-

European states say Navalny poisoned with dart frog toxin in Russian prison

European states say Navalny poisoned with dart frog toxin in Russian prison

-

Braathen hails 'drastic' changes after Olympic gold

-

De Minaur eases past inconsistent Humbert into Rotterdam final

De Minaur eases past inconsistent Humbert into Rotterdam final

-

Eurovision 70th anniversary live tour postponed

-

Cuba cancels cigar festival amid economic crisis

Cuba cancels cigar festival amid economic crisis

-

Son of Iran's last shah urges US action as supporters rally in Munich

-

Jansen helps South Africa limit New Zealand to 175-7

Jansen helps South Africa limit New Zealand to 175-7

-

Braathen wins unique Winter Olympic gold for Brazil, Malinin seeks answers

-

Relatives of Venezuela political prisoners begin hunger strike after 17 freed

Relatives of Venezuela political prisoners begin hunger strike after 17 freed

-

Ten-man West Ham survive Burton battle to reach FA Cup fifth round

-

International crew set to dock at space station

International crew set to dock at space station

-

Suryakumar says India v Pakistan 'not just another game'

-

Brazilian Olympic champion Braathen is his own man - and Norway's loss

Brazilian Olympic champion Braathen is his own man - and Norway's loss

-

About 200,000 join Iran demonstration in Munich: police

-

Where did it all go wrong for 'Quad God' Malinin?

Where did it all go wrong for 'Quad God' Malinin?

-

Brazil's Braathen wins South America's first ever Winter Olympic gold

-

Banton powers England to victory over Scotland at T20 World Cup

Banton powers England to victory over Scotland at T20 World Cup

-

Zelensky says all Ukrainian power plants damaged, calls Putin 'slave to war'

-

Palestinian leader urges removal of all Israeli 'obstacles' on Gaza ceasefire

Palestinian leader urges removal of all Israeli 'obstacles' on Gaza ceasefire

-

Igor Tudor hired as Tottenham interim manager

-

Rubio tells Europe to join Trump's fight, says it belongs with US

Rubio tells Europe to join Trump's fight, says it belongs with US

-

Winter Olympians have used 10,000 condoms

-

Weston's skeleton Olympic gold a triumph over adversity

Weston's skeleton Olympic gold a triumph over adversity

-

England bowl Scotland out for 152 in T20 World Cup

-

Bangladesh PM-to-be Rahman thanks those who 'sacrificed for democracy'

Bangladesh PM-to-be Rahman thanks those who 'sacrificed for democracy'

-

Sabalenka, Swiatek withdraw from WTA 1000 event in Dubai

-

Brazil's Braathen in pole for historic Olympic giant slalom medal

Brazil's Braathen in pole for historic Olympic giant slalom medal

-

Top entertainment figures back under-fire UN Palestinians expert

-

Pakistan 'always ready' for India despite late green light: Agha

Pakistan 'always ready' for India despite late green light: Agha

-

Rubio tells Europe it belongs with US, calls it to join Trump's fight

-

Tucker stars as Ireland crush Oman by 96 runs at T20 World Cup

Tucker stars as Ireland crush Oman by 96 runs at T20 World Cup

-

Rubio tells allies US and Europe 'belong together'

-

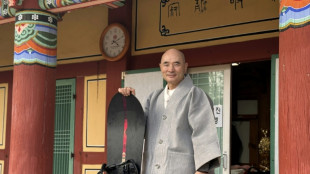

Snowboarding monk in spotlight after S. Korea's Olympic glory

Snowboarding monk in spotlight after S. Korea's Olympic glory

-

Bangladesh's Tarique Rahman poised to be PM as Islamists concede

-

What does Greenland's mining industry look like?

What does Greenland's mining industry look like?

-

Greenland prepares next generation for mining future

-

China top court says drivers responsible despite autonomous technology

China top court says drivers responsible despite autonomous technology

-

Sixers rookie Edgecombe leads 'Team Vince' to NBA Rising Stars crown

-

Rubio at Munich security meet to address Europeans rattled by Trump

Rubio at Munich security meet to address Europeans rattled by Trump

-

Medal-winner Sato says Malinin paid for 'toxic schedule'

-

Carney offers support of united Canada to town devastated by mass shooting

Carney offers support of united Canada to town devastated by mass shooting

-

All-in on AI: what TikTok creator ByteDance did next

-

Healthy Ohtani has Cy Young Award in sights

Healthy Ohtani has Cy Young Award in sights

-

One of Lima's top beaches to close Sunday over pollution

-

'Nothing is impossible': Shaidorov shocks favourite Malinin to make history

'Nothing is impossible': Shaidorov shocks favourite Malinin to make history

-

Malinin wilts at Olympics as Heraskevych loses ban appeal

-

How Often Should I Get a Dental Cleaning in Coral Springs, FL?

