-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

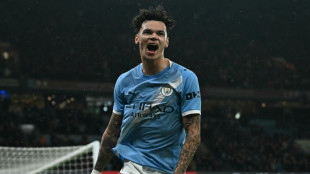

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Manganese X Energy Announces Eric Sprott's Commitment to Fund Pre-Feasibility Study of Electric Royalties' Flagship Manganese Royalty Asset in New Brunswick

Electric Royalties Ltd. (TSXV:ELEC)(OTCQB:ELECF) ("Electric Royalties" or the "Company") is pleased to provide an update on the Battery Hill Manganese Project ("Battery Hill" or "the Project") in New Brunswick, Canada, on which it owns a 2% Gross Metal Royalty.

On January 2, 2025, Manganese X Energy Corp. (TSXV:MN) ("Manganese X"), the operator of Battery Hill, announced its intention to complete a non-brokered private placement offering to raise gross proceeds of up to C$2,100,000, including a C$2,000,000 commitment from leading mining investor Eric Sprott.

Manganese X plans to use the proceeds primarily to advance the development of Battery Hill, including the upcoming pre-feasibility study. A 2022 preliminary economic assessment ("PEA")1 for Battery Hill projected gross revenue of US$177 million per year over an initial forecast mine life of 47 years, with a relatively short payback period of less than three years.

Brendan Yurik, CEO of Electric Royalties, commented: "This private placement led by Eric Sprott's $2 million investment underscores our shared confidence in the Battery Hill Project and its potential to become a leading North American source of high-purity manganese for the battery industry. The successful completion of the pre-feasibility study would represent an important development milestone for Battery Hill and is expected to come at no cost to Electric Royalties."

For more information on the private placement, please see Manganese X's news release dated January 2, 2025. Electric Royalties is relying on the information provided by Manganese X and this news release is not an offer to sell or the solicitation of an offer to buy the securities in the United States or in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to qualification or registration under the securities laws of such jurisdiction. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from U.S. registration requirements and applicable U.S. state securities laws.

The PEA is preliminary in nature; it includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

David Gaunt, P.Geo., a qualified person who is not independent of Electric Royalties, has reviewed and approved the technical information in this release.

About Electric Royalties Ltd.

Electric Royalties is a royalty company established to take advantage of the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper) that will benefit from the drive toward electrification of a variety of consumer products: cars, rechargeable batteries, large scale energy storage, renewable energy generation and other applications.

Electric vehicle sales, battery production capacity and renewable energy generation are slated to increase significantly over the next several years and with it, the demand for these targeted commodities. This creates a unique opportunity to invest in and acquire royalties over the mines and projects that will supply the materials needed to fuel the electric revolution.

Electric Royalties has a growing portfolio of 41 royalties in lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc and copper across the world. The Company is focused predominantly on acquiring royalties on advanced stage and operating projects to build a diversified portfolio located in jurisdictions with low geopolitical risk, which offers investors exposure to the clean energy transition via the underlying commodities required to rebuild the global infrastructure over the next several decades toward a decarbonized global economy.

For further information, please contact:

Brendan Yurik

CEO, Electric Royalties Ltd.

Phone: (604) 364‐3540

Email: [email protected]

https://www.electricroyalties.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

1 Technical report titled "NI 43-101 Technical Report on the Preliminary Economic Assessment of the Battery Hill Manganese Project, Woodstock, New Brunswick, Canada" with an effective date of May 12, 2022, available under Manganese X Energy Corp.'s profile on sedarplus.ca. The Mineral Resource (MR) within the mine plan includes Measured MR of 5.90 Mt grading 7.65% Mn, Indicated MR of 6.37 Mt grading 7.26% Mn and Inferred MR of 4.73 Mt grading 8.26% Mn at 3.3% Mn cut-off. Input assumptions to the pit shells that constrain the MR estimate include an HPMSM price of US$2,900/t, mine operating cost of $7.43/t, process operating cost of $110/t, G&A cost of $7.60/t, stockpile reclaim cost of $1.46/t, closure cost of $3.00/t, selling cost of US$65/t, process recovery of 78%, a gross metal royalty of 3% applied to the HPMSM produced, and a pit slope of 45°.

Cautionary Statements Regarding Forward-Looking Information and Other Company Information

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company within the meaning of Canadian securities laws. This news release includes information regarding other companies and projects owned by such other companies in which the Company holds a royalty interest, based on previously disclosed public information disclosed by those companies and the Company is not responsible for the accuracy of that information, and that all information provided herein is subject to this Cautionary Statement Regarding Forward-Looking Information and Other Company Information. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events and may include statements regarding the financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities of the Company and the projects in which it holds royalty interests.

While management considers these assumptions to be reasonable, based on information available, they may prove to be incorrect. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company or these projects to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to risks associated with general economic conditions; adverse industry events; marketing costs; loss of markets; future legislative and regulatory developments involving the renewable energy industry; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; the mining industry generally, recent market volatility, income tax and regulatory matters; the ability of the Company or the owners of these projects to implement their business strategies including expansion plans; competition; currency and interest rate fluctuations, and the other risks.

The reader is referred to the Company's most recent filings on SEDAR+ as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at sedarplus.ca and at otcmarkets.com.

SOURCE: Electric Royalties Ltd.

A.Jones--AMWN