-

Iranian in possible prisoner exchange faces 'terrorism' verdict in France

Iranian in possible prisoner exchange faces 'terrorism' verdict in France

-

'Street-smart' New Zealand can topple England to make T20 semis: coach

-

Iran-US talks begin in push to avert war

Iran-US talks begin in push to avert war

-

Merz says Germany, China must overcome trade gaps 'together'

-

Automaker Stellantis posts massive loss, pivots from EV

Automaker Stellantis posts massive loss, pivots from EV

-

US, Ukraine to meet in Geneva after overnight Russian strikes

-

Snake-like robot unveiled for Fukushima debris removal

Snake-like robot unveiled for Fukushima debris removal

-

'Public lynching': Senegal cracks down on LGBTQ+ community

-

Hong Kong sentences father of wanted activist to 8 months in jail

Hong Kong sentences father of wanted activist to 8 months in jail

-

The woman fighting to reclaim her face from Albania's 'AI minister'

-

Bulgaria ski station becomes refuge for digital nomads

Bulgaria ski station becomes refuge for digital nomads

-

Thai runner-up party seeks criminal case against election officials

-

North Korea's Kim shuns South but could 'get along' with US

North Korea's Kim shuns South but could 'get along' with US

-

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

-

Germany's Merz visits China AI hub hoping for business deals

Germany's Merz visits China AI hub hoping for business deals

-

Post-uprising polls won't shake Nepal's delicate India-China balance

-

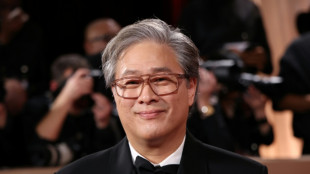

S.Korea's Park Chan-wook to head Cannes festival jury

S.Korea's Park Chan-wook to head Cannes festival jury

-

Australian ex-PM says 'more important than ever' to ditch UK monarchy

-

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

-

US-Ukraine talks to open in Geneva after overnight Russian strikes

-

Export ban sparks rush to process lithium in Zimbabwe

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

-

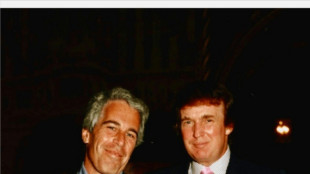

Epstein files reveal links to cash, women, power in Africa

Epstein files reveal links to cash, women, power in Africa

-

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

Brumbies not getting carried away by emphatic Super Rugby start

-

Dr. Angela Zeng's TEDx Talk on Supporting Children's Mental Health Without Medication Goes Live

-

Truly Good Foods Unveils Golden Hour(TM) Snack Bars

Truly Good Foods Unveils Golden Hour(TM) Snack Bars

-

Renee Is Transforming AI Therapy, And It's Just Getting Started

-

Eagle Plains Increases Saskatchewan Gold Royalty Portfolio

Eagle Plains Increases Saskatchewan Gold Royalty Portfolio

-

Innovation Holds Key to Future Growth, New Research from Ipsos, Alchemy-RX and Market Logic Finds

-

Forecast Change for The 2025/2026 Fiscal Year

Forecast Change for The 2025/2026 Fiscal Year

-

Banyan Gold Continues to Intersect Visible Gold and High-Grade Mineralization in Powerline, Yukon, Canada

Altigen Technologies Reports Third Quarter Results for Fiscal Year 2025

NEWARK, CALIFORNIA / ACCESS Newswire / July 31, 2025 / Altigen Technologies (OTCQB:ATGN), a leading Silicon Valley-based Microsoft Cloud Communications Solutions provider, announced today its financial results for the third quarter ended June 30, 2025.

Key Financial Highlights (3Q 2025 versus 3Q 2024)

Net Revenue increased 7% to $3.52 million

Cloud services revenue decreased 1% to $1.69 million;

Service and Other revenue increased 25% to $1.56 million;

Gross margin increased to 63%, compared with 61%;

GAAP net income was $111 thousand, compared with $62 thousand.

