-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

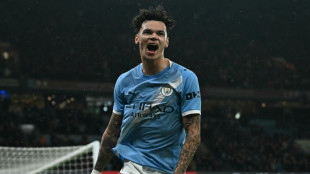

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

-

England to face New Zealand and Costa Rica in pre-World Cup friendlies

England to face New Zealand and Costa Rica in pre-World Cup friendlies

-

'Disgrace to Africa': Students turn on government over Dakar university violence

-

Simon in credit as controversial biathlete wins Olympic gold

Simon in credit as controversial biathlete wins Olympic gold

-

McIlroy confident ahead of Pebble Beach title defense

-

US top official in Venezuela for oil talks after leader's ouster

US top official in Venezuela for oil talks after leader's ouster

-

Ukraine will only hold elections after ceasefire, Zelensky says

Skeena Gold & Silver Draws US$45 Million of Funding Under Gold Stream Arrangement; Provides Progress Update on Eskay Creek

Skeena Resources Limited (TSX:SKE)(NYSE:SKE) ("Skeena Gold & Silver", "Skeena" or the "Company") collected US$45 million of gold stream funding on December 30, 2024 under its gold stream arrangement, as outlined in the Company's news release dated June 25, 2024 (the "Gold Stream Arrangement"). Skeena is also pleased to report continued advancement on numerous authorizations from the Province of British Columbia to support ongoing activity at the Company's 100%-owned Eskay Creek Gold-Silver Project ("Eskay" or the "Project"). To date, the Company has successfully advanced various pre-construction activities as part of the early works program.

Randy Reichert, President & Chief Executive Officer of Skeena, commented: "The current tranche of the gold stream financing will enable Skeena to continue advancing the Project, with further drawdowns anticipated throughout 2025. We are encouraged by the supportive and constructive dialogue with the Province of British Columbia, which has helped facilitate early works activities in 2024. As a result, we are progressing with our pre-development plans and proactively de-risking the Project to stay on track for production in 2027."

US$45 Million Payment Under Gold Stream Arrangement

Skeena Gold & Silver has collected the second tranche of US$45 million under the Gold Stream Arrangement. This is the second of five tranches under the previously announced US$200 million gold stream, whereby the funds were made available following receipt of the Bulk Technical Sample permits in December and the satisfaction of certain other customary conditions (see news release dated December 16, 2024). The remaining three tranches will be drawn in settlements of US$50 million, subject to the satisfaction of certain customary conditions before March 31, 2026 to support continued development of the Project.

Skeena is entitled to a buyback provision to reduce the stream percentage by 66.67% by repaying the proportional deposit plus an imputed 18% IRR, for a period of 12 months following the Project completion date. The buyback provision provides the Company with flexibility and optionality to strengthen future cashflows should gold prices continue to rise, while ensuring certainty of funding in the capital-intensive development period.

2024 Early Works Review

In June 2024, Skeena Gold & Silver received approval for an amendment to the Mines Act permit M-197 from the Province of British Columbia, which allowed for early works activities at Eskay Creek. The approval of this permit was the first step required to facilitate the commencement of a Technical Sample Quarry and land clearing work to begin.

During the 2024 season from June to November, activities included:

Access to the technical sample area and clearing of the area was completed in the summer using smaller equipment. This preparation will enable the use of larger, more efficient equipment in the summer of 2025, to facilitate further advancements in the development of the technical sample quarry. Two Pilot haul roads were advanced: one connecting to the Tom Mackay Tailings Storage Facility and the other providing access to the infrastructure pad area.

Advancement of the infrastructure pad area, with bulk earthworks efficiently self-performed by the skilled project development team on-site.

Commencement of civil earthworks for the Volcano Creek substation (237kV tie-in) to interconnect with Coast Mountain Hydro to supply future hydro-sourced electricity to the project.

Concurrent with project activities onsite, engineering and procurement is progressing well and on budget with the estimates outlined in the 2023 Definitive Feasibility Study. Most of the major mill equipment has been contracted including the building structural steel and installation, SAG/ball mills, tertiary/regrind mills, jaw crusher, flotation cells, concentrate thickener, concentrate dryer, and transformers and the circuit breakers. Long lead-time items such as electrical components have also been secured. Other critical contracts continue to advance including the selection of a mobile mining fleet supplier.

