-

'Public lynching': Senegal cracks down on LGBTQ+ community

'Public lynching': Senegal cracks down on LGBTQ+ community

-

Hong Kong sentences father of wanted activist to 8 months in jail

-

The woman fighting to reclaim her face from Albania's 'AI minister'

The woman fighting to reclaim her face from Albania's 'AI minister'

-

Bulgaria ski station becomes refuge for digital nomads

-

Thai runner-up party seeks criminal case against election officials

Thai runner-up party seeks criminal case against election officials

-

North Korea's Kim shuns South but could 'get along' with US

-

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

Spurs win 10th straight, Pistons silence Thunder in battle of NBA's best

-

Germany's Merz visits China AI hub hoping for business deals

-

Post-uprising polls won't shake Nepal's delicate India-China balance

Post-uprising polls won't shake Nepal's delicate India-China balance

-

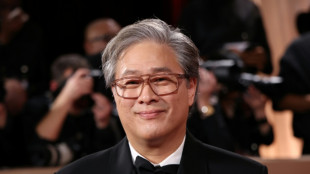

S.Korea's Park Chan-wook to head Cannes festival jury

-

Australian ex-PM says 'more important than ever' to ditch UK monarchy

Australian ex-PM says 'more important than ever' to ditch UK monarchy

-

Dressed for succession? Kim Jong Un, daughter fuel speculation with matching coats

-

US-Ukraine talks to open in Geneva after overnight Russian strikes

US-Ukraine talks to open in Geneva after overnight Russian strikes

-

Export ban sparks rush to process lithium in Zimbabwe

-

Pakistani sculptor turns scrap into colossal metal artworks

Pakistani sculptor turns scrap into colossal metal artworks

-

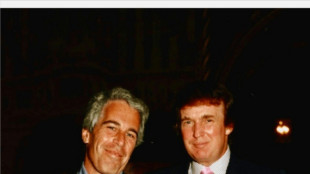

Epstein files reveal links to cash, women, power in Africa

-

Where are Southeast Asia's data centres?

Where are Southeast Asia's data centres?

-

Where AI lives: Southeast Asia's data centre boom

-

Seoul hits fresh record on mixed day for Asia markets

Seoul hits fresh record on mixed day for Asia markets

-

Kyiv residents pool together for solar panels and batteries amid Russian strikes

-

North Korea's Kim says could 'get along' with US but shuns South

North Korea's Kim says could 'get along' with US but shuns South

-

Cuba kills four on US-registered speedboat trying to 'infiltrate'

-

UK Labour party threatened by hard-right, leftists in heartland

UK Labour party threatened by hard-right, leftists in heartland

-

Australian PM sorry after saying sexual assault survivor 'difficult'

-

Kim Jong Un spurns olive branch from 'hostile' South Korea

Kim Jong Un spurns olive branch from 'hostile' South Korea

-

DR Congo sanctuary resists bloody forest sell-off

-

North Korea looking to replicate youth success at Women's Asian Cup

North Korea looking to replicate youth success at Women's Asian Cup

-

Deal or no deal: What's the state of Trump's tariffs?

-

Hillary Clinton to testify in US House panel's Epstein probe

Hillary Clinton to testify in US House panel's Epstein probe

-

African migrants won legal protections - then Trump deported them

-

US women's ice hockey captain responds to 'distasteful' Trump remark

US women's ice hockey captain responds to 'distasteful' Trump remark

-

US presses missile issue as new Iran talks to open in Geneva

-

US government accused of major 'cover-up' over Trump sex abuse claims

US government accused of major 'cover-up' over Trump sex abuse claims

-

US eases Cuba oil embargo but demands 'dramatic' change

-

IMF urges US to work with partners to ease trade restrictions

IMF urges US to work with partners to ease trade restrictions

-

Brumbies not getting carried away by emphatic Super Rugby start

-

Connecting Excellence Group PLC Announces H1 2026 Trading Update

Connecting Excellence Group PLC Announces H1 2026 Trading Update

-

Empire Metals Limited Announces DTC Eligibility

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 26

InterContinental Hotels Group PLC Announces Transaction in Own Shares - February 26

-

Cuba coast guard kills four on US-registered speedboat

-

Juve lick wounds after painful Champions League exit

Juve lick wounds after painful Champions League exit

-

Real Madrid victory for 'everyone against racism': Tchouameni

-

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

Wallabies skipper Wilson back from injury in clash of heavyweight coaches

-

PSG coach Luis Enrique calls on team to raise their game in Champions League last 16

