-

Fears of Mideast war as US-Iran conflict flares

Fears of Mideast war as US-Iran conflict flares

-

Guardiola expects short absence for injured Haaland

-

Liverpool's set play transformation a return to 'normal' for Slot

Liverpool's set play transformation a return to 'normal' for Slot

-

Man City win to close on Arsenal as Liverpool hit five

-

Kane bags brace as Bayern end Dortmund's title hopes

Kane bags brace as Bayern end Dortmund's title hopes

-

Semenyo sinks Leeds as Man City close gap on Arsenal

-

Last-gasp Lukaku saves Napoli's blushes at rock-bottom Verona

Last-gasp Lukaku saves Napoli's blushes at rock-bottom Verona

-

Could the US-Israel war on Iran drag on?

-

Iranians abroad jittery but jubilant at US, Israeli strikes

Iranians abroad jittery but jubilant at US, Israeli strikes

-

Pakistan 'have underperformed' says Agha after T20 World Cup exit

-

Under-strength Toulouse overpower Montauban in Top 14

Under-strength Toulouse overpower Montauban in Top 14

-

Vietnam AI law takes effect, first in Southeast Asia

-

Brazil's Lula visits flood zone as death toll from landslides hits 70

Brazil's Lula visits flood zone as death toll from landslides hits 70

-

New Zealand into T20 World Cup semis as Sri Lanka avoid big Pakistan loss

-

Medvedev wins Dubai title as Griekspoor withdraws

Medvedev wins Dubai title as Griekspoor withdraws

-

First Yamal hat-trick helps Liga leaders Barcelona beat Villarreal

-

Liverpool hit five past West Ham, Haaland-less City face Leeds test

Liverpool hit five past West Ham, Haaland-less City face Leeds test

-

Van der Poel romps to cobbled classic win

-

Republicans back Trump, Democrats attack 'illegal' Iran war

Republicans back Trump, Democrats attack 'illegal' Iran war

-

Madonna is surprise attraction at Dolce & Gabbana Milan show

-

Farhan keeps Pakistan hopes alive as they post 212-8 against Sri Lanka

Farhan keeps Pakistan hopes alive as they post 212-8 against Sri Lanka

-

Afghanistan says civilians killed in Pakistan air strikes

-

Tug of war: how US presidents battle Congress for military powers

Tug of war: how US presidents battle Congress for military powers

-

Residents flee as Iran missiles stun peaceful Gulf cities

-

Streets empty and shops close as US strikes confirm Iranian fears

Streets empty and shops close as US strikes confirm Iranian fears

-

Israelis shelter underground as Iran fires missiles

-

Bournemouth held by Sunderland in blow to European bid

Bournemouth held by Sunderland in blow to European bid

-

VAR expanded to include second bookings and corners for World Cup

-

Iranians in Istanbul jittery but jubilant at US, Israeli strikes

Iranians in Istanbul jittery but jubilant at US, Israeli strikes

-

Congo-Brazzaville president vows to keep power as campaign kicks off

-

US, Israel launch strikes on Iran, Tehran hits back across region

US, Israel launch strikes on Iran, Tehran hits back across region

-

Germany's Aicher wins women's super-G in Soldeu

-

Fight against terror: Trump threatens Tehran's mullahs

Fight against terror: Trump threatens Tehran's mullahs

-

US and Israel launch strikes on Iran, explosions reported across region

-

Iran's Khamenei: ruthless revolutionary at apex of Islamic republic

Iran's Khamenei: ruthless revolutionary at apex of Islamic republic

-

In Iran attack, Trump seeks what he foreswore -- regime change

-

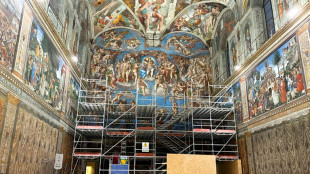

Climate change forces facelift for Michelangelo masterpiece

Climate change forces facelift for Michelangelo masterpiece

-

Trump says US aims to destroy Iran's military, topple government

-

Acosta wins season-opening MotoGP sprint after Marquez penalty

Acosta wins season-opening MotoGP sprint after Marquez penalty

-

US and Israel launch strikes against Iran

-

Afghanistan says Pakistan fighter jet down as cross-border strikes flare

Afghanistan says Pakistan fighter jet down as cross-border strikes flare

-

Kerr says only '85 percent' fit for Women's Asian Cup

-

Messi's Inter Miami to visit White House: US media

Messi's Inter Miami to visit White House: US media

-

Thunder beat Nuggets in overtime on Gilgeous-Alexander's return

-

'It's surreal': Zimbabwe superfans revel in unexpected ride to India

'It's surreal': Zimbabwe superfans revel in unexpected ride to India

-

New 'Wuthering Heights' film unleashes fresh wave of Bronte-mania

-

US backs Pakistan's 'right to defend itself' after strikes on Afghanistan

