-

UN humanitarian chief slams impunity in face of Gaza 'horror'

UN humanitarian chief slams impunity in face of Gaza 'horror'

-

Danish PM apologises to victims of Greenland forced contraception

-

Planetary health check warns risk of 'destabilising' Earth systems

Planetary health check warns risk of 'destabilising' Earth systems

-

Typhoon Ragasa slams into south China after killing 14 in Taiwan

-

Stocks torn between AI optimism, Fed rate warning

Stocks torn between AI optimism, Fed rate warning

-

US Treasury in talks with Argentina on $20bn support

-

Monchi exit 'changes nothing' for Emery at Aston Villa

Monchi exit 'changes nothing' for Emery at Aston Villa

-

Taiwan lake flood victims spend second night in shelters

-

Europe ready for McIlroy taunts from rowdy US Ryder Cup fans

Europe ready for McIlroy taunts from rowdy US Ryder Cup fans

-

US comedian Kimmel calls Trump threats 'anti-American'

-

Australia win tense cycling mixed relay world title

Australia win tense cycling mixed relay world title

-

Stokes will be battle-ready for Ashes, says England chief

-

Iran will never seek nuclear weapons, president tells UN

Iran will never seek nuclear weapons, president tells UN

-

Zelensky says NATO membership not automatic protection, praises Trump after shift

-

Becker regrets winning Wimbledon as a teenager

Becker regrets winning Wimbledon as a teenager

-

'Mind-readers' Canada use headphones in Women's Rugby World Cup final prep

-

Rose would welcome Trump on stage if Europe keeps Ryder Cup

Rose would welcome Trump on stage if Europe keeps Ryder Cup

-

AI optimism cheers up markets following Fed rate warning

-

France doubles down on threat to build future fighter jet alone

France doubles down on threat to build future fighter jet alone

-

Delay warning issued to fans ahead of Trump's Ryder Cup visit

-

EU chief backs calls to keep children off social media

EU chief backs calls to keep children off social media

-

US Treasury says in talks to support Argentina's central bank

-

'Everything broken': Chinese residents in typhoon path assess damage

'Everything broken': Chinese residents in typhoon path assess damage

-

Inside Barcelona's Camp Nou chaos: What is happening and why?

-

UK police arrest man after European airports cyberattack

UK police arrest man after European airports cyberattack

-

Ballon d'Or disappointment will inspire Yamal: Barca coach Flick

-

French-German duo wins mega offshore wind energy project

French-German duo wins mega offshore wind energy project

-

Italy deploys frigate after drone 'attack' on Gaza aid flotilla

-

Typhoon Ragasa slams into south China after killing 17 in Taiwan

Typhoon Ragasa slams into south China after killing 17 in Taiwan

-

NASA launches mission to study space weather

-

Stocks torn between Fed rate warning, AI optimism

Stocks torn between Fed rate warning, AI optimism

-

Russia vows to press offensive, rejects idea Ukraine can retake land

-

French consumer group seeks Perrier sales ban

French consumer group seeks Perrier sales ban

-

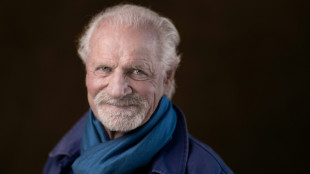

Photographer Arthus-Bertrand rejects image of 'fractured France'

