-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

-

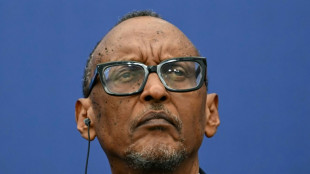

'A den of bandits': Rwanda closes thousands of evangelical churches

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

-

Steelers receiver Metcalf strikes Lions fan

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

-

Gang members given hundred-years-long sentences in El Salvador

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

Captain Kane helps undermanned Bayern go nine clear

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

Gunmen kill 9, wound 10 in South Africa bar attack

-

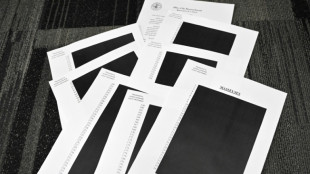

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

'It sucks': Stokes vows England will bounce back after losing Ashes

Intel, Samsung hammered as chips demand plummets

The crucial semiconductor industry, that powers everything from personal computers, smartphones to fighter jets, suffered a dismal first quarter as demand plummeted for chips.

Intel on Thursday posted a massive fall in sales for the first quarter of 2023 because of a steep drop in the demand for semiconductors, especially those for PCs.

Rising prices, a global chip glut and poor demand for hardware also punished Intel's rival Samsung Electronics, which earlier on Thursday reported its worst quarterly profits in 14 years.

Intel's revenue fell 36 percent to $11.7 billion in the three-month period and the semiconductor giant posted a loss of $2.8 billion, its biggest ever for a quarter.

The loss and sales collapse were slightly less catastrophic than expectations, and the stock rallied three percent in post-session trading.

"Intel is heavily dependent on the PC market and as we still seem to be seeing a slowdown in the PC market, consumer PCs especially, I would expect Intel to be having challenges," said Alan Priestley, an analyst at Gartner.

Intel is one of the world's leading semiconductor makers that makes a wide range of products, including the latest generation chips along with Taiwan's TSMC and South Korea's Samsung.

It was also affected by falling demand for chips that power data centers and is struggling to compete with Nvidia for the semiconductors that undergird ChatGPT-style generative AI, a major new and chips-hungry sector for the industry.

In South Korea, Samsung Electronics' chip division reported 4.58 trillion won ($746 million) in losses, its first operating loss since 2009 -- when the world was emerging from the 2008 financial crisis.

The chips industry -- which also serves the military or increasingly connected household appliances -- is well-known for its volatility, with demand and supply see-sawing with the dips and rises in the world economy.

Its central role in the global supply chain became clear during the height of the Covid pandemic.

Lockdowns and health restrictions diminished production out of Asia, leaving surging demand for chips unmet just as everyone turned online for work, shopping and entertainment.

- 'God forbid...' -

Semiconductors have also become a political pawn between the US and China, with Washington urging allies to stop supplying China with cutting edge chips or other supplies, further destabilizing the sector.

The materials required for making chips are often difficult to obtain and China is furious at Washington's effort to thwart its ability to compete in the sector.

Worry is also swirling around Taiwan, home to TSMC, the world’s most important chipmaker, with China taking a more bullish attitude toward the island that it does not recognize politically.

"If, God forbid, China all of a sudden attacked Taiwan, about three-quarters of the world's chip supply could stop," said analyst Jack Gold of J.Gold Associates, LLC.

Taiwan Semiconductor Manufacturing Company (TSMC) operates the world's largest silicon wafer factories and produces some of the most advanced microchips used in everything from smartphones and cars to missiles.

Its sales in the first quarter largely held up against the economic gloom, managing to keep profits steady, though it warned sales would take a hit later in the year.

TSMC is more shielded from a downturn in part because it produces some of the most advanced and smallest chips, which are still highly sought after and in short supply.

To respond to the China threat, and in response to the pandemic supply crunch that caught them off guard, the US and EU have planned to shell out $100 billion combined to become more self-sufficient in semiconductors production, a process that could take years.

According to Deloitte, more than 80 percent of semiconductor manufacturing happens in Asia and the best scenario will see that share reduced to 50 percent by 2030.

"It's a very intense, competitive ecosystem out there and it'll just get more complicated as more of these chips come to marketplace," said Gold.

O.M.Souza--AMWN