-

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

Germany's Hase and Volodin tango to Olympic pairs figure skating lead

-

Rayo thrash Atletico who 'deserved to lose' as Betis cut gap

-

Napoli salvage point after Malen twice puts Roma ahead

Napoli salvage point after Malen twice puts Roma ahead

-

Lyon down Nice to boost Ligue 1 title bid with 13th straight win

-

LeBron still unclear on NBA future: 'I have no idea'

LeBron still unclear on NBA future: 'I have no idea'

-

Shelton battles back from brink to beat Fritz, take Dallas crown

-

Great Britain celebrate best-ever Winter Olympics

Great Britain celebrate best-ever Winter Olympics

-

Brignone wins second Milan-Cortina gold as Klaebo claims record ninth

-

Arteta concerned over Arsenal's mounting injury list

Arteta concerned over Arsenal's mounting injury list

-

In fuel-starved Cuba, the e-tricycle is king

-

Shaidorov still spinning after outshining Malinin for Olympic gold

Shaidorov still spinning after outshining Malinin for Olympic gold

-

Late Gruda goal grabs Leipzig draw versus Wolfsburg

-

'Ultra-left' blamed for youth's killing that shocked France

'Ultra-left' blamed for youth's killing that shocked France

-

Canada wrap up perfect Olympic ice hockey preliminary campaign

-

Historical queer film 'Rose' shown at Berlin with call to action

Historical queer film 'Rose' shown at Berlin with call to action

-

Wales' Tandy tips hat to France after Six Nations hammering

-

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

Quadruple chasing Arsenal rout Wigan to reach FA Cup fifth round

-

2026 S-Class starry facelift

-

What they said as India beat Pakistan at T20 World Cup - reaction

What they said as India beat Pakistan at T20 World Cup - reaction

-

Away-day blues: England count cost of Scotland Six Nations defeat

-

'Wuthering Heights' debuts atop North America box office

'Wuthering Heights' debuts atop North America box office

-

Rayo thrash Atletico who 'deserved to lose'

-

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

Kok beats Leerdam in Olympic rematch of Dutch speed skaters

-

India rout bitter rivals Pakistan by 61 runs at T20 World Cup

-

France run rampant to thrash sorry Wales 54-12 in Six Nations

France run rampant to thrash sorry Wales 54-12 in Six Nations

-

Rio to kick off Carnival parade with ode to Lula in election year

-

Britain celebrate first-ever Olympic gold on snow after snowboard win

Britain celebrate first-ever Olympic gold on snow after snowboard win

-

Third time lucky as De Minaur finally wins in Rotterdam

-

Leeds survive Birmingham scare to reach FA Cup fifth round

Leeds survive Birmingham scare to reach FA Cup fifth round

-

Klaebo wins record ninth Winter Olympics gold medal

-

Fan frenzy as India–Pakistan clash in T20 World Cup

Fan frenzy as India–Pakistan clash in T20 World Cup

-

French 'Free Jazz' pioneer Portal dies aged 90

-

China's freeski star Gu says Olympics scheduling 'unfair'

China's freeski star Gu says Olympics scheduling 'unfair'

-

Kishan hits quickfire 77 as India make 175-7 in Pakistan showdown

-

Shiffrin takes positives after falling short in Olympic giant slalom

Shiffrin takes positives after falling short in Olympic giant slalom

-

Oh! Calcutta! -- how did England lose to Scotland in Six Nations?

-

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

Brignone strikes Olympic gold again as Klaebo becomes first to win nine

-

Marseille sporting director Benatia quits club

-

History-maker Brignone completes Olympic fairy tale as Shiffrin's medal misery continues

History-maker Brignone completes Olympic fairy tale as Shiffrin's medal misery continues