-

Nvidia smashes forecasts with record quarter as AI boom rolls on

Nvidia smashes forecasts with record quarter as AI boom rolls on

-

Vinicius seals Real Champions League progress as PSG edge out Monaco

-

Galatasaray survive Juve scare to squeeze into Champions League last 16

Galatasaray survive Juve scare to squeeze into Champions League last 16

-

PSG survive Monaco scare to reach Champions League last 16

-

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

Vinicius hits winner as Real Madrid eliminate Benfica after racism row

-

Harden fractures thumb in blow to in-form Cavaliers

Stabilis Solutions Announces Second Quarter 2025 Results

HOUSTON, TX / ACCESS Newswire / August 6, 2025 / Stabilis Solutions, Inc., ("Stabilis" or the "Company") (Nasdaq:SLNG), a leading provider of clean fueling, production, storage, and last mile delivery solutions for many of the world's most recognized, high-performance brands, today announced financial results for the second quarter ended June 30, 2025.

SECOND QUARTER 2025 HIGHLIGHTS

Revenues of $17.3 million

Net loss of ($0.6) million

Adjusted EBITDA of $1.5 million

Cash flow from operations of $4.5 million

$12.2 million of cash and $3.9 million of availability under credit agreements as of June 30, 2025

MANAGEMENT COMMENTARY

"We continued to advance our long-term business development and growth strategy by deepening engagement with customers across marine, aerospace, and power generation end-markets with a focus on securing the long-term contracts needed to grow our operations," stated Casey Crenshaw, Executive Chairman and Interim President & Chief Executive Officer. " Demand for our turnkey small-scale LNG solutions remains strong, underpinned by continued growth in commercial space applications. These trends reinforce our position as the provider of choice within our markets, and we are prepared to invest in additional LNG infrastructure in response to emerging commercial opportunities."

"Total revenue declined year-over-year in the second quarter, due to the successful completion of a large, short duration commercial project late in 2024. However, we are gaining momentum in our key high growth aerospace, marine and power generation markets, which together increased 15% year-over-year, reflecting growing demand for our solutions in high-performance and mission critical applications," continued Crenshaw. "This reinforces our confidence in the long-term fundamentals of our business, as we deepen relationships with both new and existing customers and benefit from the continued growth in LNG fuel applications."

"We remain focused on generating operating cash flows and maintaining a strong balance sheet and liquidity to support our long-term growth strategy," stated Andy Puhala, Chief Financial Officer. "As of the end of the second quarter, we had over $16 million in cash and available liquidity, providing us with the ability to continue investing in both capital expenditures and operating investments to support value creation for stakeholders."

STRATEGIC AND OPERATIONAL UPDATE

Strong momentum in key growth markets. Since the second quarter of last year, Stabilis' revenue mix in high-growth marine, power generation and aerospace end-markets increased from 62% of total revenue to nearly 77% in the second quarter of 2025. Demand within these end-markets is driven by multi-year trends such as the commercialization of the aerospace industry and the transition of marine vessels to LNG. The Company is actively pursuing further commercial opportunities to expand relationships with both new and existing customers within these end-markets.

Consistent cash conversion supports balance sheet versatility and growth investment potential. Stabilis' efficient cost structure and working capital utilization has continued to drive robust free cash flow conversion and a strengthening liquidity position. The Company continues to allocate capital and operating expenses toward growth initiatives and since the beginning of the year has invested $1.2 million in capital expenditures for growth initiatives.

FINANCIAL PERFORMANCE SUMMARY

Revenue for the second quarter of 2025 was $17.3 million, a decrease of 7% compared to the second quarter of 2024. The decrease in revenue compared to the prior year period was primarily attributable to the successful completion of a large industrial customer contract, partly offset by higher revenues associated with aerospace and power generation customers.

Net loss for the second quarter of 2025 was ($0.6) million, or ($0.03) per diluted share, compared to net income of $27 thousand or $0.00 per diluted share in the second quarter of 2024. The decrease in net income compared to the prior year period reflects the decrease in net revenues, including lower equipment and labor revenues on a completed customer contract, partly offset by a $0.2 million reduction in selling, general and administrative expenses in the second quarter of 2025.

Adjusted EBITDA for the second quarter of 2025 was $1.5 million, compared to $2.1 million, in the second quarter of last year. The decrease in Adjusted EBITDA year-over-year is primarily attributable to lower revenues including lower equipment and labor revenues on a completed customer contract.

