-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

-

Williamson says 'series by series' call on New Zealand Test future

Williamson says 'series by series' call on New Zealand Test future

-

Taiwan police rule out 'terrorism' in metro stabbing

-

Australia falls silent, lights candles for Bondi Beach shooting victims

Australia falls silent, lights candles for Bondi Beach shooting victims

-

DR Congo's amputees bear scars of years of conflict

-

Venison butts beef off menus at UK venues

Venison butts beef off menus at UK venues

-

Cummins, Lyon doubts for Melbourne after 'hugely satsfying' Ashes

-

'It sucks': Stokes vows England will bounce back after losing Ashes

'It sucks': Stokes vows England will bounce back after losing Ashes

-

Australia probes security services after Bondi Beach attack

-

West Indies need 462 to win after Conway's historic century

West Indies need 462 to win after Conway's historic century

-

Thai border clashes displace over half a million in Cambodia

-

Australia beat England by 82 runs to win third Test and retain Ashes

Australia beat England by 82 runs to win third Test and retain Ashes

-

China's rare earths El Dorado gives strategic edge

-

Japan footballer 'King Kazu' to play on at the age of 58

Japan footballer 'King Kazu' to play on at the age of 58

-

New Zealand's Conway joins elite club with century, double ton in same Test

-

Australian PM orders police, intelligence review after Bondi attack

Australian PM orders police, intelligence review after Bondi attack

-

Durant shines as Rockets avenge Nuggets loss

-

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

Pressure on Morocco to deliver as Africa Cup of Nations kicks off

-

Australia remove Smith as England still need 126 to keep Ashes alive

-

Myanmar mystics divine future after ill-augured election

Myanmar mystics divine future after ill-augured election

-

From the Andes to Darfur: Colombians lured to Sudan's killing fields

-

Eagles win division as Commanders clash descends into brawl

Eagles win division as Commanders clash descends into brawl

-

US again seizes oil tanker off coast of Venezuela

-

New Zealand 35-0, lead by 190, after racing through West Indies tail

New Zealand 35-0, lead by 190, after racing through West Indies tail

-

West Indies 420 all out to trail New Zealand by 155

-

Arteta tells leaders Arsenal to 'learn' while winning

Arteta tells leaders Arsenal to 'learn' while winning

-

Honour to match idol Ronaldo's Real Madrid calendar year goal record: Mbappe

-

Dupont helps Toulouse bounce back in Top 14 after turbulent week

Dupont helps Toulouse bounce back in Top 14 after turbulent week

-

Mbappe matches Ronaldo record as Real Madrid beat Sevilla

-

Gyokeres ends drought to gift Arsenal top spot for Christmas

Gyokeres ends drought to gift Arsenal top spot for Christmas

-

Arsenal stay top despite Man City win, Liverpool beat nine-man Spurs

-

US intercepts oil tanker off coast of Venezuela

US intercepts oil tanker off coast of Venezuela

-

PSG cruise past fifth-tier Fontenay in French Cup

-

Isak injury leaves Slot counting cost of Liverpool win at Spurs

Isak injury leaves Slot counting cost of Liverpool win at Spurs

-

Juve beat Roma to close in on Serie A leaders Inter

-

US intercepts oil tanker off coast of Venezuela: US media

US intercepts oil tanker off coast of Venezuela: US media

-

Haaland sends Man City top, Liverpool beat nine-man Spurs

-

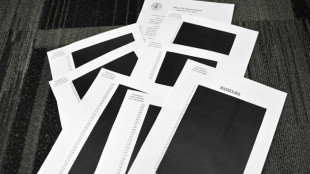

Epstein victims, lawmakers criticize partial release and redactions

Epstein victims, lawmakers criticize partial release and redactions

-

Leverkusen beat Leipzig to move third in Bundesliga

-

Lakers guard Smart fined $35,000 for swearing at refs

Lakers guard Smart fined $35,000 for swearing at refs

-

Liverpool sink nine-man Spurs but Isak limps off after rare goal

-

Guardiola urges Man City to 'improve' after dispatching West Ham

Guardiola urges Man City to 'improve' after dispatching West Ham

-

Syria monitor says US strikes killed at least five IS members

-

Australia stops in silence for Bondi Beach shooting victims

Australia stops in silence for Bondi Beach shooting victims

-

Olympic champion Joseph helps Perpignan to first Top 14 win despite red card

In Latin America, Brazilian fintech firms rule

When Brazilian sisters Daniela and Juliana Binatti quit their jobs to launch a new financial technology -- or fintech -- product, colleagues called them a pair of upstart nuts.

