-

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

Ukraine accuses Hungary of taking 'hostage' bank staff carrying $40 mn

-

Aston Martin chief Newey says no quick fix to vibration problems

-

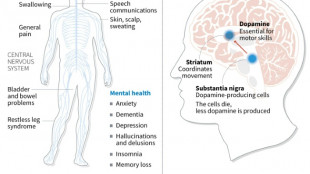

Japan approves stem-cell treatment for Parkinson's in world first

Japan approves stem-cell treatment for Parkinson's in world first

-

Heavy attacks hit Tehran as Israel says war in 'new phase'

-

North Korea thrash Bangladesh in Women's Asian Cup warning

North Korea thrash Bangladesh in Women's Asian Cup warning

-

Hong Kong mogul Jimmy Lai will not appeal national security conviction: lawyer

-

Eight dead, four missing in Brazil seniors home collapse

Eight dead, four missing in Brazil seniors home collapse

-

Paralympics brace for tense opening as Russia comes in from the cold

-

Leclerc edges Hamilton to go fastest in first Australian GP practice

Leclerc edges Hamilton to go fastest in first Australian GP practice

-

Equities mostly drop as Mideast crisis rages, though oil dips

-

Nepal counts votes after key post-uprising election

Nepal counts votes after key post-uprising election

-

Italy half-backs can make difference against England: ex-coach Mallett

-

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

Scotland coach Townsend hails 'instinctive' France ahead of key Six Nations game

-

French starlet Seixas to take on Pogacar at Strade Bianche

-

Brazil's Petrobras sees profit soar on record output

Brazil's Petrobras sees profit soar on record output

-

Arsenal, Chelsea aim to avoid FA Cup upsets

-

US, Venezuela restore ties as Washington pushes for minerals access

US, Venezuela restore ties as Washington pushes for minerals access

-

Middle East war enters seventh day as Israel strikes Beirut

-

Qualifier Parry ends Venus's desert dream

Qualifier Parry ends Venus's desert dream

-

Iran missile barrage sparks explosions over Tel Aviv

-

US says Venezuela to protect mining firms as diplomatic ties restored

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

Spurs slip deeper into relegation trouble after loss to Palace

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Sri Lanka takes control of Iranian ship fearing new US sub attack

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

ExpressExtension Is Now Accepting IRS Tax Extension Forms 7004, 4868, 8868, & 8809 for the 2024 Tax Year

ExpressExtension now accepts IRS tax extension forms for the 2024 tax year. As the new tax season begins and IRS deadlines approach, ExpressExtension provides individuals, businesses, and tax professionals with a seamless and efficient platform to request extensions for filing tax forms.

ExpressExtension is a tailored platform designed to request tax form filing extensions with the IRS. Its intuitive interface, streamlined features, and dedicated customer support ensure efficiency, making it the go-to solution for anyone requesting a time extension to file their tax returns.

Supported Extension Forms and Their Details

Business Tax Extension Form 7004:

Businesses classified as a corporation, C-corporation, S-corporation, LLC, partnership, trust, or estate can file Form 7004 to request an extension of up to 6 months for filing their business income tax return.

This extension applies to various commonly used forms, including Form 1065 and Form 1120-S, whose original deadline is March 15, and Form 1120 and Form 1041, whose original deadline is April 15.

Personal Tax Extension Form 4868:

Individual taxpayers can file Form 4868 to request a 6-month extension for submitting their personal income tax returns.

This extension applies to commonly used forms, including Form 1040, 1040-SR, 1040-SS, and 1040-NR, which have an actual deadline of April 15.

Nonprofit Tax Extension Form 8868:

Organizations exempt from federal tax, including nonprofits and charities, can request a 6-month extension by filing Form 8868.

This extension applies to all 990 forms, including Form 990, 990-EZ, 990-PF, and 990-T, with major deadlines on May 15.

Information Return Extension Form 8809:

Businesses are required to submit various information returns to the IRS detailing payments made during operations, employee compensation, ACA forms, and other relevant information. To request a 30-day extension, businesses can file Form 8809 with the IRS.

Common forms extended include Form 1099, whose original due date is January 31, ACA Form 1095, whose actual deadline is March 3, and others.

It is important to note that extension forms do not extend the deadline for tax payments. Filers must ensure their estimated tax payments are made by the original due date to avoid penalties. Extensions apply only to the filing of the return and not to the payment of taxes. Timely payment is essential to remain penalty-free.

Express Guarantee - Guaranteed Extension Approval or Your Money Back

Refund for Duplicate Filing

If the IRS rejects Forms 7004 and 4868 due to duplicate filing, clients can receive a full refund of the payment.

Retransmit Rejected Return for Free

If extension forms are rejected for other reasons, clients can retransmit the returns at no additional cost.

Ensure Streamlined Tax Extension Filing with ExpressExtension

ExpressExtension simplifies the process of requesting extensions, providing clients with a user-friendly e-filing platform efficient and secure. Tailored to meet the needs of individuals, businesses, and tax professionals, the platform ensures a seamless experience with features such as:

Instant IRS Status Updates

Secure Bulk Upload Options

Volume-Based Pricing

Flexible Tax Payment Options (EFW/EFTPS)

Multi-Device Accessibility - File from any device, anytime

Visit ExpressExtension.com and start e-filing Form 7004, 4868, 8868, & 8809 at an affordable price.

About ExpressExtension

ExpressExtension is the one-stop solution for IRS Tax Extensions. As an IRS-authorized, SOC 2 Certified e-file provider, ExpressExtension has been helping businesses, individuals, and non-profit organizations obtain IRS extensions for over a decade. Supported forms include Form 7004, 4868, 8868, and 8809.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN Enterprises has created cutting-edge software solutions for e-filing and business management for over ten years. The suite of products includes TaxBandits, Tax990, TaxExemptBonds, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Stephanie Glanville, Marketing Manager, at [email protected].

SOURCE: ExpressExtension

D.Moore--AMWN