SECOND QUARTER 2025 CONFERENCE CALL AND WEBCAST

Stabilis will host a conference call on Thursday August 7, 2025, at 9:00 a.m. ET to review the Company's financial results and conduct a question-and-answer session.

A webcast of the conference call will be available in the Investor Relations section of the Company's corporate website at https://investors.stabilis-solutions.com/events. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download, and install any necessary audio software.

To participate in the live teleconference:

Domestic Live: | 833-316-1983 |

International Live: | 785-838-9310 |

Conference ID: | SLNGQ225 |

To listen to a replay of the teleconference, which will be available through August 14, 2025:

Domestic Live: | 800-695-2533 |

International Live: | 402-530-9029 |

ABOUT STABILIS SOLUTIONS

Stabilis Solutions is a leading provider of clean fueling, production, storage, and last mile delivery solutions for many of the world's most recognized, high-performance brands. To learn more, visit www.stabilis-solutions.com.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This press release includes "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995 and within the meaning of Section 27a of the Securities Act of 1933, as amended, and Section 21e of the Securities Exchange Act of 1934, as amended. Any actual results may differ from expectations, estimates and projections presented or implied and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "can," "believes," "feels," "anticipates," "expects," "could," "will," "plan," "may," "should," "predicts," "potential" and similar expressions are intended to identify such forward-looking statements.

Such forward-looking statements relate to future events or future performance, but reflect our current beliefs, based on information currently available. Most of these factors are outside our control and are difficult to predict. A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward-looking statements. Factors that may cause such differences include, among other things: the future performance of Stabilis, future demand for and price of LNG, availability and price of natural gas, unexpected costs, and general economic conditions.

The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in the Risk Factors in Item 1A of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 25, 2025 which is available on the SEC's website at www.sec.gov or on the Investors section of our website at www.stabilis-solutions.com. All subsequent written and oral forward-looking statements concerning Stabilis, or other matters attributable to Stabilis, or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Stabilis does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in their expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

Stabilis Solutions, Inc. and Subsidiaries

Selected Consolidated Operating Results

(Unaudited, in thousands, except share and per share data)

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | March 31, | June 30, | June 30, | June 30, | ||||||||||||

2025 | 2025 | 2024 | 2025 | 2024 | ||||||||||||

Revenues: | ||||||||||||||||

Revenues | $ | 17,309 | $ | 17,338 | $ | 18,598 | $ | 34,647 | $ | 38,368 | ||||||

Operating expenses: | ||||||||||||||||

Cost of revenues | 12,724 | 12,788 | 13,550 | 25,512 | 27,064 | |||||||||||

Change in unrealized (gain) loss on natural gas derivatives | 60 | (84 | ) | (82 | ) | (24 | ) | (334 | ) | |||||||

Selling, general and administrative expenses | 3,131 | 4,933 | 3,331 | 8,064 | 6,787 | |||||||||||

Gain from disposal of fixed assets | - | (103 | ) | (72 | ) | (103 | ) | (199 | ) | |||||||

Depreciation expense | 1,860 | 1,867 | 1,768 | 3,727 | 3,568 | |||||||||||

Total operating expenses | 17,775 | 19,401 | 18,495 | 37,176 | 36,886 | |||||||||||

Income (loss) from operations before equity income | (466 | ) | (2,063 | ) | 103 | (2,529 | ) | 1,482 | ||||||||

Net equity income from foreign joint venture operations | 50 | 368 | 295 | 418 | 492 | |||||||||||

Income (loss) from operations | (416 | ) | (1,695 | ) | 398 | (2,111 | ) | 1,974 | ||||||||

Other income (expense): | ||||||||||||||||

Interest income (expense), net | 24 | 21 | 28 | 45 | 24 | |||||||||||

Other income (expense), net | (24 | ) | (12 | ) | 26 | (36 | ) | 5 | ||||||||

Total other income (expense) | - | 9 | 54 | 9 | 29 | |||||||||||

Net income (loss) before income tax (benefit) expense | (416 | ) | (1,686 | ) | 452 | (2,102 | ) | 2,003 | ||||||||

Income tax (benefit) expense | 197 | (88 | ) | 425 | 109 | 507 | ||||||||||

Net income (loss) | $ | (613 | ) | $ | (1,598 | ) | $ | 27 | $ | (2,211 | ) | $ | 1,496 | |||

