-

Great Britain celebrate best-ever Winter Olympics

Great Britain celebrate best-ever Winter Olympics

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

-

Arteta concerned over Arsenal's mounting injury list

Arteta concerned over Arsenal's mounting injury list

-

In fuel-starved Cuba, the e-tricycle is king

-

Shaidorov still spinning after outshining Malinin for Olympic gold

Shaidorov still spinning after outshining Malinin for Olympic gold

-

Late Gruda goal grabs Leipzig draw versus Wolfsburg

-

'Ultra-left' blamed for youth's killing that shocked France

'Ultra-left' blamed for youth's killing that shocked France

-

Canada wrap up perfect Olympic ice hockey preliminary campaign

-

Historical queer film 'Rose' shown at Berlin with call to action

Historical queer film 'Rose' shown at Berlin with call to action

-

Wales' Tandy tips hat to France after Six Nations hammering

-

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

-

2026 S-Class starry facelift

-

What they said as India beat Pakistan at T20 World Cup - reaction

What they said as India beat Pakistan at T20 World Cup - reaction

-

Away-day blues: England count cost of Scotland Six Nations defeat

-

'Wuthering Heights' debuts atop North America box office

'Wuthering Heights' debuts atop North America box office

-

Rayo thrash Atletico who 'deserved to lose'

-

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

-

India rout bitter rivals Pakistan by 61 runs at T20 World Cup

-

France run rampant to thrash sorry Wales 54-12 in Six Nations

France run rampant to thrash sorry Wales 54-12 in Six Nations

-

Rio to kick off Carnival parade with ode to Lula in election year

-

Britain celebrate first-ever Olympic gold on snow after snowboard win

Britain celebrate first-ever Olympic gold on snow after snowboard win

-

Third time lucky as De Minaur finally wins in Rotterdam

-

Leeds survive Birmingham scare to reach FA Cup fifth round

Leeds survive Birmingham scare to reach FA Cup fifth round

-

Klaebo wins record ninth Winter Olympics gold medal

-

Fan frenzy as India–Pakistan clash in T20 World Cup

Fan frenzy as India–Pakistan clash in T20 World Cup

-

French 'Free Jazz' pioneer Portal dies aged 90

-

China's freeski star Gu says Olympics scheduling 'unfair'

China's freeski star Gu says Olympics scheduling 'unfair'

-

Kishan hits quickfire 77 as India make 175-7 in Pakistan showdown

-

Shiffrin takes positives after falling short in Olympic giant slalom

Shiffrin takes positives after falling short in Olympic giant slalom

-

Oh! Calcutta! -- how did England lose to Scotland in Six Nations?

-

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

-

Marseille sporting director Benatia quits club

-

History-maker Brignone completes Olympic fairy tale as Shiffrin's medal misery continues

History-maker Brignone completes Olympic fairy tale as Shiffrin's medal misery continues

