-

Sophie Adenot, the second French woman to fly to space

Sophie Adenot, the second French woman to fly to space

-

Alleged rape victim of Norway princess's son says she took sleeping pills

-

Activist group Palestine Action wins legal challenge against UK ban

Activist group Palestine Action wins legal challenge against UK ban

-

Driven by Dhoni, Pakistan's X-factor tweaker Tariq targets India

-

Davidson set to make history as Ireland seek to rebound against Italy

Davidson set to make history as Ireland seek to rebound against Italy

-

Europe defends NATO, US ties at security gathering

-

China's fireworks heartland faces fizzling Lunar New Year sales

China's fireworks heartland faces fizzling Lunar New Year sales

-

Bangladesh's Yunus 'banker to the poor', pushing democratic reform

-

Cracknell given Six Nations debut as Wales make changes for France

Cracknell given Six Nations debut as Wales make changes for France

-

L'Oreal shares sink as sales miss forecasts

-

Bangladesh nationalists celebrate landslide win, Islamists cry foul

Bangladesh nationalists celebrate landslide win, Islamists cry foul

-

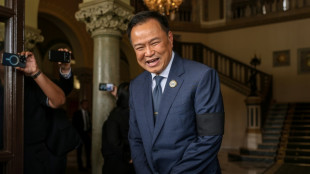

Thai PM agrees coalition with Thaksin-backed party

-

Zimbabwe pull off shock win over Australia at T20 World Cup

Zimbabwe pull off shock win over Australia at T20 World Cup

-

Merz, Macron to address first day of Munich security meet

-

Three dead, many without power after storm lashes France and Spain

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Abasca Resources Announces Engagement of High Grade Mining Consulting Ltd. and Non-Brokered Private Placement of up to $3.0 Million

Abasca Resources Announces Engagement of High Grade Mining Consulting Ltd. and Non-Brokered Private Placement of up to $3.0 Million

-

Darrell Kelley and Business Partners to Visit Ghana for Humanitarian Engagement and Exploratory Discussions

Money Metals Secures $50 Million in Funding to Expand Its Gold-Backed Loan Service

EAGLE, ID / ACCESS Newswire / March 19, 2025 / Money Metals today announced the acquisition of $50 million in equity and debt capital to expand its program giving businesses and investors access to low-interest financing secured by their physical gold and silver.

"Accessing cash liquidity without selling precious metals and getting stuck with a capital gains tax bill makes a ton of sense in certain situations, but silver and gold loan options are almost non-existent," said Stefan Gleason, CEO of Money Metals Exchange, Money Metals Depository, and Money Metals Capital Group.

"Such loans are totally unavailable from traditional bankers who amazingly still view gold and silver with skepticism and/or who are outright unqualified to verify, store, or value them," continued Gleason.

"But thanks to Money Metals, individuals and businesses can now borrow against their gold and silver without paying exorbitant pawn-shop-type interest rates," Gleason noted. "Our precious-metals-backed credit lines are quick to set up, user friendly, and cost-effective."

Money Metals loan applicants can borrow up to 75 percent against the market value of their metals after depositing their coins, bars, or rounds minted of gold, silver, platinum, and/or palladium as collateral into their own Money Metals Depository storage account.

Underwriting is nearly instantaneous, and terms on Money Metals' revolving lines of credit include interest-only payments, auto-renewal options, and low interest rates.

"Because of Money Metals' low cost of capital and because our borrowers provide quality collateral, we can offer rates that are competitive with home equity lines of credit and bank loans," said Gleason.

"Given the advantages for certain types of borrowers, such as real estate investors and small-business entrepreneurs, we envision demand for our loan program exceeding $100 million in the near term."

Borrower collateral is stored in a physically segregated manner and fully insured at Money Metals Depository, the privately operated Class 3 vaulting facility in Eagle, Idaho, that has recently received national attention for being larger than the U.S. Bullion Depository at Fort Knox, Kentucky. The world-class Idaho depository secures precious metals holdings for trustees, IRA custodians, banks, individuals, and businesses.

Borrowers submit a simple application, ship their collateral to Money Metals Depository for inspection and storage, and receive funds immediately upon execution of loan documents.

Loan proceeds must be used for business or investment purposes (rather than personal, family, or household purposes) and cannot be immediately used to purchase additional precious metals. Minimum loan size is $15,000 and the maximum is $5 million - with the program available to borrowers in nearly all U.S. states and several countries.

Money Metals Capital Group can also provide letters of credit, i.e. financial documents that guarantee payment from a buyer to a seller. Such instruments are a common tool in international trade to reduce risk and ensure payment.

For more information (or to apply for a loan), call (800) 800-1865 or visit https://www.moneymetalscapital.com.

About Money Metals Capital Group:

Money Metals Capital Group is a U.S.-based specialty finance company that makes precious-metals-backed loans to individuals and businesses. The firm is affiliated with Money Metals Exchange and Money Metals Depository. For more information, please visit https://www.moneymetals.com/.

SOURCE: Money Metals Exchange

View the original press release on ACCESS Newswire

P.Silva--AMWN