-

Venezuela amnesty bill postponed amid row over application

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

-

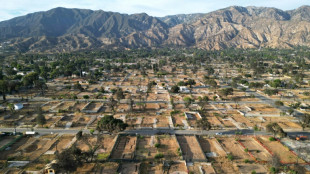

LA fires: California probes late warnings in Black neighborhoods

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

Former Arsenal player Partey faces two more rape charges

-

Scotland coach Townsend adamant focus on England rather than his job

-

Canada PM to visit town in mourning after mass shooting

Canada PM to visit town in mourning after mass shooting

-

US lawmaker moves to shield oil companies from climate cases

-

Ukraine says Russia behind fake posts targeting Winter Olympics team

Ukraine says Russia behind fake posts targeting Winter Olympics team

-

Thousands of Venezuelans stage march for end to repression

-

Verstappen slams new cars as 'Formula E on steroids'

Verstappen slams new cars as 'Formula E on steroids'

-

Iranian state TV's broadcast of women without hijab angers critics

-

Top pick Flagg, France's Sarr to miss NBA Rising Stars

Top pick Flagg, France's Sarr to miss NBA Rising Stars

-

Sakkari fights back to outlast top-seed Swiatek in Qatar

-

India tune-up for Pakistan showdown with 93-run rout of Namibia

India tune-up for Pakistan showdown with 93-run rout of Namibia

-

Lollobrigida skates to second Olympic gold of Milan-Cortina Games

-

Comeback queen Brignone stars, Ukrainian banned over helmet

Comeback queen Brignone stars, Ukrainian banned over helmet

-

Stocks diverge as all eyes on corporate earnings

-

'Naive optimist' opens Berlin Film Festival with Afghan romantic comedy

'Naive optimist' opens Berlin Film Festival with Afghan romantic comedy

-

'Avatar' and 'Assassin's Creed' shore up troubled Ubisoft

Galloper Announces Continuation of Private Placement

VANCOUVER, BC / ACCESS Newswire / February 20, 2025 / Galloper Gold Corp. (CSE:BOOM)(OTC PINK:GGDCF) (the "Company" or "Galloper") further to its news releases of January 14, 2025 and January 28, 2025, confirms it is continuing with its non-brokered private placement (the "Private Placement") of units ("Units") and expects to close the second tranche by March 18, 2025. The Company closed the first tranche of the Private Placement on January 27, 2025, issuing 4,000,000 Units and raising gross proceeds of $200,000.

Each Unit consists of one common share (a "Common Share") and one-half of a Common Share purchase warrant (a "Warrant"), with each full Warrant exercisable to purchase one Common Share at a price of $0.075 for 12 (twelve) months from the date of issuance.

The Company may pay finders' fees to eligible finders, in accordance with applicable securities laws and the policies of the Canadian Securities Exchange ("CSE"). The Private Placement is subject to approval of the CSE, and all securities issued under the Private Placement will be subject to statutory hold periods expiring four months and one day from the date of closing of the Private Placement.

The Company intends to use the net proceeds of this financing to advance its Glover Island asset, for general and administrative expenses which will include funds for marketing and investor relations, and cash for working capital.

The securities offered have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

About Galloper Gold Corp.

Galloper is focused on mineral exploration in the Central Newfoundland Gold Belt with its Glover Island and Mint Pond properties, each prospective for gold and base metals. The Glover Island Property, where the historic Lucky Smoke gold occurrence was recently expanded through drilling, consists of 532 mining claims totaling 13,300 hectares while Mint Pond consists of 499 claims totaling 12,475 hectares.

For more information please visit www.GalloperGold.com and the Company's profile on SEDAR+ at www.sedarplus.ca.

On behalf of the Board of Directors,

Mr. Hratch Jabrayan

CEO and Director

Galloper Gold Corp.

Company Contact:

[email protected]

Tel: 778-655-9266

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward-looking statements. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward-looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with mineral exploration generally, risks related to capital markets, risks related to the state of financial markets or future metals prices and the other risks described in the Company's publicly filed disclosure.

Management has provided the above summary of risks and assumptions related to forward-looking statements in this news release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this news release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Galloper Gold Corp.

View the original press release on ACCESS Newswire

Ch.Havering--AMWN