-

Brignone claims second Olympic gold, Shiffrin misses podium

-

Evans wins Rally Sweden to top championship standings

Evans wins Rally Sweden to top championship standings

-

No handshake between India, Pakistan captains before T20 World Cup clash

-

French 'ultra-left' behind killing of right-wing youth: justice minister

French 'ultra-left' behind killing of right-wing youth: justice minister

-

Forest appoint Pereira as fourth boss this season

-

Norwegian cross-country skier Klaebo wins a Winter Olympics record ninth gold

Norwegian cross-country skier Klaebo wins a Winter Olympics record ninth gold

-

'King of the Moguls' Kingsbury bows out on top with Olympic dual moguls gold

-

Hiam Abbass says 'cinema is a political act' after Berlin row

Hiam Abbass says 'cinema is a political act' after Berlin row

-

'Imposter' Nef shooting for double Olympic gold

-

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

Brignone leads giant slalom in double Olympic gold bid, Shiffrin in striking distance

-

After Munich speech, Rubio visits Trump's allies in Slovakia and Hungary

Jaguar Mining Provides Update on BA Zone Exploration at the Pilar Mine, Reports High-Grade Gold Intercepts

12.80 g/t Au over an estimated true width of 25.00m with 320.00 GT (including 27.21 g/t Au over an estimated true width of 7.00m) in hole PPL1174

TORONTO, ON / ACCESS Newswire / August 5, 2025 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) is pleased to provide an update on exploration drilling activities at the BA zone, located within its Pilar mine in Brazil. Recent diamond drilling results continue to confirm the presence of high-grade gold mineralization extending at depth.

Since the Company's previous BA zone update (see press release dated September 5, 2024), the Pilar mine has begun to see increased gold grades and additional production from this zone, a trend that is expected to continue.

A total of 2,328 meters of additional drilling has been completed in the BA zone, targeting mineralization between Level 16 and Level 20. The most significant result to date was from drill hole PPL1174, which intersected 12.80 g/t Au over an estimated true width of 25.00m, representing 320.00 GT (Grade x Thickness). This intercept included 27.21 g/t Au over an estimated true width of 7.00m (refer to Figures 1, 2 and 3 for more details).

Highlights from diamond drilling completed since September 2024 include:

12.80 g/t Au over an estimated true width of 25.00m - hole FSB1174 - including 27.21 g/t Au over an estimated true width of 7.00m

34.43 g/t Au over an estimated true width of 2.30m - hole FSB1212

8.03 g/t Au over an estimated true width of 8.00m - hole FSB1171 - including 12.18 g/t Au over an estimated true width of 4.4m

14.52 g/t Au over an estimated true width of 7.00m - hole FSB1173

Armando Massucatto, Exploration Manager for Jaguar Mining, commented: "The exceptional intersections returned from the BA zone, notably by drill holes PPL1102 (see press release dated September 5, 2024) and PPL1174 (this release), underscore both the geological and structural coherence of the mineralization. These results affirm a pronounced down-plunge continuity, characteristic of prolific mineralized systems within the Iron Quadrangle, which are known to persist for several kilometers along plunge. Importantly, the mineralization remains open at depth and expands into adjacent un-tested upper levels, with gold grades maintained along extension. This supports a positive outlook for the ongoing growth of the Pilar mine's mineral resource base, highlighting exploration potential for the addition of further ounces."

Luis Albano Tondo, President and newly appointed CEO of Jaguar Mining, commented: "The ongoing work at the BA zone continues to exceed our expectations. Our latest drilling results confirm that the high-grade gold mineralization continues at depth and validate the continuity and predictability of this orebody across the levels we are actively developing. This comprehensive understanding of the deposit's geometry empowers us to systematically unlock a source of ore reserves in Pilar. We are now confidently forecasting the BA zone to deliver approximately 50% of the mine's total production going forward, solidifying its role as a key growth driver for Jaguar."

