-

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

-

Marseille sporting director Benatia quits club

-

History-maker Brignone completes Olympic fairy tale as Shiffrin's medal misery continues

History-maker Brignone completes Olympic fairy tale as Shiffrin's medal misery continues

-

Brignone claims second Olympic gold, Shiffrin misses podium

-

Evans wins Rally Sweden to top championship standings

Evans wins Rally Sweden to top championship standings

-

No handshake between India, Pakistan captains before T20 World Cup clash

-

French 'ultra-left' behind killing of right-wing youth: justice minister

French 'ultra-left' behind killing of right-wing youth: justice minister

-

Forest appoint Pereira as fourth boss this season

-

Norwegian cross-country skier Klaebo wins a Winter Olympics record ninth gold

Norwegian cross-country skier Klaebo wins a Winter Olympics record ninth gold

-

'King of the Moguls' Kingsbury bows out on top with Olympic dual moguls gold

-

Hiam Abbass says 'cinema is a political act' after Berlin row

Hiam Abbass says 'cinema is a political act' after Berlin row

-

'Imposter' Nef shooting for double Olympic gold

-

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

-

After Munich speech, Rubio visits Trump's allies in Slovakia and Hungary

-

England's Banton at home in first World Cup after stop-start career

England's Banton at home in first World Cup after stop-start career

-

Australia's Aiava slams 'hostile' tennis culture in retirement post

-

Nepal recover from 46-5 to post 133-8 against West Indies

Nepal recover from 46-5 to post 133-8 against West Indies

-

Emotional Kim captures first title in 16 years at LIV Adelaide

-

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

-

Berlinale filmmakers make creative leaps over location obstacles

-

I want answers from my ex-husband, Gisele Pelicot tells AFP

I want answers from my ex-husband, Gisele Pelicot tells AFP

-

Interpol backroom warriors fight cyber criminals 'weaponising' AI

-

New world for users and brands as ads hit AI chatbots

New world for users and brands as ads hit AI chatbots

-

Japan's 'godless' lake warns of creeping climate change

-

US teen Lutkenhaus breaks world junior indoor 800m record

US teen Lutkenhaus breaks world junior indoor 800m record

-

World copper rush promises new riches for Zambia

-

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

Paw patrol: Larry the cat marks 15 years at 10 Downing Street

-

India plans AI 'data city' on staggering scale

-

Jamaica's Thompson-Herah runs first race since 2024

Jamaica's Thompson-Herah runs first race since 2024

-

Crash course: Vietnam's crypto boom goes bust

-

Ahead of Oscars, Juliette Binoche hails strength of Cannes winners

Ahead of Oscars, Juliette Binoche hails strength of Cannes winners

-

US cattle farmers caught between high costs and weary consumers

-

New York creatives squeezed out by high cost of living

New York creatives squeezed out by high cost of living

-

Lillard matches NBA 3-point contest mark in injury return

-

NBA mulling 'every possible remedy' as 'tanking' worsens

NBA mulling 'every possible remedy' as 'tanking' worsens

-

Team USA men see off dogged Denmark in Olympic ice hockey

-

'US-versus-World' All-Star Game divides NBA players

'US-versus-World' All-Star Game divides NBA players

-

Top seed Fritz beats Cilic to reach ATP Dallas Open final

-

Lens run riot to reclaim top spot in Ligue 1, Marseille slip up

Lens run riot to reclaim top spot in Ligue 1, Marseille slip up

-

Last-gasp Zielinski effort keeps Inter at Serie A summit

-

Vinicius bags brace as Real Madrid take Liga lead, end Sociedad run

Vinicius bags brace as Real Madrid take Liga lead, end Sociedad run

-

Liverpool beat Brighton, Man City oust Beckham's Salford from FA Cup

-

Australia celebrate best-ever Winter Olympics after Anthony wins dual moguls

Australia celebrate best-ever Winter Olympics after Anthony wins dual moguls

-

Townsend becomes a fan again as Scotland stun England in Six Nations

-

France's Macron urges calm after right-wing youth fatally beaten

France's Macron urges calm after right-wing youth fatally beaten

-

China's freeski star Gu recovers from crash to reach Olympic big air final

-

Charli XCX 'honoured' to be at 'political' Berlin Film Festival

Charli XCX 'honoured' to be at 'political' Berlin Film Festival

-

Relatives of Venezuela political prisoners begin hunger strike

-

Trump's 'desire' to own Greenland persists: Danish PM

Trump's 'desire' to own Greenland persists: Danish PM

-

European debate over nuclear weapons gains pace

Mako Mining Announces Q2 2025 Production Results Generating Record Gold Revenue of US$38.1 million and an Increase in Cash of US$18.2 million

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / July 14, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide second quarter 2025 ("Q2 2025") production results for the Company's San Albino gold mine ("San Albino") in northern Nicaragua, the Moss Mine in Arizona and an update on the Eagle Mountain gold project in Guyana. Certain amounts shown in this news release may not total to exact amounts due to rounding differences. All amounts expressed in U.S. dollars unless otherwise noted.

