-

Dieng powers Bucks over NBA champion Thunder

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

-

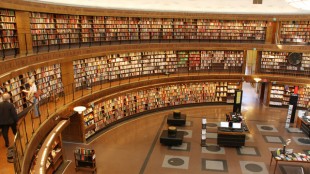

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

N. Korea warns of 'terrible response' if more drone incursions from South

-

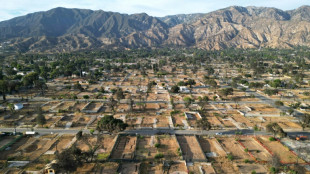

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

CoTec Holdings Corp. Announces Increase In Convertible Loan

VANCOUVER, BC / ACCESS Newswire / February 28, 2025 / CoTec Holdings Corp. (TSXV:CTH) (the "Corporation") is pleased to announce an amendment to its convertible loan agreement dated November 19, 2024 (the "Convertible Loan Agreement") with Kings Chapel International Limited ("Kings Chapel").

Pursuant to the amendment, the principal amount available to the Company under the Convertible Loan Agreement has been increased by up to $2.5 million. The outstanding principal amount of the loan bears interest at an annual rate of 10% and is repayable, together with accrued and outstanding interest, on December 31, 2027. The Corporation's obligations under the Convertible Loan Agreement are unsecured.

The outstanding principal amount under the Convertible Loan Agreement will be converted into common shares of the Corporation ("Common Shares") (i) at any time at Kings Chapel's election, at a price of CAD$0.75 per share and (ii) automatically at a price of CAD$0.75 per share, on the first day on which the volume weighted average trading price of the Common Shares on the principal stock exchange on which the Common Shares are then traded over the immediately preceding 15 trading days is equal to or greater than $1.00. No conversion of the outstanding principal amount will occur to the extent that, after giving effect to the conversion, Kings Chapel, its affiliates and any person with whom Kings Chapel or its affiliates would own more than 49% of the outstanding Common Shares.

Kings Chapel is an existing insider and Control Person (as defined by TSX Venture Exchange ("TSXV") Rules) of the Corporation. Julian Treger, a director of the Corporation and its Chief Executive Officer, is a beneficiary of a family trust associated with Kings Chapel. As a result, the execution of the Convertible Loan Agreement is a related party transaction subject to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The execution of the Convertible Loan Agreement is exempt from the formal valuation requirements of MI 61-101 pursuant to subsection 5.5(b) of MI-61-101 because the Common Shares are listed only on the TSX Venture Exchange (the "TSXV") and is exempt from the minority shareholder approval requirements of MI 61-101 pursuant to subsection 5.7(1)(a) of MI 61-101 because the fair market value of neither the Convertible Loan Agreement nor the Common Shares issuable pursuant to the conversion of the outstanding principal amount under the Convertible Loan Agreement exceed 25% of the Corporation's market capitalization as determined in accordance with MI 61-101.

The issuance of Common Shares upon any conversion of the outstanding principal amount under the Convertible Loan Agreement is subject to the Corporation obtaining all necessary TSXV approvals. All securities issued in connection with the Convertible Loan Agreement will be subject to a statutory hold period of four months plus a day from the date of the Convertible Loan Agreement in accordance with applicable securities legislation in Canada.

About CoTec

CoTec is a publicly traded investment issuer listed on the TSXV and the OTCQB and trades under the symbol CTH and CTHCF respectively. CoTec Holdings Corp. is a forward-thinking resource extraction company committed to revolutionizing the global metals and minerals industry through innovative, environmentally sustainable technologies and strategic asset acquisitions. With a mission to drive the sector toward a low-carbon future, CoTec employs a dual approach: investing in disruptive mineral extraction technologies that enhance efficiency and sustainability while applying these technologies to undervalued mining assets to unlock their full potential. By focusing on recycling, waste mining, and scalable solutions, the Company accelerates the production of critical minerals, shortens development timelines, and reduces environmental impact. CoTec's strategic model delivers low capital requirements, rapid revenue generation, and high barriers to entry, positioning it as a leading mid-tier disruptor in the commodities sector.

For further information, please contact:

Braam Jonker - (604) 992-5600

Forward-Looking Information Cautionary Statement

Statements in this press release regarding the Company and its investments which are not historical facts are "forward-looking statements" that involve risks and uncertainties, including statements relating to management's expectations with respect to its current and potential future investments and the benefits to the Company which may be implied from such statements. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties. Actual results in each case could differ materially from those currently anticipated in such statements. For further details regarding risks and uncertainties facing the Company please refer to "Risk Factors" in the Company's filing statement dated April 6, 2022, a copy of which may be found under the Company's SEDAR+ profile at www.sedarplus.ca.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: CoTec Holdings Corp.

View the original press release on ACCESS Newswire

Th.Berger--AMWN