-

Gaza civil defence says dozens killed in Israeli strikes

Gaza civil defence says dozens killed in Israeli strikes

-

Pakistan's Shaheen sends Asia Cup warning as third India clash looms

-

Amazon to shut checkout-free UK grocery shops

Amazon to shut checkout-free UK grocery shops

-

Typhoon Ragasa hits south China after killing 15 in Taiwan

-

Russia vows to press on in Ukraine, rejects Trump jibe

Russia vows to press on in Ukraine, rejects Trump jibe

-

Germany's Merz rejects claims he is slowing green shift

-

Sinner says 'changing a lot' after US Open loss to Alcaraz

Sinner says 'changing a lot' after US Open loss to Alcaraz

-

Russia-linked disinfo campaign targets Moldovan election

-

Danish PM to apologise to victims of Greenland forced contraception

Danish PM to apologise to victims of Greenland forced contraception

-

Wiretapping scandal goes to court in Greece

-

Ekitike apologises to Liverpool fans after 'stupid' red card

Ekitike apologises to Liverpool fans after 'stupid' red card

-

UK rail operators set for new EU border checks

-

Markets waver after Wall St drop, Alibaba soars

Markets waver after Wall St drop, Alibaba soars

-

S. Korea's ex-first lady goes on trial in corruption case

-

Modern-day Colombian guerrillas are mere druglords: ex-FARC commander

Modern-day Colombian guerrillas are mere druglords: ex-FARC commander

-

Australian telco giant slapped with $66 million fine over 'appalling' conduct

| RYCEF | 0% | 15.75 | $ | |

| GSK | -0.83% | 40.185 | $ | |

| BP | 1.73% | 35.35 | $ | |

| RELX | -0.22% | 46.37 | $ | |

| AZN | -0.94% | 75.26 | $ | |

| NGG | -0.1% | 71.29 | $ | |

| RIO | 0.67% | 64 | $ | |

| BTI | -1.49% | 52.41 | $ | |

| VOD | -0.62% | 11.29 | $ | |

| BCC | -0.78% | 78.36 | $ | |

| CMSC | -0.33% | 24.07 | $ | |

| JRI | -0.36% | 13.99 | $ | |

| SCS | -1.84% | 16.565 | $ | |

| BCE | -1.18% | 22.97 | $ | |

| RBGPF | -1.74% | 75.29 | $ | |

| CMSD | -0.4% | 24.224 | $ |

Markets turn lower as trade war rally fades

Stock markets fell Friday as their latest rally ran out of legs, with sentiment weighed by strong US jobs data that saw investors row back their expectations for interest rate cuts.

With Japan's trade deal with Washington out of the way for now, attention was also turning to European Union attempts to reach an agreement to pare Donald Trump's threatened tariffs before next Friday's deadline.

Equities have enjoyed a strong run-up for much of July on expectations governments will hammer out pacts, pushing some markets past or close to record highs.

However, while Wall Street hit new records Thursday -- S&P 500 chalked up its 10th in 19 sessions -- another round of strong jobs data suggested the Federal Reserve might have to wait longer than hoped to cut borrowing costs.

The 217,000 initial claims for unemployment benefits in the week to July 19 was the lowest since mid-April and suggested the labour market remains tight.

The figures followed forecast-topping non-farm payrolls in June and come as inflation shows signs of picking up as Trump's tariffs begin to bite.

Traders are now betting on 42 basis points of rate cuts by the end of the year, according to Bloomberg News. That's down from more than 50 previously.

Meanwhile, a manufacturing survey showed US business confidence deteriorated in July for the second successive month, with companies worried about tariffs and cuts to federal spending.

Trump continued to press Fed chief Jerome Powell to slash interest rates during a visit to its headquarters on Thursday, where they bickered over its renovation cost.

The president, who wants to oust Powell over his refusal to cut, took a fresh dig during the trip, telling reporters: "As good as we're doing, we'd do better if we had lower interest rates."

Trump's anger at the Fed and his calls for officials to lower rates has raised concerns about the independence of the central bank, which is expected to stand pat at its policy meeting next week.

"While unlikely to yield anything concrete, the optics of a president storming the temple of monetary orthodoxy is enough to put Powell watchers on edge," said SPI Asset Management's Stephen Innes.

"The risk isn't immediate policy change -- it's longer-term erosion of independence, and the signal that Powell may not be sitting as comfortably as markets assume."

Trade hopes remain elevated -- Brussels and Washington appear close to a deal that would halve Trump's threatened 30 percent levy, with a European Commission spokesman saying he believed an agreement was "within reach".

The bloc, however, is still forging ahead with contingency plans in case talks fail, with member states approving a 93 billion-euro ($109 billion) package of counter-tariffs.

With few positive catalysts to drive buying, Asian markets turned lower heading into the weekend.

Tokyo retreated after putting on around five percent in the previous two days, while Hong Kong was also off following five days of gains.

There were also losses in Shanghai, Sydney, Mumbai, Singapore and Manila. London, Paris and Frankfurt dropped in the morning.

Seoul, Bangkok, Jakarta and Wellington edged up.

The dollar extended gains against its peers as investors pared their rate forecasts.

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: DOWN 0.9 percent at 41,456.23 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 25,388.35 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,593.66 (close)

London - FTSE 100: DOWN 0.4 percent at 9,103.42

Dollar/yen: UP at 147.40 yen from 146.94 yen on Thursday

Euro/dollar: DOWN at $1.1751 from $1.1756

Pound/dollar: DOWN at $1.3469 from $1.3507

Euro/pound: UP at 87.28 pence from 87.01 pence

West Texas Intermediate: UP 0.4 percent at $66.33 per barrel

Brent North Sea Crude: UP 0.5 percent at $69.53 per barrel

New York - Dow: DOWN 0.7 percent at 44,693.91 (close)

D.Kaufman--AMWN