-

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

Antonio Tejero, leader of Spain's failed 1981 coup, dies at 93

-

Hakimi, set to face trial for rape, in PSG team for Champions League game

-

Eleven men lured into Russia war returned to South Africa

Eleven men lured into Russia war returned to South Africa

-

Brazil politicians convicted for ordering murder of black activist councilor

-

Ex-US Treasury chief Summers quits Harvard over Epstein ties

Ex-US Treasury chief Summers quits Harvard over Epstein ties

-

Modi says India stands 'firmly' with Israel during visit

-

New Zealand knock sorry Sri Lanka out of T20 World Cup

New Zealand knock sorry Sri Lanka out of T20 World Cup

-

Berlinale meet called over film director's anti-Israel speech

-

Van der Poel to make season bow at Omloop Het Nieuwsblad

Van der Poel to make season bow at Omloop Het Nieuwsblad

-

Maria Grazia Chiuri's Fendi homecoming feted in Milan

-

Norway's King Harald to stay in hospital to treat infection: doctor

Norway's King Harald to stay in hospital to treat infection: doctor

-

Mbappe season on ice ahead of silverware sprint, World Cup

-

New Zealand produce late flurry to reach 168-7 against Sri Lanka

New Zealand produce late flurry to reach 168-7 against Sri Lanka

-

France appoints new Louvre chief after jewellery heist

-

No Ahmedabad advantage for South Africa against West Indies: Maharaj

No Ahmedabad advantage for South Africa against West Indies: Maharaj

-

Scotland fans skirt World Cup rules for kilt bags

-

18 Egyptians missing after deadly boat capsize near Greece

18 Egyptians missing after deadly boat capsize near Greece

-

Stock markets strike record highs as AI concerns ease

-

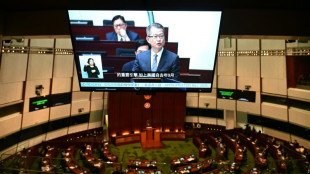

Hong Kong finance chief tips up to 3.5% growth this year

Hong Kong finance chief tips up to 3.5% growth this year

-

Arctic underdogs Bodo/Glimt topple Champions League giants in 'fairytale'

-

Bill Gates admits affairs but denies involvement in Epstein crimes

Bill Gates admits affairs but denies involvement in Epstein crimes

-

Hope fades in search for missing after deadly Brazil rains

-

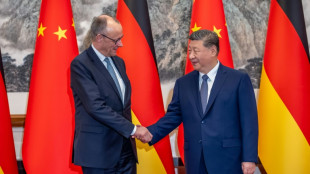

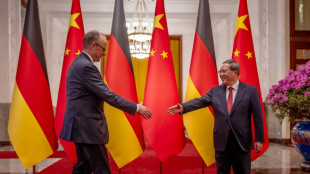

Germany's Merz meets Xi, announces Chinese Airbus order

Germany's Merz meets Xi, announces Chinese Airbus order

-

Hakimi, set to face trial for rape, in PSG Champions League matchday squad

-

Man Utd financial results show profit increase after job cuts

Man Utd financial results show profit increase after job cuts

-

Guinness maker Diageo cuts outlook on weak US, China demand

-

Swiss-EU deals package to be signed next week

Swiss-EU deals package to be signed next week

-

Ice melt threatens emperor penguins during annual moult: researchers

-

Pope lines up trips to Central Africa, Algeria, Spain, Monaco

Pope lines up trips to Central Africa, Algeria, Spain, Monaco

-

Stock markets hit record highs on easing AI concerns

-

Samson in India's mix for high-stakes clash against Zimbabwe

Samson in India's mix for high-stakes clash against Zimbabwe

-

Turkey's Erdogan dismisses secular critics of Ramadan school plan

-

Ferguson inspiring Hearts' bid for Scottish title history

Ferguson inspiring Hearts' bid for Scottish title history

-

Snoop Dogg's Swansea party showcases Championship glow-up

-

France appoints new president at Louvre after jewellery heist

France appoints new president at Louvre after jewellery heist

-

Germany's Merz meets Xi in China, seeking closer ties

-

Aston Martin slashes staff as US tariffs hit carmakers

Aston Martin slashes staff as US tariffs hit carmakers

-

Chief executive of 2030 Olympic Games becomes latest director to quit

-

Rubio meets Caribbean leaders as US raises pressure on Cuba

Rubio meets Caribbean leaders as US raises pressure on Cuba

-

Head of France's Versailles Palace to take over Louvre: source to AFP

-

England's Brook gains redemption after 'hardest winter of my life'