How Often Should I Get a Dental Cleaning in Coral Springs, FL?

-

New to The Street to Broadcast Show #726 on Bloomberg at 6:30 PM EST Featuring Vivos Therapeutics (NASDAQ:VVOS), Aeries Technology (NASDAQ:AERT), Virtuix Holdings (NASDAQ:VTIX), and Stardust Power (NASDAQ:SDST)

-

Epomaker HE30 One-Handed Hall Effect Mechanical Keyboard: Born for Gaming

Epomaker HE30 One-Handed Hall Effect Mechanical Keyboard: Born for Gaming

-

B2B Buzz Launches Integrated AI Framework to Combat Declining Returns in Single-Channel Outreach

CORRECTION: Brookmount Exploration Announces Potential Acquisition of Principal Solar, Inc

This release corrects the ticker symbol for Principal Solar, Inc.

RENO, NV / ACCESS Newswire / May 23, 2025 / Brookmount Explorations, Inc. (OTC PINK:BMXI), a gold exploration and production company, is pleased to announce that Brookmount has today executed a Memorandum of Understanding ("MoU") for the potential acquisition of a controlling interest in Principal Solar, Inc. (OTC:PSWW).

Under the terms of the MoU, Brookmount will initially acquire, for cash and shares, a controlling interest in Principal Solar. Following this acquisition, Brookmount's North American asset portfolio, comprising three gold development properties in the Tintina Gold Belt, will be acquired by Principal Solar. Thereafter, the parties plan to distribute Brookmounts' shares in Principal Solar to Brookmount shareholders in the form of a special dividend to be calculated on a pro-rated basis for the Brookmount shares owned. At the conclusion of the transaction, it is anticipated that Brookmount shareholders will retain an 80% interest and Principal Solar shareholders a 20% interest in the consolidated group.

The transaction will be structured such that Brookmount will retain control of the North American properties and ownership going forward will be evenly distributed between Brookmount shareholders.

The management of Brookmount and Principal Solar have been involved in discussions concerning the proposed transaction since last year and respective managements believe that the transaction proposed is in the best interests of the shareholders of both companies. By providing an independent investment platform for Brookmount's North American assets, Brookmount intends to will create additional financial opportunities for further development of the assets leading up to and beyond basic production. Following completion of the potential transaction, Principal Solar, (to be renamed "North American Gold") intends to pursue an underwritten public offering of its shares and simultaneous listing.

In announcing the transaction CEO of Brookmount, Nils Ollquist commented: "We are incredibly pleased that the efforts of our team and that of Rick Toussaint, CEO of Principal Solar, are progressing towards the conclusion of a seminal transaction for our collective shareholders. We believe that restructuring our North American assets as a separate business in this manner will enhance their collective value from a balance sheet perspective. We believe that it will also significantly improve access to development, production and larger stakeholders. Our Indonesian assets, having recently been brought under direct management control, will continue to provide Brookmount with valuable, increasing cash flow to facilitate continued growth and development of its Asian gold production assets. By utilizing two different publicly traded companies, one for the operating mines in Indonesia and one for the pre-production assets in the lucrative Tintina Gold Belt, the Company believes it will maximize shareholder value. We are working diligently toward a definitive agreement with Principal Solar and will make further announcements as progress is achieved."

About Brookmount Gold

Founded in 2018, Brookmount Gold is a high-growth gold-producing company quoted on OTC Markets in the United States (OTC PINK:BMXI). With operating gold mines in Southeast Asia and exploration and production assets in North America, the company is focused on building production of existing assets to scale, in addition to acquiring and developing additional high quality gold assets with JORC/NI 43-101 verified resources.

Safe Harbor Statements:

Except for the historical information contained herein, certain of the matters discussed in this communication constitute "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995. Words such as "may," "might," "will," "should," "could," "anticipate," "estimate," "expect," "predict," "project," "future," "potential," "intend," "seek to," "plan," "assume," "believe," "target," "forecast," "goal," "objective," "continue" or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. These forwardlooking statements include, but are not limited to, statements regarding benefits of the proposed license, expected synergies, anticipated future financial and operating performance and results, including estimates of growth. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. For example, the expected timing and likelihood of completion of the pending transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the pending transaction that could reduce anticipated benefits or cause the parties to abandon the transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstance that could give rise to the termination of the negotiations, the risk that the parties may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of Brookmount's common stock. All such factors are difficult to predict and are beyond our control. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this report, except as required by applicable law or regulations.

Investor Relations Contact: [email protected] or 410-825-3930

Website: https://www.brookmountgold.com

Corporate Contact: [email protected]

Social Links: Brookmount Gold X (Former Twitter): https://x.com/brookmountgold

SOURCE: Brookmount Explorations, Inc.

View the original press release on ACCESS Newswire

A.Jones--AMWN