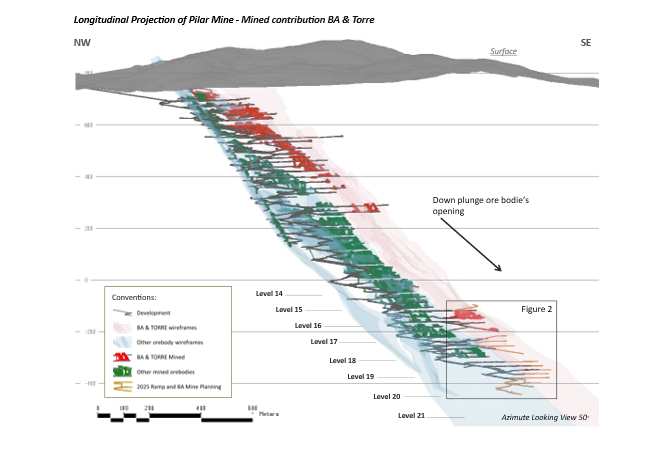

Figure 1 - Long Section showing the Pilar Mine underground layout and the position of the BA Zone relative to the other main orebodies. The location of the planned and ongoing BA Zone sub-level access development between level 15 and level 19 is highlighted at the bottom right corner of the figure.

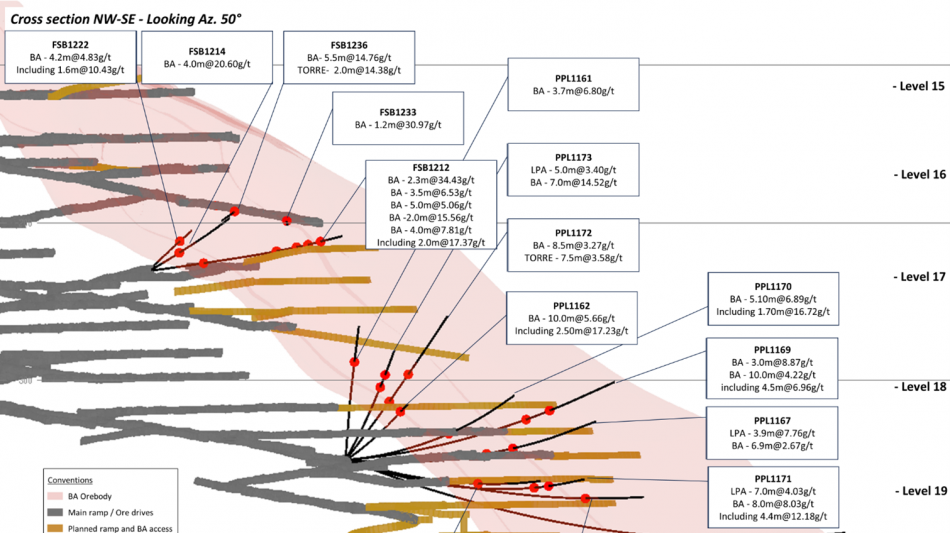

Figure 2 - Long sectional view showing the location of access development to evaluate the BA Zone, along with key diamond drill mineralized intersections reported in this press release.

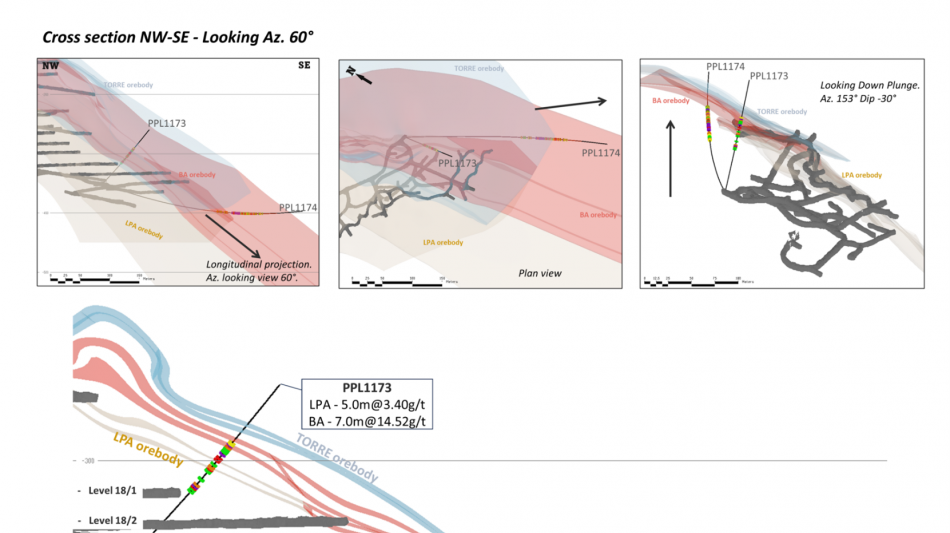

Figure 3 - Long sectional view highlighting the detail of drill holes PPL1173 and 1174, which confirm high grade continuity of the BA Zone over more than 250m.