"Our fiscal third quarter marked Altigen's fifth consecutive quarter of profitability," said Jeremiah Fleming, President and CEO of Altigen Technologies. "Compared to the same period last year, we delivered improvements across nearly every key financial metric, demonstrating that our digital transformation strategy is clearly taking hold."

Trended Financial Information (in thousands, except for EPS and percentages) | ||||||||||

Fiscal | Fiscal | Fiscal | Fiscal | Fiscal | ||||||

3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q24 | ||||||

Total Revenue | $ | 3,517 | $ | 3,500 | $ | 3,378 | $ | 3,736 | $ | 3,283 |

Cloud Services | 1,685 | 1,680 | 1,720 | 1,680 | 1,710 | |||||

Services and Other | 1,563 | 1,552 | 1,366 | 1,731 | 1,249 | |||||

Legacy Products (Recurring) | 269 | 268 | 292 | 325 | 324 | |||||

GAAP Operating (Loss) / Income | $ | 125 | $ | 283 | $ | 75 | $ | 209 | $ | 68 |

Operating Margin | 3.6 | % | 8.1 | % | 2.2 | % | 0.7 | % | 2.1 | % |

GAAP Net Income/(Loss) | $ | 111 | $ | 287 | $ | 87 | $ | 2,079 | $ | 62 |

Adjusted EBITDA (1) | 645 | 314 | 291 | 507 | 214 | |||||

Adjusted EBITDA excludes one-time litigation costs and other non-recurring or unusual charges that may arise from time to time that we do not consider to be directly related to core operating performance.

Conference Call

Altigen will be discussing its financial results and outlook on a conference call today at 1:00 p.m. Pacific Time (4:00 p.m. ET). The conference call can be accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011 (international), conference ID #822684. To access the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international), conference ID #52683. A web archive will be made available at www.altigen.com for 90 days following the call's conclusion.

About Altigen Technologies

Altigen Technologies (OTCQB:ATGN) is focused on driving digital transformation in today's modern workplace. Our Cloud Communications solutions and Technology Consulting services empower companies of all sizes to elevate customer engagement, increase employee productivity and improve operational efficiency. We're headquartered in Silicon Valley with operations strategically located in five countries spanning three continents. For more information, call 1-888-ALTIGEN or visit our website at www.altigen.com.

Safe Harbor Statement

This press release contains forward‐looking information. The statements are based on reasonable assumptions, beliefs and expectations of management and the Company provides no assurance that actual events will meet management's expectations. Furthermore, the forward-looking statements contained in this press release are based on the Company's views of future events and financial performances which are subject to known and unknown risks and uncertainties including, but not limited to, statements regarding the Company's operational improvements, performance enhancements, AI solution development, and expectations for sustainable growth. There can be no assurances that the Company will achieve the expected results, and actual results may be materially different than expectations and from those stated or implied in forward-looking statements.

Please refer to the Company's most recent Annual Report filed with the OTCQB over-the-counter market for a further discussion of risks and uncertainties. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. The Company does not undertake any obligation to update any forward-looking statements.

Contact:

Altigen Communications, Inc.

Investor Relations - [email protected]

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except shares and per share data)

June 30, | September 30, | |||

2025 | 2024 | |||

(unaudited) | ||||

ASSETS | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 3,471 | $ | 2,575 |

Accounts receivable, net | 1,185 | 1,770 | ||

Other current assets | 155 | 185 | ||

Total current assets | 4,811 | 4,530 | ||

Property and equipment, net | - | - | ||

Operating lease right-of-use assets | 68 | 149 | ||

Goodwill | 2,725 | 2,725 | ||

Intangible assets, net | 1,177 | 1,242 | ||

Capitalized software development cost, net | 1,490 | 1,363 | ||

Deferred tax asset | 5,638 | 5,638 | ||

Other long-term assets | 15 | 2 | ||

Total assets | $ | 15,924 | $ | 15,649 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

