-

Rapid floods shock Sri Lanka's survivors

Rapid floods shock Sri Lanka's survivors

-

Equity markets mixed as traders eye US data ahead of Fed decision

-

Pope to offer hope on Lebanon visit

Pope to offer hope on Lebanon visit

-

Seoul mayor indicted over alleged illegal polling payments

-

Asia floods toll tops 1,000 as military aid survivors

Asia floods toll tops 1,000 as military aid survivors

-

Hong Kong student urging probe into deadly fire leaves police station

-

Thunder hold off Blazers to avenge lone defeat of NBA season

Thunder hold off Blazers to avenge lone defeat of NBA season

-

Zelensky meets Macron to shore up support for Ukraine as Trump optimistic

-

Trump-backed candidate leads Honduras poll

Trump-backed candidate leads Honduras poll

-

Australia ban offers test on social media harm

-

Williamson bolsters New Zealand for West Indies Test series

Williamson bolsters New Zealand for West Indies Test series

-

South Korean religious leader on trial on graft charges

-

Please don't rush: slow changes in Laos 50 years after communist victory

Please don't rush: slow changes in Laos 50 years after communist victory

-

Williamson bolsters New Zealand batting for West Indies Test series

-

How Australia plans to ban under-16s from social media

How Australia plans to ban under-16s from social media

-

Militaries come to aid of Asia flood victims as toll nears 1,000

-

'For him': Australia mum channels grief into social media limits

'For him': Australia mum channels grief into social media limits

-

Thunder down Blazers to avenge lone defeat of season

-

Asian markets mixed as traders eye US data ahead of Fed decision

Asian markets mixed as traders eye US data ahead of Fed decision

-

Migrant domestic workers seek support, solace after Hong Kong fire

-

Experts work on UN climate report amid US pushback

Experts work on UN climate report amid US pushback

-

Spain aim to turn 'suffering' to success in Nations League final second leg

-

Pope to urge unity, bring hope to Lebanese youth on day two of visit

Pope to urge unity, bring hope to Lebanese youth on day two of visit

-

Thousands march in Zagreb against far right

-

Trump confirms call with Maduro, Caracas slams US maneuvers

Trump confirms call with Maduro, Caracas slams US maneuvers

-

Young dazzles as Panthers upset Rams, Bills down Steelers

-

BioNxt Signs Letter Agreement to Acquire 100% Interest in IP and to Codevelop a Sublingual Drug Formulation for Chemotherapy and Immunosuppressant Treatments

BioNxt Signs Letter Agreement to Acquire 100% Interest in IP and to Codevelop a Sublingual Drug Formulation for Chemotherapy and Immunosuppressant Treatments

-

Grande Portage Resources Announces Additional Offtake Study Validating the Flexibility of Offsite-Processing Configuration for the New Amalga Gold Project

-

Powertechnic Records RM10.50 Million Revenue in Q3 FY2025

Powertechnic Records RM10.50 Million Revenue in Q3 FY2025

-

Linear Minerals Corp. Announces Completion of the Plan of Arrangement and Marketing Agreement

-

Arms makers see record revenues as tensions fuel demand: report

Arms makers see record revenues as tensions fuel demand: report

-

Trump optimistic after Ukraine talks as Rubio says 'more work' needed

-

Real Madrid title hopes dented at Girona in third straight draw

Real Madrid title hopes dented at Girona in third straight draw

-

Pau beat La Rochelle as Hastoy sent off after 34 seconds

-

Real Madrid drop points at Girona in third straight Liga draw

Real Madrid drop points at Girona in third straight Liga draw

-

Napoli beat rivals Roma to join Milan at Serie A summit

-

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

Shiffrin bags 104th World Cup win with Copper Mountain slalom victory

-

Disney's 'Zootopia 2' rules Thanksgiving at N. American box office

-

Arteta takes heart from Arsenal escape in Chelsea battle

Arteta takes heart from Arsenal escape in Chelsea battle

-

Duplantis and McLaughlin-Levrone crowned 'Athletes of the Year'