About Skeena

Skeena is a leading precious metals developer that is focused on advancing the Eskay Creek Gold-Silver Project - a past producing mine located in the renowned Golden Triangle in British Columbia, Canada. Eskay Creek will be one of the highest-grade and lowest cost open-pit precious metals mines in the world, with substantial silver by-product production that surpasses many primary silver mines. Skeena is committed to sustainable mining practices and maximizing the potential of its mineral resources. In partnership with the Tahltan Nation, Skeena strives to foster positive relationships with Indigenous communities while delivering long-term value and sustainable growth for its stakeholders.

On behalf of the Board of Directors of Skeena Gold & Silver,

Walter Coles | Randy Reichert |

Contact Information

Investor Inquiries: [email protected]

Office Phone: +1 604 684 8725

Company Website: www.skeenagoldsilver.com

Qualified Persons

In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo., Senior Vice President, Exploration & Resource Development, is the Qualified Person for the Company and has prepared, validated, and approved the technical and scientific statements and information contained or incorporated by reference in the news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Cautionary note regarding forward-looking statements

Certain statements and information contained or incorporated by reference in this news release constitute "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation (collectively, "forward-looking statements"). These statements relate to future events or our future performance. The use of words such as "anticipates", "believes", "proposes", "contemplates", "generates", "targets", "is projected", "is planned", "considers", "estimates", "expects", "is expected", "potential" and similar expressions, or statements that certain actions, events or results "may", "might", "will", "could", or "would" be taken, achieved, or occur, may identify forward-looking statements. All statements other than statements of historical fact are forward-looking statements. Specific forward-looking statements contained herein include, but are not limited to, statements regarding the progress of development at Eskay, including the construction budget, schedule and required funding in respect thereof; the timing for and the Company's progress towards commencement of commercial production; the Company's capital structure; the Company's ability to buy back the gold stream in the future; amounts drawn and the timing of and completion of conditions precedent in respect of the Senior Secured Loan, gold stream agreement, additional equity investment and the cost over-run facility, the availability of the Senior Secured Loan as a source of future liquidity; and the results of the Definitive Feasibility Study, processing capacity of the mine, anticipated mine life, probable reserves, estimated project capital and operating costs, sustaining costs, results of test work and studies, planned environmental assessments, the future price of metals, metal concentrate, and future exploration and development. Such forward-looking statements are based on material factors and/or assumptions which include, but are not limited to, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and the assumptions set forth herein and in the Company's MD&A for the year ended December 31, 2023, its most recently filed interim MD&A, and the Company's Annual Information Form ("AIF") dated March 28, 2024. Such forward-looking statements represent the Company's management expectations, estimates and projections regarding future events or circumstances on the date the statements are made, and are necessarily based on several estimates and assumptions that, while considered reasonable by the Company as of the date hereof, are not guarantees of future performance. Actual events and results may differ materially from those described herein, and are subject to significant operational, business, economic, and regulatory risks and uncertainties. The risks and uncertainties that may affect the forward-looking statements in this news release include, among others: the inherent risks involved in exploration and development of mineral properties, including permitting and other government approvals; changes in economic conditions, including changes in the price of gold and other key variables; changes in mine plans and other factors, including accidents, equipment breakdown, bad weather and other project execution delays, many of which are beyond the control of the Company; environmental risks and unanticipated reclamation expenses; and other risk factors identified in the Company's MD&A for the year ended December 31, 2023, its most recently filed interim MD&A, the AIF dated March 28, 2024, the Company's short form base shelf prospectus dated January 31, 2023, and in the Company's other periodic filings with securities and regulatory authorities in Canada and the United States that are available on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

Readers should not place undue reliance on such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligations to update and/or revise any forward-looking statements except as required by applicable securities laws.

SOURCE: Skeena Resources Limited

M.Thompson--AMWN