trips up on Cannes festival's new dress code

Halle Berry trips up on Cannes festival's new dress code

-

NFL sets first regular-season games in Dublin, Berlin, Madrid

Stocks rebound, oil falls in volatile trading

US and European stocks surged on Wednesday while oil fell after days of market turmoil over Russia's invasion of Ukraine.

Wall Street opened sharply higher, with the S&P 500 and tech-heavy Nasdaq above two percent.

In Europe, Frankfurt's benchmark DAX index soared by more than six percent and the Paris CAC 40 jumped more than five percent in afternoon trading.

London's FTSE 100 was up more than two percent, despite losses earlier in Asia.

"European markets rebound as investors fish for bargains," summarised Russ Mould, investment director at AJ Bell.

Other analysts said investors were hopeful that a diplomatic solution could be found in the conflict in Ukraine.

"Given the state of things in the world, one can easily extrapolate from these indications that market participants are feeling better about the Russia-Ukraine situation," said Briefing.com analyst Patrick O'Hare.

"Market participants should know by now, of course, that talk from Russia is cheap," O'Hare said.

OANDA analyst Craig Erlam told AFP the surge in European stocks is likey a "dead cat bounce" -- a market term referring to a rebound that briefly interrupts a prolonged downturn.

"We appear to be seeing a temporary corrective move," Erlam said, predicting the rebound would not last as Russia continues to wage war on Ukraine.

"The invasion is still happening, sanctions are still being imposed and oil prices are still high," he noted.

"None of that is conducive with a sustainable stock market recovery."

Major Asian markets declined Wednesday as investors dwelled on Washington's Russian oil and gas ban.

EU nations, which receive roughly 40 percent of their gas imports and one quarter of their oil from Russia, opted to set a goal of cutting their Russian gas imports by two-thirds.

Brent crude fell five percent to around $121 per barrel, still a high figure one day after the United States and Britain moved to ban imports of Russian crude as part of Western sanctions on Moscow.

- $240 oil? -

Brent had spiked to $139 on Monday -- about $8 short of an all-time record -- in expectation of the US embargo.

European natural gas prices languished far below this week's record peak, despite fears over the region's reliance on Russian gas.

Europe gas reference Dutch TTF slid 28 percent to 154.53 euros per megawatt hour, having leapt at the start of this week to an all-time high at 345 euros.

Oil prices could rocket further if more nations slap sanctions on Russian crude, according to Bjornar Tonhaugen, head of oil markets at Rystad Energy.

"Oil prices could hit $240 per barrel this summer in the worst-case scenario if Western countries roll out sanctions on Russia's oil exports en masse," Tonhaugen said.

"Market volatility is at an all-time high, with ... the expectation that supply will further tighten due to restrictive sanctions on Russian energy from the West."

The crisis has also fuelled fears that the fragile global recovery from Covid-19 will be replaced by a period of stagflation, in which inflation surges and economies flatline or contract.

Haven investment gold declined Wednesday, one day after hitting a near-record $2,070 per ounce -- the highest since August 2020.

- Key figures around 1440 GMT -

New York - Dow: UP 1.9 percent at 33,264.40 points

Frankfurt - DAX: UP 6.1 percent at 13,608.30

Paris - CAC 40: UP 5.6 percent at 6,298.69

London - FTSE 100: UP 2.2 percent at 7,117.80

EURO STOXX 50: UP 5.8 percent at 3,708.75

Tokyo - Nikkei 225: DOWN 0.3 percent at 24,717.53 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 20,627.71 (close)

Shanghai - Composite: DOWN 1.1 percent at 3,256.39 (close)

Brent North Sea crude: DOWN 5.0 percent at $121.62 per barrel

West Texas Intermediate: DOWN 4.8 percent at $117.76

Euro/dollar: UP at $1.1041 from $1.0899 Tuesday

Pound/dollar: UP at $1.3173 from $1.3104

Euro/pound: UP at 83.79 pence from 83.18 pence

Dollar/yen: UP at 115.72 yen from 115.67 yen

burs-rfj-lth/rl

M.Thompson--AMWN