-

Rubio says 'more work' required after US-Ukraine talks in Florida

Rubio says 'more work' required after US-Ukraine talks in Florida

-

McLaren boss admits team made strategy blunder

-

West Ham's red-carded Paqueta slams FA for lack of support

West Ham's red-carded Paqueta slams FA for lack of support

-

Ramaphosa labels US attacks on S.Africa 'misinformation'

-

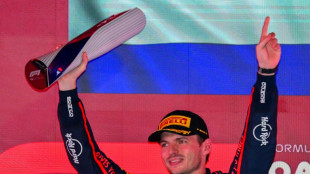

Relaxed Verstappen set for another title showdown

Relaxed Verstappen set for another title showdown

-

Van Graan compares Bath match-winner Arundell to Springbok great Habana

-

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

Arsenal held by 10-man Chelsea, Isak end drought to fire Liverpool

-

Slot hails 'important' Isak goal as Liverpool beat West Ham

-

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

Merino strikes to give Arsenal bruising draw at 10-man Chelsea

-

Thauvin double sends Lens top of Ligue 1 for 1st time in 21 years

Stocks extend gains on US rate cut hopes

Asia and Europe extended a global equities rally Wednesday after another round of tepid US data reinforced expectations that the Federal Reserve will cut interest rates again next month.

London edged up, and the pound was flat, as the centre-left Labour government prepared to deliver a tax-raising budget aimed at curbing debt and funding public services.

The UK bond market will be closely watched, with finance minister Rachel Reeves seeking to reassure investors she has control over public finances.

Paris and Frankfurt stocks also gained, supported by hopes of progress toward the end of Russia's war in Ukraine.

US envoy Steve Witkoff will visit Moscow next week to meet with Russian President Vladimir Putin as Washington presses on with negotiations to end the war.

Crude prices steadied after falling sharply Tuesday on speculation that a Ukraine peace deal could see Russia allowed to export vastly more oil.

Risk appetite was further boosted by a report that US President Donald Trump's top economic aide was the frontrunner to become the Federal Reserve's next boss.

Kevin Hassett is a close ally of the president and Bloomberg reported that he was someone who would back Trump's calls for more rate cuts.

"It's hard to ignore that the dramatic shifts in rate cut hopes have been the dominant market driver in recent weeks," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Expectations for a December rate cut surged this week after several Fed officials said they backed a third straight reduction, citing labour market weakness despite stubborn inflation.

Fresh data reinforced those expectations: official figures showed US retail sales lost momentum in September and a separate survey saw consumer confidence hit its lowest level since April this month.

Payroll firm ADP said also that the four weeks to November 8 saw private employers shed an average 13,500 jobs per week.

Wall Street's three main indices enjoyed a third day of healthy gains, with Asia largely following.

Seoul jumped more than two percent, while Tokyo and Taipei each closed up 1.9 percent. Hong Kong rose and Shanghai dipped.

The gains come after a pullback on trading floors for much of November owing to worries about lofty valuations, particularly among tech firms, with some questioning the vast sums of cash invested in the artificial intelligence sector.

Shares in Chinese ecommerce titan Alibaba dropped more than one percent after the group reported a fall in profit linked to consumer subsidies and the building of data centres to deal with its AI ambitions.

- Key figures at around 1100 GMT -

London - FTSE 100: UP 0.2 percent at 9,632.60 points

Paris - CAC 40: UP 0.5 percent at 8,061.85

Frankfurt - DAX: UP 0.4 percent at 23,547.04

Tokyo - Nikkei 225: UP 1.9 percent at 49,559.07 (close)

Hong Kong - Hang Seng Index: UP 0.1 percent at 25,928.08 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,864.18 (close)

New York - Dow: UP 1.4 percent at 47,112.45 (close)

Euro/dollar: UP at $1.1576 from $1.1570 on Tuesday

Pound/dollar: DOWN at $1.3164 from $1.3165

Dollar/yen: UP at 156.49 yen from 155.97 yen

Euro/pound: UP at 87.93 pence from 87.86 pence

Brent North Sea Crude: DOWN 0.1 percent at $61.77 per barrel

West Texas Intermediate: DOWN 0.1 percent at $57.90 per barrel

G.Stevens--AMWN