England's Brook gains redemption after 'hardest winter of my life'

-

Iran dismisses missile, nuclear claims after Trump alleges 'sinister ambitions'

-

Inside the Mexican resort that was the final hideout of 'El Mencho'

Inside the Mexican resort that was the final hideout of 'El Mencho'

-

Somaliland pins hopes on critical mineral gold rush

-

Bejart Ballet's iconic Bolero ignites Istanbul

Bejart Ballet's iconic Bolero ignites Istanbul

-

Sri Lanka arrests ex-spy chief over 2019 Easter bombings

-

South Korea birth rate jumps but still under key fertility threshold

South Korea birth rate jumps but still under key fertility threshold

-

Democrats bet on centrism in rebuttal to Trump speech

-

Australian police arrest two over alleged kidnapping, murder of grandfather

Australian police arrest two over alleged kidnapping, murder of grandfather

-

Redknapp's Gold Cup dream sparked by late grandmother

How to Sell a Manufacturing Business: Expert Guide Released

Selling a manufacturing business can become a very complicated process. IRAEmpire's guide aims to help business owners get the best value for their enterprise while also completing the process seamlessly.

LOS ANGELES, CALIFORNIA / ACCESS Newswire / August 28, 2025 / IRAEmpire.com has released a new, comprehensive guide to help manufacturing business owners plan and execute a successful exit. The guide explains how to value a manufacturing company, prepare operations for buyer scrutiny, and navigate the legal and financial complexities that come with selling in this highly competitive sector.

The resource is designed for small to mid-sized manufacturers, family-owned plants, and industrial entrepreneurs planning an exit in the next 12-24 months. With step-by-step strategies, industry insights, and practical checklists, it empowers owners to maximize value, avoid common mistakes, and sell on their terms.

Read the Full Manufacturing Business Selling Guide Here

What Makes Selling a Manufacturing Business Different

Manufacturing companies operate in a space where operational efficiency, supply chain stability, and production capacity weigh heavily on value. Buyers don't just want strong financials - they want confidence in the company's systems, workforce, and ability to deliver consistent output. Equipment age, compliance with safety and environmental regulations, intellectual property (like patents or proprietary processes), and customer concentration are all major factors in deal pricing.

At the same time, manufacturers remain attractive acquisition targets because of reshoring trends, supply chain diversification, and rising demand for domestic production. IRAEmpire's guide explains how sellers can highlight strengths such as long-term contracts, skilled teams, and efficient operations while addressing potential buyer concerns.

Inside the Guide: How to Sell a Manufacturing Business

IRAEmpire's new guide highlights the most important steps manufacturing business owners must take to maximize value and achieve a successful exit. Selling a manufacturing company isn't a quick process - it requires planning, precision, and industry-specific expertise. The guide emphasizes:

Valuation benchmarks - Manufacturing businesses typically sell for 3-10x EBITDA, depending on size, specialization, and competitive positioning. Proper preparation can make the difference between the low and high end of that range.

Thorough preparation before listing - Owners should organize 3-5 years of financial records, streamline operations, and document workflows to demonstrate transferability and reduce reliance on the owner.

The importance of professional advisors - Data shows that manufacturing companies represented by M&A professionals earn about 31% more than those sold without specialized guidance.

Maintaining confidentiality - Mishandling information can trigger employee turnover, customer concerns, and competitive threats, all of which reduce value. The guide shows how to market discreetly while protecting sensitive data.

Realistic timelines - The average sale takes about seven months. Sellers who rush the process risk lower valuations and less favorable deal structures.

The overarching message: treat the sale as a strategic transition, not a quick exit. With the right planning, documentation, and expert support, manufacturing business owners can position themselves for premium valuations and smooth closings.