Table 1 - Summary of significant diamond drilling intersections with grade x thickness (GT) > 20 between Level 16 and Level 20 targeting the BA Zone.

HOLE ID | From (m) | To (m) | Interval (m) | Est. True Width (m) | Grade (g/t Au) | GT (ETW) | Orebody |

PPL1161 | 67.90 | 72.20 | 4.30 | 3.70 | 6.80 | 25.16 | BA |

PPL1162 | 80.70 | 92.60 | 11.90 | 10.00 | 5.66 | 56.60 | BA |

Including | 89.80 | 92.60 | 2.80 | 2.50 | 17.23 | 43.08 | BA |

FSB1236 | 0.00 | 6.40 | 6.40 | 5.50 | 14.76 | 81.18 | BA |

FSB1236 | 11.40 | 13.75 | 2.35 | 2.00 | 14.38 | 28.76 | TORRE |

FSB1212 | 34.70 | 38.35 | 3.65 | 2.30 | 34.43 | 79.19 | BA |

FSB1212 | 82.05 | 87.85 | 5.80 | 3.50 | 6.53 | 22.86 | BA |

FSB1212 | 91.40 | 103.35 | 11.95 | 5.00 | 5.06 | 25.30 | BA |

FSB1212 | 108.05 | 110.65 | 2.60 | 2.00 | 15.56 | 31.12 | BA |

FSB1212 | 114.35 | 121.65 | 7.30 | 4.00 | 7.81 | 31.24 | BA |

Including | 117.25 | 119.84 | 2.59 | 2.00 | 17.37 | 34.74 | BA |

PPL1164 | 126.40 | 129.45 | 3.05 | 2.40 | 8.66 | 20.78 | LPA |

FSB1214 | 26.50 | 31.80 | 5.30 | 4.00 | 20.60 | 82.40 | BA |

FSB1222 | 40.45 | 45.55 | 5.10 | 4.20 | 4.83 | 20.29 | LPA |

Including | 42.45 | 44.45 | 2.00 | 1.60 | 10.43 | 16.69 | LPA |

PPL1167 | 106.70 | 112.40 | 5.70 | 3.90 | 7.76 | 30.26 | LPA |

PPL1167 | 119.40 | 129.40 | 10.00 | 6.90 | 2.67 | 18.42 | BA |

PPL1166 | 173.40 | 188.50 | 15.10 | 8.00 | 4.43 | 35.44 | BA |

Including | 173.40 | 177.15 | 3.75 | 2.00 | 12.69 | 25.38 | BA |

FSB1233 | 1.60 | 3.15 | 1.55 | 1.20 | 30.97 | 37.16 | BA |

PPL1169 | 120.35 | 124.30 | 3.95 | 3.00 | 8.87 | 26.61 | BA |

PPL1169 | 125.25 | 140.50 | 15.25 | 10.00 | 4.22 | 42.20 | BA |

Including | 129.35 | 135.70 | 6.35 | 4.50 | 6.96 | 31.32 | BA |

PPL1170 | 96.45 | 103.80 | 7.35 | 5.10 | 6.89 | 35.14 | BA |

Including | 96.45 | 98.75 | 2.30 | 1.70 | 16.72 | 28.42 | BA |

PPL1171 | 147.10 | 155.40 | 8.30 | 7.00 | 4.03 | 28.21 | LPA |

PPL1171 | 158.80 | 168.30 | 9.50 | 8.00 | 8.03 | 64.24 | BA |

Including | 158.80 | 164.65 | 5.85 | 4.40 | 12.18 | 53.59 | BA |

PPL1172 | 66.85 | 76.05 | 9.20 | 8.50 | 3.27 | 27.80 | BA |

PPL1172 | 82.75 | 91.00 | 8.25 | 7.50 | 3.58 | 26.85 | TORRE |

PPL1174 | 222.00 | 271.55 | 49.55 | 25.00 | 12.80 | 320.00 | BA |

Including | 222.00 | 236.30 | 14.30 | 7.00 | 27.21 | 190.47 | BA |

PPL1173 | 44.20 | 49.95 | 5.75 | 5.00 | 3.40 | 17.00 | LPA |

PPL1173 | 71.30 | 80.35 | 9.05 | 7.00 | 14.52 | 101.64 | BA |

Geological Context: Understanding the BA Zone's Mineralization

The geological structure of the BA orebody, as observed in our underground galleries, reveals a succession of complex, overturned folds. The axes of these folds consistently plunge to the southeast at medium to low angles, while their axial surfaces dip eastward at moderate to steep angles, aligning with the orientation of the Banded Iron Formation (BIF) bedding. Importantly, the high-grade gold mineralization is intrinsically hosted within these well-developed BIF layers.

Drill hole PPL1174 provides critical insights into this structural setting. The relationship between the rock bedding and the drill core orientation within this hole confirms that the BIF layers, which host the mineralization, maintain their folded nature even after undergoing subsequent refolding processes. This indicates a consistent structural environment at depth.

The primary gold-bearing zones are characterized by significant hydrothermal alteration, evidenced by the presence of minerals such as quartz and chlorite, alongside sulfide mineralization, predominantly pyrrhotite. The consistent presence of pyrrhotite and pyrite as the main sulfides filling the bedding, and within the vein edges, serves as a reliable indicator.

