-

Sophie Adenot, the second French woman to fly to space

Sophie Adenot, the second French woman to fly to space

-

Alleged rape victim of Norway princess's son says she took sleeping pills

-

Activist group Palestine Action wins legal challenge against UK ban

Activist group Palestine Action wins legal challenge against UK ban

-

Driven by Dhoni, Pakistan's X-factor tweaker Tariq targets India

-

Davidson set to make history as Ireland seek to rebound against Italy

Davidson set to make history as Ireland seek to rebound against Italy

-

Europe defends NATO, US ties at security gathering

-

China's fireworks heartland faces fizzling Lunar New Year sales

China's fireworks heartland faces fizzling Lunar New Year sales

-

Bangladesh's Yunus 'banker to the poor', pushing democratic reform

-

Cracknell given Six Nations debut as Wales make changes for France

Cracknell given Six Nations debut as Wales make changes for France

-

L'Oreal shares sink as sales miss forecasts

-

Bangladesh nationalists celebrate landslide win, Islamists cry foul

Bangladesh nationalists celebrate landslide win, Islamists cry foul

-

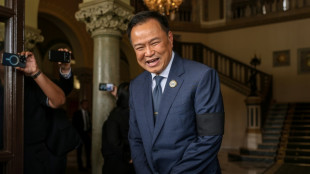

Thai PM agrees coalition with Thaksin-backed party

-

Zimbabwe pull off shock win over Australia at T20 World Cup

Zimbabwe pull off shock win over Australia at T20 World Cup

-

Merz, Macron to address first day of Munich security meet

-

Three dead, many without power after storm lashes France and Spain

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Abasca Resources Announces Engagement of High Grade Mining Consulting Ltd. and Non-Brokered Private Placement of up to $3.0 Million

Abasca Resources Announces Engagement of High Grade Mining Consulting Ltd. and Non-Brokered Private Placement of up to $3.0 Million

-

Darrell Kelley and Business Partners to Visit Ghana for Humanitarian Engagement and Exploratory Discussions

Brookmount Gold Files Annual Report & Financial Statements for Fiscal Year 2024

RENO, NV / ACCESS Newswire / March 19, 2025 / Brookmount Gold (sic. Brookmount Explorations Inc.) (OTC PINK:BMXI), a gold exploration and production company, is pleased to confirm that it has filed its Annual Report & Financial Statements for the fiscal year ending November 30, 2024, with OTC Markets…

FY 2024 Financial Highlights:

Revenue for twelve months reached $18.45 million, an increase of 8.1% over the corresponding result in 2023 of $17.06 million. Revenue was comprised principally of the direct sale of gold. During 2024 the company mined more gold and the price for gold increased from 2023.

Gross Profits increased 3.7% to $12,35 million compared to $11.91 million for fiscal year 2023. .

Net income for 2024 was $9.18 million or $.07 Earnings Per Share (EPS), based on the outstanding share count on 11/30/24 of 140,225,689. This represents a 4.1% increase from the $8.95 million net income achieved in FY23. This is primarily a reflection of increased gold production and higher gold prices, together with a reduced tax provision.

Total Assets increased to $53.63 million compared to $42,32 million on 11/30/23. This is a result of the increased cash flow generated which resulted in substantially more funds being generated and held by the joint venture for reinvestment.

Total Liabilities decreased to $1.72 million on 11/30/24 compared to $2,10 million on 11/30/23, a 4.1% decrease. This is a result of a lower negotiated tax burden.

For additional information, please visit www.otcmarkets.com for full filing details.

Nils Ollquist, CEO of Brookmount Gold commented as follows: "We are pleased, but not entirely satisfied, by our growth during the past year. During the current fiscal year, we plan to take full advantage of achieving full operational control of our mining operations in Indonesia, through seeking greater efficiency in our mining activities, expanding our number of operating shafts and improving our ore processing sequence to reduce processing times. While the initial transition process to full ownership of the mine, in the first 2 months of 2025 slowed production, the foundation for incremental growth has now been established. Our objective is that the second half of 2025 will show production higher than the second half of 2024. As the price of gold continues to rise (recently trading above $3,000/oz for the first time), and we continue to mine successfully and profitably, the future for the Company is excellent, and will be enhanced by initiatives undertaken by management to enhance the market value of its shares and reward its shareholders for their patience during the past 2 years of rapid development".

2024 Operational Highlights

In 2024 the Company mined approximately 6,500 ounces (oz) of gold, a new company record, and has now recorded twenty-three consecutive profitable quarters.

In July, the Company announced a definitive agreement for the acquisition of 100% ownership and control of The Company's mining operations at the Indonesian mine. In December, the Company completed the acquisition and took full operational control. Errin Kimball, Brookmount's Chief Geologist relocated to Indonesia to oversee the process and ensure a smooth transition. In January, the mine was reopened and mining operations recommenced.

The Company commissioned a valuation report from an independent U.S.-based accounting/appraisal firm, to review and endorse a Discounted Cash Flow (DCF) analysis of the Indonesian gold operation's value to justify the purchase. The report ultimately derived a valuation of $168.7 million, thus paving the way for the purchase and 100% control of the mine and its operations. The $168.7 million appraised value is derived from a thorough and comprehensive analysis of historical and projected production, sales, operating expenses, earnings, and ore grades statistics.

With full operational control, the Company now has the right to fully explore and exploit the 50-hectare property, including implementing a drilling program to carry the balance of provable reserves on our financial statements, while also guiding future gold exploitation. The Company is working with SGS Group, the worlds leading Testing, Inspection & Certification company with respect to conducting thermal imaging analysis of ore deposits on the property.

The Company initiated a strategy of restructuring North American operations. Given that the majority of our North American properties are each at, or near, production status, Brookmount is proposing a strategy whereby these properties will be transferred into a separate listed entity to facilitate greater access to project funding and provide an independent listing and valuation platform. The transaction will be structured in such a way that several benefits will accrue to Brookmount, and most importantly, its shareholders.

The Company launched a new social media platform to improve and streamline information delivery and communication with our stakeholders at all levels. This has led to enhanced communication and global visibility creating additional business opportunities for the company.

About Brookmount Gold

Founded in 2018, Brookmount Gold is a high-growth gold-producing company quoted on OTC Markets in the United States (OTC: BMXI). With operating gold mines in Southeast Asia and exploration and production assets in North America, the Company is focused on building production of existing assets to scale, in addition to acquiring and developing additional high quality gold assets with JORC/NI 43-101 verified resources.

Safe Harbor Statements:

Except for the historical information contained herein, certain of the matters discussed in this communication constitute "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995. Words such as "may," "might," "will," "should," "could," "anticipate," "estimate," "expect," "predict," "project," "future," "potential," "intend," "seek to," "plan," "assume," "believe," "target," "forecast," "goal," "objective," "continue" or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding benefits of the proposed license, expected synergies, anticipated future financial and operating performance and results, including estimates of growth. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. For example, the expected timing and likelihood of completion of the pending transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending transaction that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstance that could give rise to the termination of the negotiations, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Brookmount's common stock. All such factors are difficult to predict and are beyond our control. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law or regulations.

Investor Relations Contact: [email protected]

Website: https://www.brookmountgold.com Corporate

Contact: [email protected]

Social Links: Brookmount Gold X (Former Twitter): https://x.com/brookmountgold

SOURCE: Brookmount Explorations, Inc.

View the original press release on ACCESS Newswire

M.Thompson--AMWN