Alas, they ended up founding a company that US credit card giant Visa acquired this year for a cool $1 billion.

Pismo, as the firm these entrepreneurs created in 2016 is called, is the latest big success story of a Brazilian company in the fintech sector -- the one luring the most venture capital in Brazil and Latin America in general.

"When I was 16, my mother sent me out to leave my CV with banks along (the famous road) Paulista Avenue to find a job," said Daniela Binatti, who is 46 and grew up in a family of modest means in the megacity Sao Paulo.

Many of those same banks have now ended up becoming clients of hers.

With more than 450 employees and five offices around the world -- in Brazil, Britain, the United States, Singapore and India -- Pismo was acquired by Visa in June in one of the biggest deals yet in the Brazilian tech sector.

Brazil thus enlarged its herd of unicorns, or startups with a market value of at least $1 billion, to 21 out of a total of 38 in Latin America as a whole.

"Many people thought we were crazy," said Daniela Binatti, the company's director of technology.

She said she and her sister had to "break through a lot of prejudice to set up a Brazilian tech firm at an international level but we were convinced" it would succeed.

Pismo produces technology designed to make it easier for banks to launch card and payment products.

It will allow Visa to serve its customers no matter where they are or what currency they use, because Pismo's technological tools are based in the cloud and accessible from anywhere, Ricardo Josua, Pismo's executive director, said in a joint ad with Visa.

Other fintech companies created in Latin America's largest economy have shown growth potential, such as Nubank, one of the world's largest online banks, listing on Wall Street and with nearly 84 million clients; or Neon, another such bank, which in 2022 received a $300 million investment from the Spanish banking giant BBVA.

- An appealing ecosystem -

Pismo and its predecessors "show that Brazil is the region's ripest ecosystem for creating financial technology companies," said Diego Herrera, a specialist in the Connectivity, Markets and Finance Division at the Inter-American Development Bank.

Brazil, and in particular its fintech firms, lured 40 percent of the nearly $8 billion in venture capital that Latin America received in 2022, said LAVCA, the Association for Private Capital Investment in Latin America.

This is due mainly to the size of the Brazilian market, in which 84 percent of the adult population has a bank account in a country with 203 million people, said Eduardo Fuentes, head of research at an innovation platform called Distrito.

Brazil's outsized role in luring VC money also stems from the fact that just a few banks control this huge market, causing "many problems that entrepreneurs try to resolve," Fuentes added, citing high costs as an example.

What is more, "Brazil attracts international investors because it has skills and an environment favorable to innovation," said Fuentes, citing things like platforms for collective financing, payment institutions, and PIX, a revolutionary system for making small, instant payments.

Herrera said Brazil "is still the most attractive country in the region and keeps luring investment" even though the flow of money has dropped off from the record levels it hit during the pandemic, as the world economy slowed and interest rates rose.

- Opportunities -

There are 869 financial technology companies in Brazil, giving it eighth place in a global ranking in this category created by financial services company Finnovating.

Most of them focus on credit, payments and financial management, said Mariana Bonora, head of ABFintechs.

"Many opportunities arise in niches that are neglected" by traditional banks, such as products that serve people who are vulnerable or for entrepreneurs, Bonora added.

The online bank Cora -- seen as a possible unicorn -- seized on one of those niches to set up its business.

"We serve small and medium-sized companies, which account for more than 90 percent of all companies in this country, with lower costs and less red tape," said cofounder of Cora.

This Sao Paulo-based bank received $116 million in international funding during the pandemic, and boasts 400 employees and a million customers.

Looking ahead, Brazil hopes to consolidate its fintech ecosystem thanks mainly to the "open finance" system promoted by the country's central bank, which will facilitate exchange of data among institutions, said Herrera.

Other sources of innovation will be the regulation of crypto assets and the implementation of the digital real, the Brazilian currency.

A.Mahlangu--AMWN