-

Brignone claims second Olympic gold, Shiffrin misses podium

-

Evans wins Rally Sweden to top championship standings

Evans wins Rally Sweden to top championship standings

-

No handshake between India, Pakistan captains before T20 World Cup clash

-

French 'ultra-left' behind killing of right-wing youth: justice minister

French 'ultra-left' behind killing of right-wing youth: justice minister

-

Forest appoint Pereira as fourth boss this season

-

Norwegian cross-country skier Klaebo wins a Winter Olympics record ninth gold

Norwegian cross-country skier Klaebo wins a Winter Olympics record ninth gold

-

'King of the Moguls' Kingsbury bows out on top with Olympic dual moguls gold

-

Hiam Abbass says 'cinema is a political act' after Berlin row

Hiam Abbass says 'cinema is a political act' after Berlin row

-

'Imposter' Nef shooting for double Olympic gold

-

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

-

After Munich speech, Rubio visits Trump's allies in Slovakia and Hungary

-

England's Banton at home in first World Cup after stop-start career

England's Banton at home in first World Cup after stop-start career

-

Australia's Aiava slams 'hostile' tennis culture in retirement post

-

Nepal recover from 46-5 to post 133-8 against West Indies

Nepal recover from 46-5 to post 133-8 against West Indies

-

Emotional Kim captures first title in 16 years at LIV Adelaide

-

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

Exiled Kremlin critic on fighting Putin -- and cancer -- from abroad

-

Berlinale filmmakers make creative leaps over location obstacles

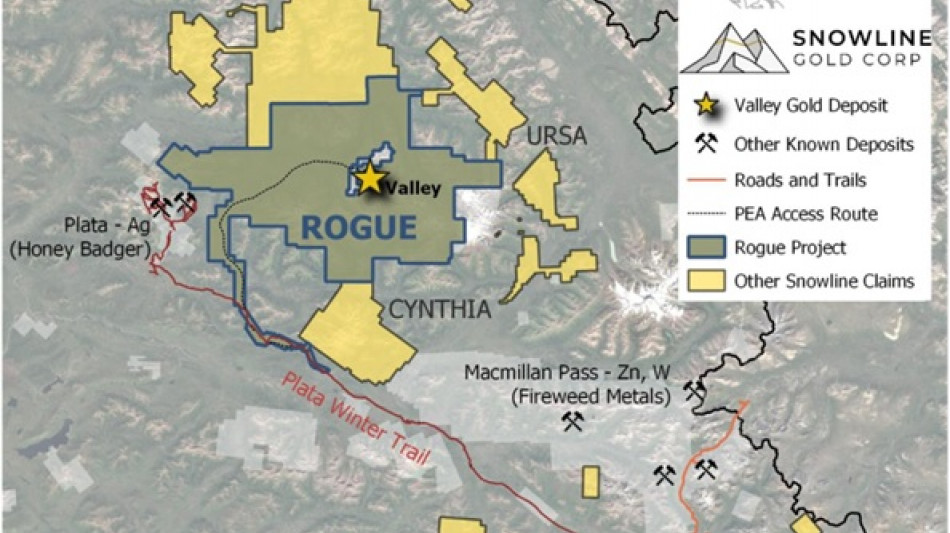

Snowline Gold Files Preliminary Economic Assessment Report for Its Valley Gold Deposit, Rogue Project, Yukon

VANCOUVER, BC / ACCESS Newswire / July 31, 2025 / SNOWLINE GOLD CORP. (TSXV:SGD)(US OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce the filing on SEDAR+ of a technical report supporting the Preliminary Economic Assessment ("PEA" ) for its Valley gold deposit ("Valley") on its 100%-owned Rogue Project in Canada's Yukon Territory ("the Technical Report").

The PEA is a conceptual study of the potential economic viability of Valley's mineral resources and the first economic assessment of any kind on the broader Rogue Project. Results of the PEA were disclosed by the Company in a June 23, 2025 news release.

The PEA[1] envisions a conventional open pit mining and milling operation for Valley with a projected 20-year LOM producing 6.8 million ounces (Moz) of payable gold with a front-weighted production profile and attractive economic parameters. It demonstrates a C$3.37 billion post-tax net present value at a 5% discount rate (NPV5%) at US$2,150/oz Au, increasing to C$6.80 billion at US$3,150/oz Au[2], and 544 koz annual average Au production at all in sustaining costs ("AISC")[3] of US$569/oz[4] Au for the first five (5) full years of production. Full details of the PEA are available in the Technical Report, available under the Company's profile at www.sedarplus.com and available on the Company's website at www.snowlinegold.com.

The Rogue Project and broader infrastructure work considered by the PEA overlaps with Traditional Territories of the First Nation of Na-Cho Nyäk Dun, the Ross River Dena Council and Kaska Nation.

2025 FIELD PROGRAM UPDATE

The primary objective of Snowline's 2025 field campaign is efficient, rapid advancement of Valley to support a Pre-Feasibility Study ("PFS") and project permitting. Work currently underway includes geotechnical drilling (+3,000 m) and sonic drilling, engineering studies, and expanded environmental monitoring. Complementing this is 15,000 m of exploration drilling at Valley planned to support resource expansion and conversion.

Snowline also remains committed to regional exploration at our earlier-stage Yukon projects, with the goal of establishing a gold district in the target-rich environment surrounding Valley. 10,000 m of first pass and follow up drilling is underway, with seven targets across the Rogue (outside of Valley) and Einarson projects drilled to date. Extensive regional surface exploration and geophysical surveying will complement drilling efforts while advancing the numerous targets within Snowline's exploration pipeline.

To date, approximately 18,500 m have been drilled this season. Initial drill results from the 2025 drill season are forthcoming.

ABOUT SNOWLINE GOLD CORP.

Figure 1. Rogue Project Regional Map

Snowline Gold Corp. is a Yukon Territory-focused gold exploration and development company with an eight-project portfolio covering roughly 360,000 ha (3,600 km 2 ). The Company is advancing its Valley deposit - a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system located in the eastern Yukon - while continuing regional exploration of surrounding targets on the Rogue Project and the broader district in the highly prospective, yet underexplored Selwyn Basin.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

TECHNICAL REPORT

The Technical Report was prepared principally by SRK Consulting (Canada) Inc. as lead consultants, along with additional independent contractors, and is titled "Independent Preliminary Economic Assessment for the Rogue Project Yukon, Canada" dated July 30, 2025 with an effective date of March 1, 2025.

