-

Germany's Aicher wins women's super-G in Soldeu

Germany's Aicher wins women's super-G in Soldeu

-

Fight against terror: Trump threatens Tehran's mullahs

-

US and Israel launch strikes on Iran, explosions reported across region

US and Israel launch strikes on Iran, explosions reported across region

-

Iran's Khamenei: ruthless revolutionary at apex of Islamic republic

-

In Iran attack, Trump seeks what he foreswore -- regime change

In Iran attack, Trump seeks what he foreswore -- regime change

-

Climate change forces facelift for Michelangelo masterpiece

-

Trump says US aims to destroy Iran's military, topple government

Trump says US aims to destroy Iran's military, topple government

-

Acosta wins season-opening MotoGP sprint after Marquez penalty

-

US and Israel launch strikes against Iran

US and Israel launch strikes against Iran

-

Afghanistan says Pakistan fighter jet down as cross-border strikes flare

-

Kerr says only '85 percent' fit for Women's Asian Cup

Kerr says only '85 percent' fit for Women's Asian Cup

-

Messi's Inter Miami to visit White House: US media

-

Thunder beat Nuggets in overtime on Gilgeous-Alexander's return

Thunder beat Nuggets in overtime on Gilgeous-Alexander's return

-

'It's surreal': Zimbabwe superfans revel in unexpected ride to India

-

New 'Wuthering Heights' film unleashes fresh wave of Bronte-mania

New 'Wuthering Heights' film unleashes fresh wave of Bronte-mania

-

US backs Pakistan's 'right to defend itself' after strikes on Afghanistan

-

Bezzecchi beats Marquez to pole at season-opening Thailand MotoGP

Bezzecchi beats Marquez to pole at season-opening Thailand MotoGP

-

OpenAI strikes Pentagon deal with 'safeguards' as Trump dumps Anthropic

-

Oscar-nominated 'F1' sound engineers recreate roar of racetrack

Oscar-nominated 'F1' sound engineers recreate roar of racetrack

-

15 dead as cash-packed military plane crashes in Bolivia

-

Costa Rica's Grynspan pledges reform in bid for UN chief job

Costa Rica's Grynspan pledges reform in bid for UN chief job

-

Former All Black Bridge hailed for influence at Western Force

-

'Sinners' vampires inspired by animals, says Oscar hopeful makeup artist

'Sinners' vampires inspired by animals, says Oscar hopeful makeup artist

-

For Oscar nominee Stellan Skarsgard, good cinema is like slow food

-

'Brilliant industry' sees Reds down Highlanders in Super Rugby

'Brilliant industry' sees Reds down Highlanders in Super Rugby

-

Neil Sedaka, US singer and songwriter, dies age 86

-

Paramount acquires Warner Bros. in $110 bn mega-merger

Paramount acquires Warner Bros. in $110 bn mega-merger

-

Rosenior eyes extended stay to stabilise Chelsea

-

Spurs struggling physically admits Tudor

Spurs struggling physically admits Tudor

-

Lens held by Strasbourg in blow to Ligue 1 title chances

-

NFL salary cap passes $300 mn for first time

NFL salary cap passes $300 mn for first time

-

Wolves secure rare win to dent Villa's bid for Champions League place

-

Oil prices jump on Iran attack fears while US stocks fall

Oil prices jump on Iran attack fears while US stocks fall

-

Two dead, dozens injured as tram derails in Milan

-

Trump tells US govt to 'immediately' stop using Anthropic AI tech

Trump tells US govt to 'immediately' stop using Anthropic AI tech

-

Court orders Greenpeace to pay $345 mn to US oil pipeline company

-

IAEA stresses 'urgency' to verify Iran's nuclear material

IAEA stresses 'urgency' to verify Iran's nuclear material

-

UN urges action to prevent full civil war in South Sudan

-

Hackers steal medical details of 15 million in France

Hackers steal medical details of 15 million in France

-

Susan Sarandon praises Spain’s stance on Gaza

-

Murray adamant size isn't everything despite losing Wales place

Murray adamant size isn't everything despite losing Wales place

-

Messi knocked down by fan in Puerto Rico pitch invasion

-

Two killed, dozens injured as tram derails in Milan

Two killed, dozens injured as tram derails in Milan

-

O'Neill taken aback by Rangers boss Rohl's comments on Celtic

-

Ukrainian, Slovak leaders hold call amid energy spat

Ukrainian, Slovak leaders hold call amid energy spat

-

French hard-left firebrand sparks row with 'antisemitic' Epstein jibe

-

Ahmed, Jacks blast England to thrilling win over New Zealand

Ahmed, Jacks blast England to thrilling win over New Zealand

-

UK police arrest man after Churchill statue sprayed with graffiti

-

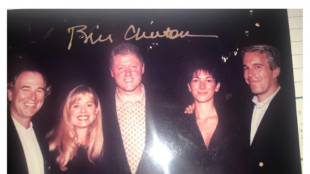

Bill Clinton denies wrongdoing at grilling on Epstein ties

Bill Clinton denies wrongdoing at grilling on Epstein ties

-

Red Cross urges Afghanistan-Pakistan 'de-escalation'