Q2 2025 San Albino Operational Highlights

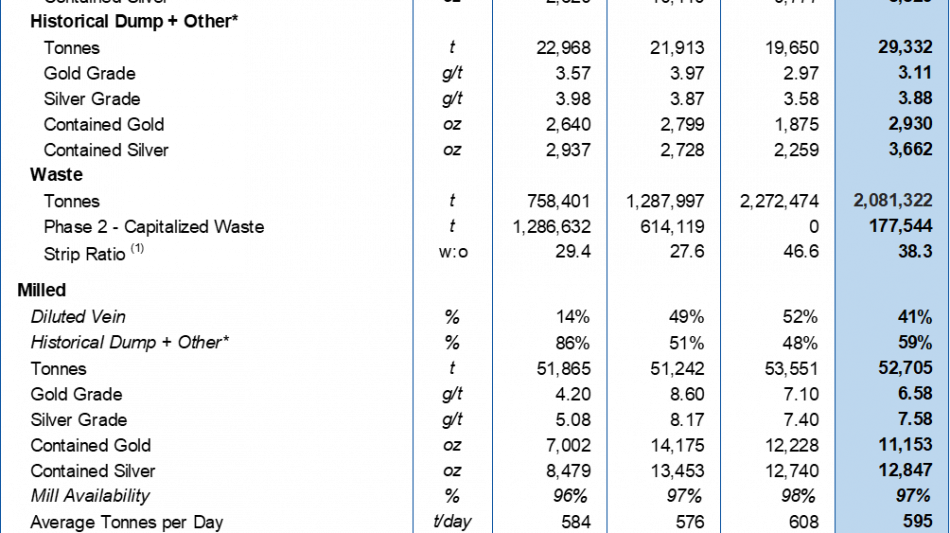

54,354 tonnes mined, containing 10,911 ounces ("oz") of gold ("Au") at an average grade of 6.24 grams per tonne ("g/t") Au and 12,491 oz of silver ("Ag") at 7.15 g/t Ag

25,022 tonnes mined from diluted vein material containing 7,981 oz Au at 9.92 g/t Au and 8,829 oz Ag at 10.97 g/t Ag

29,332 tonnes mined from historical dump and other mineralized material above cutoff grade ("historical dump + other") containing 2,930 oz Au at 3.11 g/t Au and 3,662 oz Ag at 3.88 g/t Ag

38.3:1 strip ratio (1)

52,705 tonnes milled containing 11,153 oz Au and 12,847 oz Ag grading 6.58 g/t Au and 7.58 g/t Ag

41% and 59% from diluted vein and historical dump and other, respectively

595tonnes per day ("tpd") milled at 97% availability

Mill recovery of 80.3% for gold

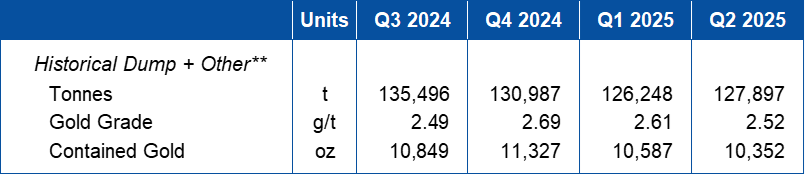

At quarter end, the stockpile was estimated at 127,897 tonnes at an average grade of 2.52 g/t Au for contained Au of 10,352 oz

Q2 2025 Mako Financial Highlights

Mako total gold sales of 11,476 oz Au for total revenue of $38.1 million in Q2 2025

San Albino Mine sales of 10,104 oz Au at $3,323 per ounce

Moss Mine sales of 1,372 oz Au from residual leaching activities at $3,321 per ounce

Delivered final 13,500 oz silver payment to Sailfish Silver Loan for a total of $0.4 million in Q2 2025

$1.5 million release of collateral at Moss Mine from Trisura Guarantee Insurance Company

