-

England set for Etihad start to Euro 2028 tournament campaign

England set for Etihad start to Euro 2028 tournament campaign

-

Sinner cruises past Zverev and into last four of ATP Finals

-

US presses final penny after more than 230 years

US presses final penny after more than 230 years

-

Baxter says England must be 'selfless' to see off All Blacks

-

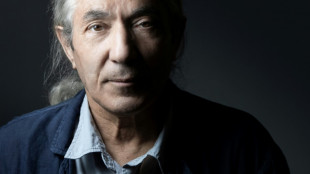

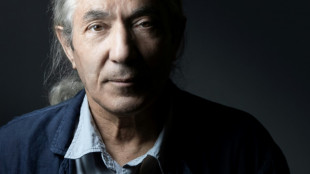

Pardoned French-Algerian writer Sansal arrives in Germany

Pardoned French-Algerian writer Sansal arrives in Germany

-

Bayern battle back to shock Arsenal in Women's Champions League

-

China hopes US will 'some day' return to climate fold, official tells AFP

China hopes US will 'some day' return to climate fold, official tells AFP

-

Trump 'knew about the girls,' new Epstein emails claim

-

Scotland 'optimistic' Russell will be fit to face Argentina

Scotland 'optimistic' Russell will be fit to face Argentina

-

Big platforms chart gradual path to self-driving at Web Summit

-

Jane Goodall honored in Washington by conservationists including DiCaprio

Jane Goodall honored in Washington by conservationists including DiCaprio

-

Tuberculosis killed 1.23 million last year: WHO

-

New Zealand coach Robertson says Twickenham visit is 'why I'm doing the job'

New Zealand coach Robertson says Twickenham visit is 'why I'm doing the job'

-

Hopes of US shutdown deal fail to sustain market rally

-

US military personnel do not risk prosecution for drug strikes: Justice Dept

US military personnel do not risk prosecution for drug strikes: Justice Dept

-

Jailed writer Sansal on way to Germany after Algeria pardon

-

Ukraine ministers resign over major corruption scandals

Ukraine ministers resign over major corruption scandals

-

Record-breaking US shutdown to end as political fallout begins

-

Wallets, not warming, make voters care about climate: California governor

Wallets, not warming, make voters care about climate: California governor

-

Astronomers spot storm on another star for first time

-

G7 foreign ministers seek to boost Ukraine war effort

G7 foreign ministers seek to boost Ukraine war effort

-

Released Epstein emails allege Trump 'knew about the girls'

-

Rees-Zammit back in Wales 'happy place' after Test return

Rees-Zammit back in Wales 'happy place' after Test return

-

Chelsea winger Sterling's house burgled

-

Auger-Aliassime beats Shelton to get off mark at ATP Finals

Auger-Aliassime beats Shelton to get off mark at ATP Finals

-

Argentina's Milei to follow Trump in skipping S.Africa G20: spokesperson

-

Back on track: Belgian-Dutch firm rescues Berlin to Paris sleeper train

Back on track: Belgian-Dutch firm rescues Berlin to Paris sleeper train

-

Los Angeles 2028 Olympic Games schedule revealed

-

Wolves appoint Edwards as manager in bid to avoid relegation

Wolves appoint Edwards as manager in bid to avoid relegation

-

UK music industry warns growth threatened by AI, Brexit

-

Epstein alleged Trump 'knew about the girls': Democrats

Epstein alleged Trump 'knew about the girls': Democrats

-

German experts slam spending plans, cut GDP forecast

-

S.Africa's Ramaphosa says US skipping G20 'their loss'

S.Africa's Ramaphosa says US skipping G20 'their loss'

