-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

N. Korea warns of 'terrible response' if more drone incursions from South

-

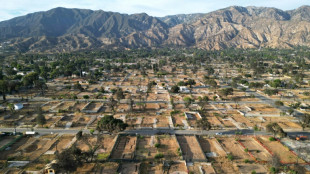

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

-

Scotland coach Townsend adamant focus on England rather than his job

Scotland coach Townsend adamant focus on England rather than his job

-

Canada PM to visit town in mourning after mass shooting

-

US lawmaker moves to shield oil companies from climate cases

US lawmaker moves to shield oil companies from climate cases

-

Ukraine says Russia behind fake posts targeting Winter Olympics team

-

Thousands of Venezuelans stage march for end to repression

Thousands of Venezuelans stage march for end to repression

-

Verstappen slams new cars as 'Formula E on steroids'

Silver X Mining Announces Brokered Private Placement for Gross Proceeds of up to C$3.0 Million

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESS Newswire / February 27, 2025 / Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX) ("Silver X" or the "Company") is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. to act as sole agent and sole bookrunner (the "Agent") in connection with a "best-efforts" private placement to sell up to 17,647,059 units of the Company (each, a "Unit") at a price of C$0.17 per Unit (the "Offering Price") for gross proceeds of up to C$3,000,000 (the "MarketedOffering").

Each Unit will consist of one common share of the Company (each, a "Common Share") and one Common Share purchase warrant (each, a "Warrant"). Each Warrant shall entitle the holder to purchase one Common Share (each, a "Warrant Share") at a price of C$0.25 at any time on or before that date which is 36 months after the closing date of the Offering.

The Company has granted to the Agent an option, exercisable up to 48 hours prior to the closing date of the Offering, to sell up to an additional 2,941,176 Units at the Offering Price to raise up to an additional C$500,000 in gross proceeds (the "Agent's Option", and together with the Marketed Offering, the "Offering").

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 - Prospectus Exemptions ("NI 45-106"), the Units will be offered for sale to purchasers in the provinces of Alberta, British Columbia, Manitoba, Ontario and Saskatchewan (the "Canadian Selling Jurisdictions") pursuant to the listed issuer financing exemption under Part 5A of NI 45-106 (the "Listed Issuer Financing Exemption"). The securities issuable pursuant to the sale of Units are expected to be immediately freely tradeable under applicable Canadian securities legislation if sold to purchasers resident in Canada. The Units may also be sold in offshore jurisdictions and in the United States on a private placement basis pursuant to one or more exemptions from the registration requirements of the United States Securities Act of 1933 (the "U.S. Securities Act"), as amended.

The Company intends to use the net proceeds from the Offering for capital and exploration expenditures related to the Company's operations in the Nueva Recuperada Silver District in Peru as well as for working capital and general corporate purposes.

The Offering is scheduled to close on March 13, 2025, or such other date as the Company and the Agent may agree, and is subject to certain conditions including, but not limited to, receipt of all necessary approvals including the approval of the TSX Venture Exchange.

There is an offering document related to the Offering that can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at www.silverxmining.com. Prospective investors should read this offering document before making an investment decision.

This news release does not constitute an offer to sell or solicitation of an offer to sell any securities in the United States. The securities have not been and will not be registered under the U.S. Securities Act, as amended or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

About Silver X

Silver X is a rapidly growing silver producer-developer. The Company owns the 20,472-hectare Nueva Recuperada Silver Project in Central Peru and produces silver, gold, lead and zinc from its Tangana Mining Unit. Silver X is building a premier silver company aiming to deliver outstanding value to all stakeholders, consolidating and developing undervalued assets, adding resources, and increasing production while aspiring to sustain the communities that support us and stewarding the environment. Current production, paired with immediate development and brownfield expansion opportunities, present investors with the opportunity to invest in the early stages of a silver producer with strong growth prospects. For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. García

CEO and Director

For further information, please contact:

Susan Xu

Investor Relations

[email protected]

+1 778 323 0959

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward-looking information. Forward-looking information contained in this press release may include, without limitation, expectations regarding the completion of the Offering, the expected use of proceeds from the Offering, other sources of funds, exploration plans, results of operations, expected performance at the Project, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedarplus.ca from time to time. Forward- looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: Silver X Mining Corp.

View the original press release on ACCESS Newswire

C.Garcia--AMWN