Cash Balance of $28.6 million as of June 30th, 2025

Akiba Leisman, Chief Executive Officer of Mako states that "in Q2 2025 we generated US$38.1 million in revenue, a record for the Company. Gold sales of 10,104 ounces were similar to the previous two quarters; however, realized gold prices of $3,323 per ounce were substantially higher. This was the first full quarter the Company owned the Moss Mine, with 1,372 gold ounces sold from the residual leach operations. After reinvesting cash flow in exploration in Nicaragua, rapidly advancing the Eagle Mountain project in Guyana, and preparing for the restart of mining operations at the Moss Mine in Arizona, the Company managed to increase cash on the balance sheet by US$18.2 million to US$28.6 million, which gives an indication as to how profitable our current mining assets are. This cash will be used for the eventual construction of the Eagle Mountain project next year."

Table 1 - Operating Results for San Albino

* Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

**For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price Gold.

(1) Strip Ratio calculation does not include waste material that is capitalized

(2) Equivalent Gold ounces are calculated by: Silver recovered. or Silver sold (oz) / Avg. Realized Price Gold ($/oz) / Avg. Realized Price Silver ($/oz)

Table 2 - San Albino Quarter-End Stockpile Statistics

** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

Mining at San Albino

In Q2 2025, the mine produced an average of 597 tonnes per day of diluted vein, historical dump and other material. The average strip ratio (which excludes capitalized waste material) was 38.3:1. The Diluted vein material was sourced from six different veins: Las Conchitas South (Bayacun-Limon-Mango 35%, Las Dolores 22%) and Las Conchitas Central (Intermediate 32% and Cruz Grande 11%).

Milling at San Albino

During Q2 2025, the plant throughput rate averaged 595 tpd, 19% above nameplate capacity. Mill availability remained high at 97% which compares favorably with industry averages. The mill head grade averaged 6.58 g/t Au, comprised of 41% diluted vein material and 59% historical dump + other material. A total of 8,961 ounces of gold were recovered during the quarter at a mill recovery of 80.3%.

Moss Mine

In Q2 2025, residual leaching continued at the Moss Mine, with gold sales of 1,372 oz. The Company engaged a new mining contractor on June 10th with the mine receiving an initial delivery of mining equipment with the full fleet expected to arrive by early August. There are currently over 80,000 tonnes of material already blasted that are waiting to be excavated, hauled and crushed through the fully refurbished 10,000 tonnes per day plant. The Company expects to restart mining operations in early Q3 2025, with steady state production expected by the end of the year.

Eagle Mountain Gold Project

The H1 2025 work program included engineering and environmental activities to confirm mine design parameters and to generate the baseline environmental data and other studies required to complete an Environmental Impact Assessment ("EIA") for submission to the Guyana Environmental Protection Agency ("EPA"). The Company anticipates submission of the draft EIS to the EPA in H2 2025.

Phase 2 geotechnical activities, which commenced in Q1 2025, comprised drilling and testing of the saprolite and underlying fresh rock to facilitate infrastructure siting studies and site hydrogeological drilling and hydrology testing to generate data for both pit optimization and water resource management studies. H1 2025 activities also included environmental geochemical testing of water, soils, and rock and metallurgical tests to produce representative tailings samples for environmental modelling.

In March, the Company advanced permitting efforts for the Eagle Mountain Project with the submission of comprehensive Environmental Application and Project Summary documents to the Guyana EPA, marking a critical step in the regulatory approval process. Subsequently, in May, Mako hosted EPA officials at the Eagle Mountain site.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a 100% interest in the PEA-stage Eagle Mountain Project in Guyana, South America. Eagle Mountain is the subject of engineering, environmental and mine permitting activity.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: [email protected] or visit our website at www.makominingcorp.com and SEDAR www.sedarplus.ca.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered "forward-looking information" within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company's plans and expectations and assumptions as of the date such statements forward looking statements include that: expectations stated regarding Q2 and Q3 2025 production at San Albino, expected timing for the submission of the EIS to the Guyana EPA. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; that production results in Q2 and Q3 2025 will not meet expectations; that the EIS will not be submitted on the timeline expected; uncertainty related to mining exploration properties; political risks and uncertainties involving the Company's mineral properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's expectations regarding the Company's Q2 2025 production and operating results at San Albino gold project, financial highlights for Q2 2025 and current corporate updates, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on ACCESS Newswire

B.Finley--AMWN