-

Algeria pardons writer Boualem Sansal

-

Tuchel warns Bellingham must fight for England berth at World Cup

Tuchel warns Bellingham must fight for England berth at World Cup

-

Mbappe says France football team 'to remember' Paris terror victims

-

Joshua decision on 2025 bout imminent - promoter

Joshua decision on 2025 bout imminent - promoter

-

Cambodia says Thai troops kill one in fresh border clashes

-

UK holidaymakers told to shout, not get in a flap over seagulls

UK holidaymakers told to shout, not get in a flap over seagulls

-

Pope Leo reels off four favourite films

-

Lebanese say Israel preventing post-war reconstruction

Lebanese say Israel preventing post-war reconstruction

-

Stocks mostly rise on hopes of US shutdown deal, rate cut

-

Bayer beats forecasts but weedkiller woes still weigh

Bayer beats forecasts but weedkiller woes still weigh

-

42 feared dead in migrant shipwreck off Libya: UN

-

Cambodia, Thailand trade accusations of fresh border clashes

Cambodia, Thailand trade accusations of fresh border clashes

-

Pakistan tightens Islamabad security after suicide blast

-

Messi return 'unrealistic', says Barca president Laporta

Messi return 'unrealistic', says Barca president Laporta

-

Bayer narrows loss, upbeat on weedkiller legal woes

-

Corruption scandal, court battles pose test for Zelensky

Corruption scandal, court battles pose test for Zelensky

-

DR Congo ex-rebel leader Lumbala's war crimes trial opens in France

Hopes of US shutdown deal fail to sustain market rally

Stock markets fluctuated Wednesday as optimism that the US government shutdown was nearing an end and another Federal Reserve interest rate cut was on the horizon failed to sustain a rally.

Traders broadly welcomed an expected vote to reopen the government, after the longest shutdown in US history effectively stemmed the flow of official economic data and closed down vital services.

The House of Representatives appeared likely to vote Wednesday on a spending bill to solve the budget standoff after eight Democrats broke ranks in the Senate on Monday.

But the news failed to sustain a rally across the board on US markets -- the Dow rising while the tech heavy Nasdaq and the S&P 500 fell back in the first few hours of trading.

In Europe, Paris hit a new record and Frankfurt also rose after a mixed day on Asian markets.

"The end of the shutdown is positive for financial markets as we should get a clear read on economic data in the next week or so," said Kathleen Brooks, research director at trading group XTB.

However, she said the prospect of a resumption of government services was fuelling demand for "risk assets".

The dearth of key data points left investors and the Federal Reserve unable to make informed decisions on policy.

Adam Sarhan of 50 Park Investments said traders were now waiting for another possible tech rally later in the month.

"Investors are going to wait for the next bullish catalyst, which could be Nvidia, arguably the most important AI stock out there right now," Sarhan said. The chipmaker is set to report earnings on November 19.

Traders had been spooked on Tuesday by news that Japanese investment titan SoftBank had sold all its shares in US chip giant Nvidia for $5.8 billion, without giving a reason.

Shares in Nvidia fell three percent on Tuesday but clawed that back Wednesday, and SoftBank plunged as much as 10 percent in Tokyo after Wednesday's open before closing down 3.5 percent.

Meanwhile, expectations grew that the Fed would cut rates in December after data from private payrolls firm ADP pointed to a slower rate of hiring.

"Is it a problem? It depends for whom," said Ipek Ozkardeskaya, Senior Analyst at Swissquote bank. "It's certainly a problem for politicians, but not for investors."

She said investors needed that kind of jobs data to justify a rate cut, which in turn would lower the cost of the borrowing and make their huge AI investments more affordable.

- Key figures at around 1640 GMT -

New York - Dow: UP 0.7 percent at 48,247.24 points

New York - S&P 500: DOWN 0.2 percent at 6,835.20

New York - Nasdaq Composite: DOWN 0.7 percent at 23,304.46

London - FTSE 100: UP 0.1 percent at 9,911.42 (close)

Paris - CAC 40: UP 1.0 percent at 8,241.24 (close)

Frankfurt - DAX: UP 1.2 percent at 24,381.46 (close)

Tokyo - Nikkei 225: UP 0.4 percent at 51,063.31 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 26,922.73 (close)

Shanghai - Composite: DOWN 0.1 percent at 4,000.14 (close)

Euro/dollar: UP at $1.1591 from $1.1588 on Tuesday

Pound/dollar: DOWN at $1.3130 from $1.3168

Dollar/yen: UP at 154.66 yen from 154.10 yen

Euro/pound: UP at 88.28 pence from 87.99 pence

West Texas Intermediate: DOWN 4.1 percent at $58.50 per barrel

Brent North Sea Crude: DOWN 3.8 percent at $62.71 per barrel

L.Harper--AMWN