Net income (loss) per common share: | ||||||||||||||||

Basic and diluted per common share | $ | (0.03 | ) | $ | (0.09 | ) | $ | 0.00 | $ | (0.12 | ) | $ | 0.08 | |||

EBITDA | $ | 1,420 | $ | 160 | $ | 2,192 | $ | 1,580 | $ | 5,547 | ||||||

Adjusted EBITDA | $ | 1,480 | $ | 2,069 | $ | 2,110 | $ | 3,549 | $ | 5,213 | ||||||

Stabilis Solutions, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited, in thousands, except share and per share data)

June 30, | December 31, | |||

2025 | 2024 | |||

Assets | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 12,220 | $ | 8,987 |

Accounts receivable, net | 4,397 | 6,239 | ||

Inventories, net | 180 | 345 | ||

Prepaid expenses and other current assets | 1,039 | 1,902 | ||

Total current assets | 17,836 | 17,473 | ||

Property, plant and equipment: | ||||

Cost | 118,596 | 117,246 | ||

Less accumulated depreciation | (69,048 | ) | (65,518 | ) |

Property, plant and equipment, net | 49,548 | 51,728 | ||

Goodwill | 4,314 | 4,314 | ||

Investments in foreign joint ventures | 10,760 | 11,659 | ||

Right-of-use assets and other noncurrent assets | 786 | 410 | ||

Total assets | $ | 83,244 | $ | 85,584 |

Liabilities and Stockholders' Equity | ||||

Current liabilities: | ||||

Accounts payable | $ | 5,950 | $ | 5,667 |

Accrued liabilities | 3,456 | 3,566 | ||

Current portion of long-term notes payable | 1,295 | 2,010 | ||

Current portion of finance and operating lease obligations | 640 | 384 | ||

Total current liabilities | 11,341 | 11,627 | ||

Long-term notes payable, net of current portion and debt issuance costs | 6,336 | 6,848 | ||

Long-term portion of operating lease obligations | 85 | 101 | ||

Total liabilities | 17,762 | 18,576 | ||

Commitments and contingencies | ||||

Stockholders' equity: | ||||

Common stock; $0.001 par value, 37,500,000 shares authorized, 18,596,301 and 18,585,014 shares issued and outstanding at June 30, 2025 and December 31, 2024, respectively | 19 | 19 | ||

Additional paid-in capital | 103,644 | 103,214 | ||

Accumulated other comprehensive loss | (323 | ) | (578 | ) |

Accumulated deficit | (37,858 | ) | (35,647 | ) |

Total stockholders' equity | 65,482 | 67,008 | ||

Total liabilities and stockholders' equity | $ | 83,244 | $ | 85,584 |

Stabilis Solutions, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited, in thousands)

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | March 31, | June 30, | June 30, | June 30, | ||||||||||||

2025 | 2025 | 2024 | 2025 | 2024 | ||||||||||||

Cash flows from operating activities: | ||||||||||||||||

Net income (loss) | $ | (613 | ) | $ | (1,598 | ) | $ | 27 | $ | (2,211 | ) | $ | 1,496 | |||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | ||||||||||||||||

Depreciation | 1,860 | 1,867 | 1,768 | 3,727 | 3,568 | |||||||||||

Stock-based compensation expense | - | 447 | 408 | 447 | 791 | |||||||||||

Bad debt expense (recovery) | 106 | 7 | (100 | ) | 113 | 68 | ||||||||||

Gain on disposal of assets | - | (103 | ) | (72 | ) | (103 | ) | (199 | ) | |||||||

Income from equity investment in joint venture | (120 | ) | (417 | ) | (340 | ) | (537 | ) | (587 | ) | ||||||

Cash settlements from natural gas derivatives, net | 76 | 163 | (359 | ) | 239 | (359 | ) | |||||||||

Realized and unrealized (gains) losses on natural gas derivatives, net | 225 | (84 | ) | 30 | 141 | 30 | ||||||||||

Distributions from equity investment in joint venture | 1,637 | - | 1,716 | 1,637 | 1,716 | |||||||||||

Changes in operating assets and liabilities: | ||||||||||||||||

Accounts receivable | 205 | 1,540 | (228 | ) | 1,745 | 1,736 | ||||||||||

Prepaid expenses and other current assets | 213 | 423 | 445 | 636 | 680 | |||||||||||