Spetz Announces Closing of Second Tranche of Previously Announced $10,000,000 Private Placement for a Total of $8.1 Million

TORONTO, ON / ACCESS Newswire / June 19, 2025 / SPETZ INC. (the "Company" or "Spetz") (CSE:SPTZ)(OTC PINK:DBKSF) is pleased to announce that it has held yesterday the closing of the second tranche (the "Second Tranche") of its previously announced non-brokered private placement (the "Private Placement") at which it issued 1,506,000 units (the "Units") at a price of $0.50 per Unit, for gross proceeds of $753,000. Each of the Units consists of one common share and one-half of a common share purchase warrant (the "Warrants") of Spetz. Each whole Warrant entitles its holder to acquire one additional common share of the Company at a price of $0.75 for a period of 24 months from the closing date. The Private Placement was described in the press releases of the Company disseminated on March 24, 2025, May 12, 2025 and May 28, 2025.

As previously announced, the Company issued 14,702,617 Units for gross proceeds of C$7,351,308.50 on May 28, 2025 under a first tranche of the Private Placement (the "First Tranche"). In aggregate, the Company issued under the Private Placement 16,208,617 Units for aggregate gross proceeds of C$8,104,308.50. The net proceeds from the Private Placement will be used for general working capital purposes, validator expansion, and growth initiatives within the blockchain infrastructure sector.

Additional closings of the Private Placement may be held until June 23, 2025, subject to the issuance of a maximum of an additional 3,791,383 Units at a price of $0.50 per Unit, for total maximum additional gross proceeds of $1,895,691.50.

In connection with the Second Tranche, the Company paid cash commissions to four (4) securities dealers in an aggregate amount of $39,000. In addition, the Company granted non-transferable finders' warrants (the "Finder's Warrants") to four (4) securities dealers entitling them to acquire up to an aggregate of 108,000 additional common shares of Spetz at a price of $0.75 per share for a period of 24 months from the closing date.

In the press release of the Company dated May 28, 2025 announcing the First Tranche, we indicated that the aggregate amount of cash commissions paid to finders was equal to $315,812. However, the aggregate amount of cash commissions paid to finders under the First Tranche was instead equal to $321,812. Additionally, we indicated that the aggregate amount of non-transferable finders' warrants granted to finders under the First Tranche entitled them to acquire up to an aggregate of 719,524 additional common shares of Spetz. However, the aggregate amount of additional common shares to which the finders are entitled pursuant to the non-transferable finders' warrants granted is instead 731,524.

All of the foregoing securities are subject to a hold period of four months and day expiring on October 19, 2025.

About Spetz Inc.

Spetz Inc. (dba SonicStrategy) (CSE:SPTZ)(OTC PINK:DBKSF) is the parent company of SonicStrategy Inc., a public-market gateway to the Sonic blockchain ecosystem. Spetz provides investors with compliant exposure to staking infrastructure and DeFi strategies across the Sonic network.

Sonic Strategy Website: www.sonicstrategy.io

Company Contacts:

Investor Relations Email: [email protected] | Mitchell Demeter Email: [email protected] |

Phone: +1-345-936-9555 | |

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Note Regarding Forward-looking Statements

Certain information herein constitutes "forward-looking information" under Canadian securities laws, reflecting management's expectations regarding objectives, plans, strategies, future growth, results of operations, and business prospects of the Company. Words such as "may", "plans," "expects," "intends," "anticipates," "believes," and similar expressions identify forward-looking statements, which are qualified by the inherent risks and uncertainties surrounding future expectations.

Forward-looking statements are based on a number of estimates and assumptions that, while considered reasonable by management, are subject to business, economic, and competitive uncertainties and contingencies. The Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected outcomes. Factors influencing these outcomes include economic conditions, regulatory developments, competition, capital availability, and business execution risks. No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, including, the closing of additional tranches of the Private Placement, how the Company will use of the net proceeds of the Private Placement or if any Warrants or Finder's Warrants will ever be exercised.

The forward-looking information contained in this press release represents Spetz's expectations as of the date of this release and is subject to change. Spetz does not undertake any obligation to update forward-looking statements, except as required by law.

This press release does not constitute an offer to sell or the solicitation of an offer to buy, and shall not constitute an offer, solicitation or sale in any state, province, territory or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state, province, territory or jurisdiction. None of the securities issued in the Private Placement will be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), and none of them may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the 1933 Act.

We seek Safe Harbor.

SOURCE: Spetz Inc

View the original press release on ACCESS Newswire

O.Karlsson--AMWN