The Technical Report is available under the Company's profile at www.sedarplus.com and available on the Company's website at www.snowlinegold.com.

QUALIFIED PERSONS

The following authors of the Technical Report are Qualified Persons for the purposes of NI 43-101, and the PEA-related information in this news release has been prepared under the supervision of and approved by them:

Bob McCarthy, P.Eng., SRK Consulting (Canada) Inc

Edward Saunders, P.Eng., SRK Consulting (Canada) Inc

Ignacio Garcia Schmidt, P.Eng., SRK Consulting (Canada) Inc

Mauricio Herrera, P.Eng., SRK Consulting (Canada) Inc

Christina James, P.Eng., SRK Consulting (Canada) Inc

Jeff Clarke, P.Geo., SRK Consulting (Canada) Inc

Adrian Dance, P.Eng., SRK Consulting (Canada) Inc

Heather Burrell, P. Geo., Archer, Cathro & Associates (1981) Limited

Steven C. Haggarty, P. Eng., Haggarty Technical Services Corp.

Daniel J. Redmond, P. Geo., D Redmond Consulting and Associates

Additional scientific and technical information in this news release not specific to the PEA has been prepared under the supervision of and approved by Thomas Branson, M.Sc., P. Geo., Vice President of Exploration for Snowline, as Qualified Person for the purposes of NI 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

[email protected]

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

USE OF NON-GAAP MEASURES

Certain financial measures referred to in this news release are not measures recognized under IFRS and are referred to as non-GAAP financial measures or ratios. These measures have no standardized meaning under IFRS and may not be comparable to similar measures presented by other companies. The definitions established and calculations performed by Snowline are based on management's reasonable judgement and are consistently applied. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

The non-GAAP financial measures used in this news release and common to the gold mining industry are all-in sustaining cost per ounce of gold sold and free cash flow.

All-in sustaining cost per ounce of gold sold and free cash flow are non-GAAP financial measures or ratios and have no standardized meaning under IFRS Accounting Standards ("IFRS") and may not be comparable to similar measures used by other issuers. As Valley is not in production, the Company does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures or ratios may not be reconciled to the nearest comparable measures under IFRS.

END NOTES

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and forward-looking information (collectively, the "forward-looking statements") within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance of the Company. Forward-looking statements in this news release include, but are not limited to, the Company's expectations and estimates with respect to: the economic and scoping-level parameters of the PEA and Valley; the anticipated timeline for completion of a potential PFS; mineral resource estimates; the cost and timing of any development of Valley; the proposed mine plan and mining methods; dilution and mining recoveries; processing method and rates; production rates; projected metallurgical recovery rates; infrastructure requirements; energy sources; capital, operating and sustaining cost estimates; the projected life of mine and other expected attributes of Valley; the NPV; future metal prices; the timing of any engineering, environmental assessment or Indigenous consultation processes; the expansion of environmental baseline monitoring programs; future drill programs and general business and economic conditions.

Statements relating to "mineral resources" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the mineral resources described can be profitably produced in the future. Generally, forward-looking statements can be identified using forward-looking terminology. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "target", "forecast", "schedule", "prospective", "envision", "continue", "intend", "assume", "anticipate", "believe", "estimate", "budget", "predict", "project" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to the inherent uncertainties regarding cost estimates; the use of non-GAAP measures in financial performance accounting; changes in commodity and metal prices; currency fluctuation; financing; unanticipated resource grades and recoveries; infrastructure; results of future exploration activities; cost overruns; availability of materials and equipment; timeliness of government approvals; political risk and related economic risk; unanticipated environmental impact on operations; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. Additionally, while the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

[1] The PEA is preliminary in nature and includes inferred mineral resources (approximately 5% of total mineral resources) that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by Metal Prices, Economic Factors, Environmental, Permitting, Legal, Title, or other relevant issues.

[2] Sensitivities apply to the financial model only; pit selection, cut-off grade and processing schedules remain based on a US$1,950/oz gold price and would likely be redesigned to optimize for significantly higher or significantly lower gold price scenarios.

[3] AISC are the sum of operating costs, off-site costs, 1% NSR payments, sustaining capital costs and progressive reclamation costs (C$13M), divided by payable gold ounces produced. AISC excludes closure costs and any post-closure costs. Refer to the "Non-GAAP Financial Measures" section of this news release for more information.

[4] Based on an exchange rate of 1.40 CAD per 1.00 USD.

SOURCE: Snowline Gold Corp.

View the original press release on ACCESS Newswire

D.Cunningha--AMWN