-

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

-

Aston Martin chief Newey says no quick fix to vibration problems

-

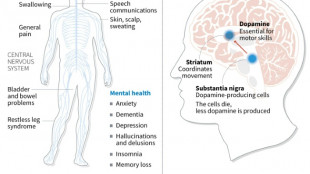

Japan approves stem-cell treatment for Parkinson's in world first

Japan approves stem-cell treatment for Parkinson's in world first

-

Heavy attacks hit Tehran as Israel says war in 'new phase'

-

North Korea thrash Bangladesh in Women's Asian Cup warning

North Korea thrash Bangladesh in Women's Asian Cup warning

-

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

-

Eight dead, four missing in Brazil seniors home collapse

Eight dead, four missing in Brazil seniors home collapse

-

Paralympics brace for tense opening as Russia comes in from the cold

-

Leclerc edges Hamilton to go fastest in first Australian GP practice

Leclerc edges Hamilton to go fastest in first Australian GP practice

-

Equities mostly drop as Mideast crisis rages, though oil dips

-

Nepal counts votes after key post-uprising election

Nepal counts votes after key post-uprising election

-

Italy half-backs can make difference against England: ex-coach Mallett

-

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

-

French starlet Seixas to take on Pogacar at Strade Bianche

-

Brazil's Petrobras sees profit soar on record output

Brazil's Petrobras sees profit soar on record output

-

Arsenal, Chelsea aim to avoid FA Cup upsets

-

US, Venezuela restore ties as Washington pushes for minerals access

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

-

US says Venezuela to protect mining firms as diplomatic ties restored

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Sri Lanka takes control of Iranian ship fearing new US sub attack

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

TSS, Inc. Announces New $20M Debt Financing to Meet Accelerating Demand for AI-Enabled Technologies

Secures funding to expand operations and enhance power infrastructure in support of recently announced long-term customer agreement

TSS, Inc. (NASDAQ:TSSI), a leader in IT hardware and software integration for AI and high-performance computing, today announced it has closed on a $20 million credit facility with Texas-based Susser Bank to support capacity expansion required to meet accelerating demand for AI-enabled technologies.

As previously announced, the company signed a long-term agreement to lease 212,793 square feet of space in the Georgetown Logistics Park located in Georgetown, Texas. This lease is part of the company's plan to expand its power infrastructure to support expected AI integration growth under its recently announced long-term customer agreement. Drawdowns under the new credit agreement will be used to fund improvements at the Georgetown facility.

The company also filed a shelf registration statement with the Securities and Exchange Commission (the "SEC"). The company believes that filing the shelf registration statement is a prudent corporate housekeeping measure that will provide greater financial flexibility in the coming years. If the company decides to raise capital in a future offering using the shelf registration statement, it will describe the specific details of that future offering in a prospectus supplement that is filed with the SEC.

Darryll Dewan, Chief Executive Officer of TSS Inc. commented, "We are pleased to expand our relationship with Susser Bank, and we appreciate their support. Our ability to expand our physical capacity with bank financing is a testament to the credibility of our growth plan. This credit facility supports the development of our operational footprint required by the projected demand from our customer and enables us to pursue new opportunities in the rapidly evolving AI space. Build out of the new space has begun, and we continue to expect to be operational at this location in early 2025."

Key Terms of the Agreement

The credit facility has a term of five years, and borrowings bear interest at a rate of one-month term SOFR plus 3.00% per annum. Payments will be interest-only for a maximum of six months, converting to a fully amortizing term loan upon completion of construction.

About TSS, Inc.

TSS specializes in simplifying the complex. The TSS mission is to streamline the integration and deployment of high-performance computing infrastructure and software, ensuring that end users quickly receive and efficiently utilize the necessary technology. Known for flexibility, the company builds, integrates, and deploys custom, high-volume solutions that empower data centers and catalyze the digital transformation of generative AI and other leading-edge technologies essential for modern computing, data, and business needs. TSS's reputation is built on passion and experience, quality, and fast time to value. As trusted partners of the world's leading data center technology providers, the company manages and deploys billions of dollars in technology each year. For more information, visit www.tssiusa.com.

About Susser Bank

Founded 63 years ago, Susser Bank is a Texas-based company and has operated under the ownership and direction of Susser Banc Holdings Corporation since 2018. The combined entities hold assets exceeding $2.45 billion while maintaining very strong capital and liquidity. The company is led by the Susser family and a legacy of six generations of Texas entrepreneurs. Susser Bank is dedicated to building long-term client relationships and providing outstanding financial solutions that make Texas stronger.

Forward Looking Statements

This press release may contain "forward-looking statements" -- that is, statements related to future -- not past -- events, plans, and prospects. In this context, forward-looking statements may address matters such as our expected future business and financial performance, and often contain words such as "guidance," "prospects," "expects," "anticipates," "intends," "plans," "believes," "seeks," "should," or "will." Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Particular uncertainties that could adversely or positively affect the Company's future results include: we may not have sufficient resources to fund our business and may need to issue debt or equity to obtain additional funding; our reliance on a significant portion of our revenues from a limited number of customers and our ability to diversify our customer base; risks relating to operating in a highly competitive industry; risks relating to supply chain challenges; risk related to changes in labor market conditions; risks related to the implementation of a new enterprise resource IT system; risks related to the development of our procurement services business; risks relating to rapid technological, structural, and competitive changes affecting the industries we serve; risks involved in properly managing complex projects; risks relating to the possible cancellation of customer contracts on short notice; risks relating to our ability to continue to implement our strategy, including having sufficient financial resources to carry out that strategy; and other risks and uncertainties disclosed in our filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

Contacts:

Hayden IR

James Carbonara (646-755-7412)

Brett Maas (646-536-7331)

[email protected]

TSS, Inc.

Danny Chism, CFO

(512) 310-4908

[email protected]

SOURCE: TSS, Inc.

F.Dubois--AMWN