-

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

-

Man City close gap on Arsenal after O'Reilly sinks Newcastle

-

Finland down Slovakia to claim bronze in men's ice hockey

Finland down Slovakia to claim bronze in men's ice hockey

-

More than 1,500 request amnesty under new Venezuela law

-

US salsa legend Willie Colon dead at 75

US salsa legend Willie Colon dead at 75

-

Canada beat Britain to win fourth Olympic men's curling gold

-

Fly-half Jalibert ruled out of France side to face Italy

Fly-half Jalibert ruled out of France side to face Italy

-

Russell restart try 'big moment' in Scotland win, says Townsend

-

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

-

Liga leaders Real Madrid stung by late Osasuna winner

-

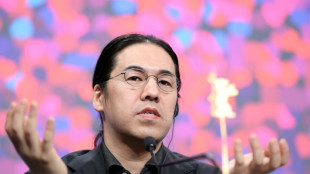

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

-

England's Genge says thumping Six Nations loss to Ireland exposes 'scar tissue'

-

Thousands march in France for slain far-right activist

Thousands march in France for slain far-right activist

-

Imperious Alcaraz storms to Qatar Open title

-

Klaebo makes Olympic history as Gu forced to wait

Klaebo makes Olympic history as Gu forced to wait

-

Late Scotland try breaks Welsh hearts in Six Nations

-

Lens lose, giving PSG chance to reclaim Ligue 1 lead

Lens lose, giving PSG chance to reclaim Ligue 1 lead

-

FIFA's Gaza support 'in keeping' with international federation - IOC

-

First all-Pakistani production makes history at Berlin film fest

First all-Pakistani production makes history at Berlin film fest

-

Gu forced to wait as heavy snow postpones Olympic halfpipe final

-

NASA chief rules out March launch of Moon mission over technical issues

NASA chief rules out March launch of Moon mission over technical issues

-

Dutch double as Bergsma and Groenewoud win Olympic speed skating gold

-

At least three dead as migrant boat capsizes off Greek island

At least three dead as migrant boat capsizes off Greek island

-

Struggling Juventus' woes deepen with home loss to Como

-

Chelsea, Aston Villa held in blow to Champions League hopes

Chelsea, Aston Villa held in blow to Champions League hopes

-

Thousands march in France for slain far-right activist under heavy security

-

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

Kane nets double as Bundesliga leaders Bayern beat Frankfurt

-

Canada beat USA to take bronze in Olympic women's curling

-

Hunger and belief key to Ireland's win, says Sheehan

Hunger and belief key to Ireland's win, says Sheehan

-

Pegula sees off Svitolina to win Dubai WTA 1000 title

-

Trump hikes US global tariff rate to 15%

Trump hikes US global tariff rate to 15%

-

AI revolution looms over Berlin film fest

-

Gibson-Park guides Ireland to record-breaking win in England

Gibson-Park guides Ireland to record-breaking win in England

-

Defence the priority for France against Italy, says Dupont

-

Juventus end bad week with 2-0 loss against Como

Juventus end bad week with 2-0 loss against Como

-

Libya's Ramadan celebrations tempered by economic woes

-

Norway's cross-country king Klaebo wins sixth gold of Milan-Cortina Winter Olympics

Norway's cross-country king Klaebo wins sixth gold of Milan-Cortina Winter Olympics

-

Iranian students chant anti-government slogans, as US threats loom

-

Hezbollah vows resistance after deadly Israeli strike

Hezbollah vows resistance after deadly Israeli strike

-

'Stormy seas' of Gaza row overshadow Berlin film fest finale

-

Pakistan-New Zealand Super Eights clash delayed by rain

Pakistan-New Zealand Super Eights clash delayed by rain

-

Werder Bremen cancel US tour citing 'political reasons'

-

South Africa's De Kock says handling pressure key in India clash

South Africa's De Kock says handling pressure key in India clash

-

French volunteer bakes for Ukraine amid frosts and power outages

-

Mexico's Del Toro wins stage to take overall UAE Tour lead

Mexico's Del Toro wins stage to take overall UAE Tour lead

-

Brook says a 'shame' if Pakistan players snubbed for Hundred

-

Gu shoots for elusive gold as Klaebo makes Olympic history

Gu shoots for elusive gold as Klaebo makes Olympic history

-

France win Olympic ski mountaineering mixed relay

-

Norway's Klaebo wins sixth gold of Milan-Cortina Winter Olympics

Norway's Klaebo wins sixth gold of Milan-Cortina Winter Olympics

-

Global summit calls for 'secure, trustworthy and robust AI'

New US rule requires publicly-listed firms to disclose emissions

Publicly-traded US companies would be required to disclose their greenhouse gas emissions and their approach to managing climate change risks under a proposed rule approved by Washington Monday.

The measure, which now goes for public comment following a vote by the Securities and Exchange Commission (SEC), follows similar steps by regulators in Japan and Europe, and aims to standardize emissions reporting.

"Climate risks can pose significant financial risks to companies," said SEC Chair Gary Gensler, an appointee of President Joe Biden.

Gensler argued the measure would provide "reliable information about climate risks to make informed investment decisions."

Companies would be required to report emissions from their own activities, known as Scope 1, and indirect emissions from purchased energy, known as Scope 2.

Firms would also need to disclose Scope 3 emissions, which are indirectly incurred in the value chain. These include energy sold to another company if these emissions are consequential to its finances or if they have set targets for these emissions.

The rules would take effect between 2024 and 2026. Smaller firms would be exempt from the measure.

"This is a watershed moment," said Allison Herren Lee, a Democratic commissioner who backed the change.

But Hester Peirce, the lone Republican member of the SEC and the only one of four commissioners to vote against the proposal, argued current rules sufficiently account for climate risk and that the measure distorts the regulatory agency's mission.

"It forces investors to view companies through the eyes of a vocal set of stakeholders, for whom a company's climate reputation is of equal or greater importance than a company's financial performance," Peirce said.

The rule comes as environmentalist shareholder groups and increasing numbers of mainstream investors press companies for action on climate change.

The SEC proposal has also been slammed by leading Republican lawmakers as an overreach at a time when Biden's attempted to curb climate change via legislation are stalled in Congress.

J.Williams--AMWN