-

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

-

Scotland coach Townsend under pressure as England await

-

Canadian ice dancers put 'dark times' behind with Olympic medal

Canadian ice dancers put 'dark times' behind with Olympic medal

-

'Exhausting' off-field issues hang over Wales before France clash

-

Crusaders target another title as Super Rugby aims to speed up

Crusaders target another title as Super Rugby aims to speed up

-

Chinese Olympic snowboarder avoids serious injury after nasty crash

-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

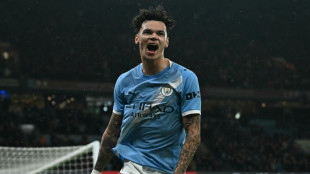

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

-

Milei labor law reforms spark clashes in Buenos Aires

Milei labor law reforms spark clashes in Buenos Aires

-

Bangladesh's political crossroads: an election guide

-

Bangladesh votes in landmark polls after deadly uprising

Bangladesh votes in landmark polls after deadly uprising

-

US stocks move sideways after January job growth tops estimates

-

Man City close in on Arsenal with Fulham cruise

Man City close in on Arsenal with Fulham cruise

-

Mike Tyson, healthy eating advocate for Trump administration

-

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

LA 2028 Olympics backs chief Wasserman amid Epstein uproar

-

Brighton's Milner equals Premier League appearance record

-

Seahawks celebrate Super Bowl win with title parade

Seahawks celebrate Super Bowl win with title parade

-

James Van Der Beek, star of 'Dawson's Creek,' dies at 48

-

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

Scotty James tops Olympic halfpipe qualifiers as he chases elusive gold

-

Trump tells Israel's Netanyahu Iran talks must continue

January 2025 Update Letter to Shareholders

Following the recent distribution of Company subsidiaries, the remaining operations now feature a highly efficient structure with minimal overhead and a business model focused on asset and operational growth

Company is uniquely positioned as an expanding provider of critical materials, including, rare earth, battery and semiconductor elements for defense and commercial applications

To our shareholders:

2024 marked a pivotal year of positioning and preparing our subsidiaries and business for growth and expansion as a leading players in the critical mineral supply chain. This strategic direction stemmed from the recommendations of our Board of Director's Special Committee, established in 2022 to identify ways to unlock shareholder value. Our mission is to build low-cost growth platforms by leveraging our core strengths: evaluating opportunities, strategically positioning them, and assembling the right team to execute effectively.

With that process nearly complete, American Resources' primary mission moving forward is to further the build-out of our innovative technologies, solutions, and operations in both the upstream and downstream segments of our former subsidiaries' operations, with a large focus on leveraging the unique capabilities of ReElement Technologies Corporation to support suppliers and users of critical minerals. AREC will continue to invest in and build critical mineral feedstock opportunities while also evaluating downstream opportunities to invest in innovative solutions, such as our prior investment in Advanced Magnetic Lab, as an example.

We believe our ability to identify low-cost opportunities, like mining waste feedstocks that the Company can capture and process into a concentrated feedstock to supply ReElement, represents a significant growth avenue. This partnership and strategy also have the potential to enable one of the largest domestic environmental cleanup initiatives ever to exist in the legacy fossil fuel and mining industries worldwide, leveraged through ReElement's ability to refine such feedstocks economically.

For example, one of American Resources' investment focuses moving forward is the significant opportunity in unconventional rare earth and critical mineral supply sources, such as mining waste. This topic has gained substantial attention both politically and within the industry. These unconventional resources align well with ReElement Technologies' refining process and other companies capable of concentrating these feedstocks. With a vast number of mining waste sites within the United States alone, we believe these locations present a profitable and exciting investment opportunity. By leveraging byproduct economics for extraction, concentration, and purification of elements and minerals, this initiative represents one of the several verticals in American Resources.

Moving forward, our primary focus will remain on investing in cutting-edge technologies and innovative operations, while also maintaining our investment holdings in the following assets, operations, and entities as outlined below.

ReElement Technologies Corporation

Ownership Interest: Approximately 19.9%

ReElement Technologies Corporation is revolutionizing the refining of critical and rare earth elements to ultra-high purity, with an initial focus on rare earth elements and key critical minerals such as lithium, cobalt, and nickel. With 16 patents and technologies under its ownership or control, along with sponsored research partnerships with three leading U.S. universities, ReElement is driving innovation to meet increasing demand for magnet and battery metals.