US backs Pakistan's 'right to defend itself' after strikes on Afghanistan

-

Bezzecchi beats Marquez to pole at season-opening Thailand MotoGP

-

OpenAI strikes Pentagon deal with 'safeguards' as Trump dumps Anthropic

OpenAI strikes Pentagon deal with 'safeguards' as Trump dumps Anthropic

-

Oscar-nominated 'F1' sound engineers recreate roar of racetrack

Spetz Inc. Acquires 3.35m Sonic Tokens in First Week as Strategic Accumulation Program Commences

TORONTO, ON / ACCESS Newswire / June 5, 2025 / Spetz Inc. (the "Company" or "Spetz") (CSE:SPTZ)(OTC PINK:DBKSF) is pleased to announce that it has completed its first week of open-market purchases as part of its strategic digital asset accumulation program.

During the initial week, the Company acquired approximately 3.35 million S tokens, the native token of the Sonic blockchain, at an average cost of $0.56 CAD ($0.41 USD) per token for an aggregate of $1.87m CAD, bringing our company balance to 3.9m Sonic tokens. These purchases reflect the Company's conviction in Sonic as an emerging Layer 1 blockchain

"These initial acquisitions mark an exciting shift in our operational focus," said Mitchell Demeter, CEO and Director of Spetz. "With the successful divestiture of our legacy business, we are now fully aligned behind SonicStrategy and are committed to supporting the growth of the Sonic ecosystem through both capital allocation and infrastructure participation. We believe the timing and entry price of these initial purchases represent a strong opportunity to build long-term value for our shareholders."

As part of its ongoing corporate governance and employee alignment initiatives, the Company announces that it has issued a total of 3,150,000 stock options under its equity incentive plan, all exercisable at a price of $0.81. The options have been allocated as follows: 1,000,000 to officers, 375,000 to directors, and 1,775,000 to consultants and advisors. The options have a term of 10 years and vest in quarterly tranches over a period of 24 months. These grants are intended to align the interests of key personnel with the long-term success of the Company. All securities issued pursuant to the equity incentive plan are subject to a minimum hold period of four months and one day from the grant date.

About Spetz Inc.

Spetz Inc. (CSE:SPTZ)(OTC PINK:DBKSF) is the parent company of SonicStrategy Inc., a public-market gateway to the Sonic blockchain ecosystem. Spetz provides investors with compliant exposure to staking infrastructure and DeFi strategies across the Sonic network.

Company Contacts:

Investor Relations

Email: [email protected]

Mitchell Demeter

Email: [email protected]

Phone: +1-345-936-9555

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-looking Statements

Certain information herein constitutes "forward-looking information" under Canadian securities laws, reflecting management's expectations regarding objectives, plans, strategies, future growth, results of operations, and business prospects of the Company. Words such as "may", "plans," "expects," "intends," "anticipates," "believes," and similar expressions identify forward-looking statements, which are qualified by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are based on a number of estimates and assumptions that, while considered reasonable by management, are subject to business, economic, and competitive uncertainties and contingencies. The Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected outcomes. Factors influencing these outcomes include economic conditions, regulatory developments, competition, capital availability, and business execution risks. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur.

The forward-looking information contained in this press release represents Spetz's expectations as of the date of this release and is subject to change. Spetz does not undertake any obligation to update forward-looking statements, except as required by law.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, and shall not constitute an offer, solicitation or sale in any state, province, territory or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state, province, territory or jurisdiction. None of the securities issued in the Private Placement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act.

We seek Safe Harbor.

SOURCE: Spetz Inc

View the original press release on ACCESS Newswire

O.Johnson--AMWN