-

Blizzard blows New Yorkers' plans off course

Blizzard blows New Yorkers' plans off course

-

More than 200 political prisoners in Venezuela launch hunger strike

-

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

Milan-Cortina hailed as 'new kind' of Winter Olympics at closing ceremony

-

Thunder strike from long range to halt Cavs' seven-game win streak

-

Strasbourg snap Lyon winning run in Ligue 1

Strasbourg snap Lyon winning run in Ligue 1

-

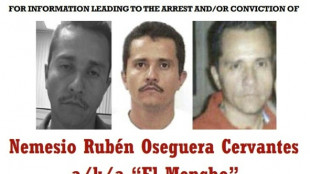

Top Mexican drug cartel leader killed

-

'One Battle' triumphs at BAFTAs that honour British talent

'One Battle' triumphs at BAFTAs that honour British talent

-

New Nissan Leaf 2026 review

-

Giroud penalty ends Lille's winless run in Ligue 1

Giroud penalty ends Lille's winless run in Ligue 1

-

Thrashing Spurs dragged Arsenal out of title hell: Arteta

-

Iran-US talks expected Thursday despite fears of strikes

Iran-US talks expected Thursday despite fears of strikes

-

Milan beaten by Parma, Napoli rage at officials

-

Hughes looses teeth then scores Olympic gold-winning goal for USA

Hughes looses teeth then scores Olympic gold-winning goal for USA

-

Eze and Gyokeres destroy Spurs to boost Arsenal title bid

-

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

Arsenal's Eze sinks Spurs again, Liverpool late show floors Forest

-

Galthie praises France lock Meafou and defence

-

'Nothing was good', says Mac Allister despite Liverpool win

'Nothing was good', says Mac Allister despite Liverpool win

-

USA defeat Canada for Olympic men's ice hockey gold, Trump celebrates

-

EU 'expects' US to honour trade deal as Trump hikes tariffs

EU 'expects' US to honour trade deal as Trump hikes tariffs

-

'GOAT' battles to top of N. America box office

-

South Africa thrash India to end 12-match T20 World Cup win streak

South Africa thrash India to end 12-match T20 World Cup win streak

-

Bielle-Biarrey breaks record as France beat Italy in Six Nations

-

US says trade deals in force despite court ruling on tariffs

US says trade deals in force despite court ruling on tariffs

-

Barcelona back top of La Liga with Levante win

-

Gu strikes gold, USA beat Canada in men's ice hockey

Gu strikes gold, USA beat Canada in men's ice hockey

-

What's behind England's Six Nations slump?

-

Napoli rage at officials after loss at Atalanta

Napoli rage at officials after loss at Atalanta

-

Liverpool late show floors Nottingham Forest

-

Rimac Nevera R: Beyond imagination

Rimac Nevera R: Beyond imagination

-

USA beat Canada to win men's Olympic ice hockey gold

-

Samardzic seals comeback win for Atalanta over Napoli

Samardzic seals comeback win for Atalanta over Napoli

-

Eileen Gu switches slopes for catwalk after Olympic flourish

-

Luce: Ferrari's ingenious electric revolution

Luce: Ferrari's ingenious electric revolution

-

Miller guides South Africa to 187-7 against India

-

Scotland boss 'proud' of comeback Six Nations win over Wales

Scotland boss 'proud' of comeback Six Nations win over Wales

-

Iranian students rally for second day as fears of war with US mount

-

US Secret Service kills man trying to access Trump Florida estate

US Secret Service kills man trying to access Trump Florida estate

-

Coventry 'let the Games do their magic': former IOC executives

-

Cayenne Turbo Electric 2026

Cayenne Turbo Electric 2026

-

Sri Lanka have to qualify 'the hard way' after England drubbing

-

Doris says Six Nations rout of England is sparking Irish 'belief'

Doris says Six Nations rout of England is sparking Irish 'belief'

-

Thousands of pilgrims visit remains of St Francis

-

Emotional Gu makes history with Olympic freeski halfpipe gold

Emotional Gu makes history with Olympic freeski halfpipe gold

-

Impressive Del Toro takes statement victory in UAE

-

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

Gu wins triumphant gold of Milan-Cortina Olympics before ice hockey finale

-

England rout Sri Lanka for 95 to win Super Eights opener

-

Underhill tells struggling England to maintain Six Nations 'trust' as Italy await

Underhill tells struggling England to maintain Six Nations 'trust' as Italy await

-

Alfa Tonale 2026: With a new look

-

BMW 7 Series and i7: facelift in 2026

BMW 7 Series and i7: facelift in 2026

-

Eileen Gu makes history with Olympic freeski halfpipe gold

ECB holds rates as Lagarde stresses heightened uncertainty

The European Central Bank held interest rates steady Thursday for its fourth meeting in a row but was tight-lipped on the future rate path as it stressed lingering geopolitical uncertainty.

ECB President Christine Lagarde said tumult around the borders of Europe as well as the impacts of trade tensions meant it was impossible to issue guidance for the future.

"One thing that has not changed much at all and which, if anything, may have actually worsened is uncertainty," she told a press conference presenting the rate decision and improved growth forecasts.

"With the degree of uncertainty that we are facing, we simply cannot offer forward guidance."

The ECB nudged up its growth forecasts for the 20 countries that share the euro for 2026 and 2027 to 1.2 and 1.4 percent, up from 1.0 and 1.3 percent at its September projection.

Touching on the bumped-up growth forecasts, Lagarde said staff expected increased growth across the bloc thanks partly to higher investment as a result of spending on AI.

"We think that there is some change taking place in our economies," Lagarde said, pointing to business surveys.

"Both large corporates, but also SMEs (small and medium enterprises) as well, their investment based on the data that we collect, based on the surveys that we conduct, is largely attributable to the development of AI."

- 'All optionalities on the table' -

Investors were paying close attention to the new growth and inflation forecasts, seen by some as a possible barometer of the ECB's thinking when it came to possible future rate moves.

Governing Council member Isabel Schnabel -- widely considered a hawk who is particularly wary of inflation -- caused a stir earlier this month after telling Bloomberg that she was "rather comfortable" to see traders pencil in hikes, fuelling expectations of possible hikes.

Addressing a question on Schnabel's comment, Lagarde said that, amid heightened global uncertainty, "there was unanimous agreement around the table about the fact that all optionalities should be on the table".

Following a year-long series of cuts, the central bank for the eurozone has now kept its key deposit rate on hold at two percent since July, in contrast to the US Fed and Bank of England which have recently cut in response to signs of cooling economies.

Eurozone inflation has settled around the ECB's two-percent target in recent months and Europe has weathered US President Donald Trump's tariff onslaught better than initially feared, meaning there was little pressure for rates to move immediately.

Though the ECB raised growth and inflation forecasts for next year, it still sees inflation as coming in close but just under target for 2026 and 2027.

Analysts said there was little to prompt the ECB to move rates any time soon, though they were divided on the longer-term path.

"The new macroeconomic projections suggest there is little scope for further easing in the short term and that, rather, risks to the ECB interest rates are to the upside," EFG Asset Management economist GianLuigi Mandruzzato said.

But Capital Economics analyst Andrew Kenningham told AFP ahead of the meeting that he thought any improved forecasts were not necessarily a sign of the eurozone economy regaining real strength.

"Because of that we think the ECB is more likely to cut rates than to hike next year," he said.

P.Santos--AMWN