Accounts payable and accrued liabilities | 898 | (1,229 | ) | 1,679 | (331 | ) | (133 | ) | ||||||||

Other | 28 | 9 | 64 | 37 | 160 | |||||||||||

Net cash provided by operating activities | 4,515 | 1,025 | 5,038 | 5,540 | 8,967 | |||||||||||

Cash flows from investing activities: | ||||||||||||||||

Acquisition of fixed assets | (635 | ) | (487 | ) | (1,376 | ) | (1,122 | ) | (2,249 | ) | ||||||

Proceeds from sale of fixed assets | - | 211 | 72 | 211 | 279 | |||||||||||

Net cash used in investing activities | (635 | ) | (276 | ) | (1,304 | ) | (911 | ) | (1,970 | ) | ||||||

Cash flows from financing activities: | ||||||||||||||||

Payments on short- and long-term notes payable and finance leases | (680 | ) | (671 | ) | (529 | ) | (1,351 | ) | (875 | ) | ||||||

Payment of debt issuance costs | - | (42 | ) | - | (42 | ) | - | |||||||||

Employee tax payments from restricted stock withholdings | - | (17 | ) | - | (17 | ) | (9 | ) | ||||||||

Net cash used in financing activities | (680 | ) | (730 | ) | (529 | ) | (1,410 | ) | (884 | ) | ||||||

Effect of exchange rate changes on cash | 17 | (3 | ) | (8 | ) | 14 | (4 | ) | ||||||||

Net increase in cash and cash equivalents | 3,217 | 16 | 3,197 | 3,233 | 6,109 | |||||||||||

Cash and cash equivalents, beginning of period | 9,003 | 8,987 | 8,286 | 8,987 | 5,374 | |||||||||||

Cash and cash equivalents, end of period | $ | 12,220 | $ | 9,003 | $ | 11,483 | $ | 12,220 | $ | 11,483 | ||||||

Non-GAAP Measures

Our management uses EBITDA and Adjusted EBITDA to assess the performance and operating results of our business. EBITDA is defined as Earnings before Interest (includes interest income and interest expense), Taxes, Depreciation and Amortization. Adjusted EBITDA is defined as EBITDA further adjusted for certain special items that occur during the reporting period, as noted below. We include EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of our operating performance. Neither EBITDA nor Adjusted EBITDA is a recognized term under generally accepted accounting principles in the U.S. ("GAAP"). Accordingly, they should not be used as an indicator of, or an alternative to, net income (loss) as a measure of operating performance. In addition, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow available for management's discretionary use, as they do not consider certain cash requirements, such as debt service requirements. Because the definition of EBITDA and Adjusted EBITDA may vary among companies and industries, it may not be comparable to other similarly titled measures used by other companies. The following table provides a reconciliation of net income (loss), the most directly comparable GAAP measure, to EBITDA and Adjusted EBITDA (in thousands).

Three Months Ended | Six Months Ended | |||||||||||||||

June 30, | March 31, | June 30, | June 30, | June 30, | ||||||||||||

2025 | 2025 | 2024 | 2025 | 2024 | ||||||||||||

Net income (loss) | $ | (613 | ) | $ | (1,598 | ) | $ | 27 | $ | (2,211 | ) | $ | 1,496 | |||

Depreciation | 1,860 | 1,867 | 1,768 | 3,727 | 3,568 | |||||||||||

Interest expense (income), net | (24 | ) | (21 | ) | (28 | ) | (45 | ) | (24 | ) | ||||||

Income tax (benefit) expense | 197 | (88 | ) | 425 | 109 | 507 | ||||||||||

EBITDA | 1,420 | 160 | 2,192 | 1,580 | 5,547 | |||||||||||

Special items* | 60 | 1,909 | (82 | ) | 1,969 | (334 | ) | |||||||||

Adjusted EBITDA | $ | 1,480 | $ | 2,069 | $ | 2,110 | $ | 3,549 | $ | 5,213 | ||||||

* Special items for all periods presented consist of adjustments related to unrealized (gain)/loss on natural gas derivatives. The three months ended March 31, 2025 and the six months ended June 30, 2025 also include an add-back of $2.1 million related to Mr. Ballard's severance expenses and a subtraction of $0.1 million for a gain related to a property damage settlement.

# # # # #

Investor Contact:

Andrew Puhala

Chief Financial Officer

832-456-6502

[email protected]

SOURCE: Stabilis Solutions

View the original press release on ACCESS Newswire

L.Mason--AMWN