American Infrastructure Corporation (Acquired by CGrowth Capital, Inc. (CGRA) and soon changing its name to American Infrastructure Holding Corporation)

Ownership Interest: approximately 9.9%:

On December 30,2024, the Board of American Resources Corporation approved the acquisition of 100% of the common shares of American Infrastructure Corporation by CGrowth Capital, Inc. in exchange for Series A Preferred Stock in CGrowth Capital, Inc. The Series A Preferred Stock includes an anti-dilution provision on the six-month and twelve-month anniversaries of the acquisition date for those shareholders that retain their Series A Preferred securities. The company is committed to properly capitalizing the business to drive further growth within the mineral and resource extraction sectors, with the goal of listing on a senior United States stock exchange during the middle of 2025.

Electrified Materials Corporation ("EMCO") (Formerly American Metals LLC)

Ownership Interest: 100%

EMCO has filed its Form-10 with the Securities and Exchange Commission (SEC). Once the filing is declared effective by the SEC, the company can becoming publicly listed, facilitating the completion of the spin-out to the shareholder of AREC. The company has signed a Memorandum of Understanding (MOU) with Lohum Clean Tech, as previously announced, and is in discussions with additional potential partners and investors that have expressed interest in participating in the company's success as part of the Form-10 spinout. Upon SEC approval, AREC will distribute the shares of EMCO to its shareholders, with the precise distribution amount to be determined by the Board of Directors of American Resources Corporation at that time.

Royalty Management Holding Corporation (NASDAQ: RMCO)

Ownership Interest: Approximately 8.8%.

AREC holds 100% of its sponsor shares and warrants received from RMCO as part of the de-SPAC merger with American Acquisition Opportunity Inc. With royalty and equity investments across a range of resource and intellectual property-based projects, the AREC team is confident that RMCO has an exciting future ahead of it. Additionally, the team believes the current public market valuation of RMCO is currently significantly undervalued relative to the strength of the platform it has developed, its low-cost operating structure and the inherent value of its underlying investments.

Novusterra Inc.

Ownership Interest: Approximately 19%.

Novusterra holds patent rights to develop various products and applications that utilize carbon nanostructures, graphite and graphene from carbon based waste streams and other sources.

Advanced Magnet Lab, Inc. (AML)

Ownership Interest: Approximately 2.1%

AREC holds a convertible promissory note in AML providing the option to AREC to become a shareholder at its discretion through the note's conversion. AML has developed a patented and innovative technology platform for manufacturing advanced permanent magnets that outperform traditional designs. The company is working with a variety of defense contractors and private industry partners to implement this cutting-edge technology.

Equipment Leasing Revenue

American Resources is a holder or controller of a large amount of diverse mining and extraction equipment and infrastructure that provides AREC with cash flow streams from rents received on that equipment.

Thank you for your continued trust and partnership. Together, I am confident we can successfully capitalize on these opportunities and build a brighter future for American Resources as well as our holdings in ReElement Technologies Corporation, Electrified Materials Corporation, American Infrastructure Corporation, Royalty Management Holding Corporation, AML and Novusterra, Inc.

Sincerely,

/s/ MARK JENSEN

Mark Jensen

Chairman and Chief Executive Officer

American Resources Corporation

About American Resources Corporation

American Resources has established a nimble, low-cost business model centered on growth, which provides a significant opportunity to scale its portfolio of assets to meet the growing global electrification markets. Its streamlined and efficient operations are able to maximize margins while reducing costs. For more information visit americanresourcescorp.com or connect with the Company on Facebook, Twitter, and LinkedIn.

Special Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks, uncertainties, and other important factors that could cause the Company's actual results, performance, or achievements or industry results to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. These statements are subject to a number of risks and uncertainties, many of which are beyond American Resources Corporation's control. The words "believes", "may", "will", "should", "would", "could", "continue", "seeks", "anticipates", "plans", "expects", "intends", "estimates", or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Any forward-looking statements included in this press release are made only as of the date of this release. The Company does not undertake any obligation to update or supplement any forward-looking statements to reflect subsequent events or circumstances. The Company cannot assure you that the projected results or events will be achieved

Investor Contact:

JTC Investor Relations

Jenene Thomas

(908) 824 - 0775

[email protected]

Company Contact:

Mark LaVerghetta

317-855-9926 ext. 0

[email protected]

SOURCE: American Resources Corporation

P.Mathewson--AMWN