Read the Manufacturing Business Selling Guide Here

Top Valuation Drivers in Manufacturing Sales

When it comes to selling a manufacturing business, buyers and investors focus on specific drivers that determine how much they are willing to pay. Understanding these factors - and optimizing them before going to market - can significantly increase valuation multiples and final sale price.

1. Financial Performance and EBITDA Margins

Strong, consistent earnings are the cornerstone of valuation. Buyers will evaluate EBITDA trends, gross margins, and cash flow stability over several years. Companies with healthy margins and a track record of reinvestment often command higher multiples.

2. Customer Concentration and Contract Stability

Buyers prefer businesses with diversified customer bases. Heavy reliance on one or two accounts is seen as a risk. Multi-year contracts and long-standing customer relationships reduce uncertainty and enhance perceived stability.

3. Workforce and Management Depth

Manufacturers with a skilled, stable workforce and experienced management teams are far more valuable than those heavily dependent on the owner. Buyers pay a premium for businesses that can operate independently with established leadership in place.

4. Equipment, Facilities, and Capacity

Modern, well-maintained equipment and efficient production facilities signal reliability and scalability. Buyers will discount companies with outdated machinery or deferred maintenance, as these represent future capital expenditures.

5. Intellectual Property and Specialization

Patents, proprietary processes, certifications, or niche expertise can set a manufacturer apart. Specialization in high-demand or regulated industries (e.g., aerospace, medical devices) often leads to stronger multiples.

6. Market Position and Growth Potential

Buyers are not just purchasing today's profits - they are investing in tomorrow's growth. A strong brand reputation, diversified product lines, and opportunities for expansion into new markets or geographies increase future earning potential.

Together, these valuation drivers shape buyer perception and final deal terms. Addressing weaknesses and showcasing strengths across these areas ensures sellers achieve maximum value when exiting their manufacturing business.

Why the Timing Is Right

The manufacturing sector is entering one of its strongest periods of consolidation and investment in recent memory. Global supply chain disruptions have accelerated reshoring initiatives, driving demand for U.S.-based production facilities. At the same time, private equity firms and strategic buyers are aggressively pursuing acquisitions in the mid-market space to expand capacity, diversify product lines, and secure long-term customer bases.

For many manufacturing businesses, this creates a rare window of opportunity. Buyers are not just looking for companies with solid financials - they are paying a premium for firms that can demonstrate operational efficiency, regulatory compliance, and scalability. Businesses with modern equipment, documented processes, and stable management teams are especially attractive because they represent lower transition risks.

Demographics add another layer of urgency. A wave of aging owners are preparing to retire, putting more quality businesses on the market. This increases overall deal flow but also means competition among buyers is intensifying for top-tier companies.

Prepared sellers who position themselves correctly - by highlighting efficiency, long-term contracts, and strong customer relationships - can leverage this seller's market to achieve premium valuations, faster negotiations, and more favorable deal terms. Those who delay risk entering a market with greater supply and potentially lower multiples as more companies come up for sale.

Leveling the Playing Field for Sellers

In most transactions, buyers arrive with deep financial expertise, legal teams, and industry knowledge. Independent manufacturers often find themselves at a disadvantage without proper preparation. IRAEmpire's guide helps bridge this gap by breaking down complex processes into clear, actionable steps - from valuation and tax planning to negotiation and final close.

By equipping owners with insider knowledge, the guide ensures they can present their business effectively, counter buyer tactics, and exit with confidence, knowing they've captured the full value of their life's work.

Access the Full Manufacturing Business Selling Guide

The complete How to Sell a Manufacturing Business guide is available now for free at IRAEmpire.com.

About IRAEmpire.com

IRAEmpire.com is an independent platform dedicated to helping individuals build, protect, and transition wealth. Known for its straightforward, no-fluff educational content, the site covers retirement planning, alternative assets, small business ownership, and succession strategies.

Media Contact:

Ryan Paulson

[email protected]

SOURCE: IRAEmpire LLC

View the original press release on ACCESS Newswire

P.Martin--AMWN