Current liabilities: | ||||

Accounts payable | $ | 294 | $ | 98 |

Accrued compensation and benefits | 562 | 593 | ||

Accrued expenses | 143 | 446 | ||

Deferred consideration - current | 744 | 744 | ||

Operating lease liabilities - current | 47 | 104 | ||

Deferred revenue - current | 538 | 481 | ||

Total current liabilities | 2,328 | 2,466 | ||

Deferred consideration - long-term | - | - | ||

Operating lease liabilities - long-term | 32 | 49 | ||

Deferred revenue - long-term | 95 | 176 | ||

Total liabilities | 2,455 | 2,691 | ||

Stockholders' equity: | ||||

Common stock | 24 | 24 | ||

Treasury stock | -1,579 | -1,565 | ||

Additional paid-in capital | 73,233 | 73,193 | ||

Accumulated deficit | -58,209 | -58,694 | ||

Total stockholders' equity | 13,469 | 12,958 | ||

Total liabilities and stockholders' equity | $ | 15,924 | $ | 15,649 |

(1) The information in this column was derived from the Company's audited consolidated financial statements as of and for the year ended September 30, 2024.

ALTIGEN COMMUNICATIONS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

Three Months Ended | Nine Months Ended | |||||||||||

June 30, | June 30, | |||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||

Net revenue | $ | 3,517 | $ | 3,283 | $ | 10,395 | $ | 9,883 | ||||

Gross profit | 2,199 | 1,994 | 6,494 | 6,009 | ||||||||

Operating expenses: | ||||||||||||

Research and development | 411 | 945 | 1,095 | 3,383 | ||||||||

Selling, general & administrative | 1,663 | 980 | 4,924 | 3,141 | ||||||||

Operating income (loss) | 125 | 69 | 475 | (515 | ) | |||||||

Other expense | (7 | ) | (5 | ) | - | (23 | ) | |||||

Interest and other income | 15 | 16 | 41 | 37 | ||||||||

Net income (loss) before provision for income taxes | 133 | 80 | 516 | (501 | ) | |||||||

Income tax benefit (expense) (1) | (22 | ) | (18 | ) | (32 | ) | (18 | ) | ||||

Net income (loss) | $ | 111 | $ | 62 | $ | 484 | $ | (519 | ) | |||

Per share data: | ||||||||||||

Basic | $ | 0.00 | $ | 0.00 | $ | 0.01 | $ | (0.02 | ) | |||

Diluted | $ | 0.00 | $ | 0.00 | $ | 0.01 | $ | (0.02 | ) | |||

Weighted average shares outstanding: | ||||||||||||

Basic | 25,852 | 24,919 | 25,601 | 24,919 | ||||||||

Diluted | 25,952 | 26,026 | 25,952 | 24,919 | ||||||||

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

Nine Months Ended | |||||

June 30, | |||||

2025 | 2024 | ||||

Cash flows from operating activities: | |||||

Net income (loss) | $ | 484 | $ | (519 | ) |

Adjustments to reconcile net income to net cash from operating activities: | |||||