These collective geological features, including the consistent structural controls, the confirmation of folded ore zones at depth, and the characteristic mineral associations, significantly enhance our confidence in the down-plunge continuity of this high-potential ore zone. This structural and mineralogical predictability supports the long-term potential of the BA zone.

Between levels 1 and 6, the BA orebody was the primary contributor to production at the Pilar mine. Starting from Level 4, the structure progressively narrowed down-plunge making the BA orebody less economically viable, until Level 12.

More recently, between levels 15 and 19, exploration drilling campaigns have confirmed the renewed economic potential of the BA orebody at greater depths. This indicates that the interval between levels 12 and 15 still holds significant exploration potential. Drilling programs targeting this zone are either underway or in the planning phase, aiming to delineate additional resources at shallower levels and support the continuity of the BA orebody throughout the deposit.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Armando José Massucatto, Geo, PhD, FAusIMM, Exploration Manager, who is also an employee of Jaguar Mining Inc. and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with over 45,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL complex (Turmalina mine and plant) and Caeté complex (Pilar and Roça Grande mines, and Caeté plant). The Roça Grande mine has been on temporary care and maintenance since April 2019. The Company also owns the Paciência complex (Santa Isabel mine and plant), which had been on care and maintenance since 2012 and is planned to restart in 2025. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Luis Albano Tondo

Chief Executive Officer

Jaguar Mining Inc.

[email protected]

+55 31-99959-6337

Marina de Freitas

Interim Chief Financial Officer

[email protected]

+55 31-98463-5344

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "forecasting", "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, the nature, focus, timing and potential results or implications of the Company's exploration, drilling and prospecting activities, including the Company's diamond drilling at its Pilar mine, as described in this news release, as well as any other future exploration activities of the Company, management's expectations regarding the exploration potential of the Pilar Mine and future gold grades and production at the Pilar mine, including forecasts relating to production at the BA zone, any information and statements related to expected growth(including, without limitation, the potential for growth in regards to the Pilar mine's mineral resource base), sales, production statistics, ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of projects and new deposits, success of exploration, development and mining activities, currency fluctuations, capital requirements, project studies, mine life extensions, restarting suspended or disrupted operations, continuous improvement initiatives, and resolution of pending litigation. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about estimated timeline for the development of the Company's mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining, Inc.

View the original press release on ACCESS Newswire

L.Miller--AMWN