Depreciation and amortization | - | 3 | |||

Deferred income tax expense | - | - | |||

Amortization of intangible assets | 150 | 137 | |||

Amortization of capitalized software | 168 | 311 | |||

Adjustment for non-cash operating lease expenses | 7 | ||||

Stock-based compensation | 41 | 42 | |||

Changes in operating assets and liabilities: | |||||

Accounts receivable and unbilled accounts receivable | 573 | (277 | ) | ||

Prepaid expenses and other current assets | 42 | (51 | ) | ||

Other long-term assets | (12 | ) | - | ||

Accounts payable | 196 | 43 | |||

Accrued expenses | (585 | ) | (47 | ) | |

Deferred revenue | 152 | 96 | |||

Net cash provided by (used in) operating activities | 1,216 | (262 | ) | ||

Cash flows from investing activities: | |||||

Purchase of intangible assets | (85 | ) | |||

Capitalized software development costs | (221 | ) | (377 | ) | |

Net cash provided by (used in) investing activities | (306 | ) | (377 | ) | |

Cash flows from financing activities: | |||||

Payment related to business acquisition | - | - | |||

Exercise of stock option | (14 | ) | 0 | ||

Net cash provided by (used in) financing activities | - | - | |||

Net increase (decrease) in cash and cash equivalents | 896 | (639 | ) | ||

Cash and cash equivalents, beginning of year | 2,575 | 2,641 | |||

Cash and cash equivalents, end of year | $ | 3,471 | $ | 2,002 | |

ALTIGEN COMMUNICATIONS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

Three Months Ended | Nine Months Ended | ||||||||||

June 30, | June 30, | ||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||

Reconciliation of GAAP to Non-GAAP Gross Profit: | |||||||||||

GAAP gross profit | $ | 2,199 | $ | 1,994 | $ | 6,494 | $ | 6,009 | |||

Amortization of capitalized software | 87 | 70 | 158 | 279 | |||||||

Amortization of acquired customer relationships | 40 | 40 | 120 | 120 | |||||||

Non-GAAP gross profit | $ | 2,326 | $ | 2,104 | $ | 6,772 | $ | 6,408 | |||

Reconciliation of GAAP to Non-GAAP Expenses: | |||||||||||

GAAP operating expenses | $ | 2,074 | $ | 1,925 | $ | 3,937 | $ | 6,524 | |||

Depreciation and amortization | - | 1 | - | 3 | |||||||

Amortization of capitalized software | 0 | 9 | 11 | 32 | |||||||

Amortization of intangible assets | 10 | 6 | 30 | 18 | |||||||

Stock-based compensation | 9 | 14 | 41 | 42 | |||||||

Non-GAAP operating expenses | $ | 2,055 | $ | 1,895 | $ | 3,855 | $ | 6,429 | |||

Reconciliation of GAAP to Non-GAAP Net Income: | |||||||||||

GAAP net profit / (loss) | $ | 110 | $ | 62 | $ | 484 | $ | (519 | ) | ||

Depreciation and amortization | - | 1 | - | 3 | |||||||

Amortization of capitalized software | 87 | 79 | 169 | 311 | |||||||

Amortization of intangible assets | 50 | 46 | 150 | 138 | |||||||

Stock-based compensation | 9 | 14 | 41 | 42 | |||||||

Deferred tax asset valuation allowance | - | - | - | - | |||||||

Non-GAAP net income | $ | 256 | $ | 202 | $ | 844 | $ | (25 | ) | ||

Per share data: | |||||||||||

Basic | $ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.00 | |||

Diluted | $ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.00 | |||

Weighted average shares outstanding: | |||||||||||

Basic | 25,852 | 24,919 | 25,601 | 24,919 | |||||||

Diluted | 25,952 | 26,026 | 25,952 | 24,919 | |||||||

Non-GAAP Financial Measures

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our core operating performance on a period-to-period basis. These non-GAAP financial measures exclude stock-based compensation expense, amortization of acquired intangible assets, depreciation and amortization expenses, acquisition-related costs, change in deferred tax asset valuation allowance, litigation costs and other non-recurring or unusual charges or benefits that may arise from time to time that we do not consider to be directly related to core operating performance. We use non-GAAP measures to evaluate the core operating performance of our business and to perform financial planning. Since we find these measures to be useful, we believe that investors benefit from seeing results reviewed by management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by facilitating: (i) the comparability of our on-going operating results over the periods presented and (ii) the ability to identify trends in our underlying business.

SOURCE: Altigen Technologies

View the original press release on ACCESS Newswire

P.Silva--AMWN